Sum

Last week I noted an important change in medium term pivot strength - DIA was only index above Q3R1 and the rest were below. Those with flexibility to rotate did well, with DIA going up each day as other indexes struggled in the past week. Pair trading did even better, as the call for IWM to lead lower also played out.

Indexes look more different than much of the year so far - DIA near 2HR1 area (exact tag on cash index), SPY slightly above Q3R1 (but futures not there yet); then QQQ and VTI are below Q3R1s. IWM has led the way lower as called, already testing a major support area 2HP and Q3P.

Bullish from here would be more indexes clearing Q3R1s. Bearish would be SPY Q3R1 rejection and possible IWM Q3P or 2HP pivot break.

Lastly, I don't mention NYA much but it almost never lets me down as an indicator (for new readers I view this along with VTI as broad indexes). While it has cleared YR1, 2HR1 is not far above. This is an important area to watch at 12034. For now it too is above its Q3R1 slightly.

SPX / SPY / ESU / ES1

SPX W: Floating up towards 2HR1 at 2503.

SPY D: So far consolidating sideways after run up to new highs; a struggle but no rejection at Q3R1.

ESU D: Below 10MA slightly - otherwise above all pivots and MAs with nicely rising slopes.

ES1 D: This version looks more bearish with Q3R1 still resistance (ES U also below Q3R1 too).

SPX sum: Sideways consolidation and pause at Q3R1, but no rejection yet. Futures contracts are not as bullish as SPX and SPY. Regardless of Q3R1 status, above all pivots and all daily MAs except 10 is still healthy uptrend.

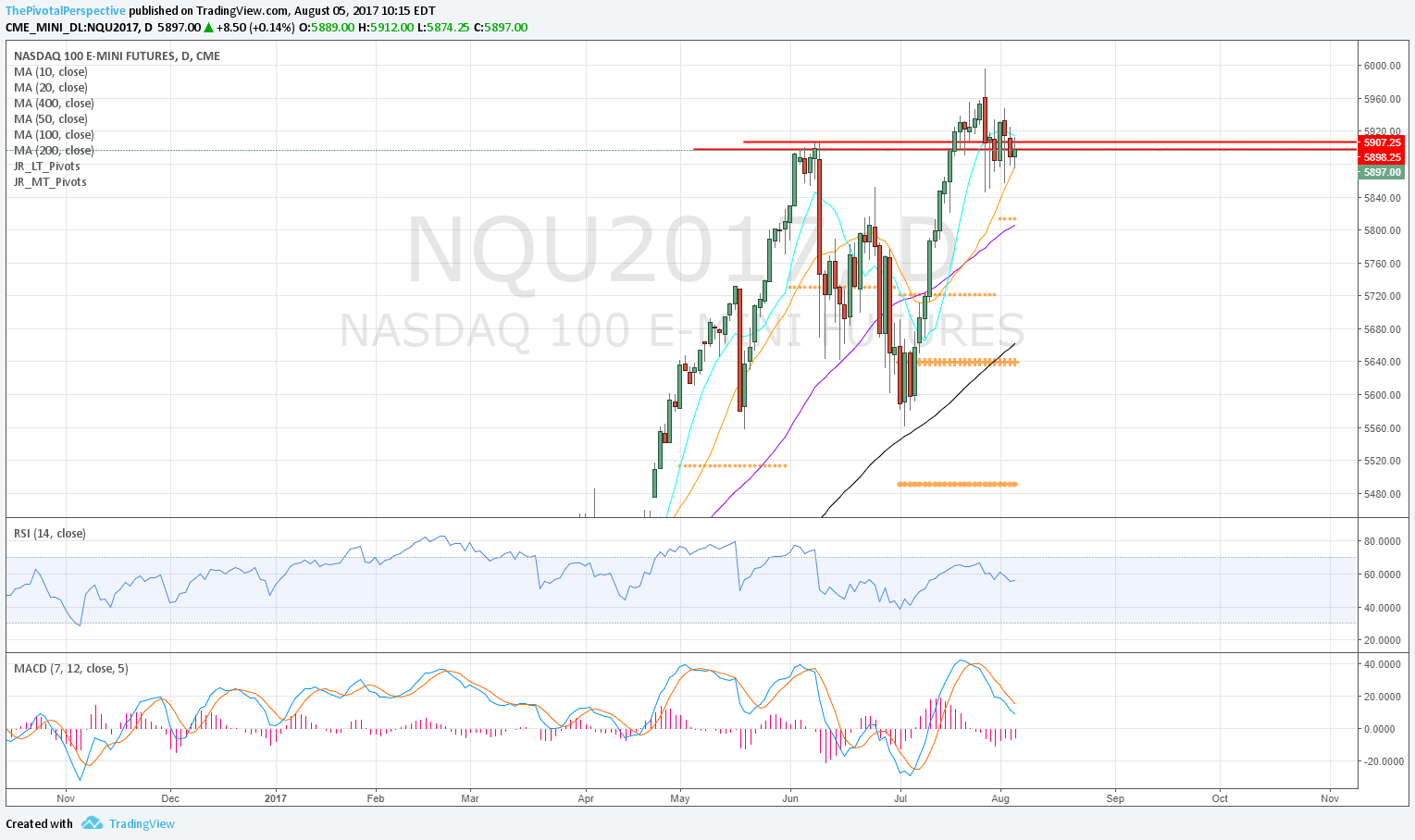

NDX / QQQ / NQU / NQ1

NDX W: Near tag of 2HR1. Glaring RSI divergence.

QQQ D: After falling under Q3R1 on 7/27, no close above and 2 days of selling from the level.

NQU: Below 10MA, but holding a sharply rising 20MA. Starting to see a bit of resistance at prior highs as well.

NQ1: Q3R1 resistance.

NDX sum: Since 7/27, Q3R1 has been resistance.

INDU / DIA

INDU W: Launch above YR1 and reached 2HR1. RSI healthy, no divergence.

DIA D: Levels slightly different here, with DIA above 2HR1 and nearly and AugR1.

INDU: Took over as medium term strength leader on 7/28 - the only index to be above Q3R1s as of that date. Momentum has continued.

RUT / IWM

W: 2HR1 stopped the move, and now nearly testing 2HP - important long term support!

D: 2HP and Q3P nearly same level and highlighted by orange arrow.

RUT: Led down as called. Now testing significant support area 2HP and Q3P. Below AugP from the second trading day of the month.

NYA & VTI

NYA W: Near tag of 2HR1. Made it above YR1 for 3 weeks, but less than enthusiastic on this last leg up.

NYA D: Holding Q3R1 as support so far, in addition to the YR1 below that.

VTI D: Struggling at Q3R1 since 7/27.