Sum

Larger uptrend intact with all indexes above all pivots, and daily charts above all rising slope MAs except the 10MA. However, 4 of 5 USA mains having trouble at Q3R1s - only DIA has cleared. In addition, RSI divergence on some weekly and daily charts. The market has invited sellers. IWM the weak link likely to lead lower. A clear of Q3R1s would alleviate concerns.

SPX / SPY / ESU / ES1

SPX W: Candlestick fans would like to see a top here. If higher then 2HR1 in play.

SPY D: Struggling at the Q3R1, especially on Friday.

ES U: But still above all pivots and MAs.

ES 1: Similar to SPY.

SPX sum - Uptrend intact, but Q3R1 resistance and RSI in toppy area.

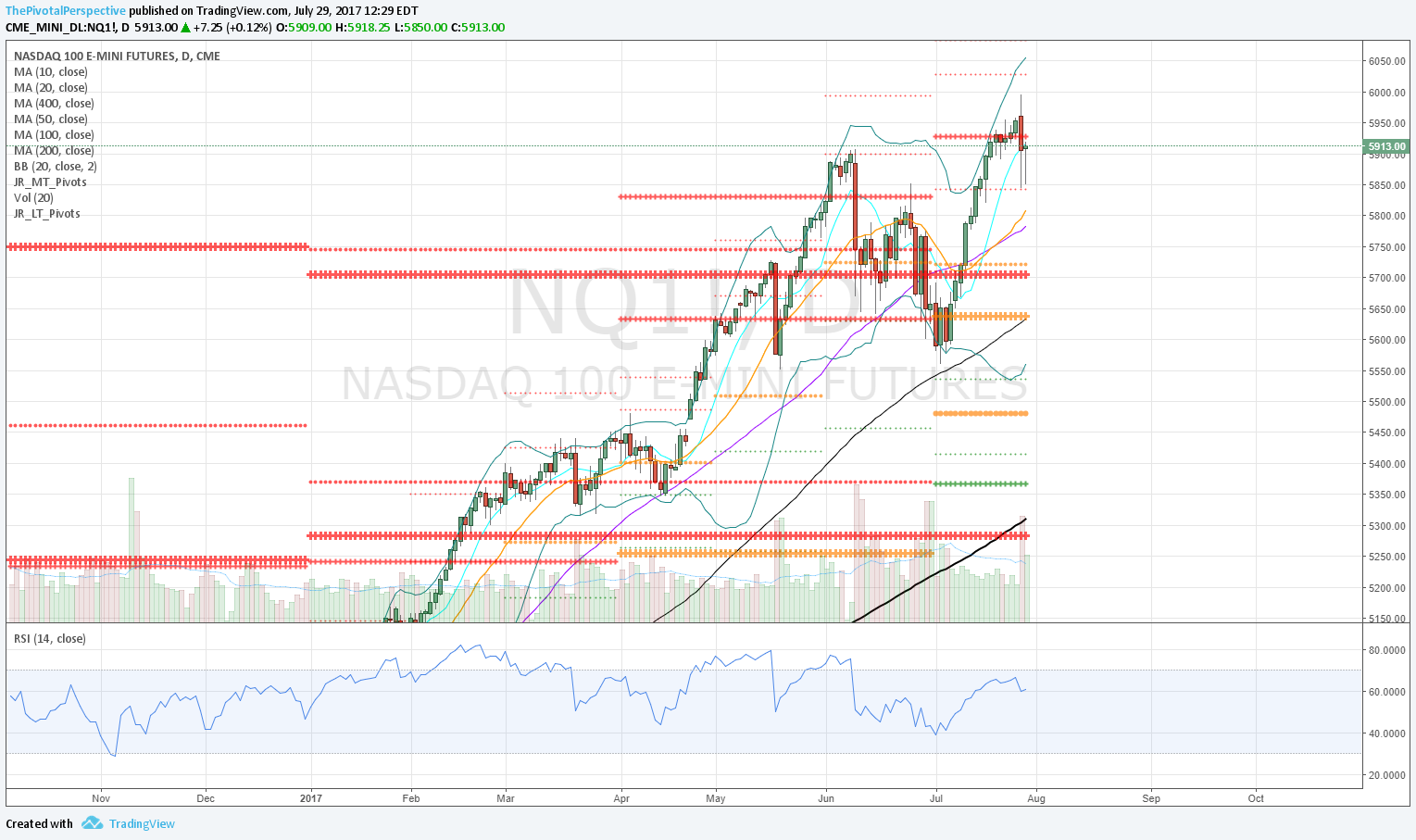

NDX / QQQ / NQU / NQ1

NDX W: Glaring RSI divergence.

QQQ D: Also back under Q3R1.

NQU: Still above all pivots and MAs; prior key important to watch as well.

NQ1: Q3R1 resistance.

NDX W: Larger uptrend, but glaring RSI divergence. Watching Q3R1 and prior June high area (price & close levels).

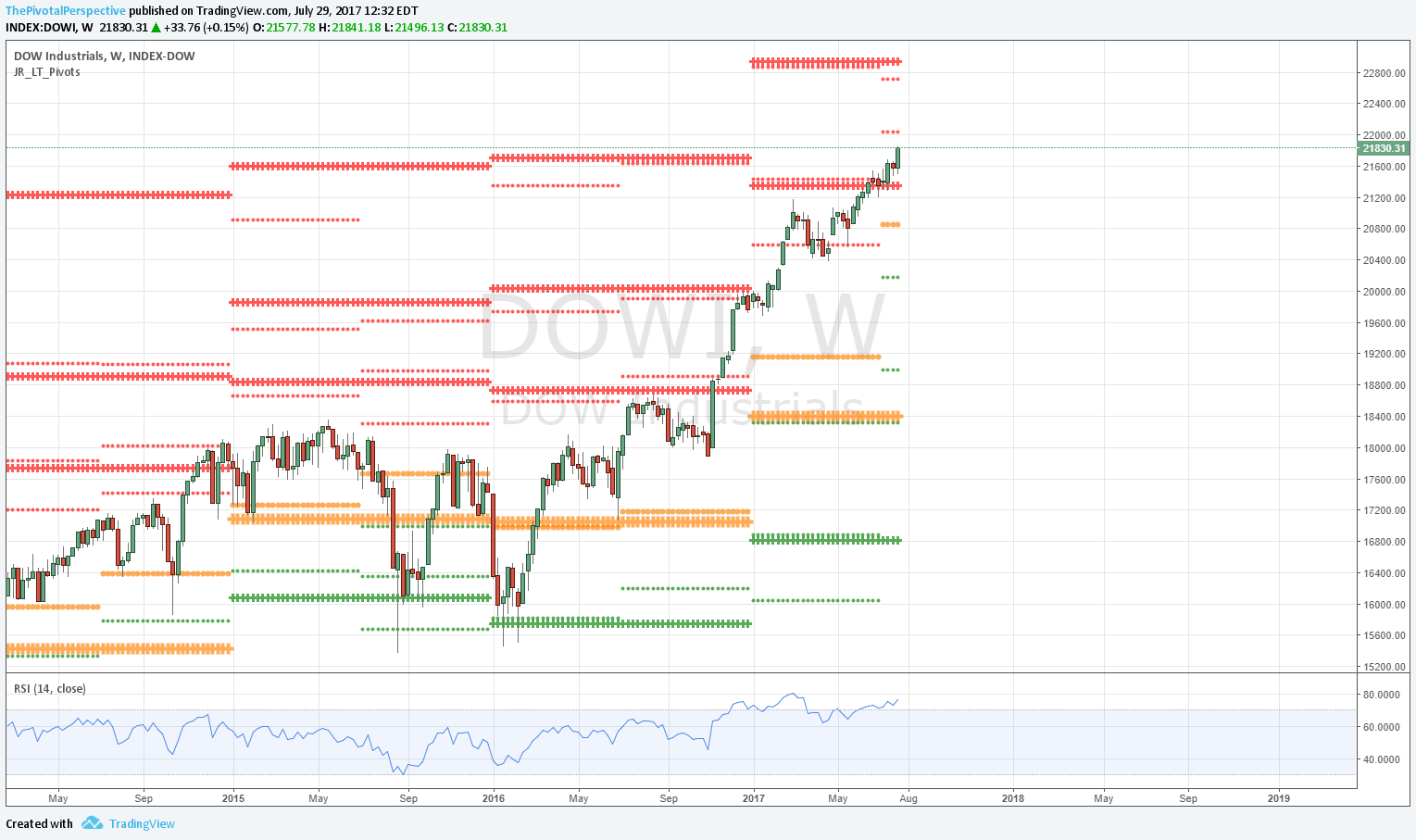

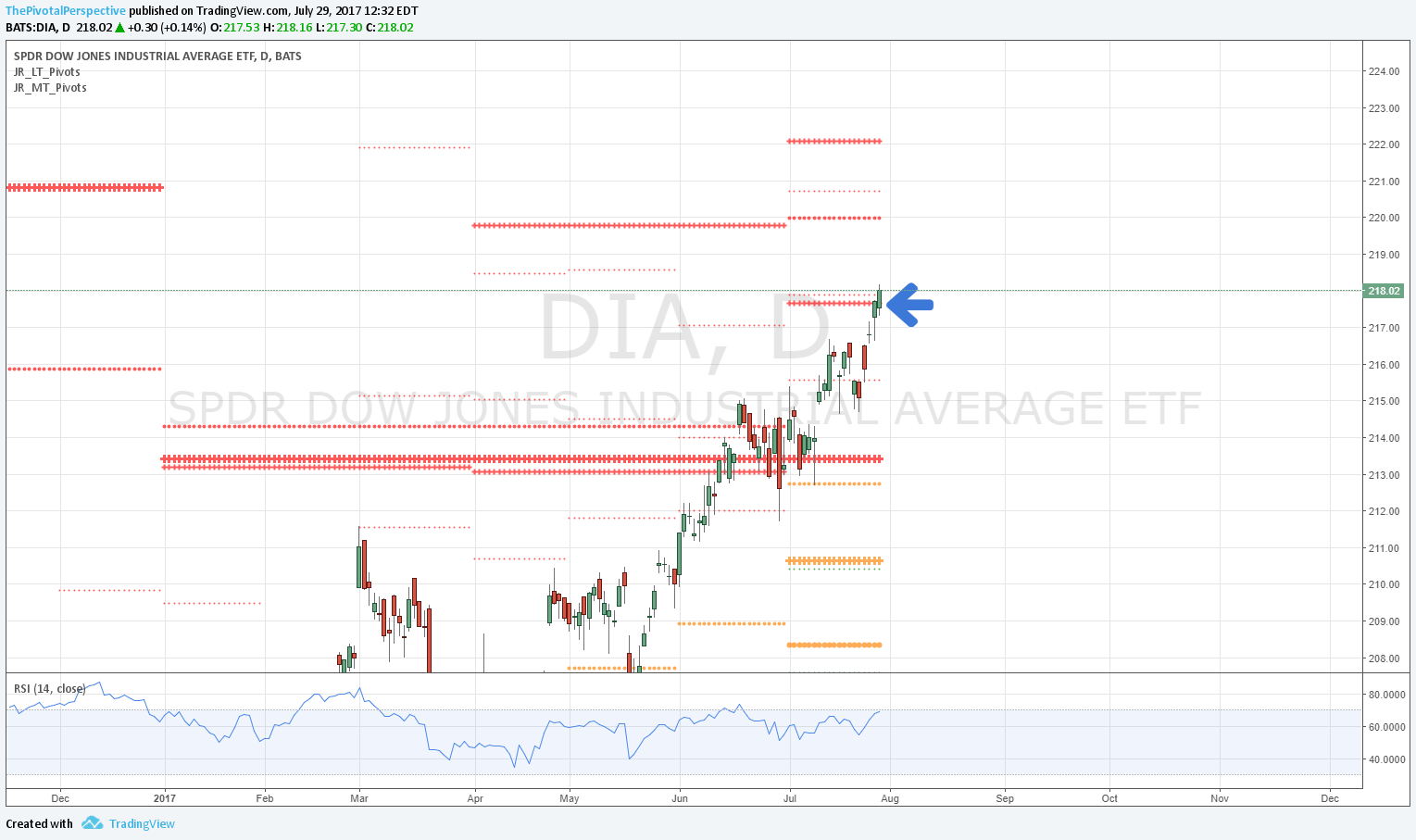

INDU / DIA

INDU W: Doing well above the YR1.

DIA: Only one to clear Q3R1.

INDU sum: DIA new medium term pivotal leader, above the Q3R1.

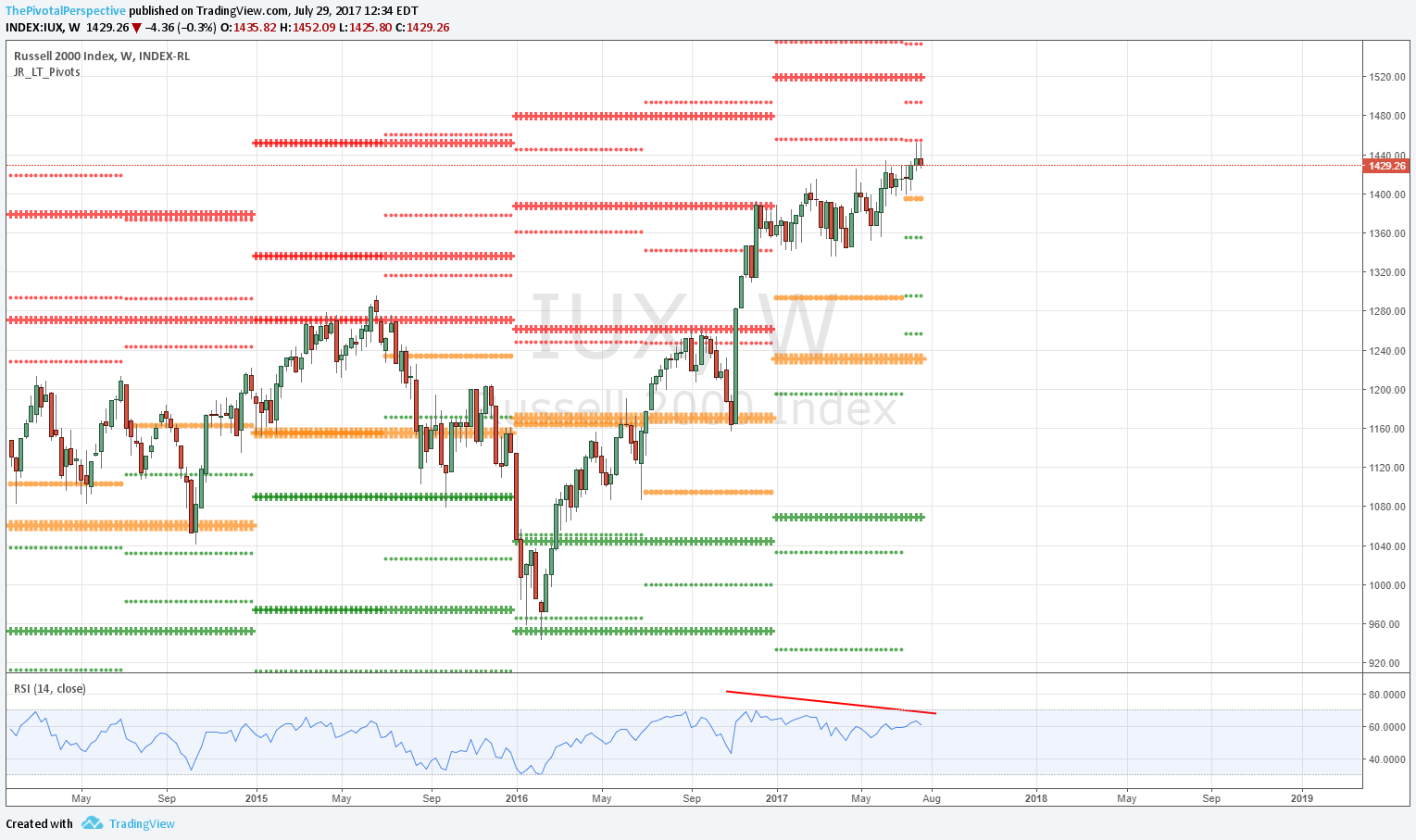

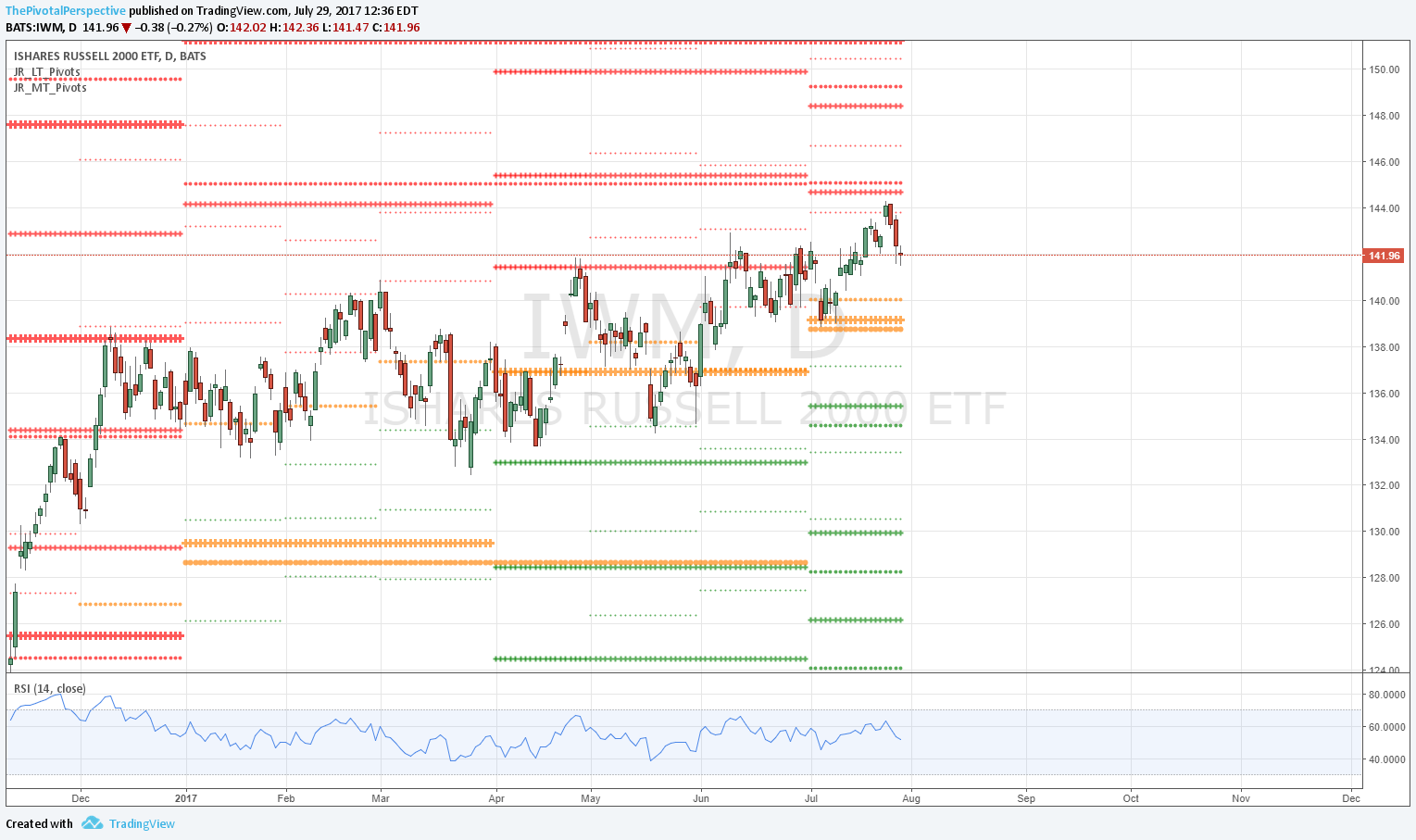

RUT / IWM

RUT W: Another tag on 2HR1.

IWM D: Q3R1 rejection.

IWM D: Also watching prior area (both price and close highs).

RUT sum: Continues to be weak link of USA main indexes.

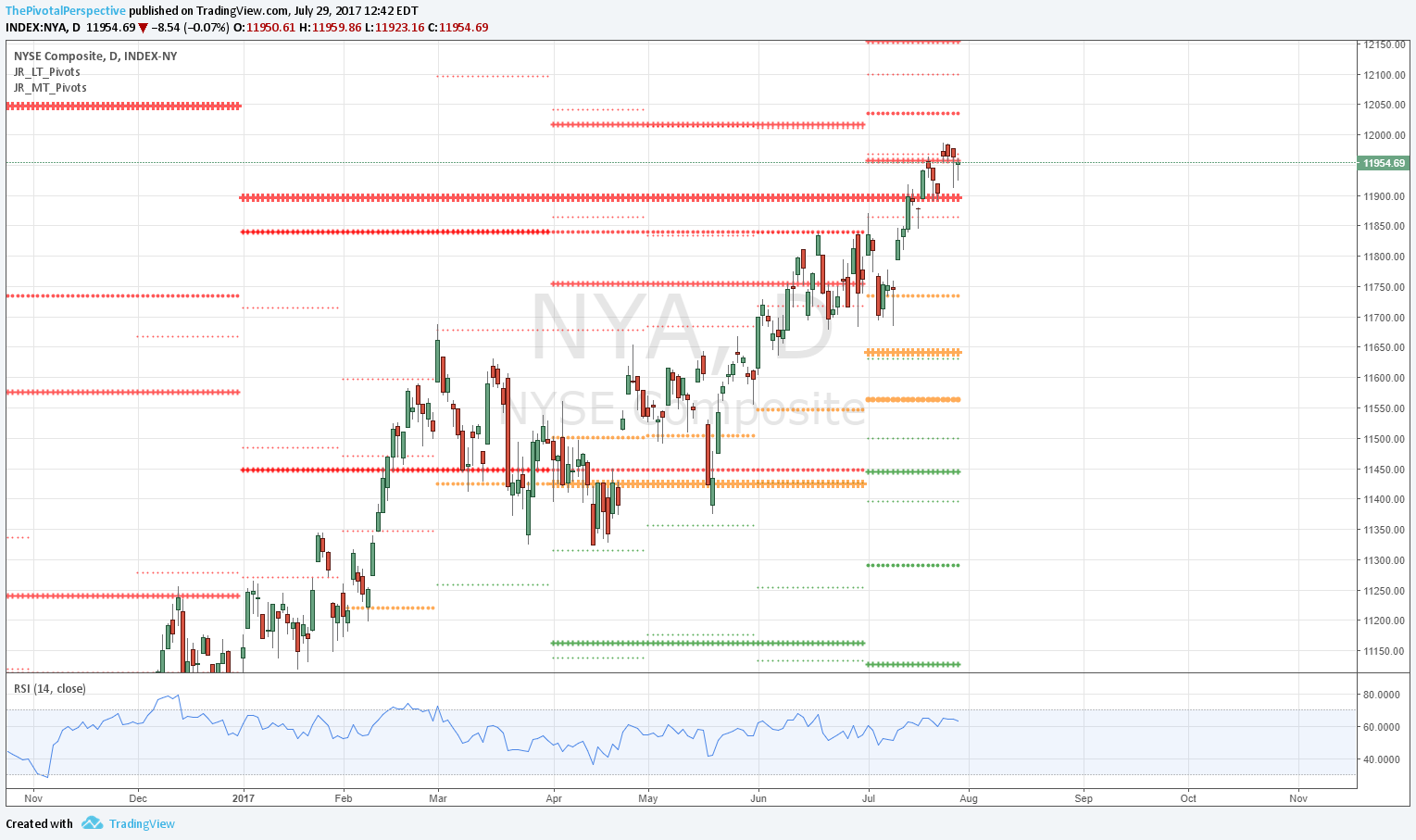

NYA & VTI

NYA W: Above the YR1 but struggling to really lift off; 2HR1 not far.

NYA D: By Friday, also trouble at Q3R1.

VTI W: Note RSI.

VTI D: Clear selling from Q3R1.