Some long term levels to consider.

Yes I like the China, India and EEM trade and TPP rotated into this in March with a substantial percentage of portfolio since then, often 40%. This has benefitted from Trump shenanigans and institutional recognition that EEMs should have far higher market cap compared to global GDP and GDP growth. But if markets were to have a pause, it is at places like this.

That said, all these weekly charts have RSI strength with higher highs than May. This increases the chance of mild drop and/or eventual comeback.

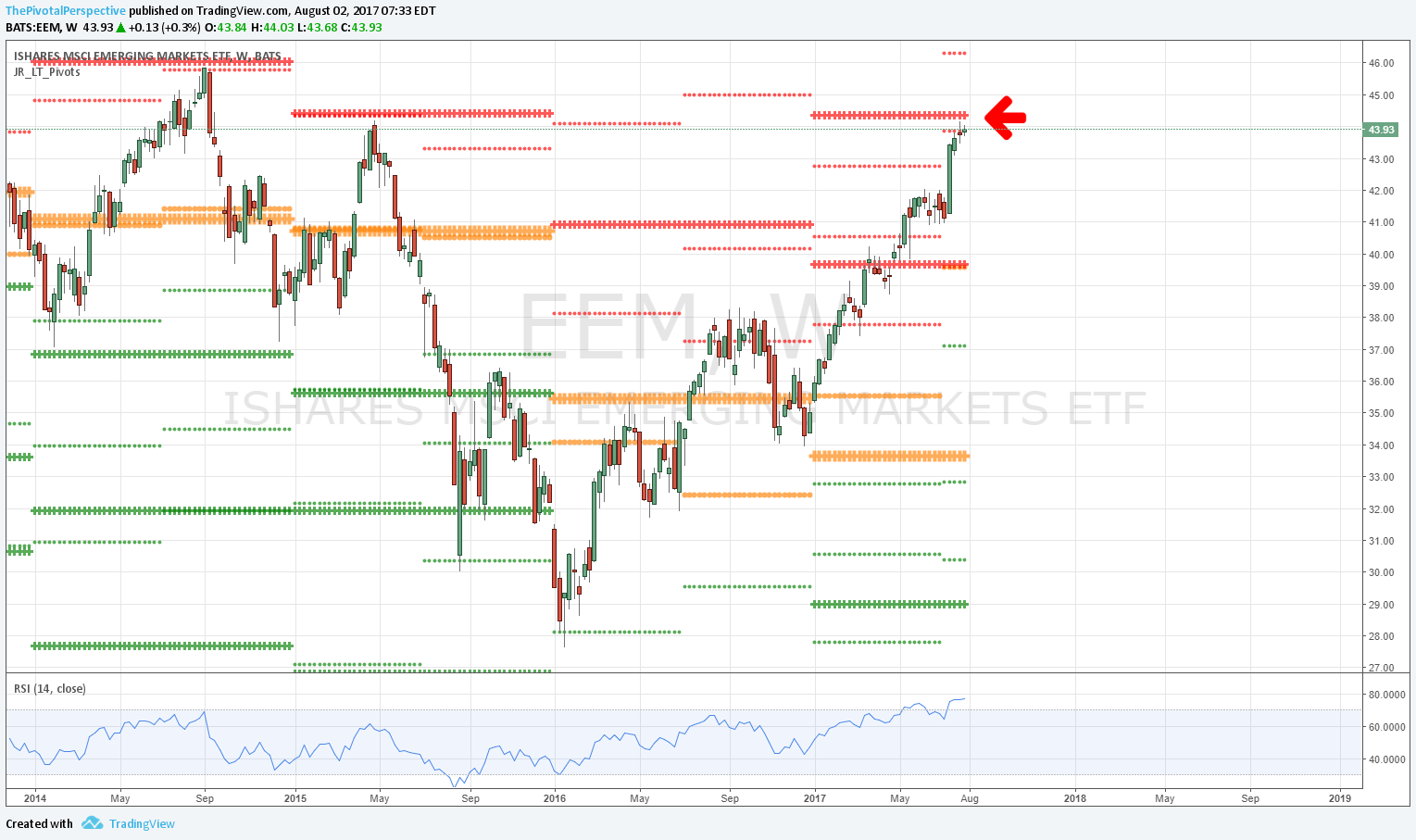

EEM W

YR2 area and 2HR1 testing, pullback likely.

INDA W

So far soaring above, bullish. Easier to hold above the YR2 as support.

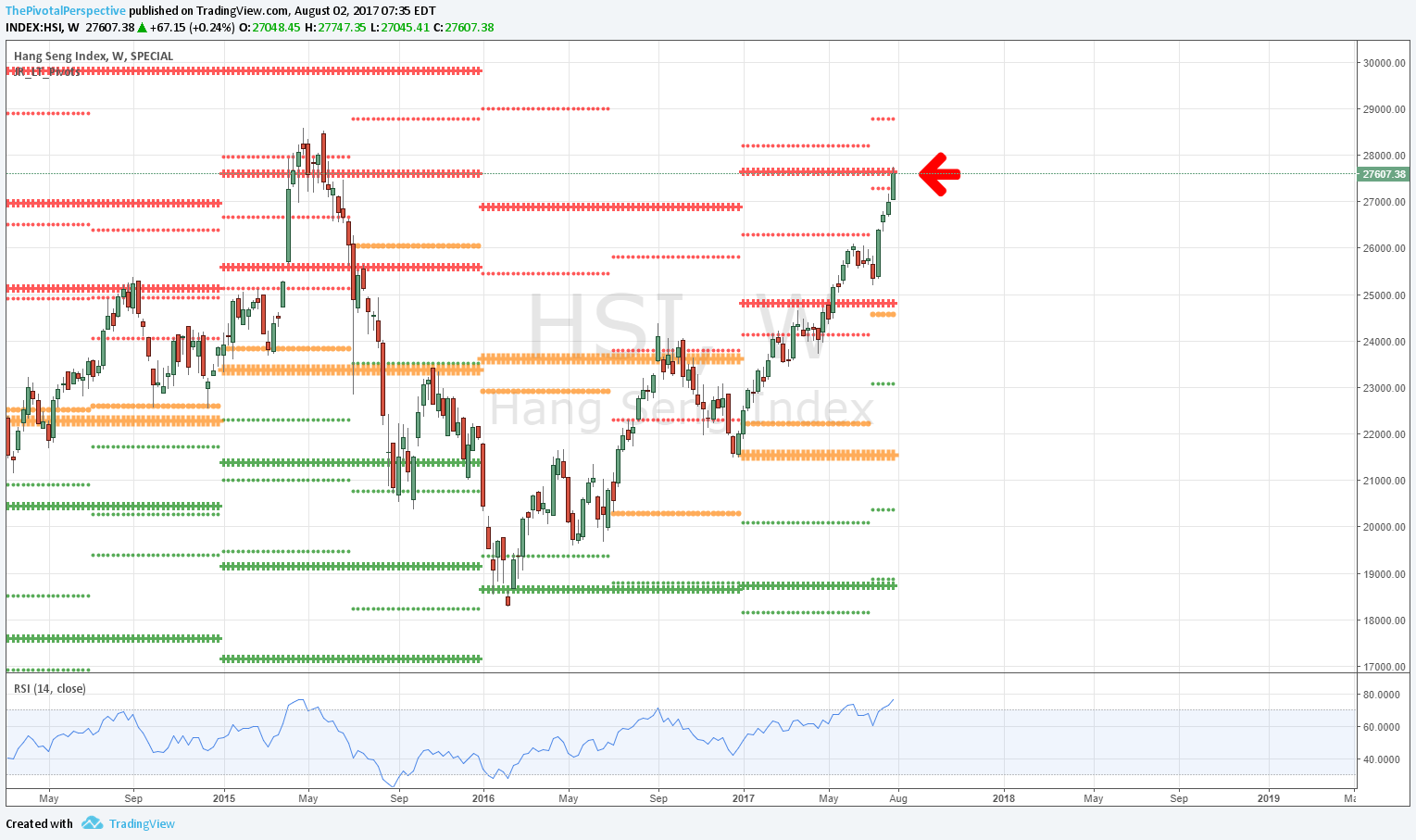

Hang Seng Index W

Bang on YR2 here.

NIFTY W

YR2 and 2HR1 tag - so far not above.

SENSEX

Same move - YR2 and 2HR1 tag.

MSCI Emerging Market Index Futures Cont Contract

YR2 and 2HR1 combo too.