REVIEW

9/16/2018 Total market view: “Current take is moderately long but watching carefully if a defensive adjustment is needed.”

Daily comment 9/19/2018: “If the market makes a small shakeout and then resumes higher we have to be open to that possibility as much as a trading top. For now I like the financials into quarter end as re-balancing is hitting the winners and helping the laggards.”

Result

Market had one day shakeout and then recovered. NDX well off the lows, but IWM not that much.

SUM

All 5 USA main indexes are above all pivots, and VIX & VXX below all pivots. Crucially, DJI cleared its YR1 without any trouble. Even though I tend to focus on SPX and NDX above the DJI, historically speaking with pivots it is probably DJI that has most impact. So I view this as quite important clear, as long as it maintains.

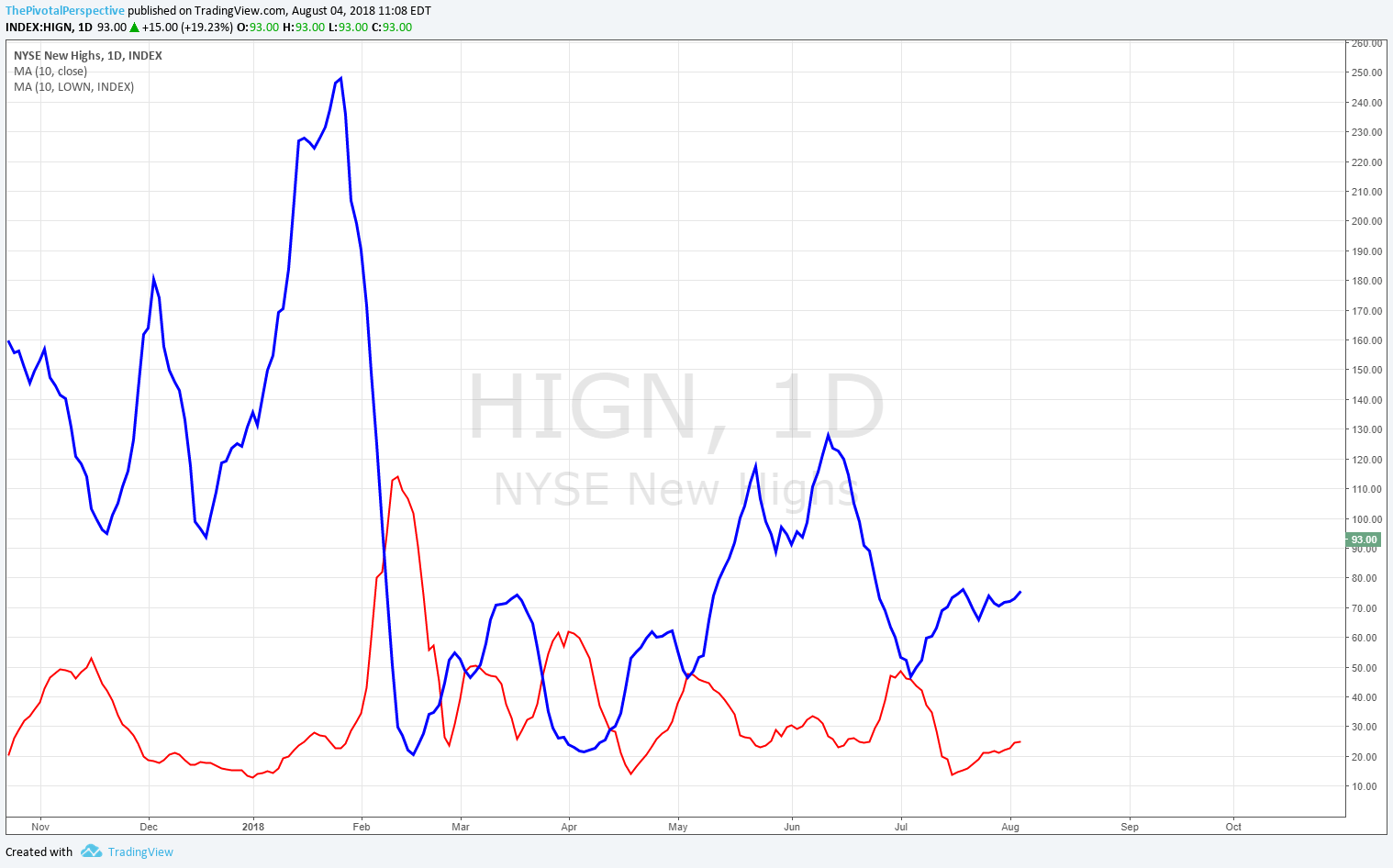

However, 2 of 5 of these indexes are testing resistance levels - SPX QR, NDX YR2; and RUT topped on QR in August. Given weekly chart and short term 2 hour chart technicals I think a drop is the next likely move. If that assessment is correct, NDX and RUT will break under MPs again.

But let’s keep the bigger picture in mind - USA indexes are in uptrends, international indexes have recovered somewhat, and safe havens have crumbled. VIX is below YP, so below all pivots. TLT is back to near lows of the year, and of the bond ETFs I track (TLT AGG LQD HYG) only HYG is above its YP on price or total return basis. Metals have been crushed.

The main risk seems to be China problems impacting tech. As I have pointed out several times recently, the quarterly chart RSI of NDX is currently 90.5. This is quite rare territory and risk is to the downside. This is why I have been watching its YR2 so carefully. A combination of YR2 rejection and monthly pivot break could easily be the start of something larger (this is what happened on 2/2/2018).

If NDX was about to power up we would also likely see strength in SMH semiconductors, XBI biotechs and KWEB China tech. Yet of these only SMH is above all pivots. Should we see a coordinated move below MPs then a bigger tech selloff may be underway.

Other factors pointing to risk-off as the next move - value perking up against growth for nearly all of Sept, equity put-call near lows of the year, and RSIs across timeframes approaching overbought or nearly so. For example, SPX Q & M charts 70+ for months now, but when weekly, daily and 2H chart all reach 70 area along with tags of upper Bollinger bands on these timeframes as well then pros are likely taking profits. Lastly, my timing work had 9/20-21 top.

But as mentioned above if we were about to see a major top then DJI should not have cleared its YR1. As long as this maintains above I expect any weakness this week to be soon bought for the start of Q4. Also it is often good to have cash on hand for next setups. If RUT and NDX reach SepS1s then that is probably a good buy.

Bottom line - near term watching to play tech short while holding other longs. VXX tagged SepS1 and looks ready to lift, so that is also a potential hedge. If DJI holds its YR1 as a test I’ll likely be shifting back more long soon enough.

PIVOTS

USA main indexes - Levels to watch this week: NDX and RUT MPs, DJI YR1, SPX QR1.

Sectors of note - XBI SepP test and fail and YR1 break. Could be good short. It would be nice for XLF to make new highs but not sure that will happen as HR1, QR2 and then YR1 all in the way.

Developed - Nikkei moving nicely, back above all pivots on 9/11, part of a tell that China not as impactful. But also heading into resistance at QR2, HR1 and then YR1 not far above that. DAX still weaker but off the lows. EFA, a widely watched institutional index, reclaimed its YP but still under HP and D200MA.

Emerging - These have rebounded with DXY drop but not really giving all clear bullish signals. Watching FXI, EEM, KWEB YPs.

Volatility - VIX below YP. A stock sell signal would involve a decent move of VIX back above YP.

Bonds - See note above. TLT very quickly back to lows of the year as TNX rallied from 2.80 area to above 3 in Sept.

Metals - GLD has stabilized at its YS1 in Sept but bounces have been whacked. Not sure of next move but if below MP again then breakdown more likely. I believe FOMC is hawkish.

Commodity - CL1 continuous contract finally made it over QP last week but quickly dropped from near tag of SepR1 and YR2. Range bound action for the 2nd half so far.

Currency - DXY move of the month was YP / MP top and MS1 low.

Crypto - I’d be more bullish BTC if it can move above is QP in Q4. 2/6low defended several times.

OTHER TECHNICALS

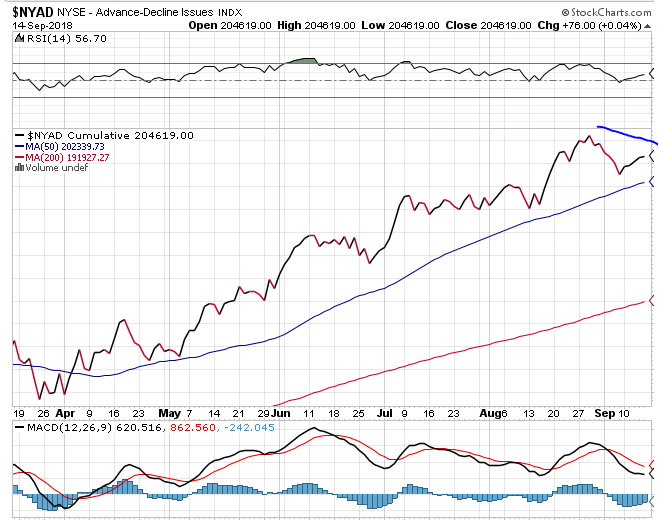

NYAD cumulative advance decline showing some divergence.

Growth vs Value (VUG:VTV) sliding in Sept.

VALUATION

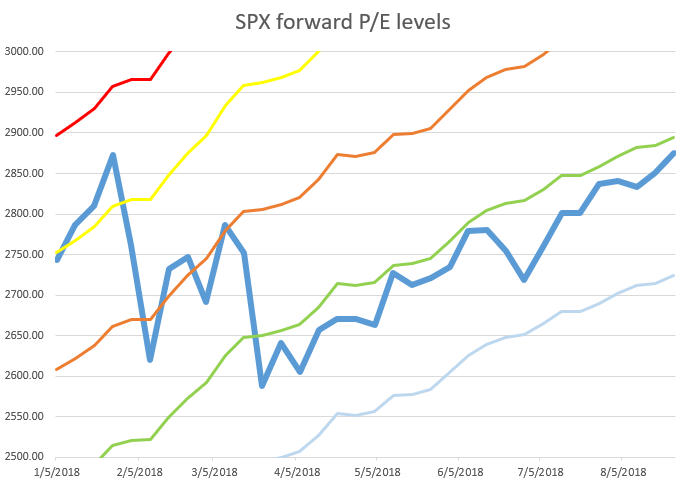

Alas my data feed having issues. Think I can use Factset numbers which should be similar, but need to test. As of last week

SENTIMENT

PC Equity 10 day MA near lows of year. But puts.

TIMING

Timing work has nailed a lot of Q3 turns. This is a very unique system.

September dates posted 8/26/2018 TMV

9/6 - 9/7 index low

9/13 - non event

9/20-21 - index high?

Oct dates

10/1

10/5 - risk on

10/13 - risk off

10/26

In addition, larger cycle weakness after 10/10-11 into early Nov.