REVIEW

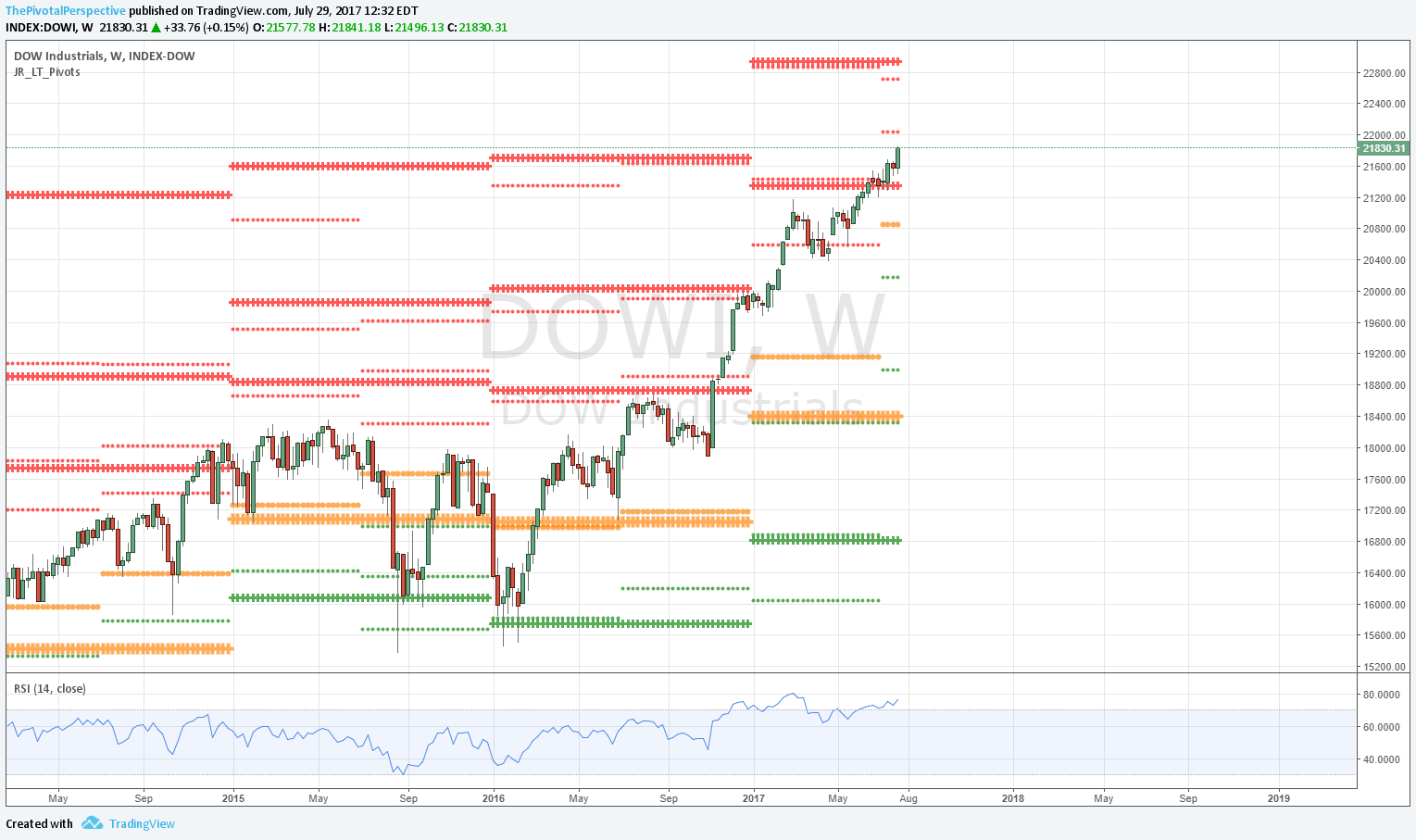

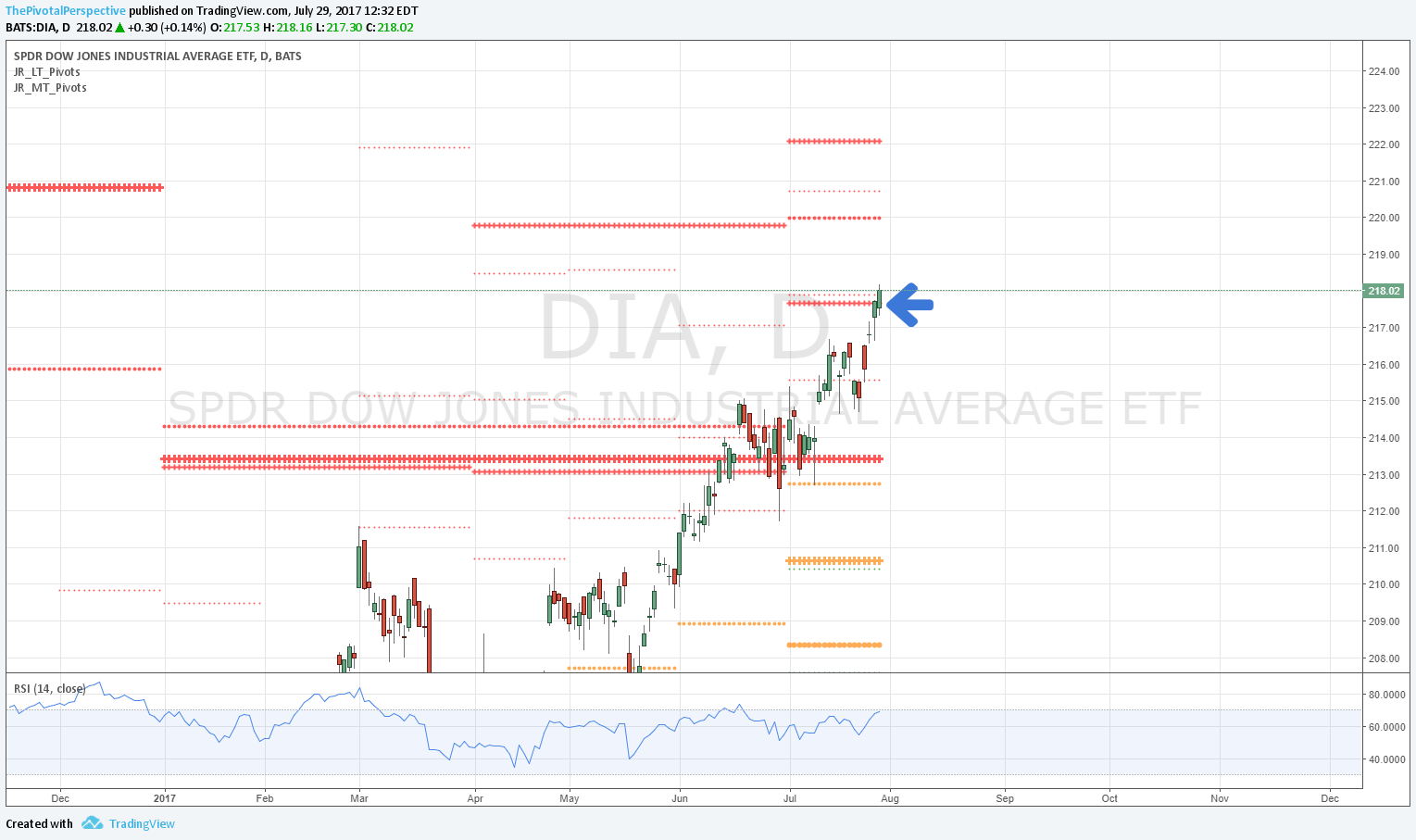

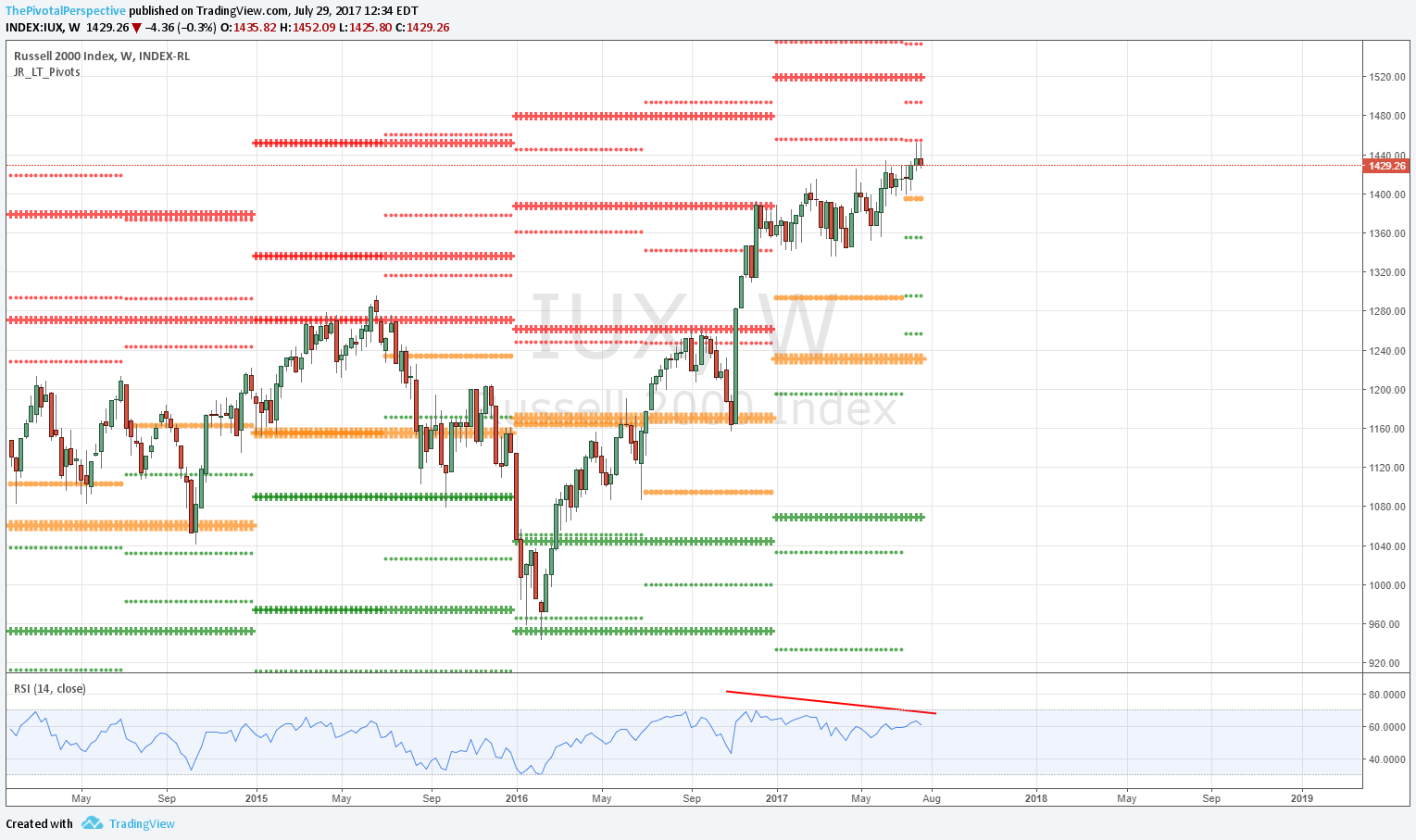

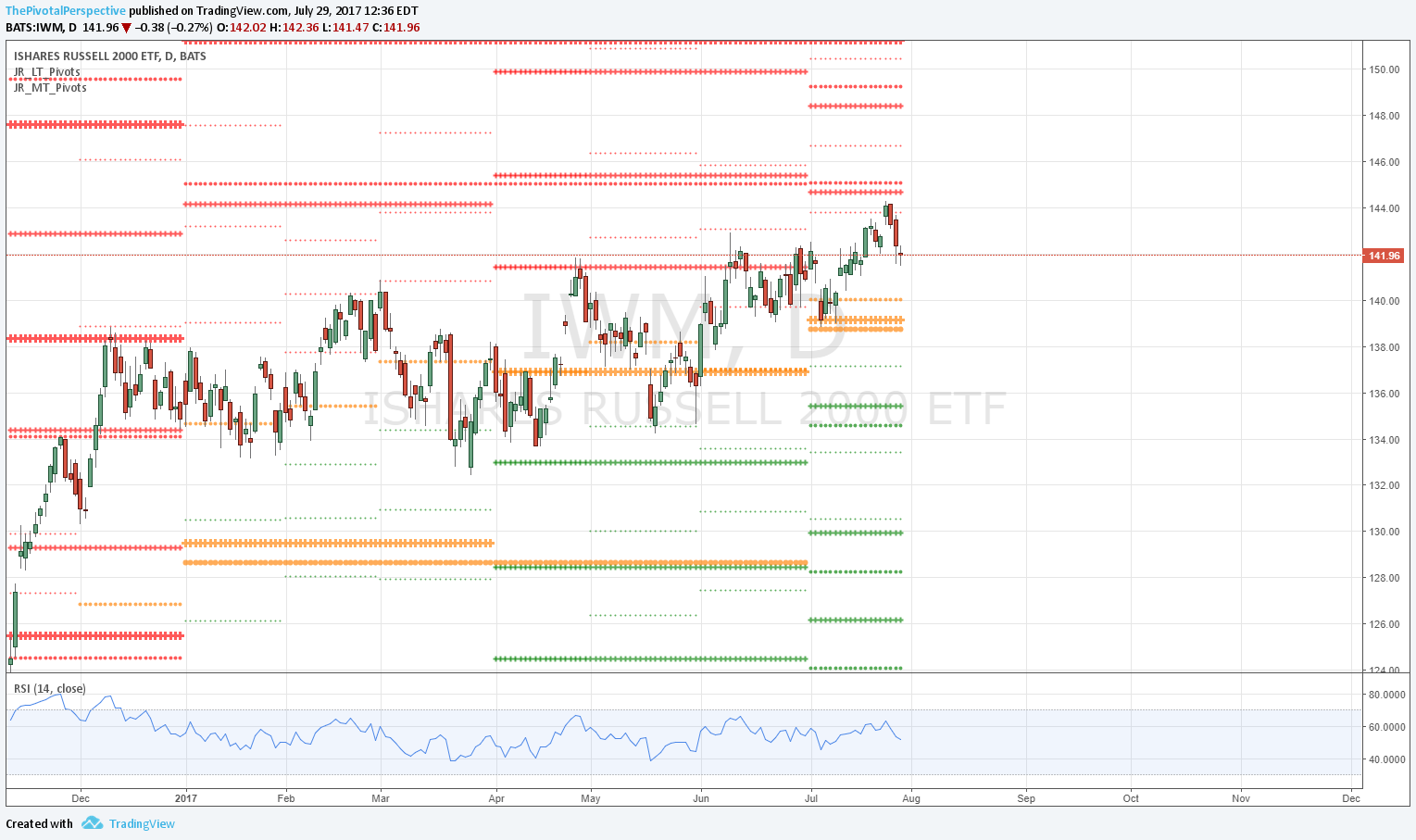

7/30/2017 Total market view: "4 of 5 USA mains are struggling at Q3 resistance levels (Q3R1s). Only DIA has cleared. This is also occurring with... (see list on link). So although larger trends intact, I thought higher odds of reaction lower in stocks. So far the market has been resilient and first drop on 7/27 was bought. I think the market is inviting sellers so we'll see if they show up. Bottom line - Portfolio reduced exposure last week, opting to raise cash instead of adding IWM shorts or UVXY hedges. VIX reversal bar from historic lows, and XIV seeming to have rejection at YR3 was part of this decision. But trends are intact so willing to buy back again if no rejection at Q3R1s."

Results mixed on the week with DIA higher, SPY fractionally higher, QQQ and IWM lower.

SUM

Last week key points of bearish concern were 4 of 5 USA main indexes struggling with Q3R1s, with only DIA above; along with technical divergence, sentiment concerns and safe haven strength. DIA continued to power up, but the rest - SPY, QQQ and VTI - are still stuck on these levels, and IWM already dropped. Sentiment concerns have eased somewhat, which may lead to a bullish resolution. However, TLT and GLD both above Q3Ps, and VIX & XIV suggesting possibility of risk off.

I don't know the way the market will go but I am wondering about some nasty counter-trend moves like:

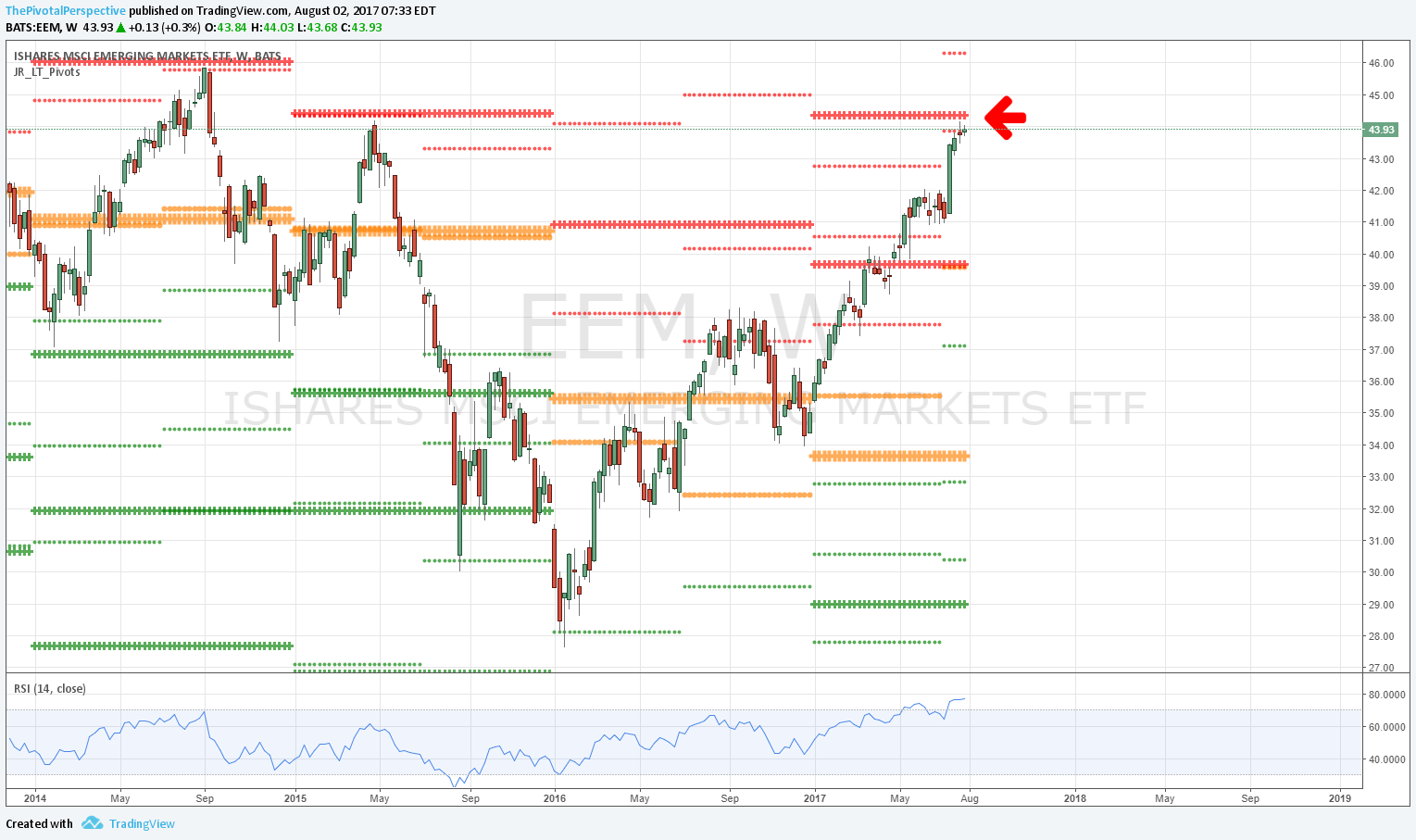

$USD rally on higher rate hike odds, which could sink GLD and cause some pullback in EEM and related FXI, INDA, etc.

VIX up and XIV YR3 slam.

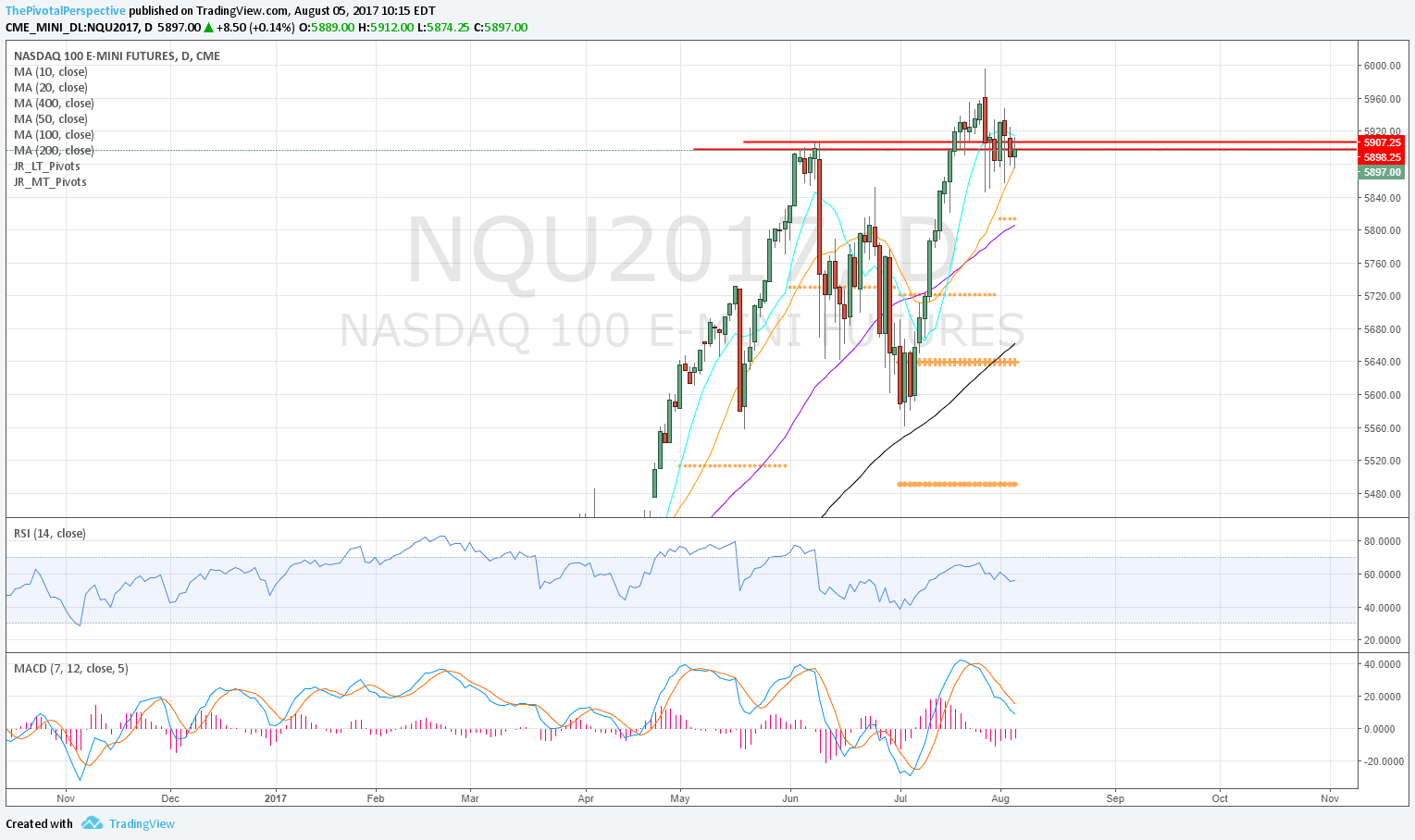

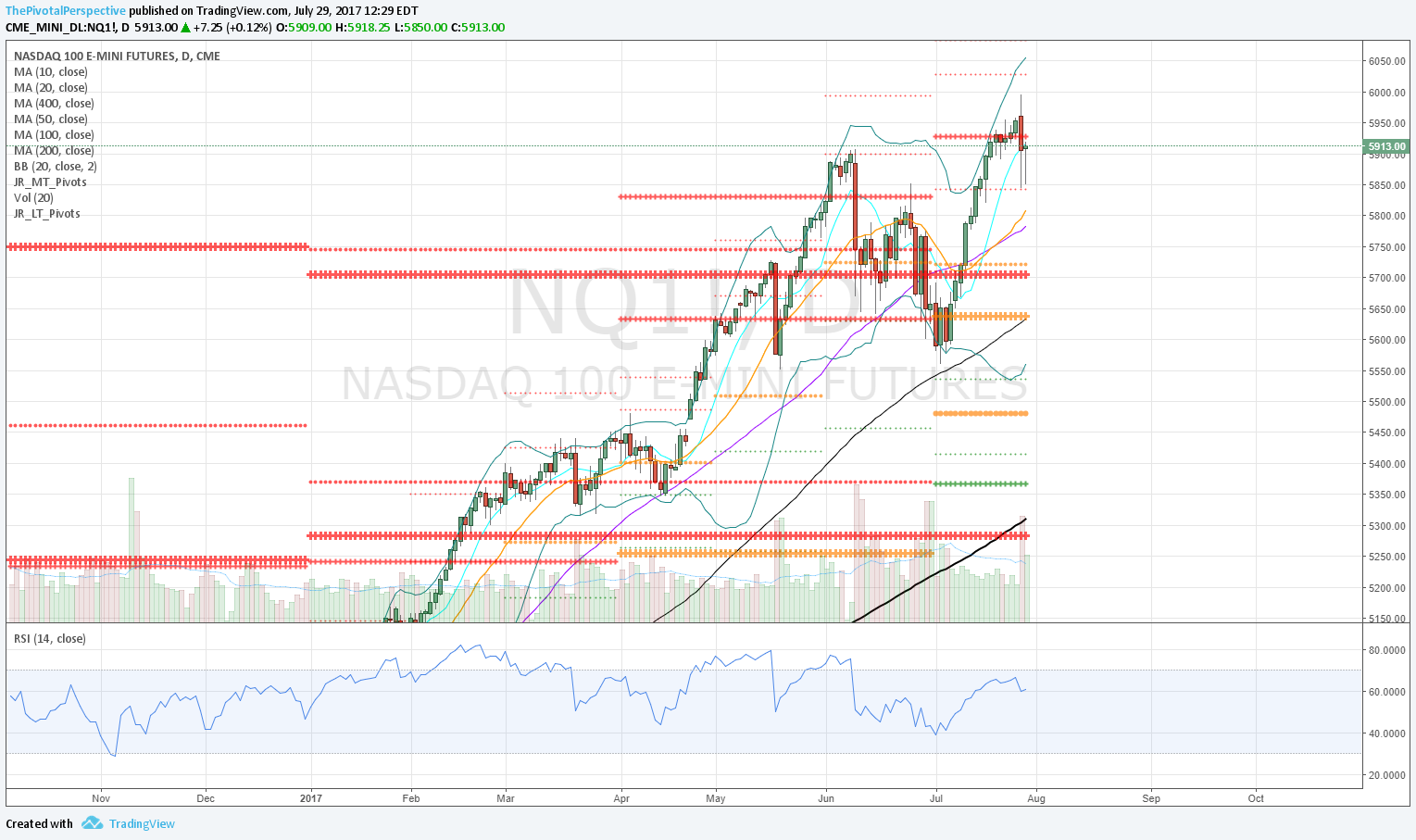

Tech stocks down again after failing at June high.

But this is just a bit of speculation as we aren't seeing these moves quite yet, and market could prove these suspicions entirely wrong on Monday with SPY, QQQ and VTI rallying above Q3R1s as the safe havens fade and VIX drops into 9s again.

Bottom line - Larger trends for stocks intact. But with safe havens strengthening, VIX divergence and XIV bang on YR3 it is time to pay attention to risk management.

PIVOTS

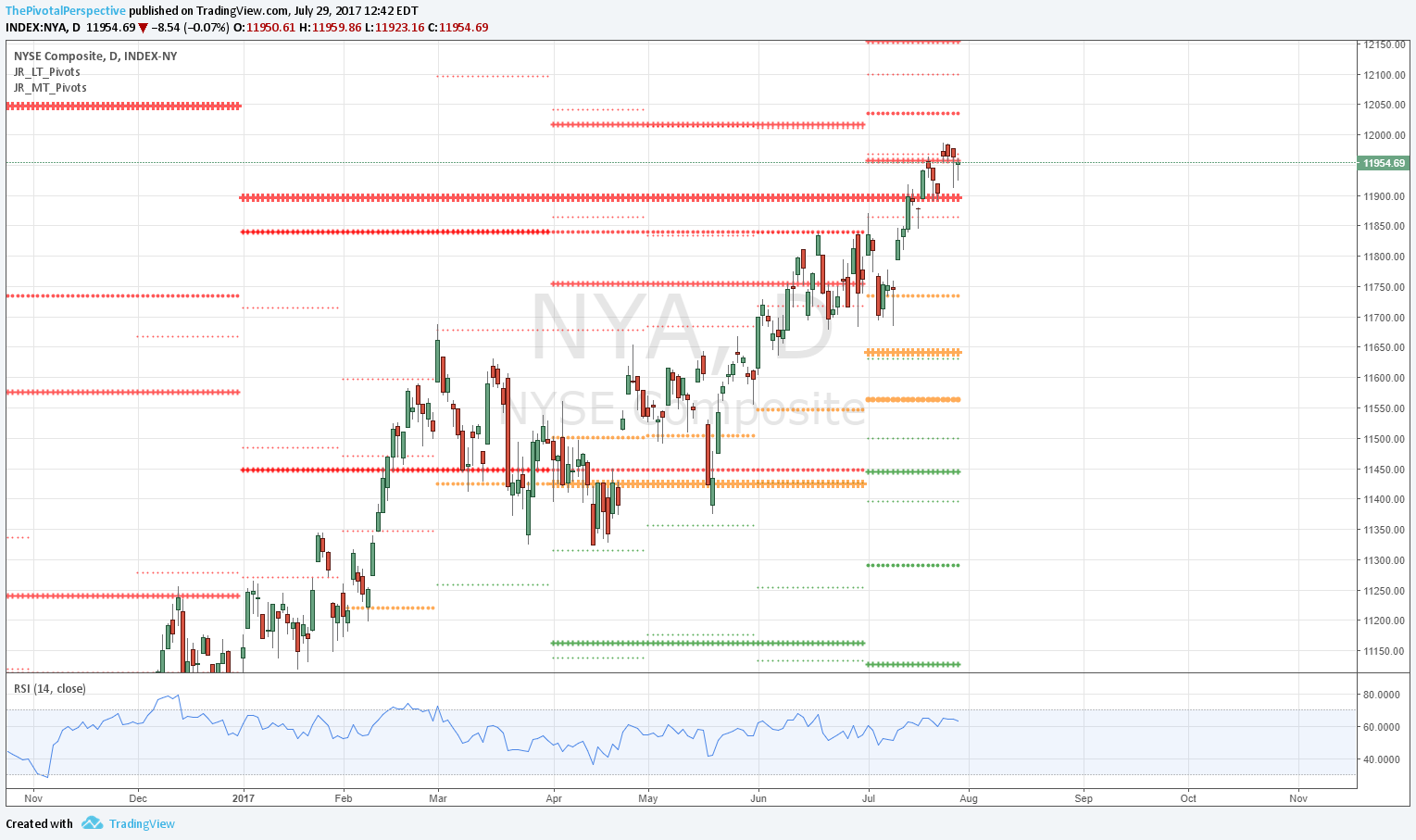

USA main indexes - SPY, QQQ and NYA Q3R1s all in play. IWM testing key support at 2HP and Q3P.

Safe havens - TLT and GLD above Q3Ps. Stronger situation for stocks if these were below. Also, SPY higher with VIX off the lows and XIV bang on YR3 to me suggest more downside risk for stocks.

Sectors of note - Despite many smart people recommending XLE as mean reversion, it remains avoid with inability to significantly rally despite USO achieving some long term strength. SMH did not reach quarterly resistance on high, and now testing AugP and D50MA.

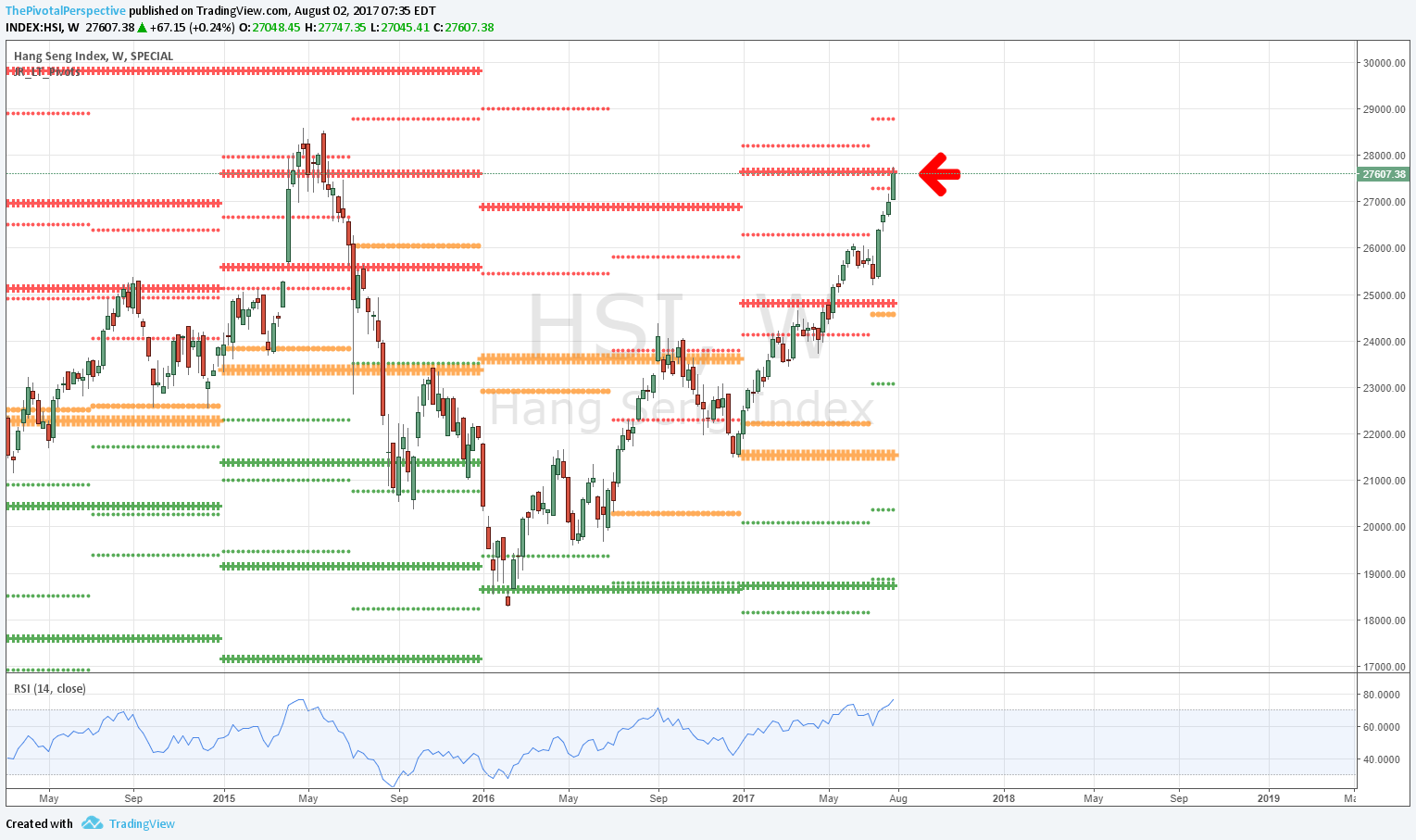

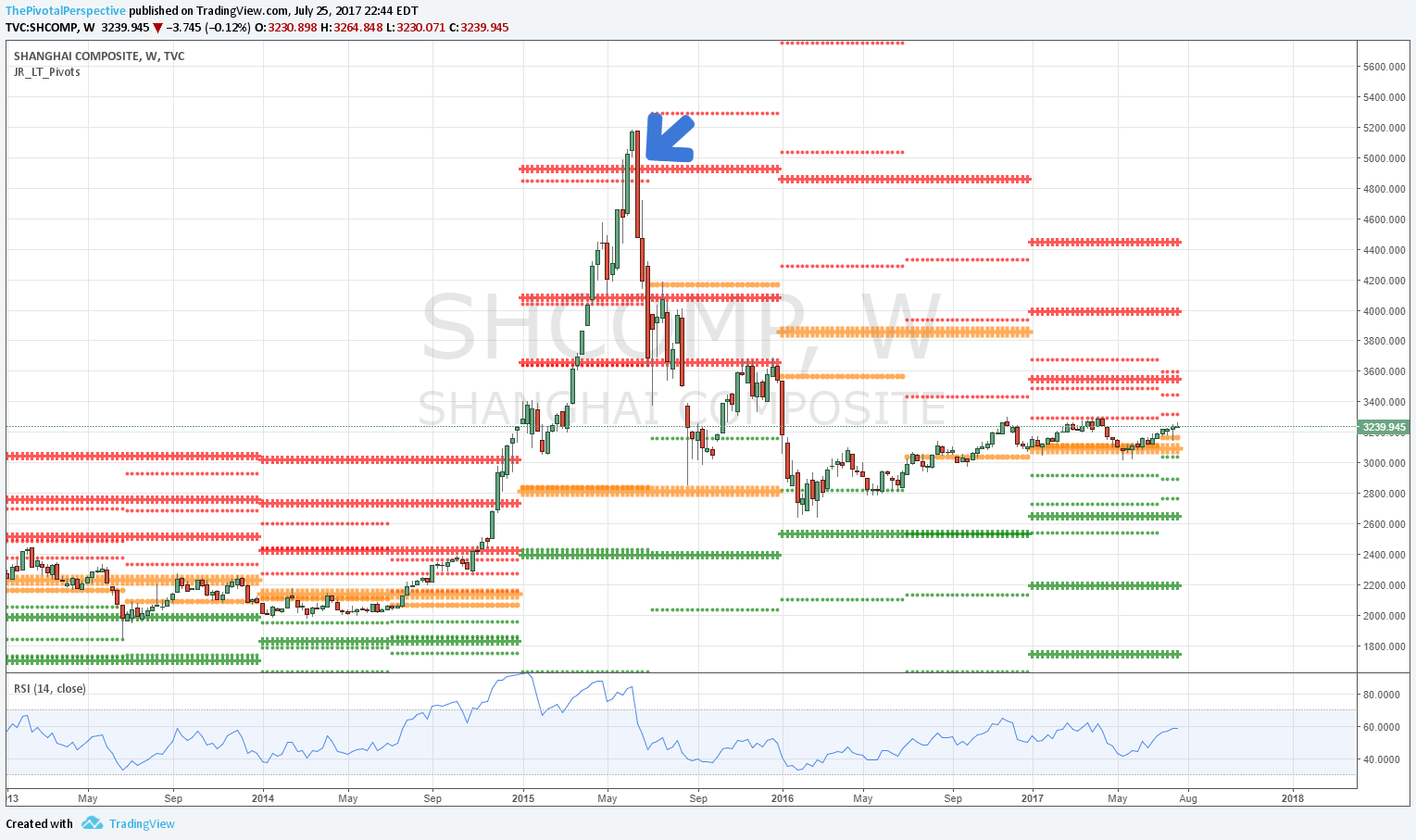

Global indexes - Several key indexes on major resistance levels so differences between these and the trading ETF vehicles are construction and currency.

Currency and commodity - $USD low on 2HS1 near exact may be enough for some near term bounce. This would change the melt up in GLD to breakdown in GDX.

OTHER TECHNICALS

Average true range is an interesting one - corrections tend to happen after range is low. But as a long term study it is problematic (at least on the charting package I am using) because it is point and not percentage based. Still, SPY weekly average true range currently 3.37 is at very low levels, lowest since 9/2014 which was just before a -9.75% drop in SPY.

VALUATION AND FUNDAMENTALS

10 week moving average of 18X forward earnings dropped a bit last week; could be noise but only 20% of the time since 2016 Q4. Another decline this week would be more significant. Regardless, major professional resistance near 2483.

SENTIMENT

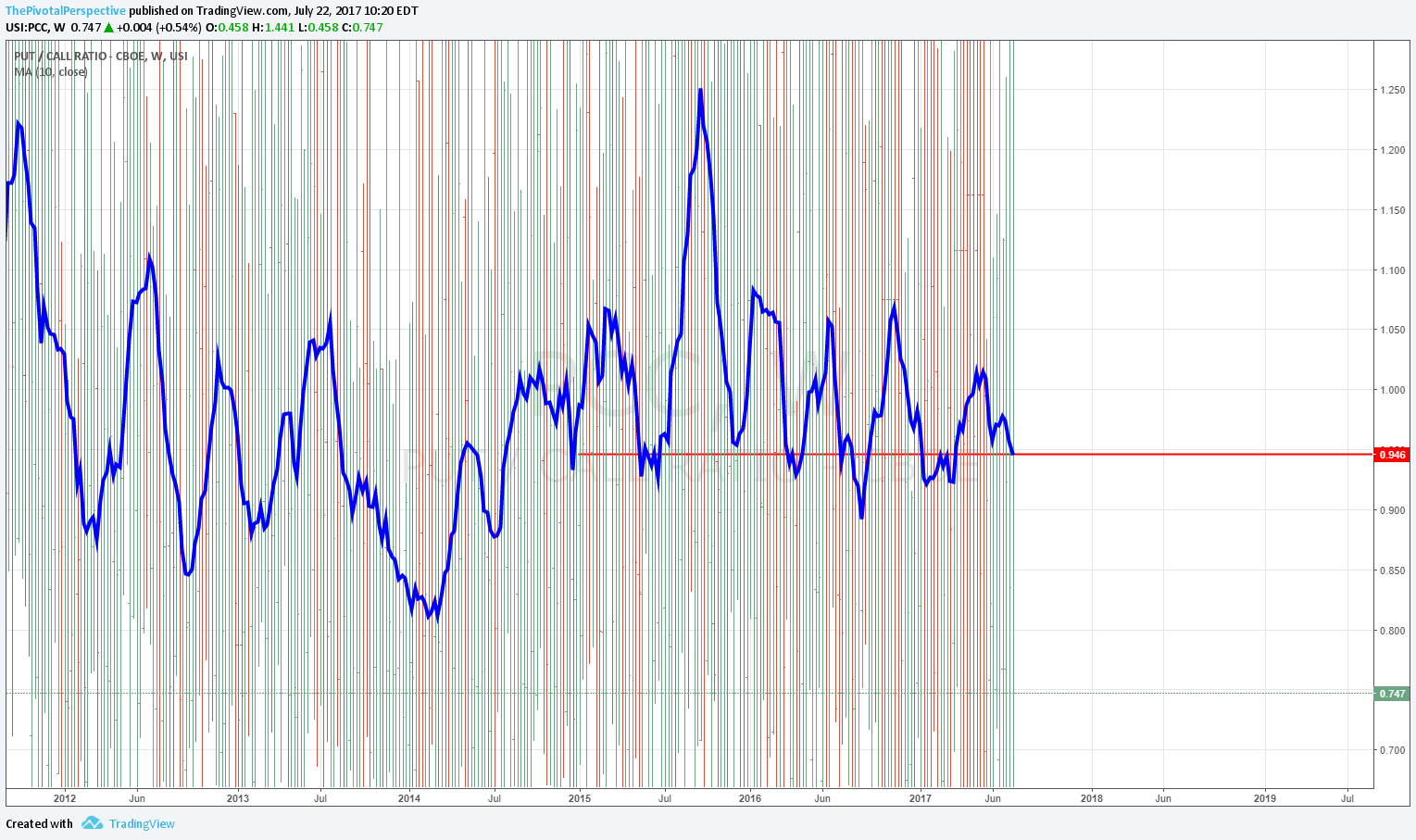

ISEE suddenly out of commission is annoying. Put-call off low levels. Two sources confirming record shorts in VIX futures.

TIMING

Proprietary work in progress model that I am still maintaining in bare bones form due to calls like this.

August dates - a busy month for timing, alas, probably too busy to be much use.

8/2, bias stock high

8/8

8/11

8/16

8/21

8/25

8/30

I know, +/- 1 is not helpful at all with this many dates. I don't control the model and it just so happens to be busier this month compared to others. With August 2015 recently in memory, a lot of people seem to expect a fast sharp drop. I can tell you that very few were expecting that at the time. Maybe markets will melt up instead, or these dates will be minor swings in a range bound period.