Sum

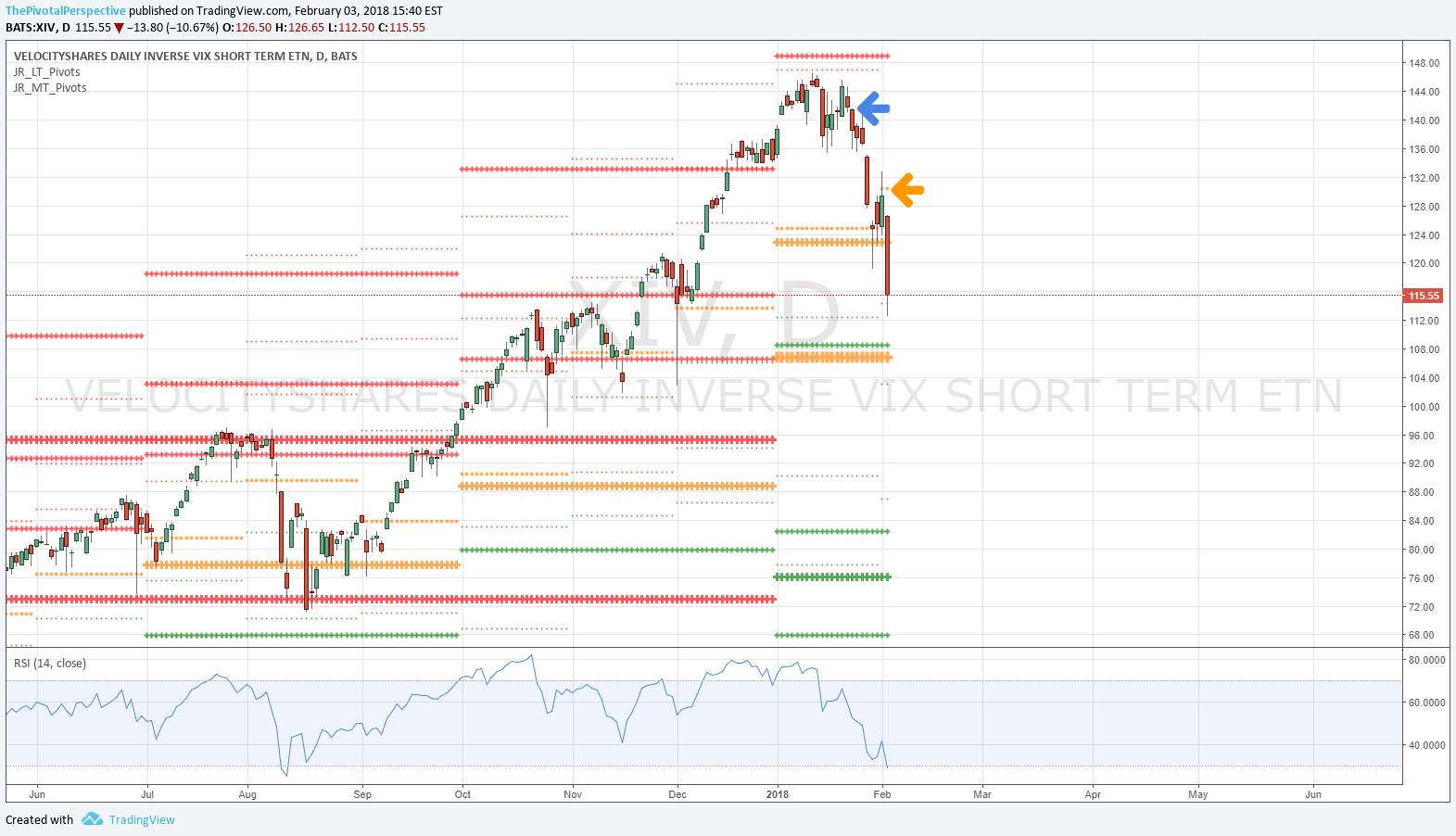

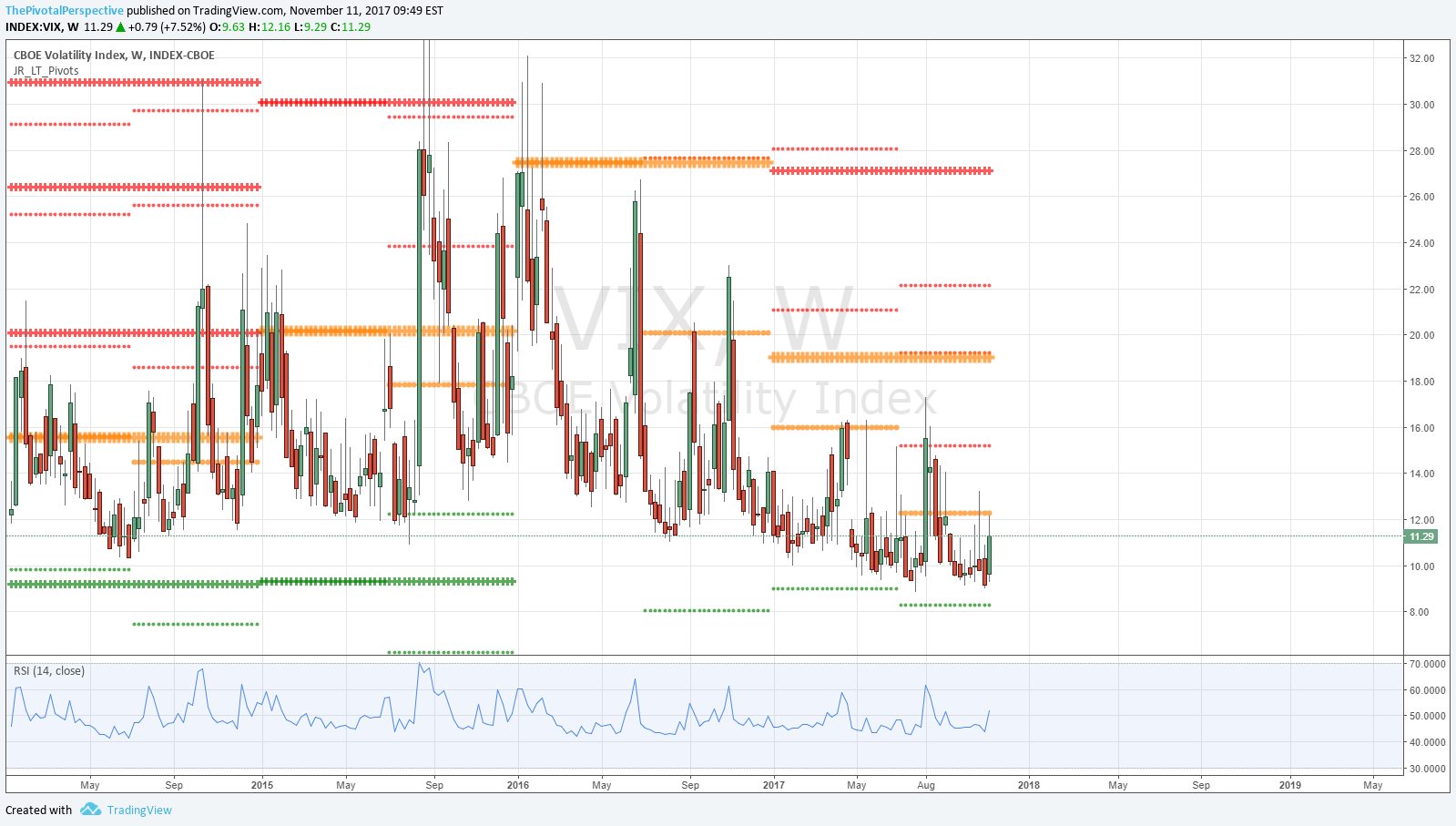

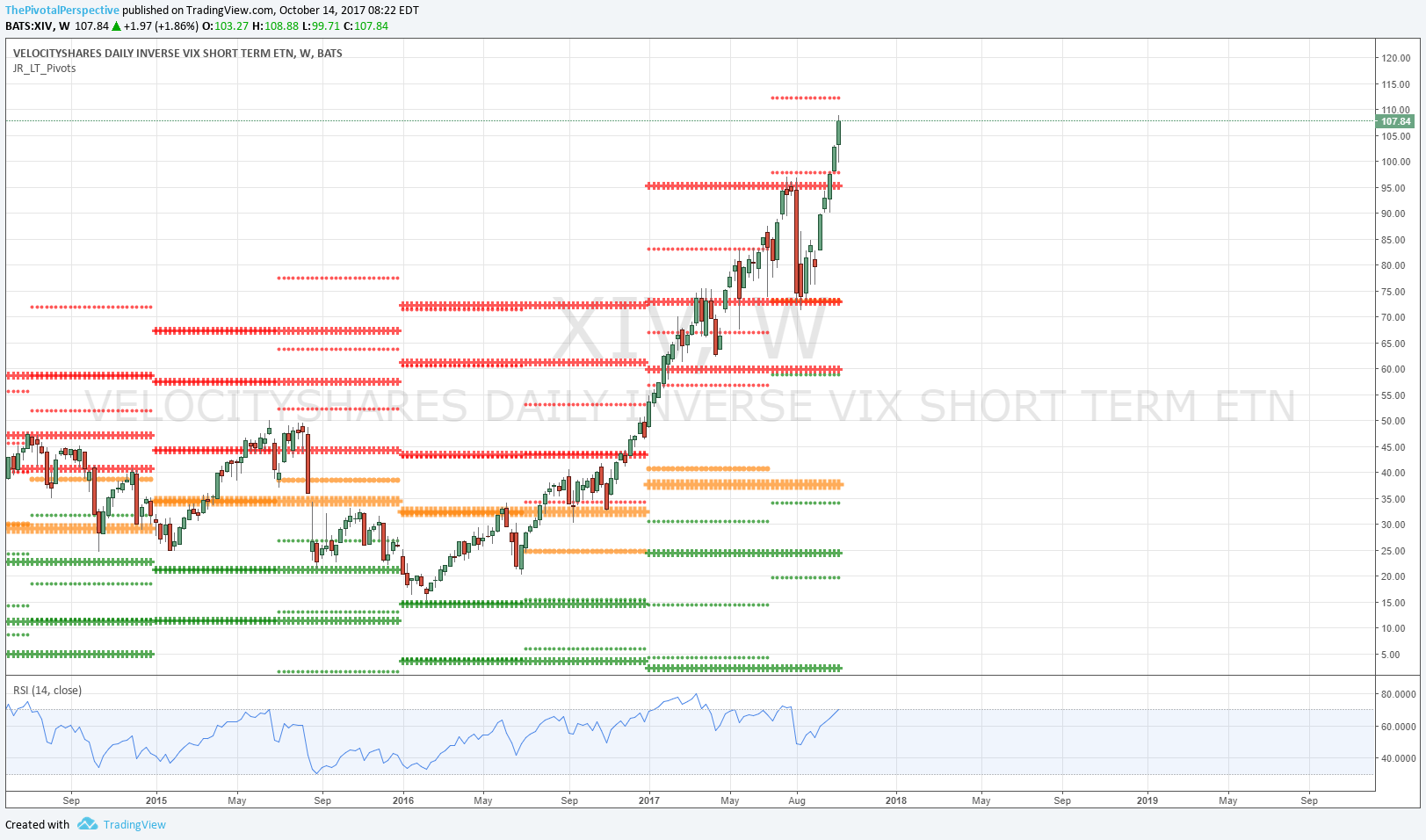

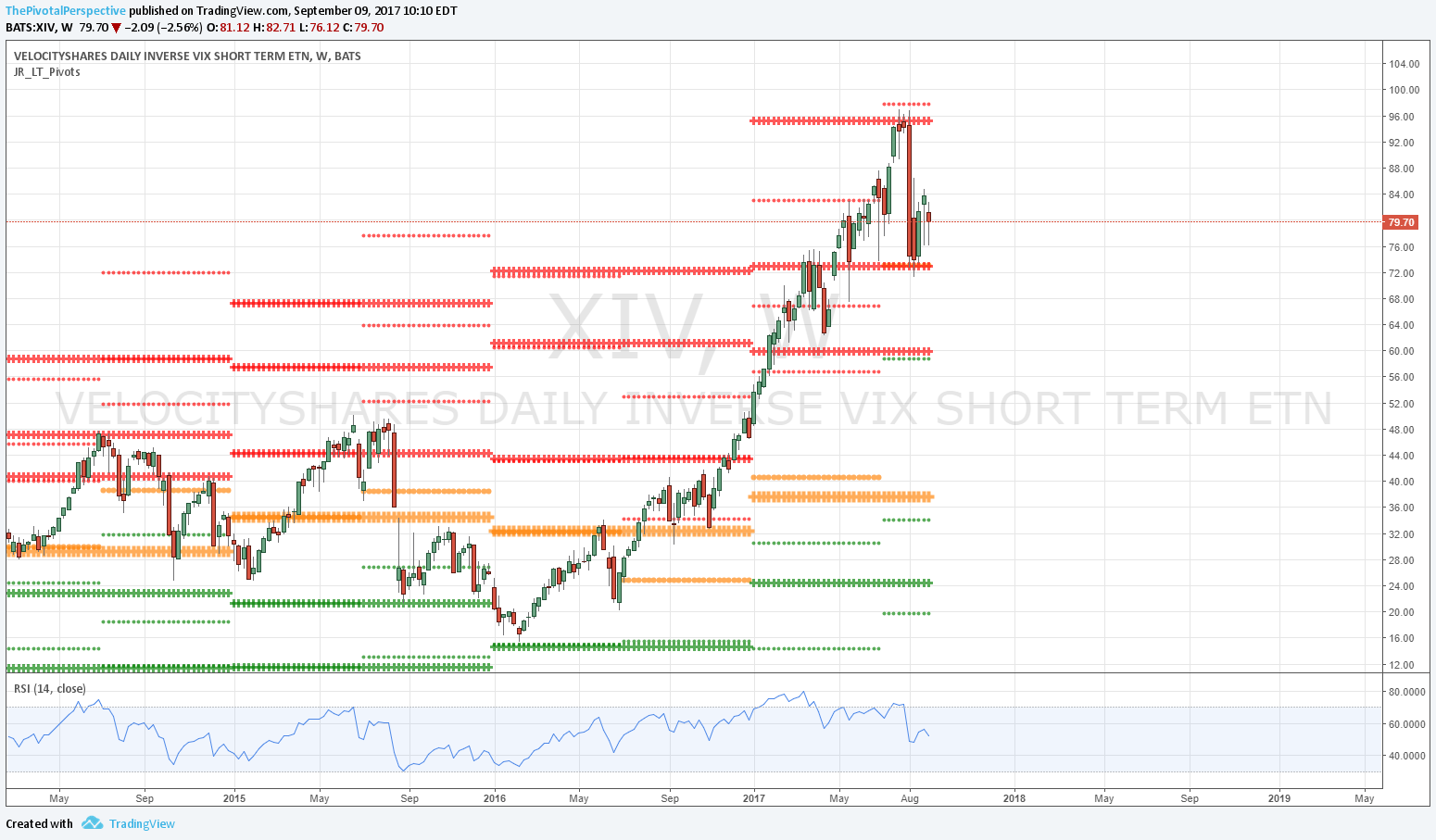

VIX still above its YP means some validity to bear case, but with VXX below all pivots it isn't much.

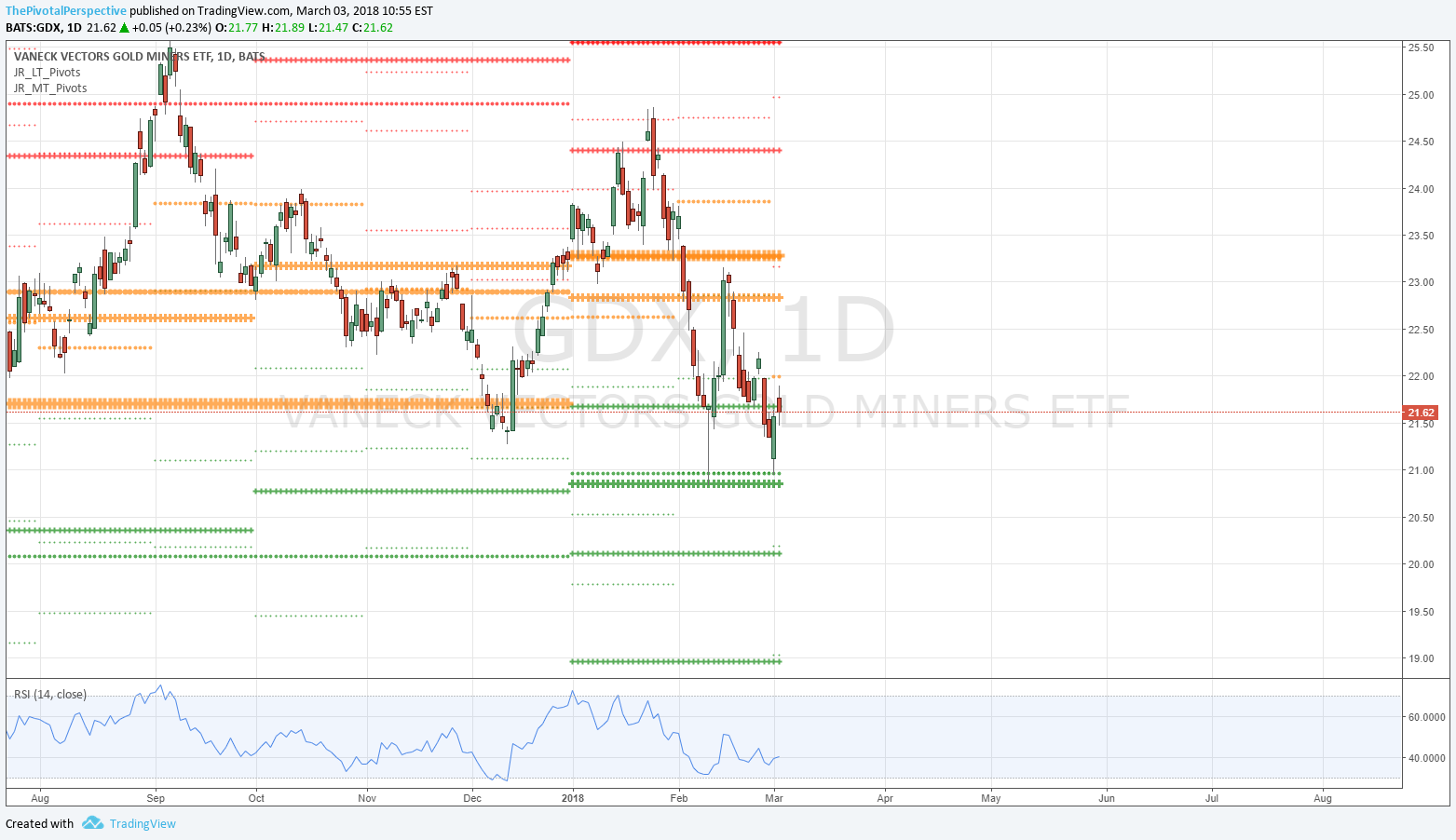

Other safe havens weak: TLT holding above its MP by a fraction, GLD weak and looks ready to go lower. GDX and SLV are odd, below all pivots but refusing to drop. I think there is a message here but won't play long side under a pivot signal.

VIX

Above its YP since 1/29. 3 recent highs on monthly pivots; 4/25, 5/3 and 5/29.

VXX

Bears seemed to have chance on 5/29 but then immediately back under HP the next day. Note the high test in YP area early April.

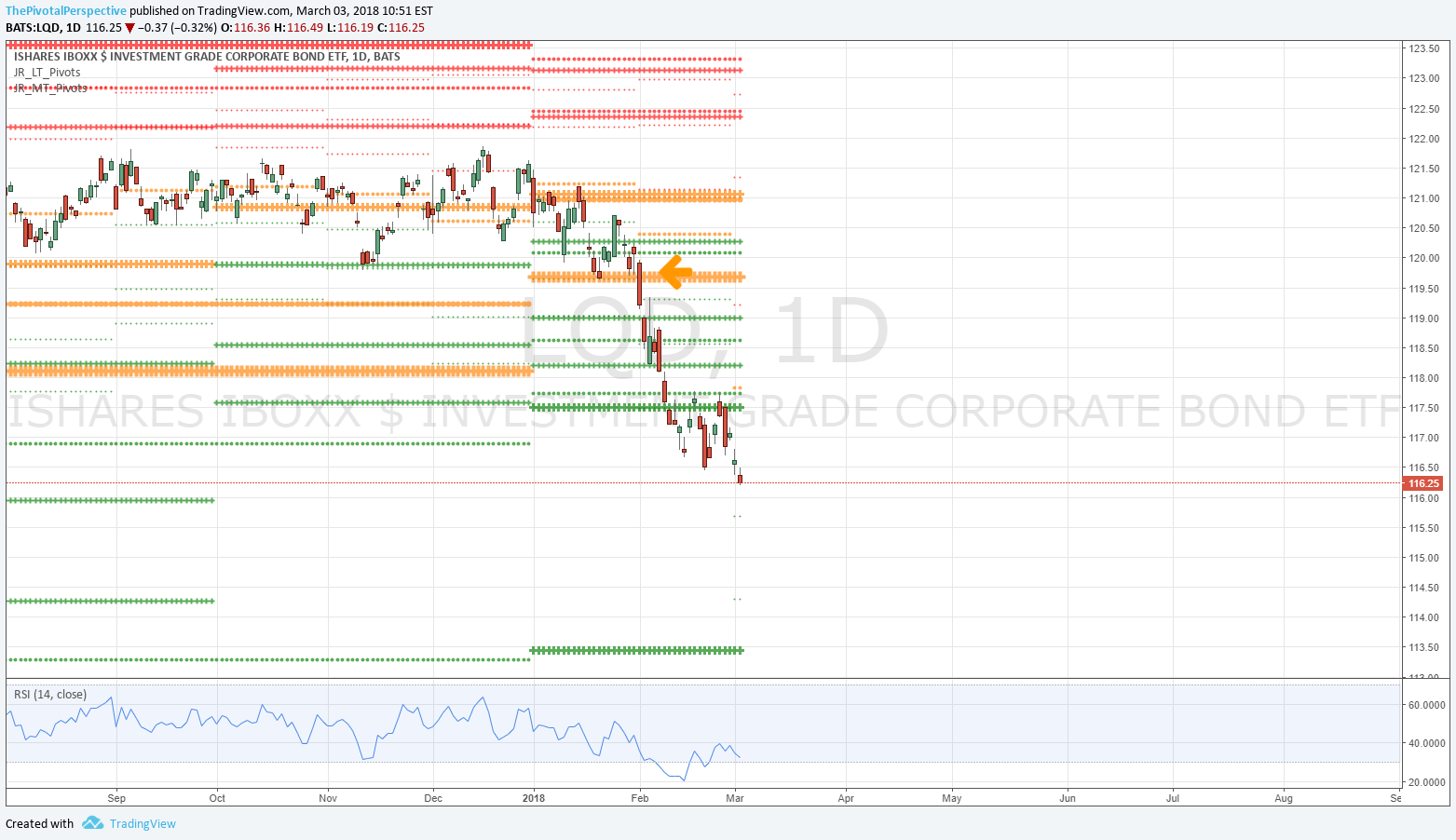

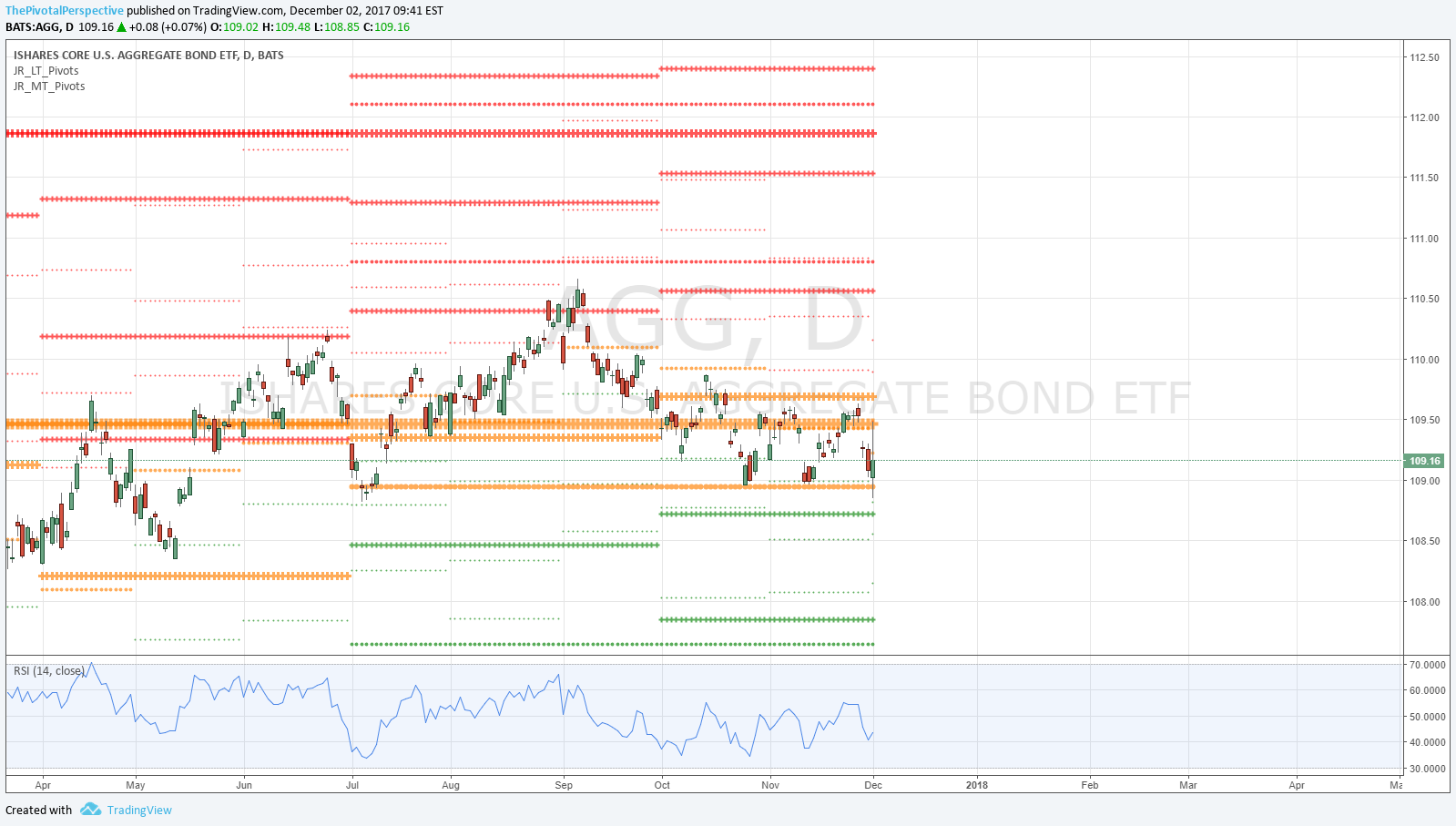

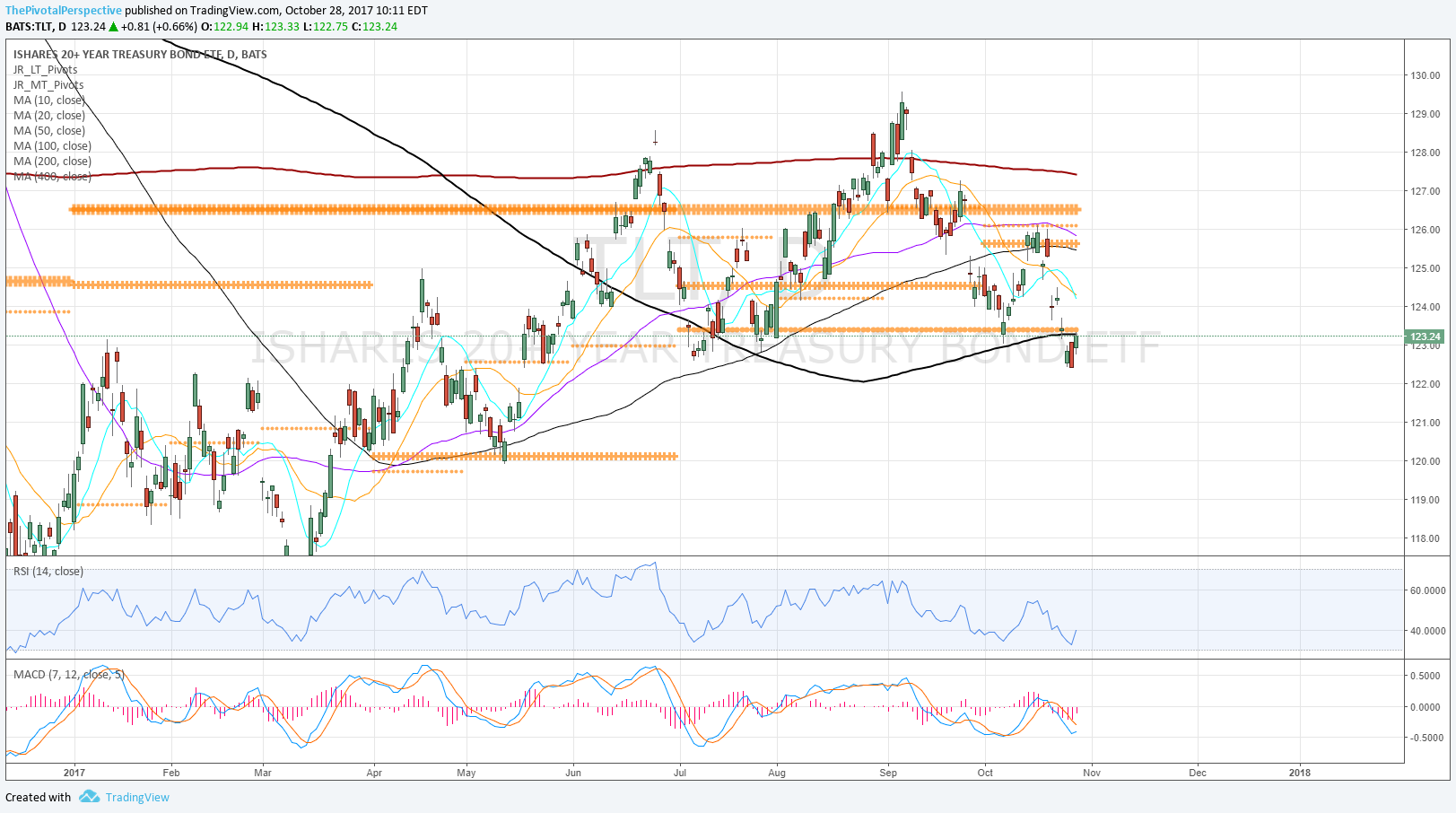

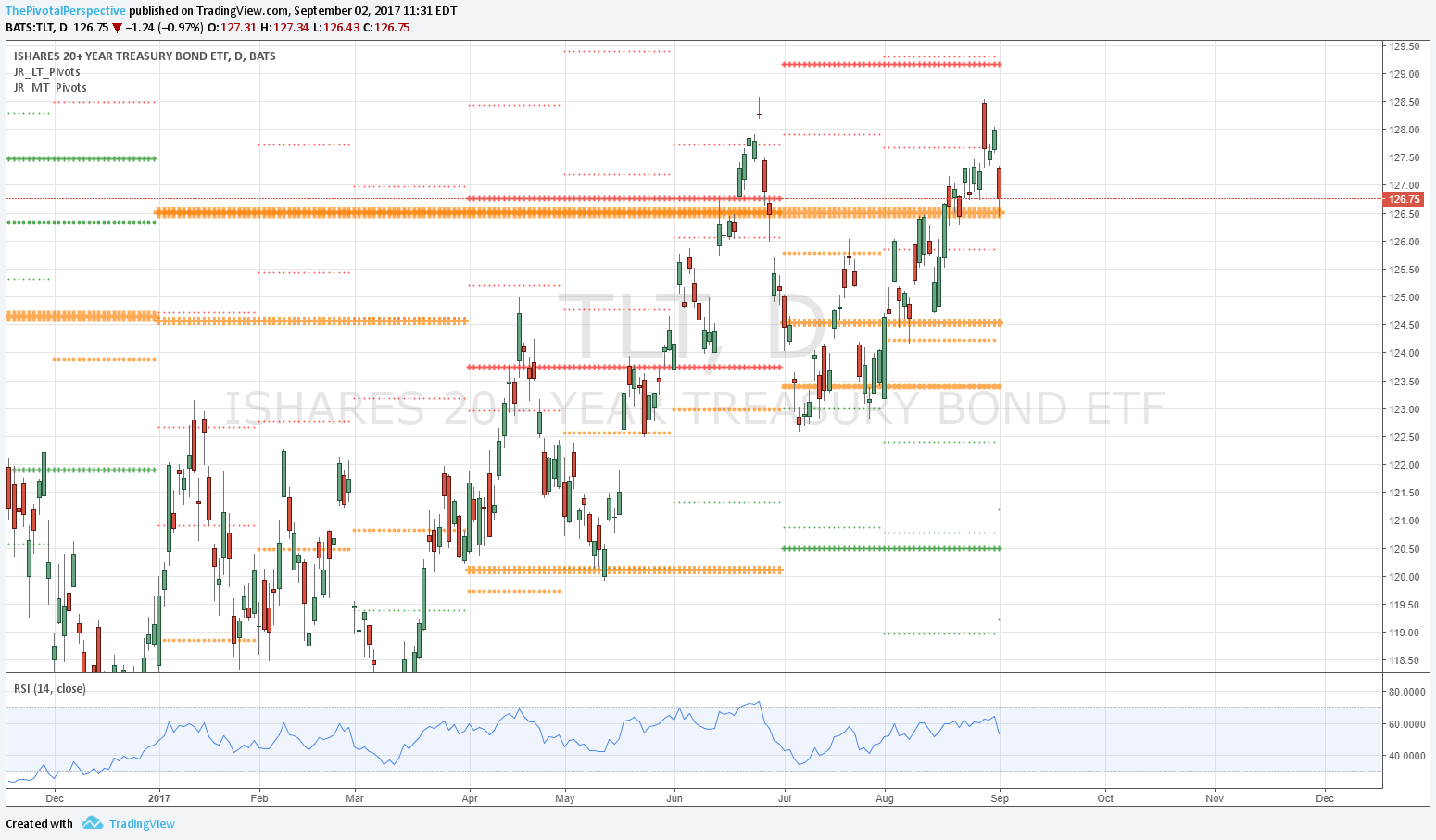

TLT

Fast bounce from low area as called, but also lasted above QP only 1 day and lower to start June. Holding above MP - barely. Any lower and below all pivots.

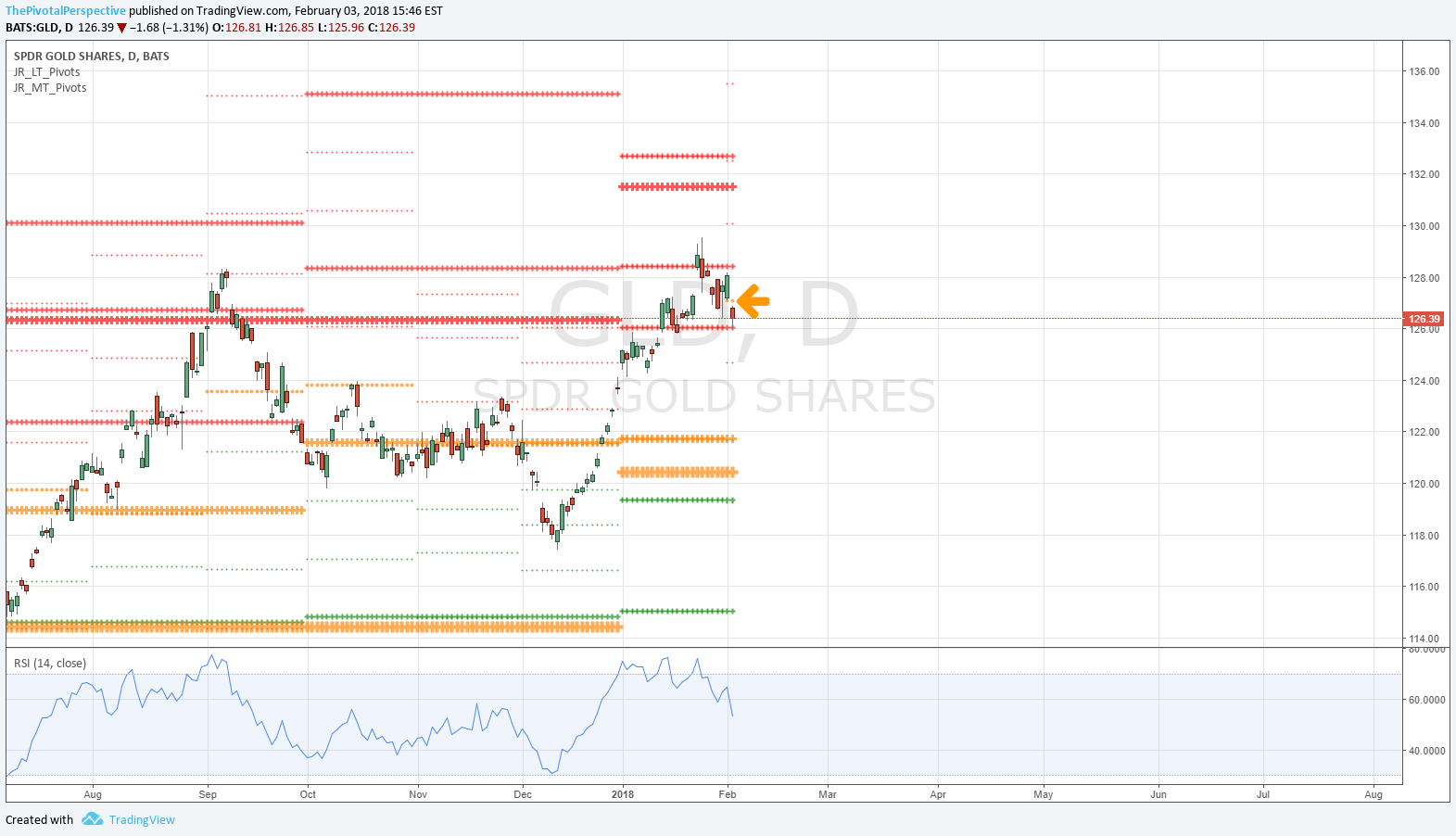

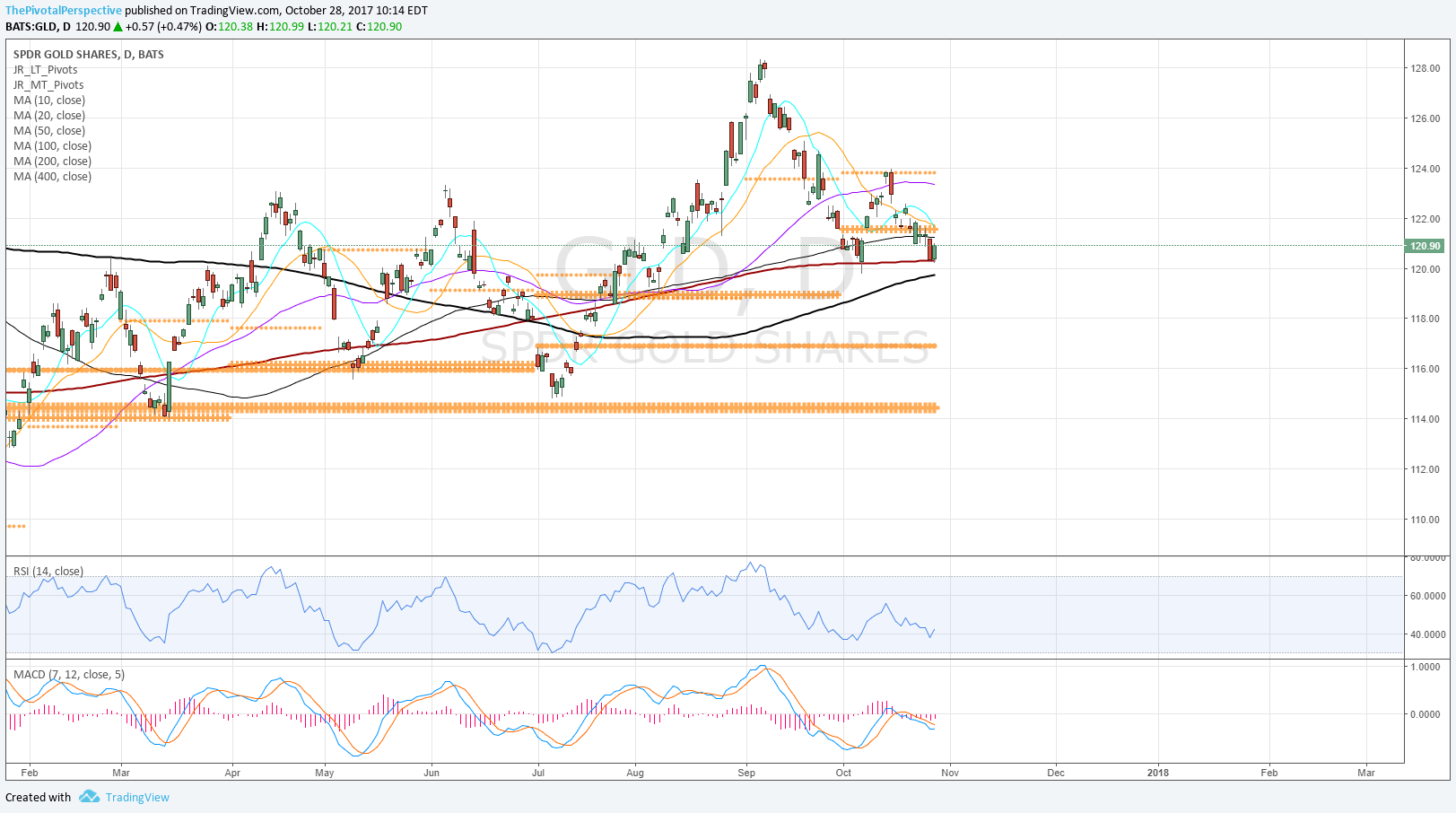

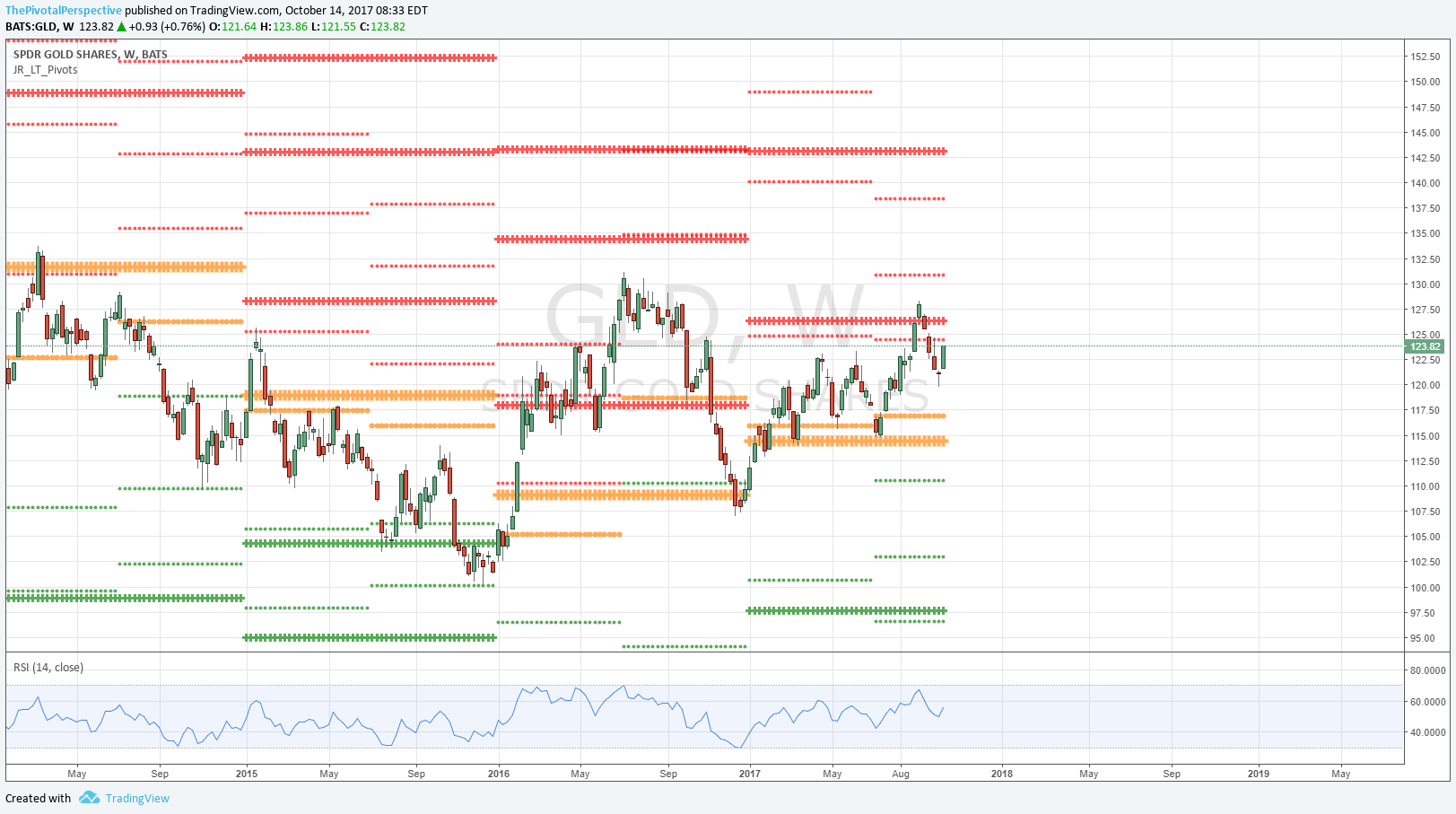

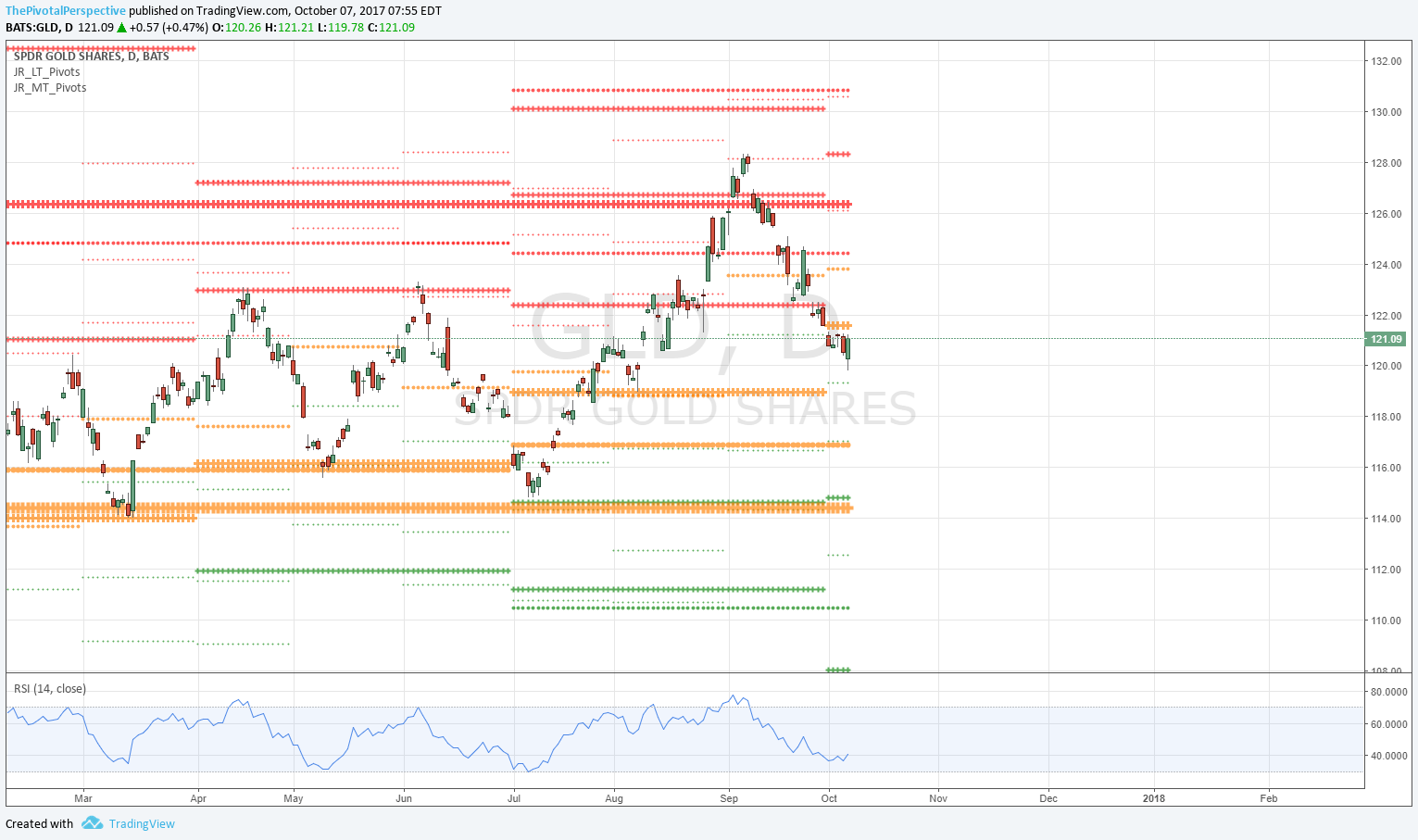

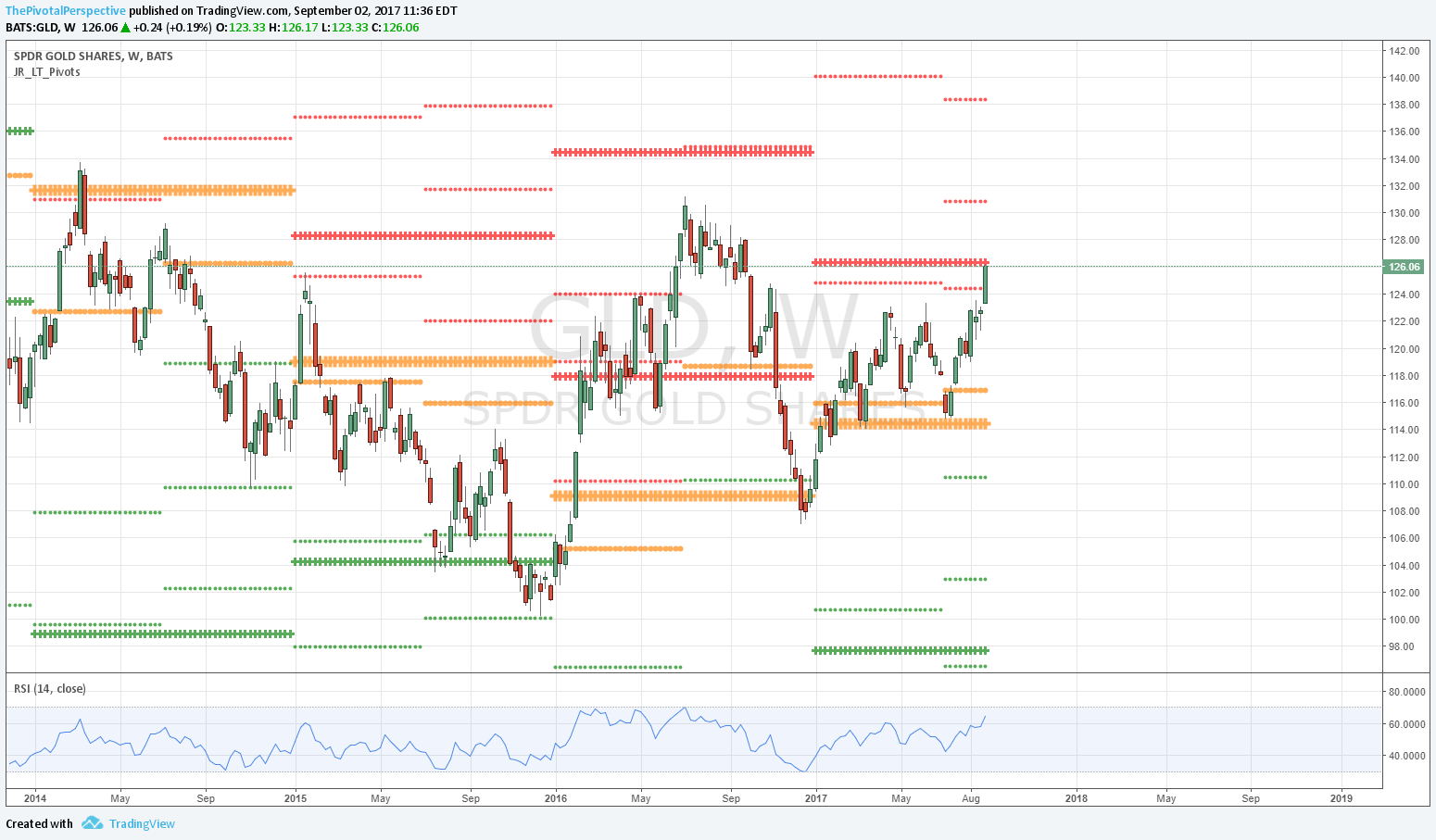

GLD

Recently tried to hold HP but didn't get far; under QP, JunP and D200MA.

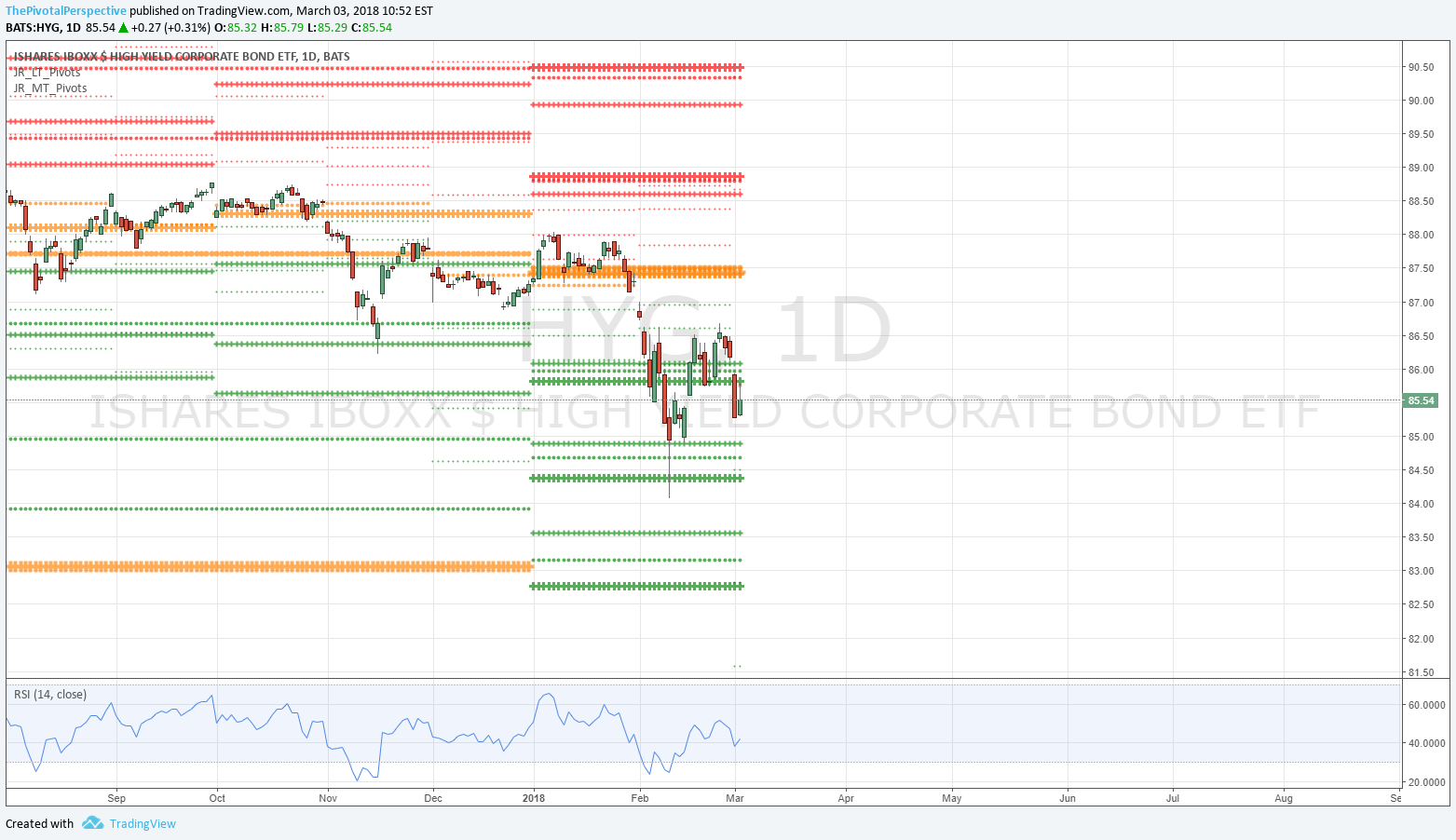

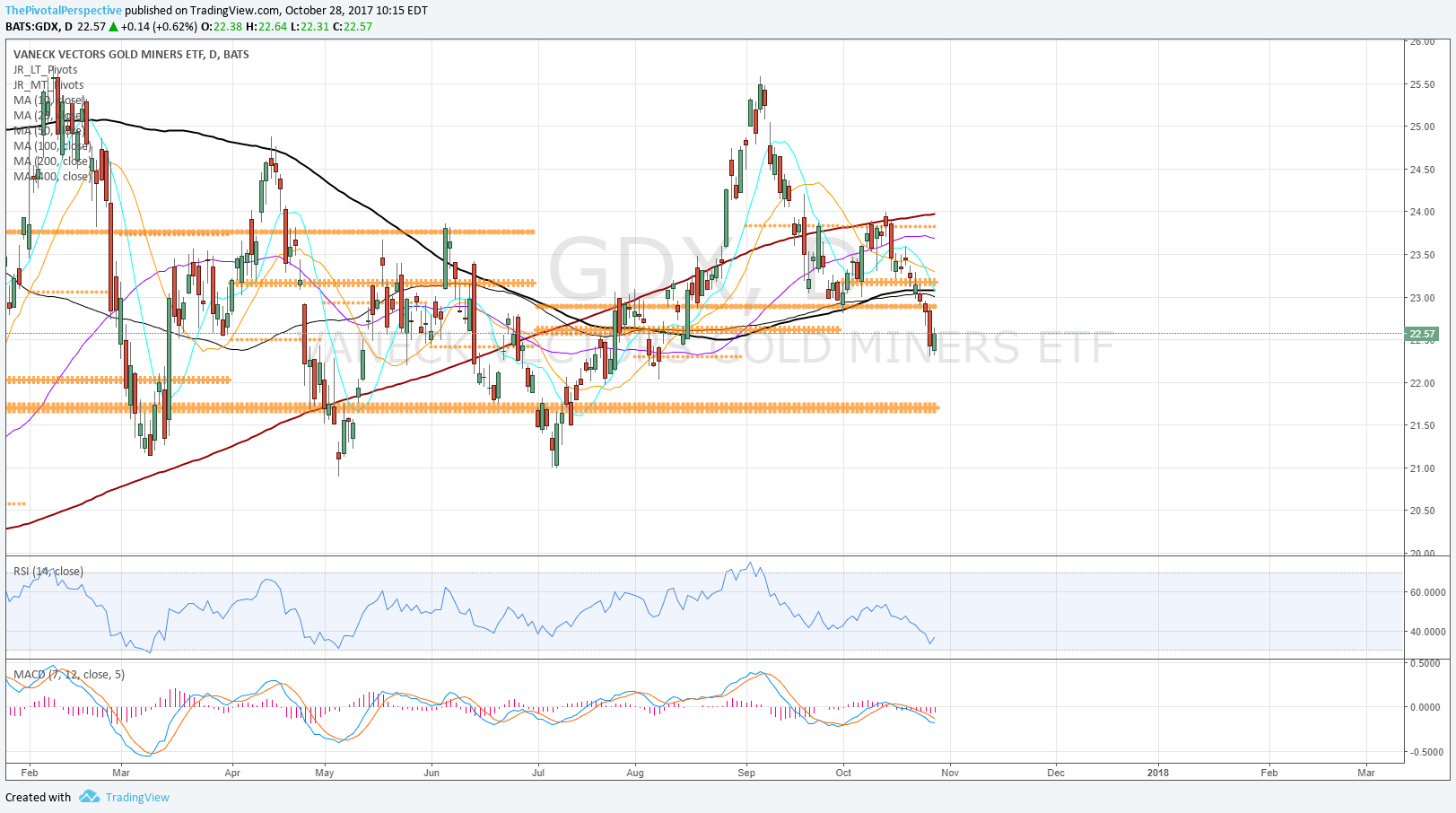

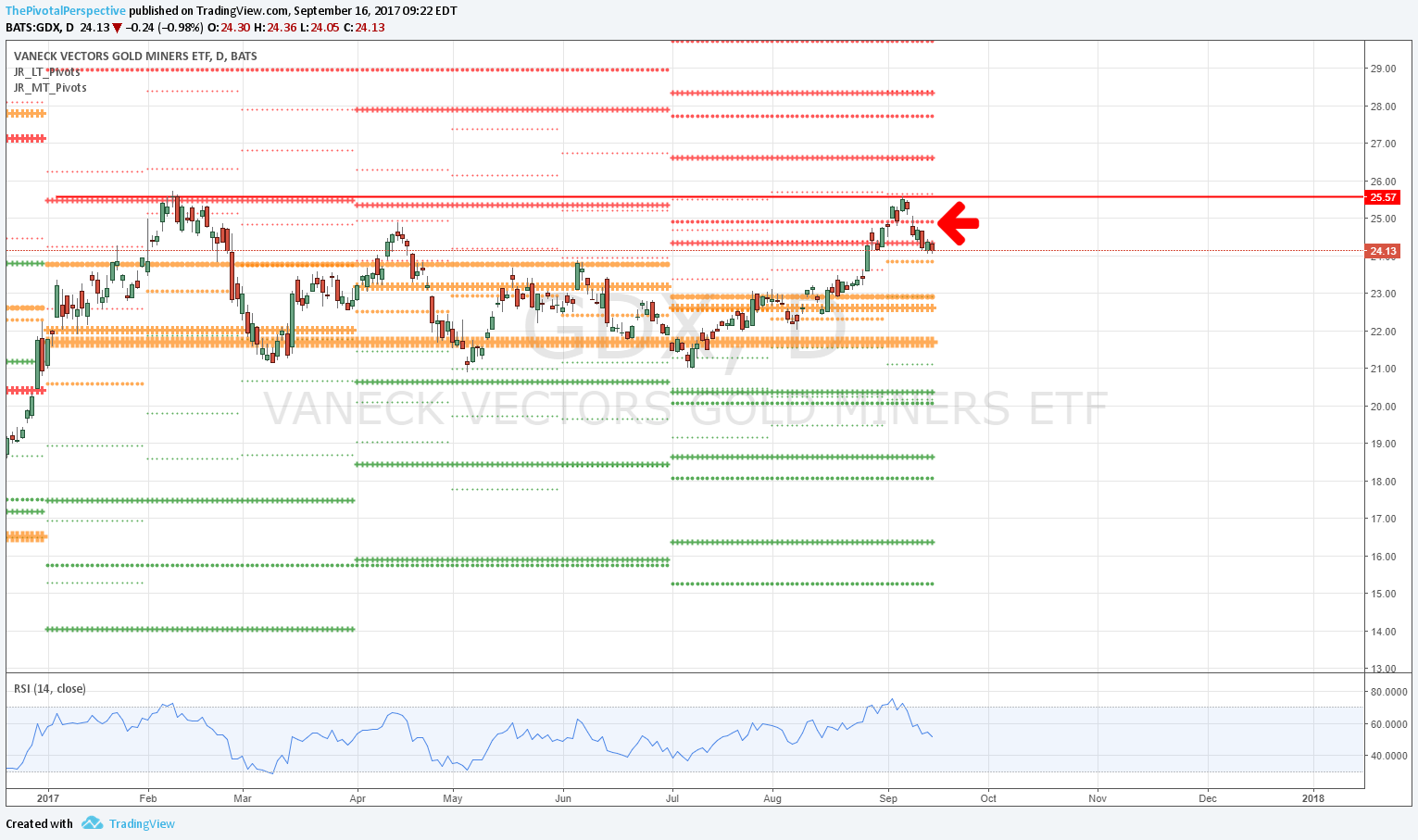

GDX

Odd - below all pivots but not dropping. Last touch of actual support was early March.

SLV

Also below all pivots without touching any monthly support since February. This 'could be' long term accumulation but if a rally gets going we will see improvement above pivots like XLE recently.