Standard put-call continuing to be decent sentiment indicator. In mid November with put-call at relative high level SPX tested and held NovP and rocketed from there. Now however, put-call at lowest point in nearly 18 months.

Too many bears

Standard put-call jumped from notable low at the end of July to relative high area, exceeded by only a couple of weeks this year.

Equity only put-call even more glaring - at highs for 2017, only exceeded in last 12 months by election anxiety.

AAII weekly survey out - bears at 38.2% 5th highest for the year, and bull-bear spread also at 5th lowest reading of 2017.

Sentiment

I tend to mention sentiment when it is doing something interesting. In the last few weeks, there was one massive ISEE spike high, but at the time, other readings were subdued. As of the end of last week they have finally been convinced of the bull side.

This increases the chance of a decline as the next move.

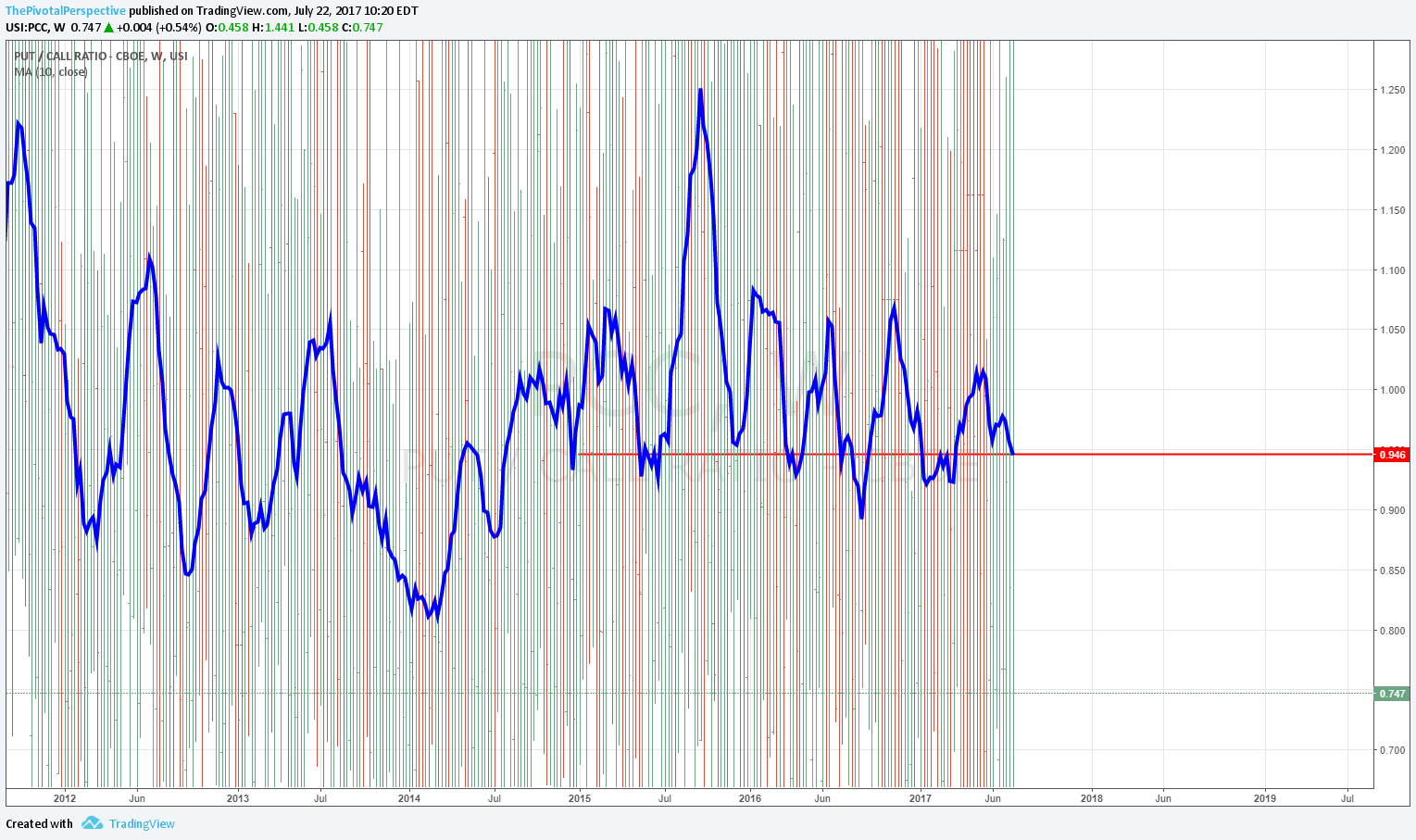

Put-call W

On the lower side, especially when viewed from 2015+. 2013 abnormal QE year.

Put-call D

Near lowest levels of past 1.5 years.

4/25/2016 - near trading top of 4/20.

7/20/2016 - SPY higher but not by much for several weeks then correction into November.

12/15/2016 - Trading top for dip into year end.

2/27/2016 - Decent trading top 3/1.

6/8/2016 - Top for NDX, -5% followed.

And now.

ISEE

3 recent spike high readings, the highest one was the 3rd highest this decade. 10 day moving average at highs for the year.

AAII

While levels not extreme for the decade, for 2017, 7/20 readings were:

2nd lowest in bears

3rd highest in bull-bear spread

NAAIM

Elevated 5/24 and 6/28, but faded a bit since then. No extremes here.

Sentiment

While I used to do a full sentiment analysis weekly while working a fund, these days I glance at it and bring it up when more important.

Sentiment extremes in August and December 2016 were part of accurate top calls. In late February readings were not quite as toppy as December, but put-call at low areas and NAAIM also at extremes. So 2 of 4 seemed to do the trick.

But now after a relatively mild decline we are seeing some readings that are decently bearish. If crowd is already bearish after 3 weeks and ~2% drop, then further declines just might not get very far.

Consider the only handful of days since 2016 where daily put-call 10MA has been higher than its recent level reached on 4/4.

But when I saw ISEE my jaw dropped - 28% bulls! Of all readings since 2010, that is 84% percentile LOW end. 39% bears are 13th percentile, and bull-bear spread is about the same.

So we have 2 of 4 readings showing decently low readings. NAAIM has gone from wildly bullish to middling, and just to confuse things a bit ISE (non pro options) gave a high spike reading on 3/31.

Sentiment

Sentiment is starting to look like it frequently does at other highs.

Sum

Put-call daily extreme & weekly low value, ISEE higher value but not extreme yet, NAAIM extreme, AAII recently some extreme depending on timeframe. All this is enough to limit upside and increase risk of shakeouts.

Put-call (CBOE standard put-call ratio with 10MA)

Daily view - only a handful of days lower in last 2 years.

Weekly view

Not as extreme but still on the low side in terms of number of weeks from 2011 below last week's value.

ISEE

MAs still subdued but 12/8 reading highest since 10/10 and among higher values of 2016.

NAAIM

2nd highest reading of all data going back to 2006 2H.

Other top ten, along with rough weekly results on SPX

1/30/2013, 104 - 4 week stall in otherwise QE fueled melt up

11/27/2013, 101 - 2 weeks sideways then down

7/27/2016, 101 - price level near key high, upside limited

12/11/2013, 100 - middle of pullback low, 2 weeks up then another drop

3/1/2007, 100 - actually quite correct, big buying after first drop in 9 months

1/3/2007, 100 - no damage, market continued moderately higher

2/25/2015, 99 - price level near major highs, not significantly higher over several months

12/26/2013, 98 - next move down

8/17/2016, 87 - near level that was high for about 3 months

12/8 - 101 ?

AAII

Reached more toppy levels 3 weeks ago, which has been quite correct. Still, as of then,

Data from 2005: 14% percentile (meaning only 14% were higher than this one)

Data from 2010: 12% percentile

Data from 2012: 10% percentile

Data from 2014: 7% percentile

Data from 2015: 3% percentile

Data from 2016: highest value

Sentiment

When working full time at a small hedge fund I did a full sentiment report once a week. A sentiment extreme is not a trading signal in and of itself but we did have notable sentiment extremes on the January and February market lows, as well as the mid August top. I wrote at the time that such extremes often contribute to a key high area - and they did.

My method is to view standard put-call with a 10MA, ISEE index, NAAIM Exposure Index, and AAII Survey all together. A decent market turn will often have extremes on at least 3 of these.

There are other methods out there - The Fat Pitch blog also does a good job of writing up the BAML asset managers survey, which I think is worth considering as well especially from a longer term perspective.

But still the four I track are working pretty well (along with pivots, other technicals, valuation & fundamentals and timing) in getting turn areas. Since August the bullish extremes have been worked off, and we understandably saw the two specifically option related meters (put-call and ISEE) make bearish extremes into the election. But now things are moving the other way.

Keep in mind that November through January is seasonally bullish, and we are likely to see higher than usual sentiment numbers that may not drop the market in the same way as the rest of the year.

Daily put-call is dropping back into normal, but not at bullish extreme yet; weekly put-call nowhere near extreme.

ISEE has yet to make daily spike highs, which we are likely to see near tops.

NAAIM as of last week is nowhere near extreme, but probably made a big jump this week.

But AAII bull % has soared to 46%, by far the highest of the year.

Data from 2005: 14% percentile (meaning only 14% were higher than this one)

Data from 2010: 12% percentile

Data from 2012: 10% percentile

Data from 2014: 7% percentile

Data from 2015: 3% percentile

Data from 2016: highest value

So what matters here? This is either somewhat high, extreme or notably extreme depending on where you start your data series. Thus conclusions would be approaching a top but not yet, upside limited, or cut longs and perhaps short depending. This is exactly why I am against pure quantitative analysis without a qualitative component (everyone seems to be a big fan of the quant side these days, while forgetting that how they select the data impacts the results). Let's consider the market environment. We are in a post QE world, but it was tapering through most of 2014. So I think the numbers that matter here are 2015 and beyond.

Sticking with that year for the remainder:

Bear %s only 35% percentile, and the bull-bear spread 7% percentile.

As of now this and the other meters are things to watch. The more the others join in a sentiment extremes, the more likely we are to see a shakeout of weak hands and possible top area. This means I am now watching for lower put-call, daily ISEE spike highs (125+), NAAIM mangers 90+, and a bit fewer AAII bears to warn of a major top.

But still, as long as SPX and INDU hold above YR1s, bulls have the ball.

Sentiment

There are 4 things I track. When I worked for a fund I made sure to do a detailed analysis each week, and these days do a a full version only occasionally. There are other things out there like commitment of traders report, or BAML fund manager survey. The Fat Pitch site does a good job of summarizing the latter.

To be honest sometimes there are discrepancies and I'm not sure how to reconcile. For example, if fund managers are holding a large portion cash - which has historically been very bullish for stocks - is that still applicable with interest rates so low? The opportunity cost of holding cash is lower than it has ever been.

So I will stick with the 4 I know.

Sum

Extremes reached on daily put-call and weekly lower end for post QE period 2014 on. NAAIM managers significant extreme. Both ISEE daily spike highs 7/18 and again 8/5 & 8/12, though moving averages remain middling for any data period. AAII individuals have been the bearish holdout, though near relative highs for past 18 months; not enough to be extreme (10% percentile, but higher end (20% percentile).

3/4 of these have recent extremes if you include the daily spikes on ISEE - should be enough to at least restrict upside, possibly increase risk of shakeout and often will contribute to a key high area.

Put-call

Daily put-call made a multi-year low near 7/20/2016, then had a sharp rise. It has recently fallen. Although this doesn't look like an extreme compared to 7/20, there are still only a few days in the last 18 months or so that have been lower. Red lines are simply the 7/20 low and 8/18 low.

Shifting to a weekly view from the start of 2012, we are on the lower end. Put call went significantly lower towards the end of 2013 into early 2014, which was the results of QE fuel, a year of non-stop up for stocks and down for bonds, and preceded the first -10% drop in months that occurred January and early February 2014.

Put-call sum

Daily extreme reached 7/20; still low enough to be considered extreme (10% percentile) 8/19. Weekly on lower end, and may even be extreme for post USA QE period.

ISEE

Daily readings: spike highs 7/18 (2nd highest of 2016), also high enough 8/5 and 8/12. Spike lows 8/1, 8/10-11, 8/16-17.

However, all moving averages are quite low considering data from 2005 to current. Even reducing data to 2012 to current, MAs are nowhere near bullish extreme. For some reason, this put-call measure designed to remove professional hedging has skewed lower over time but I don't know why. For now, spike highs have been near trading tops or at least upside limited for the last few years.

NAAIM managers

Using data from 7/2006 on, we have reached significant extremes in the last month or so. This is a warning sign for the market or at least says upside limited. There have been about 530 weekly readings, so anything in top 50 would be top 10th percentile. Let's restrict it further to top 5% percentile.

7/27 (3rd highest of all values)

8/17 (9th of all values)

7/13 (11th)

8/3 (19th)

8/10 (22nd)

7/20 (23rd)

That is a fat cluster of very exposed managers. Some of this may have been forced in buying, but still. Obviously this contradics the BAML survey as reported by Fat Pitch for higher levels of cash.

AAII Investors

Savvy bunch, frequently right but also will show some capitulation on turns. This batch has refused to get too bullish on the way up (though i'm not sure if that is correct, given the market.) Still, the highest readings of 2016 have been 3/10 & 3/24, then 7/14, 7/21 and 8/18.

Using data from 2005 on, bullish sentiment remains middle of the pack and restricting data from 2012 doesn't change much either. Similar results with % bears, bull - bear spread and 8 week bull average. Only when restricting data to 2015 on do we see bullish sentiment at a relative high. I'm not sure how valid this is; from 2015 market was stuck, and now it has broken out up.

Sentiment

It's been a while since I've done a complete version of sentiment analysis, and this week with SPX and INDU near YR1s this is a good time. I use 4 components: put-call ratio, ISEE index, NAAIM exposure index and AAII survey.

Sum

Daily put call at bullish extremes; weekly not

ISEE daily spike readings at bullish extremes; MAs not

NAAIM exposure index at bullish extremes, period

AAII individuals, savvy bunch, few bears but not historically high bulls either. It would be nice too see capitulation here to have extremes across the board

Tops can stretch out. Maybe we've just seen the high, maybe not. But if not with these extremes markets could easily be in a range for a month even if it manages to go somewhat higher. This would allow the longer term sentiment averages to go higher even if the shorter term measures cool off a bit.

1. Put-call

Daily put-call has just on 7/20 reached the lowest since June 2014. Backing up further, we can see that there are really very few days since 2012 that have been below this level:

A cluster of days in September 2012, probably when QE infinity was being announced, that stood as a major high for about 3 months.

Late December 2013 to late January 2014, when the market was giddy with 1 year of QE, then as everyone was massively bullish the market had the sharpest drop in about 7-8 months.

A few days in later June 2014, which was not a major top in SPX or INDU, but was near a major top in the RUT / IWM. NYA made a major top just a few days past this window that stood for more than 6 months.

If we tallied up the days from the 2011 lows, so that is near 5 years, there are only about 45 trading days that are lower than today in the 3 clusters listed above. Rough math 250 days per year, 5ish years = 1200 trading days, making recent low 3.7% percentile. You can call that an extreme, yes!

But when we change the view to weekly, it is middling. Why? Because put-call has been very high several times this year - Brexit end of June, not sure why in May, correction mid January.

Two lines on the chart below. One at the 2014 put-call lows, the other at the current level. As you can see there is a lot of room to drop and no particular extreme at current levels.

2. ISEE index

Daily spike readings

7/18 was a major spike at 156. This was the highest value since 6/8 (which was a trading high) that came in at 136. Interestingly call buyers correct a few days off the big low on 2/16 with a massive 168 which is the high for the year. Before that the major high was 187 on 12/15 and we know what happened shortly after. We can say near term upside limited and downside risks have increased just due to this very high reading.

Date from 2005 to current

10MA 68% percentile, not extreme

20MA 91% percentile, still quite bearish!

50MA 96% percentile, bearish extreme!

Date from 2014 to current

10MA 32% percentile, higher but not extreme

20MA 70% percentile, better but still

50MA 84% percentile

Very interesting - on a short term level with daily spikes we have definitely seen a significant extreme. But on other measures, not even close.

3. NAAIM exposure index

Data from 7/2006

Wow, 7/13 reading of 96 is in the top 10, so that means top 2% percentile of all readings since 7/2006. This is logical at highs, but let's consider the weeks that had higher exposure:

1/30/2013, 104 - no damage, QE steroids pushed SPX another 30 points higher to 2/19 high, followed by brief 1 week dip and prompt resumption of trend

11/27/2013, 101 - just a few weeks higher late December and early January before a -10% drop

12/11/2013, 100 - ditto

3/1/2007, - very right call buyers on the first big drop in months

1/3/2007, - eh, not so right call buyers and market struggled higher for 2 months then had very fast drop

2/25/2015, - near a trading high. markets went higher into May, June and July depending on index but not by very much in most cases

12/26/2013, 98 - see above

1/15/2014, 96 - see above

Most of the readings near limited upside and/or correction as the next larger move

4. AAII individuals - savvy bunch

Last week 7/14 was "more bullish" than this week, so using those figures comparing to data from 2005

Bulls 36% percentile even using slightly higher reading from 7/14, 53% percentile middle of pack!

Bears about 15% percentile, so few bears but not quite in extreme territory

Bull bear spread about 30% percentile

Data from 2014

Bull still low at 35% percentile

Bears also 35% percentile

So not much change compared to 2005

Sentiment

I don't have time to do a sentiment post each week, but will try to mention when we see extremes.

There are 4 things I track - put-call, ISEE, AAII mgrs and AAII individuals. Last week 3 of these were flashing warnings for the bulls.

PCC D with 10MA

Near relative low area. Red line the low reached on 6/8. You can see only a few trading days below this level for the last year!

On the same day 6/8, ISEE spiked up to its highest value this quarter. (No chart.)

AAII managers had gotten back up there too, with only 1 higher reading on 4/20 in the last 12 months.

Sentiment

Check the tag for prior versions. As I continue in a scaled down manner, I won't be able to do the full sentiment analysis each week. But I will try to post when there is a sentiment extreme. Today I wish to point to two sentiment readings that are pushing towards extremes.

Sum

Daily and weekly put-call the lowest in nearly 2 years; this is quite optimistic! AAII managers top 16% percentile exposure on data from mid 2006, and this is more of an extreme considering most of these readings during seasonally strong November - February period. In other words, a pretty high reading for April.

I still prefer higher highs on the rally for a big top, as I'd rather see a tag of Q2R1, 1HR1 and YR1 levels, but the easy money from February - when we saw sentiment extremes on the other low side - has been made. With market participants so bullish, the market is more susceptible to a larger pullback or range bound digestion period.

* * *

Below is a daily put-call chart with a 10MA in blue. This reached a very low level on 4/20/2016, in fact lower than any point since July 2014.

Here's the same chart including 2012-13, with just a few other dips below this level.

On a weekly basis the level is not quite as glaring, but still, near low areas for about the last 2 years!

Also, the AAII managers reported a jump to 82 exposure which is top 16% percentile of all readings from mid 2006. Also consider that a vast majority of these higher readings are during seasonally strong months of November, December. January and February. So, getting up there.

Sentiment

Check tag for prior versions.

Sum

Sentiment has correctly improved considerably off the price lows and extreme readings reached in February. Put-call has moved up from low area which seems to indicate a lot of hedging and skepticism on the most recent push up in April, but it was an extreme low reading reached shortly before that. AAII managers are not yet at extreme readings historically but came in at the highest exposure in about a year. Also AAII investors had an extreme low reading of bears. So given these three together, I think there is same warning for the market. It may not be "the top" but perhaps this points to recent highs as potentially more important than pivots would currently indicate.

* * *

Put-Call daily reached a low extreme 3/14-24 with the lowest reading near 3/18. This is shown by the red line which is also the area of several other key highs in the market. But since then it has jumped while price has gone higher. This 'should be' quite bullish as there is already quite a lot of skepticism and fear. Also as of last week I thought very low put-call would increase chance of option expiration related drop, and now that is really not a factor.

Put-Call weekly also near low areas of past 1.5 years, but not historical extremes. Still, after 2014 second half is QE unwind and FOMC rate hike fear market.

ISEE

No spikes and all MAs still very low end which indicates more put-buying. I'm not sure how to reconcile this with the standard put-call data above. ISEE is trying to capture pure sentiment plays and not pro hedging.

AAII managers

Down to 32% percentile. This has moved quite a lot. Near the weeks of the lows this year it reached 83-90% percentile, a full bearish extreme as of 2/3/2016. While 32% has room to move up it is the highest reading since 4/22/2015, nearly a year!

AAII investors

Bulls still 72% percentile, plenty of room to move up

Bears 6% percentile, extreme reading. This means of all data from 2005, this is extreme low (ie lowest 10th percentile) reading of bears.

Bull bear spread 34% percentile, room to move up.

Bull 8 week avg still 85% percentile, up from the absolute lows reached in February but still on lower end.

There is one warning flag here and that is very low number of bears.

Sentiment

Weekly series as long as time permits. Check the tag for prior versions.

Sum

Put-call is going on the low end, both daily and weekly charts. But nothing else is close to a toppy area. Usually we would see at least 2 of these 4 readings at extremes for a major top. So upside may be more limited especially around the next option expiration week, but nothing else suggests a big top.

* * *

Daily put-call down near area that has been near lows since 2014 2H to now.

Weekly put-call also getting down there now, though can go lower. Still, upside "should be" more limited perhaps especially the next option expiration week.

ISEE

Oddly 3/22 and 3/23 were daily spike LOW readings ie too pessimistic! While 3/18 was the last higher reading, nothing extreme since 12/24/2015. I think we should see a high daily reading for a major top area.

10MA 93% percentile, still bearish extreme.

20MA 97% percentile, bearish extreme.

50MA 94% percentile, bearish extreme.

AAII managers

Up to 42% percentile, up from 52% last week. This was down to near extreme 88% in February.

AAII individuals

Bulls only 27% which is 90% percentile going back to 2005. This is just not how markets top out!

Bears on the lower end 25% but that is 19% percentile. So very low bulls, not so many bears either. High neutral then. Is that a top? Probably not.

Bull bear spread reflects this with very middle of road 57% percentile.

8 week bull avg still bearish extreme 90% percentile!

Sentiment

For the series check the sentiment tag. Put-call extreme last week was part of safe-haven strategy this week that worked out well.

Sum

Put-call continues to flash a warning sign but all the other readings are quite middling without any edge. I think we should see a bit more enthusiasm for a big top in the market. That said, put call near where it was on the highs was very similar to several major market tops, see the chart and note just below. So, possibility of major high but I don't have too strong an opinion as I'd rather see extremes on at least 2 of 4 reached as we saw near 2/11 lows. If interested in this sort of stuff I also recommend checking The Fat Pitch's review of BAML survey here.

Daily put-call 10MA near area of lows from 2014 second half through 2016. Not many trading days lower and in fact these were near major tops ie 5/20/2015, 6/22/2015, 10/28/2015 - 11/4/2015, 12/29/2015 and now we have a very similar level reached near 3/18/2016.

Weekly put-call has dropped sharply from last week, increasing the chances we are seeing a major turn. Put-call is now lower than early December, but above the late May and June 2015 tops.

ISEE reached 127 on 3/18 which is on the high side but not where I usually consider extreme, ie 140+. Still that was the level on a high. We immediately saw extreme low values 3/22-23 of 54 and 60 respectively. Consider the 52 week low on 9/28/2015 was 35 and there were only 10 trading days in the past year that were below 54. So this is quite a lot of bearish sentiment in a strong market.

10MA still 94% of data from 2005, bearish extreme

20MA also 94% percentile

50MA 96% percentile

Honestly I don't know what to make of this. You can read up on their method here but these values are all extreme LOWS ie no calls and lots of puts, while standard put-call is at relative lows, the opposite.

AAII managers (data from 2006) at 59 just a shade lower than 62 last week. Very middle of the road 52% percentile, not much edge.

AAII individuals (data from 2005)

bulls 67% percentile, up from the extremes near 2/11, but quite far from any bullish extreme ie top 10% reading

bears 12%, OK, this is fairly small # of bears and close to extreme.

bull bear spread 36% percentile

bull 8 week avg still 90% percentile bearish extreme

OK, it is interesting to see low #s of bears this week but give bull bear spread and 8 week avg hard to say people are too enthusiastic.

Sentiment

Medium length version.

Sum

Recent call buying (daily chart level) near extreme but so far call buyers quite correct this week! This helps suggest some consolidation is next move, but none of the other 3 measures are anywhere close to a bullish extreme. We should see at least 2 of these as well as perhaps weekly call reading extreme, before a big top.

We did see some huge sentiment extremes on the lows; check the tag.

Daily put call with 10MA near relative low area of past year and a half. This qualifies as low extreme, and was reached on 3/14. A similar condition existed last week and that didn't stop the market from jumping above levels and big rally on FOMC day. So a general sort of thing.

Here's an weekly version. This is interesting to consider. In 2009 this was very very low, so the call buyers were right! But really people had sold so many stocks there was no longer any put protection needed, or maybe the cost was too high. After that more useful as contrary indicator: Put-call spike high near 2011 stock low; put-call extreme low in Q1 2014 after massive QE fueled run all of 2013 although no immediate major top; then another spike high at the September low. Currently in middle of recent range between early December 2015 low and mid January high, no edge.

ISEE moving averages remain in bearish extremes, helping the market somewhat. This completely conflicts with the put-call data, though ISEE method attempts to remove professional hedging for true sentiment position. In bull market the low readings were good buys. In bear market, or really from 2015, high readings were near key tops.

AAII managers jumped up to 62 but consider this is exactly middle of the road, right on 50% percentile in all readings from 2006. No extremes.

AAII individuals after being the most bullish since last November dropped significantly and went more to neutral. Savvy bunch the AAII individuals - also get caught on the turns but this reading can be correct a lot of the time. No extremes.

Sentiment

Very quick version today; I missed last week. There are others watching these readings and more. The one thing I tend to focus on is relative areas. For example, daily 10MA of put-call at .92 is not historically very low; for example in January 2014 it was down near .72. But, .92 is relatively low for our recent market environment. Here's the chart.

The blue line is the 10MA. The red line is the recent low in put-call that was made just yesterday on 3/9. So, how many trading days from the start of 2015 have been below this area? Not many. It is hard to count the individual bars on a graph like this, and certainly I don't have time for this sort of detail, but quick eyeball does look like a percentile extreme. I tend to define these as top or bottom 10% depending on how you want to look at it. In this case, we can say that in excess of 90% of all trading days from the start of 2015 had put-call MA higher than here. So, this ranks in top 10% of less fear & more optimism.

Recent ISEE readings on the low side, helping support the market. No edge.

AAII managers at 51 slight drop from last week, really no edge here.

The various AAII individual readings are not at historical extremes at all, but 37% bulls is the highest since 11/7/2015.

Bottom line here 2 relative sentiment bullish extremes, near a timing window 3/9 give or take, and most important several attempts to clear levels and another possible rejection in process. For anyone playing short side it would be better to see VIX confirm though.

Sentiment

As time permits I've been doing a weekly post on sentiment. This is not related to pivots at all but fits into my complete market view which includes technicals (pivots primarily, with other tools), fundamentals (requires a Bloomberg), timing, and sentiment.

Of the 4 measures I track, 2 were at significant bearish extremes near the 2/11 key low. I didn't quite write it up correctly at the time, but knowing this factored into the buy recommendations on 2/12 and 2/16, the only stock index long positions I have suggested this year that weren't safe haven positions.

Sum

Sentiment continues to improve across 3 of 4 measures, with only AAII managers reducing exposure slightly from last week. Keep in mind that severe bearish extremes were reached on ISEE and AAII individuals the week of the 2/12 lows, so it would be normal for some improvement as the market stabilizes. The question is what is too much.

Again not much edge to this report; if the market breaks down I suspect we will again see extremes. Or another thing to watch for would be extremes without the market breaking, a potentially bullish setup. Or lastly, a rally with disbelief. Right now sentiment seems appropriately improved for a more stable market; but I think put-call near the low side for the year, and AAII individuals highest bull reading since last November, are both a bit optimistic.

Put-call

Here's a weekly chart with a simple 10MA. As you can see the spikes were last August to October and then a much smaller spike up into mid January. The end of December finished at relative lows. The only reason I can think why 2016 is so much lower is that a significant amount of selling has been done and fewer positions to protect. Right now no real edge or even relative extreme.

The daily chart has been moving lower; much closer to lows than highs for the year. So a lot of people think drop is probably done.

ISEE data from 2005

Daily readings 2/16 had a huge daily spike which was too much optimism; recently 2/23 was below 75, not extreme. it would be normal to see a high or not much higher post 2/16 given the reading.

10MA 72% percentile, not even low end anymore (80%+)

20MA 88% percentile, low end

50MA 97% percentile

This makes sense; the shorter term readings are moving up after extremes reached 2 weeks ago. But at 72% we cannot say too optimistic; that was just 1 spike day on 2/16.

AAII mgr data from mid 2006

84% percentile, up from 75% last week.

Lower side but not extreme.

AAII individual data from 2005

bulls 76% percentile, down from 89% last week. this is obviously nowhere near a high # of bulls, but oddly is the highest reading since 11/26/2015.

bears 43% percentile, big drop from 66% then 92% before that.

bull bear spread, 62% percentile, down from 80% and then 97% extreme before that.

bull 8 week avg still 99% percentile

Like the others, a shift up from extremes reached 2 weeks ago. I would say this is a bit too bullish but sometimes the AAII individuals can be right as they were quite bearish last spring as the market was topping. So the individual data can be a bit tricky to interpret, but even this crowd will be wrong on the absolute turns like massive bearish extremes near both key lows of this year.

Sentiment

Continuing weekly series on sentiment, which is a smaller part of my total market view that includes Technical, Fundamental, Timing and Sentiment categories.

Sum

2 significant extremes last week reached on ISEE and AAII individuals both helped the bounce, but these understandably improved this week. So sorry to say, no real edge to this report. Most readings are lower side without being an extreme; or a much milder extreme compared to last week. Whether market is free to go lower now that readings are off extremes, or bounce will go higher and participants are rightfully more optimistic, sentiment study cannot really say. I'll be watching the FebPs on the main USA indexes to decide.

Put-call

Put-call weekly above 1.0 not nearly as high as last September, but high enough to arrange a option week rally it seems. It may be that asset managers still had stocks on first sudden drop last year, then lightened up in December so had fewer positions to protect in the new year.

Yet the daily view closer to relative lows. Mixed bag here so hard to have definite conclusion.

ISEE data from 2005

daily spikes: 2/4-2/9 were ALL below 75; 2/16 jumped to significant high which to me shows a bit too excessive optimism.

10MA 93% percentile, down from 98% last week. Still bearish extreme though.

20MA 89% percentile, down from 96% last week.

50MA 97% percentile.

ISEE coming off bearish extremes on all 4 levels reached in early February.

AAII manager data from 2006 2H

75% percentile, down from 83% last week; I would count 83% as lower side, but under 80, no real edge.

AAII investor data from 2005

bulls 89% percentile, down from 99% extreme last week.

bears 66% percentile, down from 92% extreme last week.

bull bear spread 80% percentile, down from 97% extreme last week.

8 week bull avg 99% percentile, just one up from absolute low reached last week

AAII investors also extremes across the board last week, improving this week.

ISEE warning

Just saw that ISEE closed at 168. This is too high, and increases the risk of rejection from SPX YS1 1896 in the near future.

When everyone was expecting a Santa rally, the highest values were 187 on 12/15/2015 and 144 on 12/24/2015. Several major tops were near readings of 140+ last year. To add context, 168 is the 2nd highest reading of the past 12 months, and 3rd highest in past 18 months.

168 means everyone is expecting more on the bounce. When everyone expects the same thing, it rarely happens.

http://www.ise.com/market-data/isee-index/

Sentiment

I did a very detailed sentiment post a week ago. Here's a faster version.

Sum: put-call and AAII managers NOT showing extremes despite market trading horribly. ISEE at extremes but that has been more bearish for quite some time, and reflected excessive optimism on 1/26-27. Lastly, AAII individuals, savviest of the lot, very bearish and deservedly so. Maybe there is less to protect, but I think we should see higher put-call at stock index lows as well as AAII managers more at bearish extreme. Loose interpretation is readings are not bearish enough!

Put-call weekly chart showing a lot fewer puts than last September. This doesn't make too much sense to me, as the market has been much more bearish. Perhaps less to protect but still.

Daily put-call just starting to turn up. Should be higher, really.

ISEE data from 2005

daily spikes: 2/4 to 2/9 all below 75. The 1/20 low was 45 and 2/8 low 50 so that is getting down there. Excessive optimism shown by 146 and 139 readings 1/26 & 1/27 respectively.

10MA 98% percentile, bearish extreme

20MA 96% percentile

50MA 98% percentile

OK, all bearish extremes here.

AAII managers data from 2006

Actually higher than last week.

83% percentile is low side but not extreme

AAII invididuals data from 2005 - best of the lot, often correct

bulls = 99% percentile, bearish extreme, just slightly more bulls than 1/19 reading

bears = 92% percentile

bull bear spread = 97% percentile

bull 8 week avg = absolute low value

Sentiment

This site is all about this pivot method but I think there are a few useful complements. I addressed the technical side of these recently in this blog post. This post is about sentiment and how I approach it. I try to keep things concise as no one has anytime for reading paragraphs anymore, but sentiment analysis does take a bit more time.

This takes a bit of work but for dedicated traders / investors I think once a week this sort of thing can be worthwhile. The main point is to see if sentiment is at extremes, especially when running into pivot support or resistance. But instead of just one reading I like a combination.

Here's the standard put-call ratio on a weekly chart with a 10MA in blue. The MA is the only thing I am looking at. Let's look at the extremes. In September 2011 after a fast 20% drop and down at lows this was above 1.2. Then in early 2014 with the market on QE steroids it was down to .81. So the first point is the drop last fall *which held NDX YP* helped confirm the buy setup because it was so clear using this that there was a lot of fear in the market, yet the biggest level on the leading index held. I've written several posts about it, but my view of 8/24 is that the NDX YP held because not one hourly bar closed below it on the drop.

Conversely, at the end of 2015, put call had dropped not to absolute lows but considering the low of the year was .91 in June with everything globally at highs, there was a lot of complacency and expectation the market would be OK. The current level of 1.05 is still elevated but as we can see from September it can go higher.

And here's the daily chart view with the same setup. Again, the relative value against extremes. If you view it this way then the end of 2015 really jumps out because put-call was down to about .87, which is just where it was near 5/20, 6/22, 7/23 and 10/29-11/3 which were the highs in the market. That said, current value .96 not extreme. It has come down sharply from the 1/15-20 readings which indicate a lot of people think low is in, expecting a bounce and/or taken off some hedges.

OK so put-call dropping, maybe it is dropping too fast for market at lows but main point - not really at extremes. No edge, perhaps a slight point to bearish for market because it is closer to lows than highs, while stock indexes are much closer to lows. I think put-call is showing a bit more optimism than the market deserves, but still, no real extreme.

The next thing I check is the ISEE index:

There are several things that matter. Intraday readings above 150 are too bullish and towards the end of last year even 140 area marked several key highs. Then below 75 is too bearish, although in later stages of a bull market where the pros are more concerned about locking in gains it took a string of these for a low, whereas in earlier stages one day near 75 would help confirm a decent pullback. Then I check the 10, 20 and 50MAs to see if they are pointing one way (like top / bottom 20th percentile) or at extremes (top / bottom 10th percentile. ISEE data goes back to 2002 but you can also sort for current environment. When the market was bullish I was just concerned with data from 2010 or 2012. But now I think worthwhile to include other bear market data, and you could even make a case for just using 2002-2003, 2007-08 in the current environment. However, in the early years (probably before 2008) the values tended to skew much higher. Points:

1. ISEE spike high 1/26 at 146 followed closely by 139 the next day too optimistic in my view. Consider Santa 12/24 with market at highs was 144. 2/2 did scare some folks with reading of 61, and 1/20 was very low 45. That is down there and helped confirm next move would be bounce. See how this works? 1/20 was also the date of a post called "Big turn?" just because I saw so many indexes & ETFs rallying from yearly support levels. A glance at ISEE (along with put-call above) helped confirm some bounce as next short term move.

2. Using data from 2005 on, 10MA is 63% percentile, 20MA is 93% percentile (still bearish extreme), and 50MA is 96% percentile. ISEE has been the most bearish of the readings for a while. So picture long term a lot of fear, short term very sharp jump. Like put-call, maybe too much.

Then I like the AAII reports, both the managers and the individuals. Managers here.

While this reading reached extreme low last fall of 16, again with support holding, it helped confirm a buy setup. Although interestingly, the highs here were Feb 2015 and end April 2015, so the managers correctly reduced exposure before the drop. Last fall with many main indexes testing highs, exposure was middling 70. This was likely due to weakness in breadth ie small caps. Recent readings in January reached 34 and 26. 26 is 88th percentile of all readings from 2006, so definitely on the low side but not the level when people are really afraid in depths of bear market when we would see below 20. After getting to 42 or 74% percentile last week, it is back down to 22 or 90% percentile this week. That is a bearish extreme.

Lastly the AAII individuals.

Now this is a tricky one, because this crowd is savvy and often right! For example, last summer this index was putting in extreme bearish readings with index chopping sideways at the highs, and they were right. But even they tend to be fooled on the extremes.

Current bull 27.5%, 89% percentile from 2005. To be clear, this means 89% of all readings were higher, and only 11% were lower. So, lower side and near extreme which I somewhat arbitrarily say top or bottom 10%. But on 1/14 the reading at 17.8% was 99.8% percentile ie the 2nd lowest reading of all since 2005. That was an extreme! Although somewhat correct because the market went lower into 1/20!

Bull bear spread helps show the difference between the two, with the current week at 75% percentile and two weeks ago down to 95% percentile so definite bearish extreme, and that level for 2 weeks in a row. Then you can check at 8 week moving avg of bulls, which is now the absolute low. It is quite interesting to me that there literally dozens of extreme low readings in 2015, comparable to March of 2009. This means the AAII individuals got it right!

Bottom line is that 2 weeks ago, the put-call, ISEE, AAII managers and individuals ALL at bearish extremes, and several indexes held their YS1s, or broke and quickly recovered on 1/20-21. That said, like a momentum oscillator can stay overbought in bull markets and oversold in bear markets, we should expect low readings in a bear market. This week only the AAII managers and AAII individual 8 week avg are at bearish extremes, and other readings have moved up with the market stabilizing after 1/20.

Basic interpretation: bear extreme above major pivot support invites bounce; bit too optimistic too fast below resistance (ie indexes still below all pivots) invites another move lower. Right now we are not seeing extremes; I am wondering if put-call and ISEE daily readings and 10MA just a bit too high for this market, but the AAII readings may be enough to counter-act. So not much edge this week. If any stock index clears its FebP then short term optimism warranted; if that doesn't happen, and sentiment continues to improve, then we could see another drop. Thanks for reading.