REVIEW

1/28/2018 Total market view: "It is The Pivotal Perspective that most major turns and market decisions happen on long term pivot, support and resistance levels (YP, YS, YR). This is especially the case when multiple main indexes, sectors, global indexes and commodities are are making the same move in unison. Last week, more USA main indexes, sectors, global indexes and oil all were in vicinity of YR1s than at any week I can recall since Februar 2016. So far, still powering up. Simply stated it is very bullish for a market which is historically stretched to have a mild pause and continue higher. I will change my tune if we see a fade back under INDU & NDX YR1s, but so far that hasn't happened. If YR1s turn into support, as they did in July - August 2016, then that opens the door to YR2s. Also keep in mind that Dow yearly levels have been major turns or key continuations every year from 2005. Clearing YR1 or making a trading top here is an important decision. Bonds are largely weak. While metals are above all pivots, they look vulnerable to a drop. Interestingly, while VIX returned back under all pivots on 1/26 it has closed above its Q1P for 4 trading days. Likewise, XIV is not rising like stocks. UVXY is looking increasingly attractive as a hedging trade (and recommended on daily comments and Twitter last week). Timing cycles points to increasing volatility 1/25-2/2+ and perhaps beyond. This doesn't mean I am saying stocks go down from there - volatility across asset classes, expanding ranges, potential shakeouts and recoveries (as what happened 1/25-26 in semiconductors, EWZ, etc)."

Results

Extensive quote but:

1. Major turn looks in

2. Tune changed in daily comment and tweets - partial profit taking signal and further volatility hedge recommended in 1/29 Daily comment, further bearish alert 2/1 on Twitter, etc

3. UVXY +47% from initial tweet to 2/4 close; +21% from 1/29 close to 2/4 close; best hedging idea other than stock index shorts

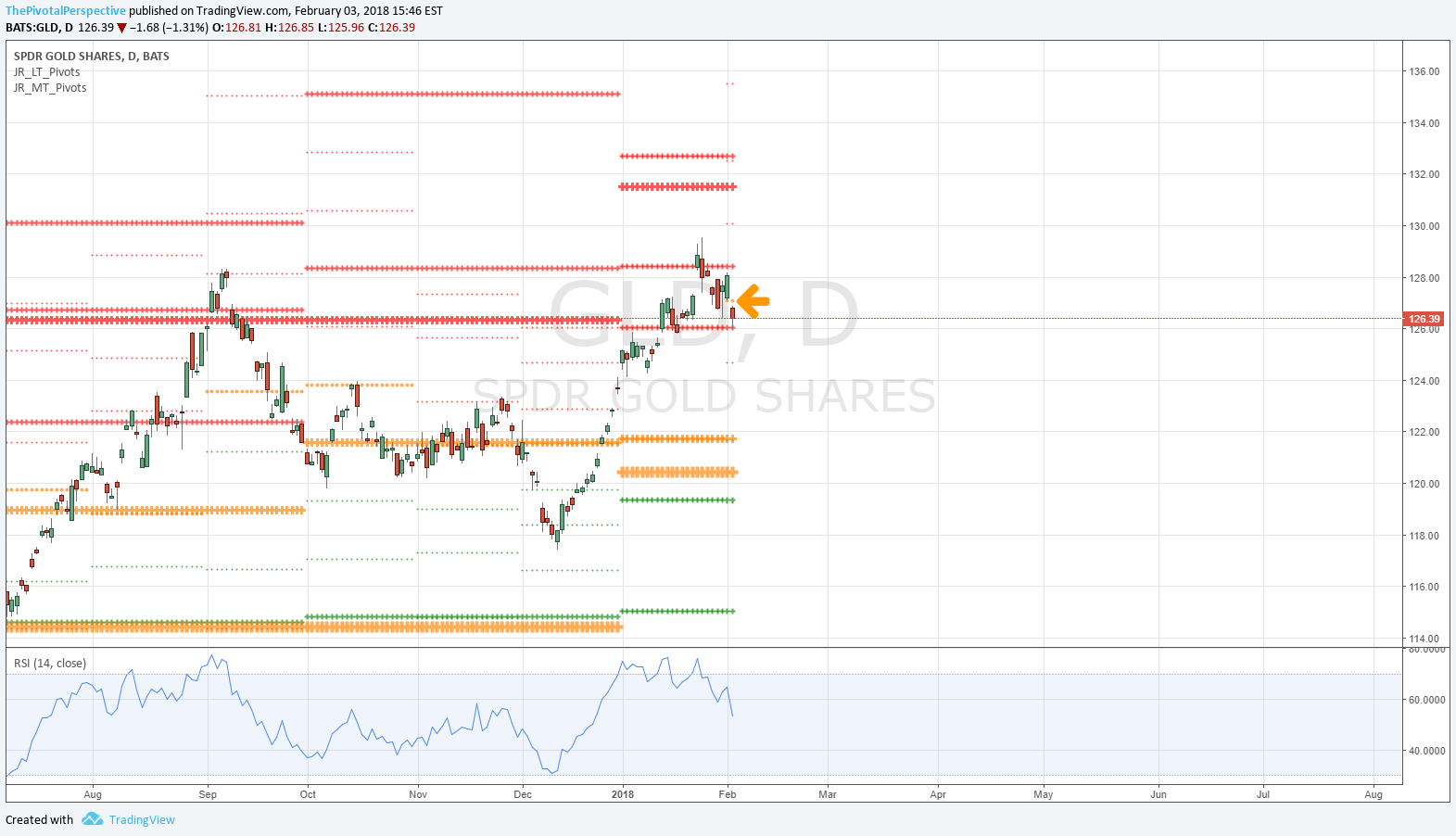

4. Nixed metal idea

SUM

It is rather amazing that of the 5 USA main indexes, 4 sectors and 11 global indexes that I track (all covered in previous blog posts) than ALL of these had 1HR1-2 or YR1 rejections in the past 1 or 2 weeks.

As stated last week, this is the most amount of indexes having the same move from yearly levels that I have seen from early 2016. Thus, likely we just saw a major top. That said, tops tend to stretch out compared to rapidly formed lows and I view this move as the first phase of a transition from trending market to range market for risk assets. After a historic run of massive gains without as much as a -3% drop, I believe buyers will step in in the -4.5% to -7% range and then the next likely move is a rally back towards highs.

In this way I can hold simultaneously that we probably just saw a major top, and that probably the initial decline won't be too bad, and that the market will likely make a move towards highs and test or even go higher before a larger drop.

It is great to have raised cash (as recommended 1/29) before a decline because then it is possible to view buying opportunities with fresh eyes. Now, we see what holds up best on the decline and most simply and crucially remains above all pivots or reclaims this status sooner than others. So far, the potential buy list is:

QQQ (will likely reclaim above all pivots sooner than other USA mains)

XLF (still above all pivots), XBI (barely below FebP)

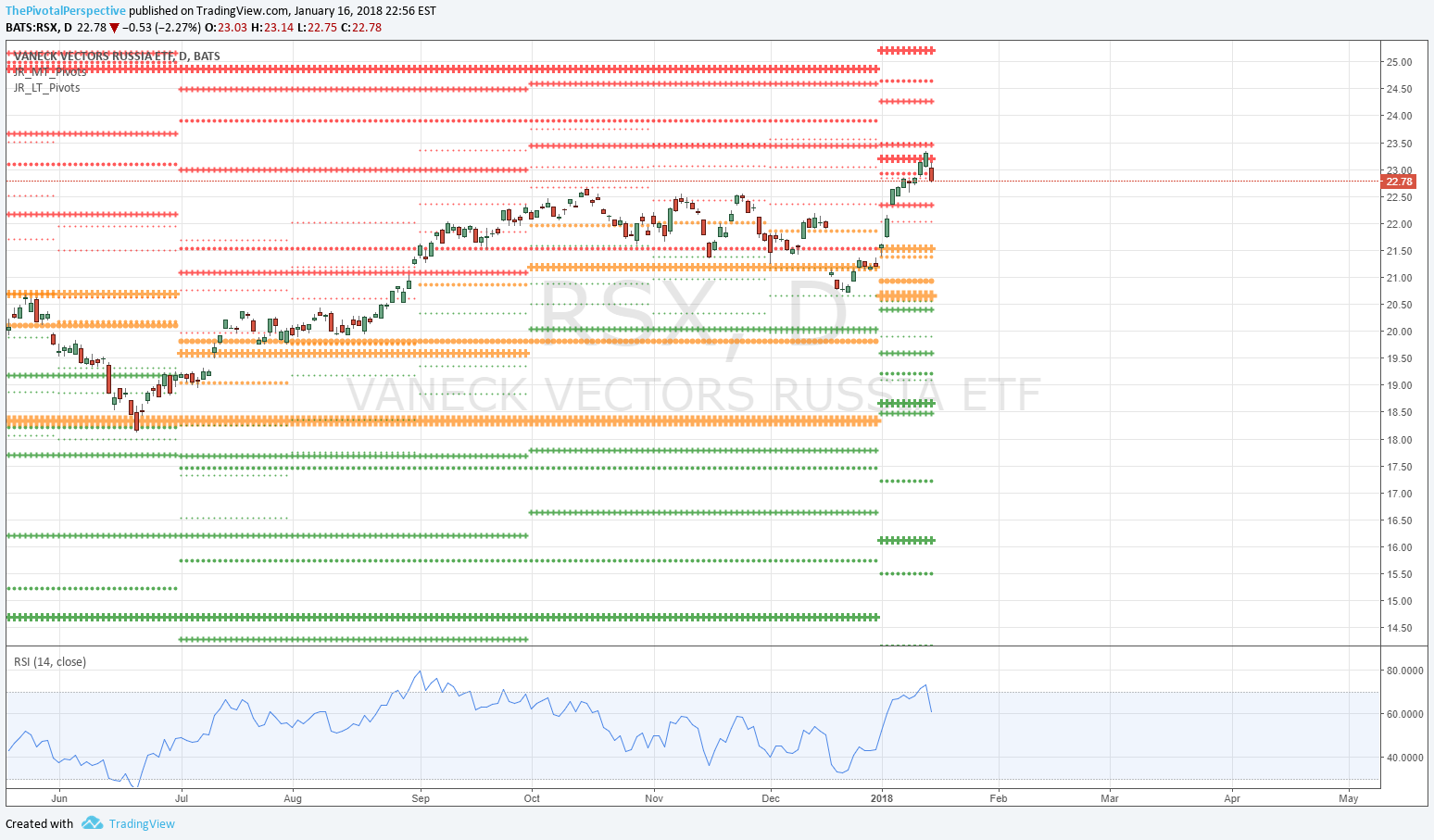

RSX, EWZ, EWJ, SHComp best among global indexes in terms of holding or slightly below FebPs

GLD

Avoid: IWM (anyway, have been short this), XLE, INDA which are the major laggards in USA mains, sectors and global indexes respectively.

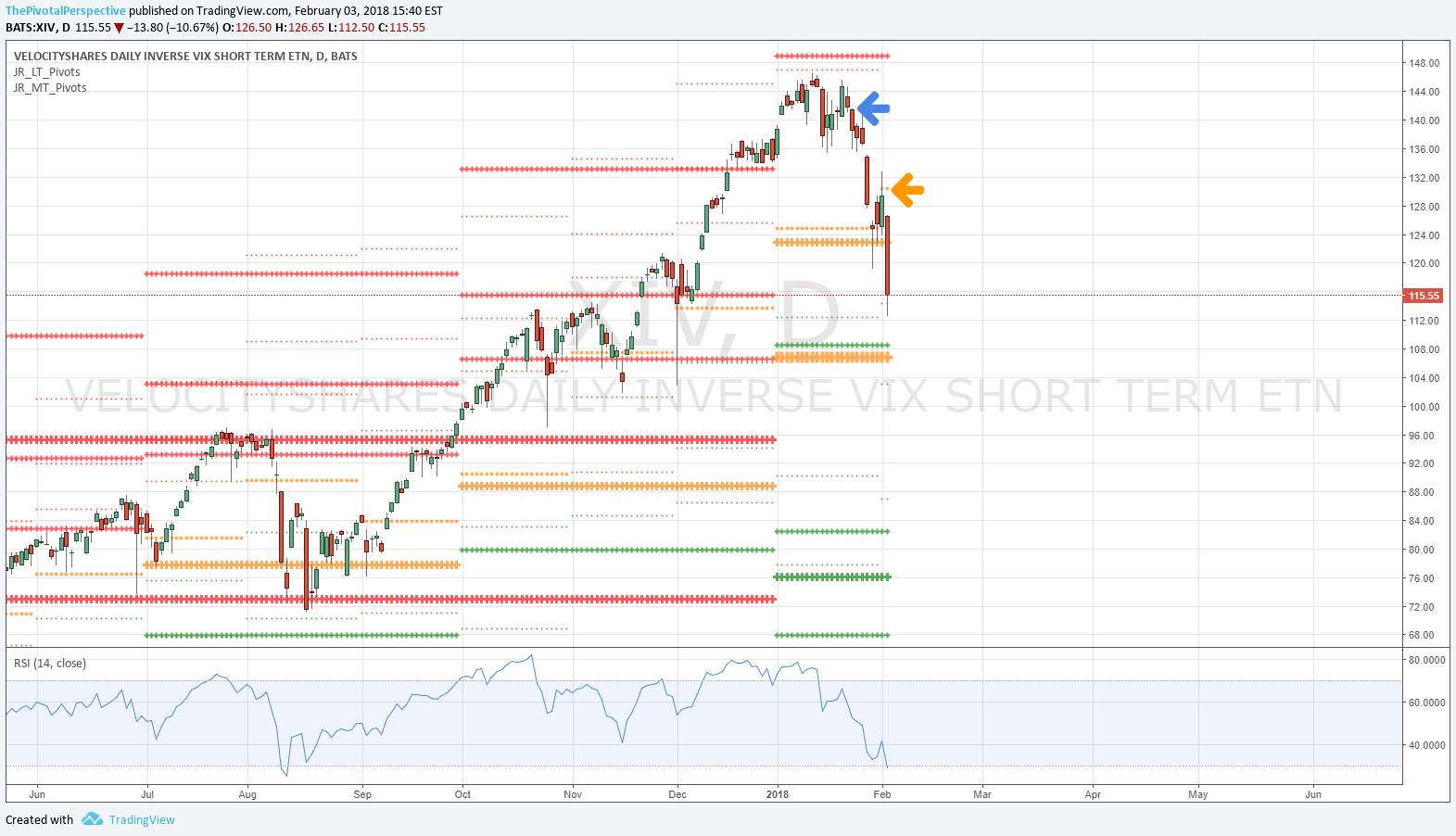

XIV reached 1HP and so any additional positions on UVXY I think were better taken off on Friday though stock indexes are set up to go lower. If you took gains on longs 1/29, added UVXY hedge, took further longs off the table and/or short hedges on 2/1 then you likely finished positive last week despite a stock/bond combination having the biggest loss since 2009. It is this kind of week that I pursue this work.

PIVOTS

USA main indexes - 5 / 5 USA mains below FebPs, above the others. QQQ will be first to recover if bounce on Monday. IWM likely first to reach Q1P on any further decline. Expecting to see FebS1s for USA mains.

Sectors - Interesting that 2017's hot sector semi-conductors are starting to cool compared to biotechs. XLF one of the few indexes still above all pivots!

Global - In a list of key emerging and developed indexes, ALL had YR1 or 1HR1-2 rejections. The story is larger than just USA Treasury bonds and USA interest rates.

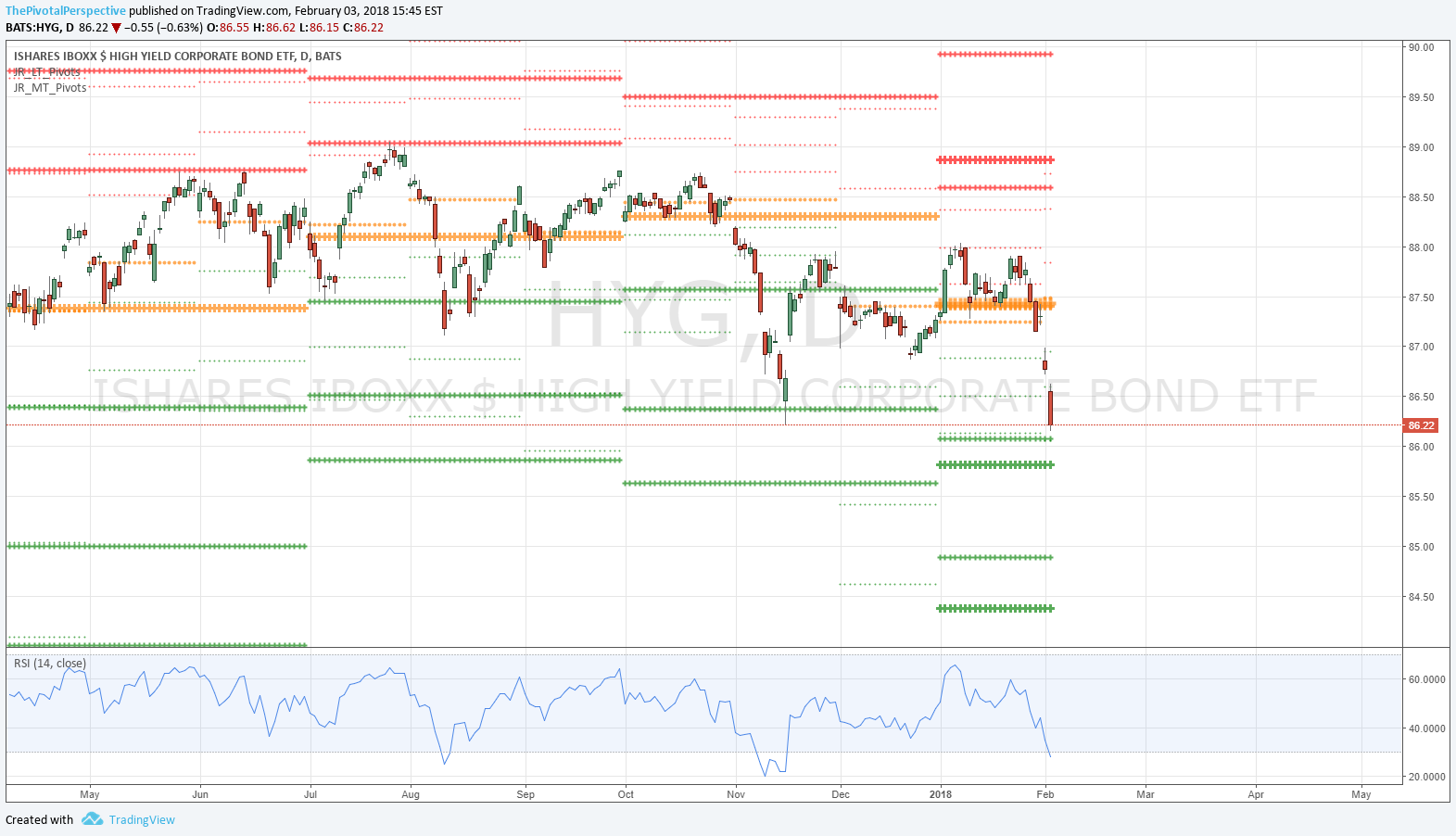

Safe havens - The Pivotal Perspective has been warning about bonds and thus interest rates from the start of the year. Last week LQD and HYG joined TLT and AGG below all pivots on a price basis. Using my long term technical total return system, TLT and AGG gave long term sell signals last week.

Currency & commodity - 1 day rebound on DXY doesn't change the trend yet. USO also near YR1 but no significant damage. BTC and LTC below all pivots from 1/22 and 1/16 respectively; ETH the clear leader, still above all pivots.

OTHER TECHNICALS

After historically high RSIs on USA main indexes, it is likely that we will see divergence highs (RSI & Bollinger band) before a larger drop.

McClellan Oscillator (MCO) into the red several times without damage from 2017 Q4; sharp acceleration into negative 1/29-1/31.

New highs & new lows (NHNL) - new lows jumped 1/30, further confirming take profit and hedge signals.

VALUATION

Here's the tweet with the chart of SPX forward P/E levels. I think we will see the FINAL bull market high in the 19X-20X range so this means upside limited from here to a 2800-3000 top. For now monitoring if the valuation levels keep increasing (ie earnings continue up) or flatten out.

SENTIMENT

We know that put-call was already at multi-year lows and other measures (AAII, ISE) had been making extremes in recent weeks.

TIMING

A bit disappointing nothing near 1/26, the top.

However, tweet from 1/24: "Special timing post: volatility cycles picking up 1/25-2/2 maybe through 2/15. This does not mean i am saying stocks down from here. There are a lot of YR1s to watch though. Yup back in UVXY already."

Really nailed that!

February dates

2/2 - looks like low

2/12

2/15