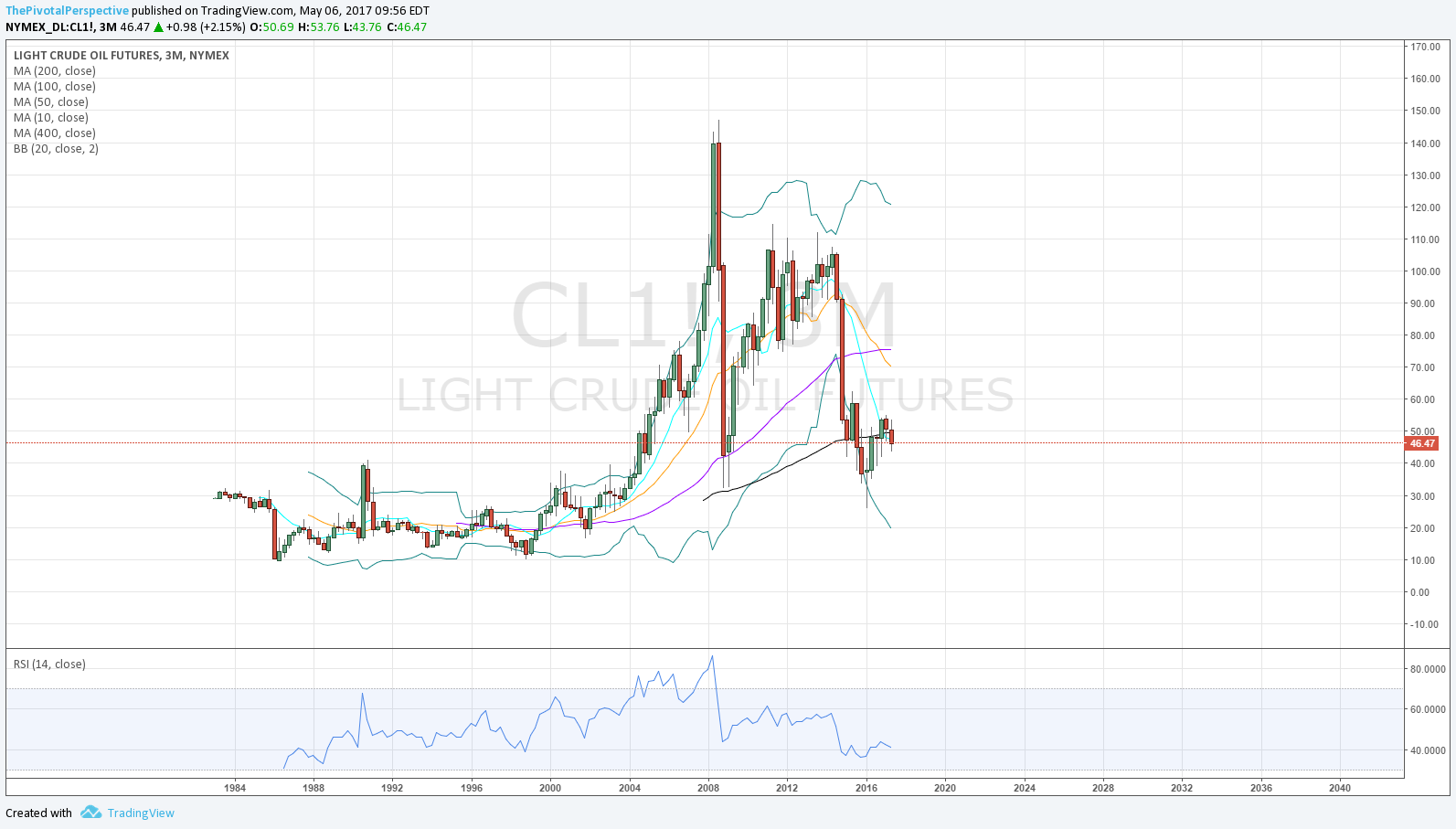

Last week: "Below 37.04 would risk a larger drop and thus increase the chance of a more significant fade for stocks back under long term pivots. Back above 37.87 would be stronger and invite a near term move to about 40."

There was a 1 day fake-out with close at 36.34, then back above the next day. Price high 41.20, close high 40.20 so far.

Sum

Low of year bang on YS1s but even after all this rally current K contract not above quarterly, half-year or yearly pivot. So, may go a bit higher then running into major long term resistance. CL1 chart 1 day above Q1P but doesn't look convincing. I don't know the next move but like stock indexes running into major pivots, some pause or shuffle is likely but whether that turns into major high, ie rejection and down, or bullish clear, remains to be seen.

For now I would consider CL1 below Q1P 40.75 mildly bearish, but current K contract may run up to 43.80. It is always tough to decide how much to weight pivots when they have a few trading days left. New Q2 pivot and of course April as of 4/1.

If you bought the spec buy on 2/12 as suggested then you have nice gains. You could give this a bit more room and see if we get a tag of the current contract quarterly pivot. It is also likely that oil will be above its Q2P and that could be a longer term hold level for a portion of this position.

CL1 W chart clear low of year on YS1. Decent rally but still below 1HP and YP.