Sum

Have to say VIX had another market move pegged (by jumping above all pivots on 1/29). UVXY worked well as a hedge, though it seemed like it could have moved even more given the greater decline in stocks than August.

VIX is quite far from returning below all pivots, so we might not have a "everybony back all in the pool" signal for stocks for a while. Near term watching YR1.

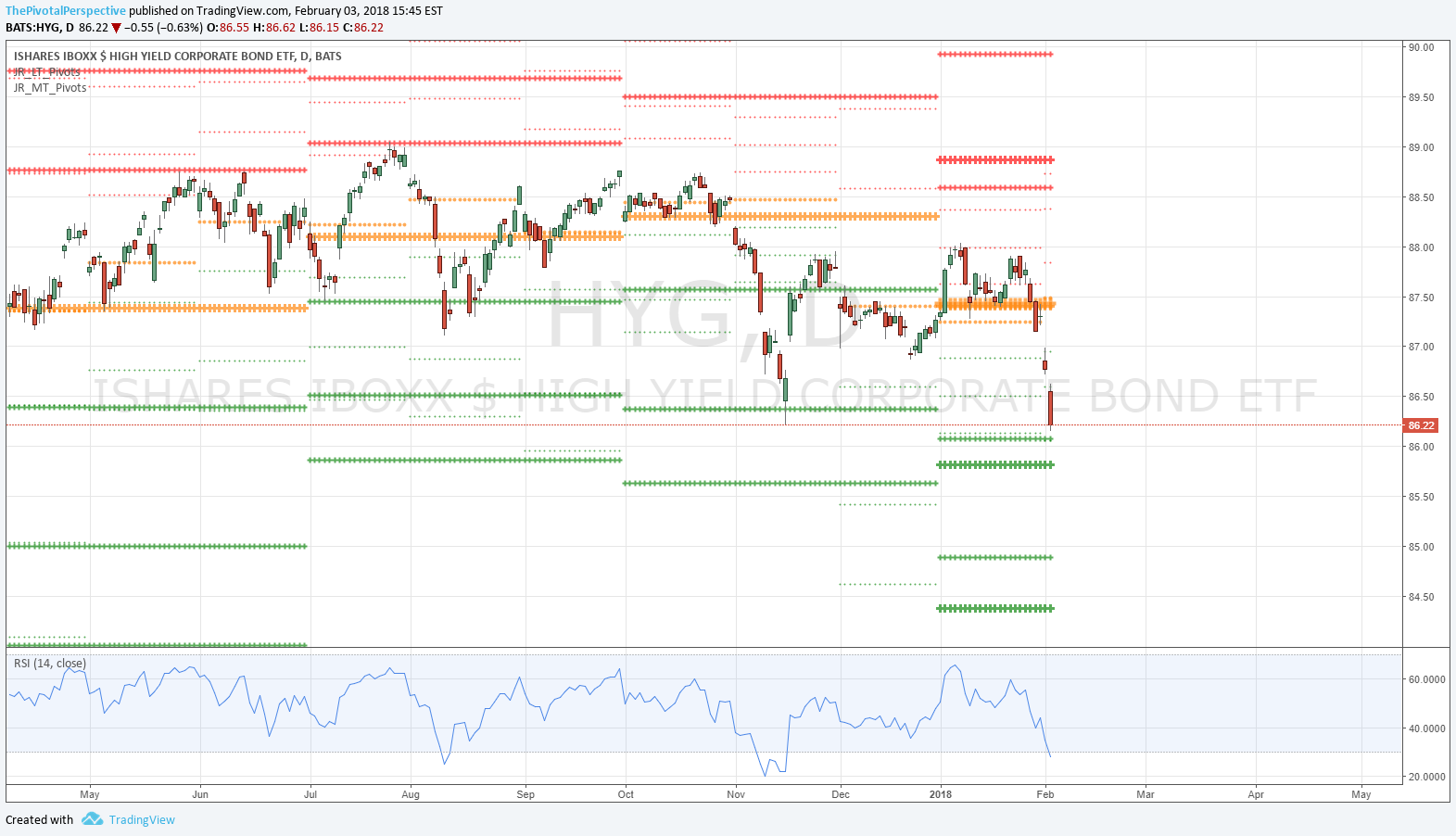

Bonds have been clearly weak from the beginning of the year, and this week LQD and HYG joined the others below all pivots. For investing purposes, I still recommend total return pivots on higher yielding vehicles as outlined in recent posts and tweets.

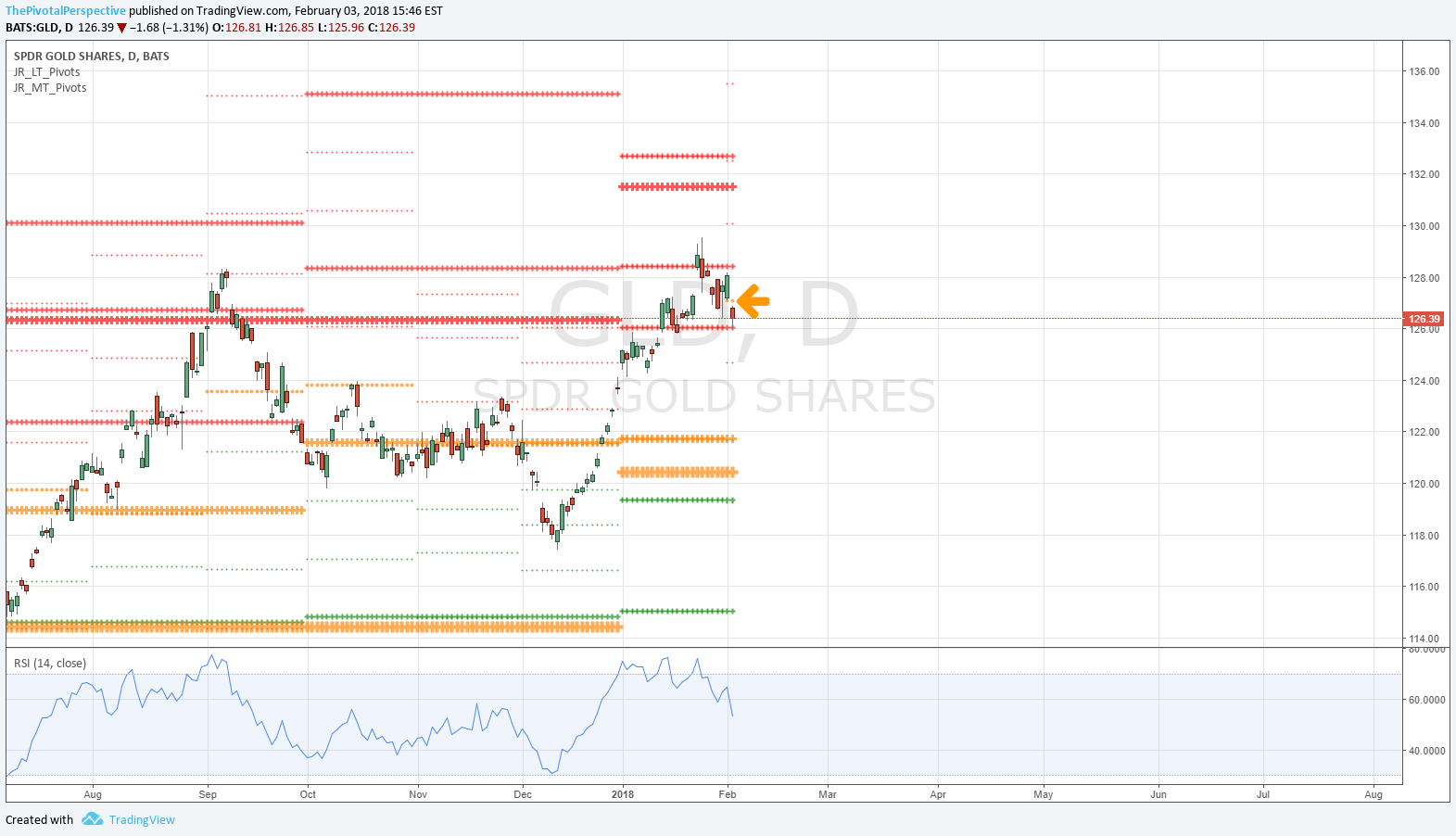

On metals, GLD could reclaim FebP and if so would be interesting buy candidate again.

VIX

W: Weekly close above YR1 first time since 2014!

D: Big jump above YP was signal to reduce risk on 1/29.

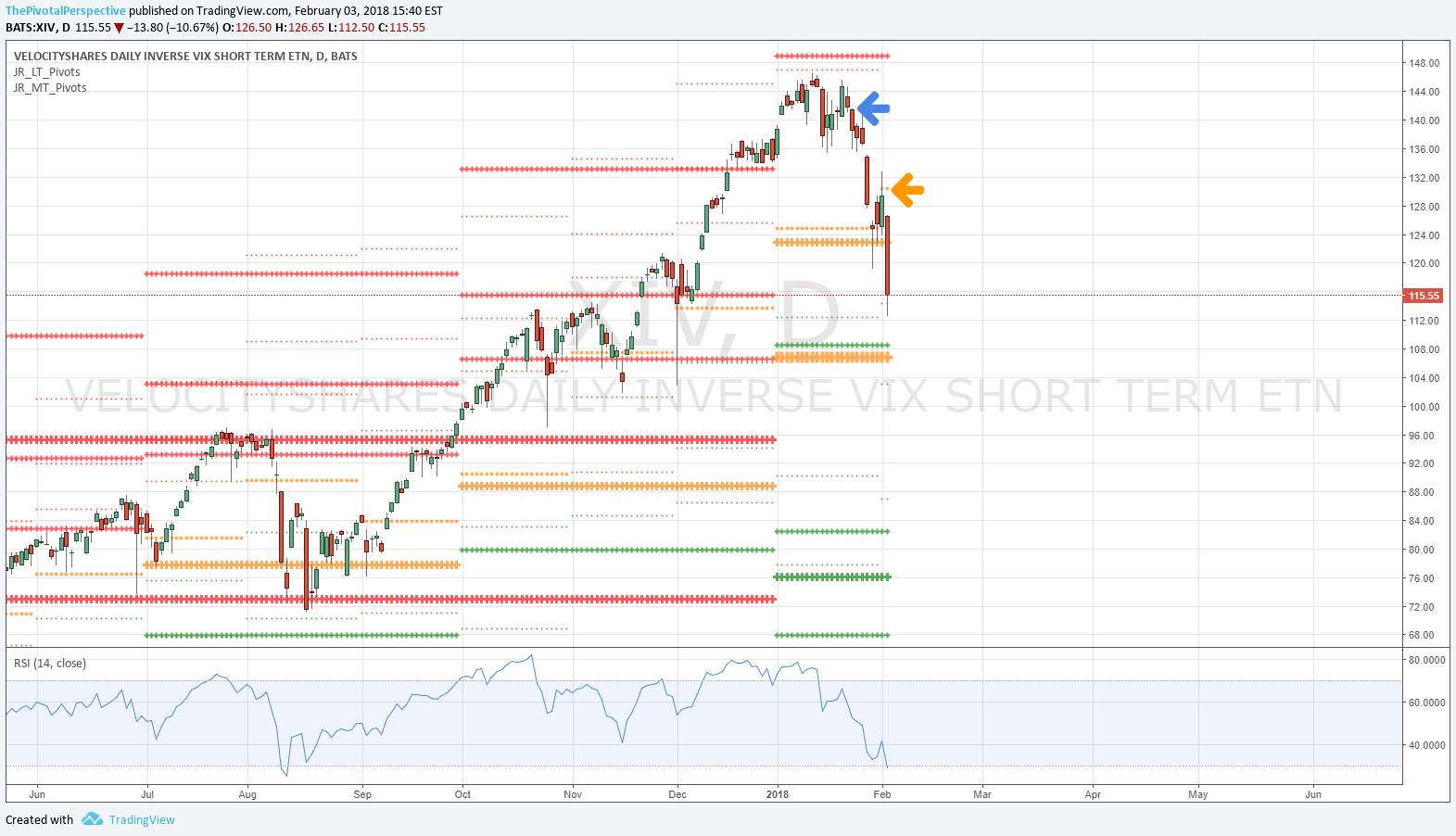

XIV

Blue arrow at buy rec; orange arrow at FebP clear resistance nice add. Q1P break, already at FebS1.

TLT

Already at YS1.

AGG

D: Below YS1.

LQD

Below all pivots.

HYG

Below all pivots as of 1/30 then again 2/1.

GLD

D: Back above FebP would be buy candidate.

GDX

Below YP, 1HP and JanP; holding Q1P.

SLV

Breakdown below all pivots. Avoid.