REVIEW

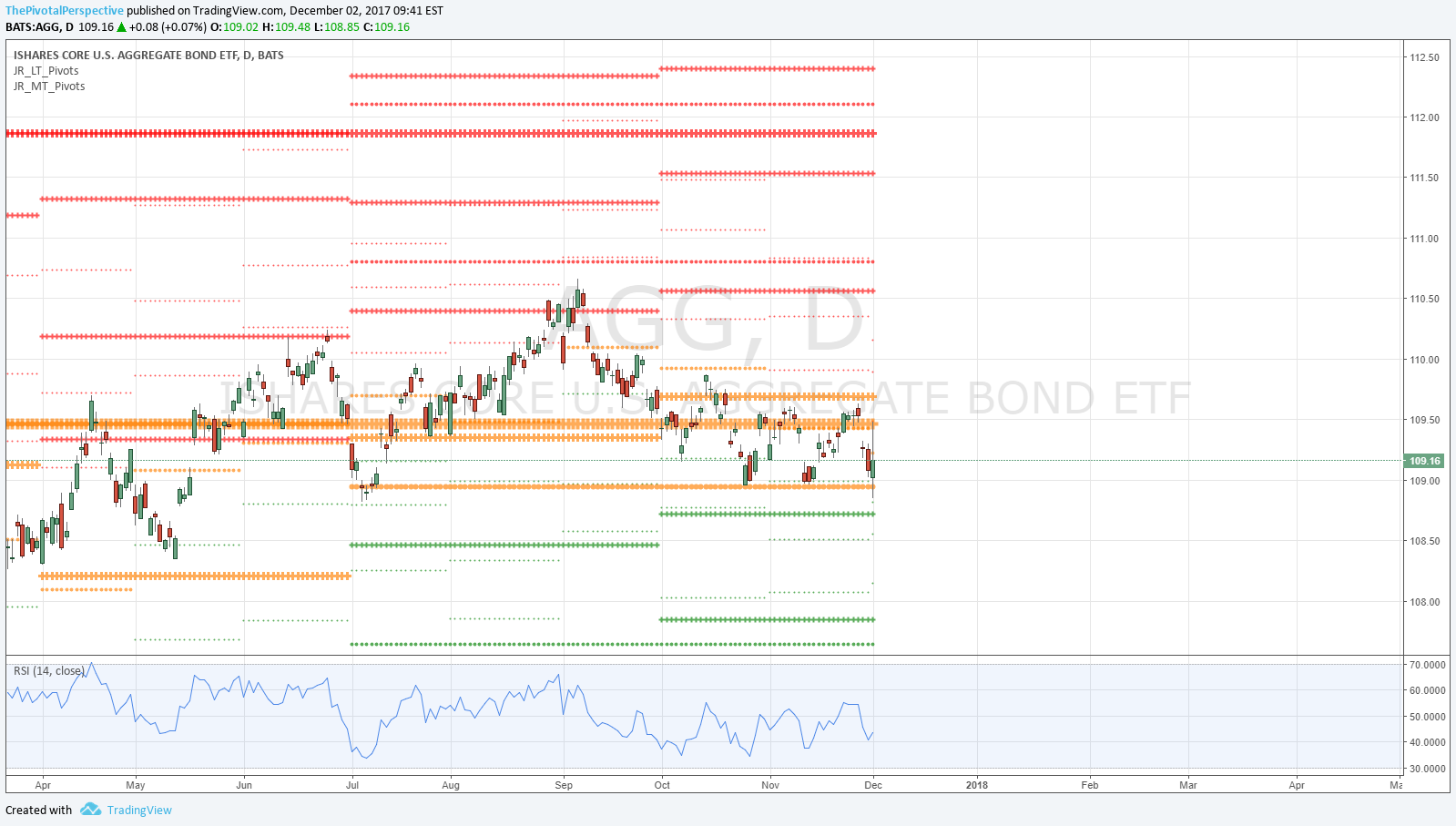

12/4/2017 Total market view: "TLT YP will be an interesting level to watch next week. If we see more noise from safe havens - ie VIX above DecP, XIV below DecP and TLT above YP, then I'll think SPY top near Q4R3 and consolidation and more weakness in global names. Otherwise, Friday's massive comeback and huge hold of DecPs seems to invite more moves towards highs in the coming week."

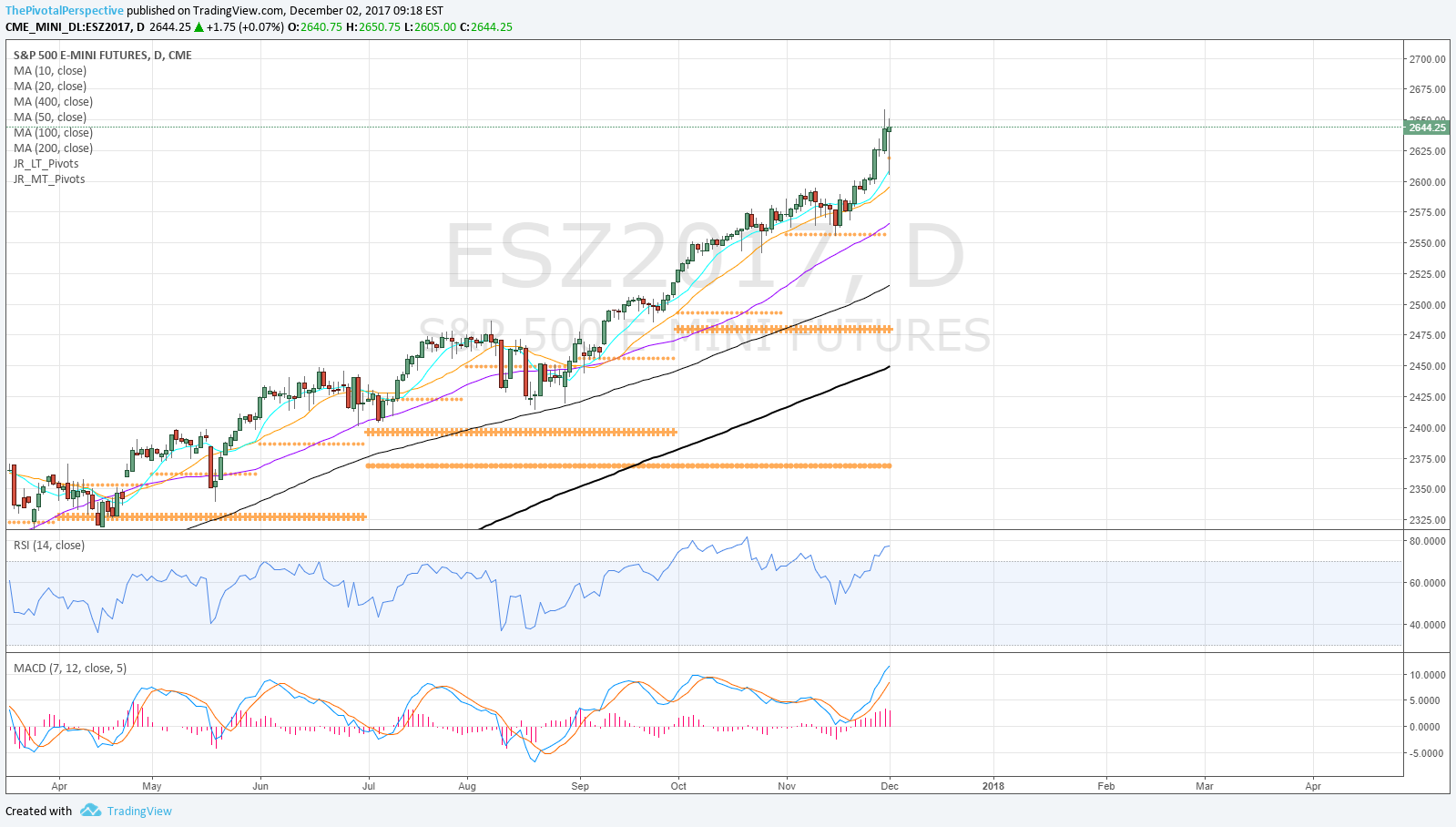

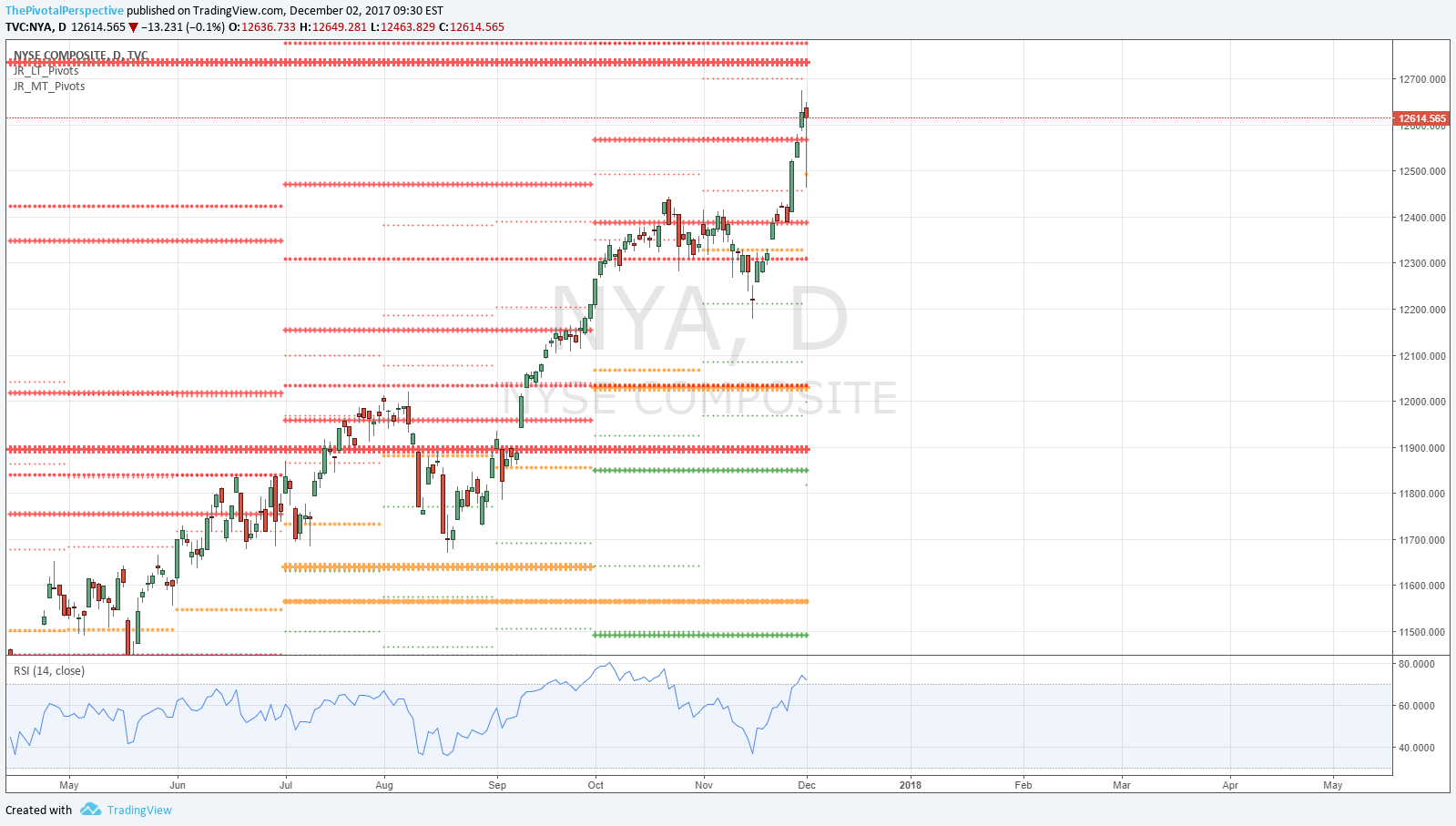

Result - VIX calm but TLT above YP and result was mixed. More weakness in global names as expected, a top on SPY Q4R3 as expected, but also a shallow dip and move back up to highs for USA indexes.

SUM

There have been mild drops twice in December so far - on 12/1 and then 12/4 into 12/6. Main indexes came back on Friday to finish near highs. The notable exceptions are global names such as FXI and EEM and in the USA sectors, SMH. I think this is simply a matter of some traders locking in gains after tremendous runs and having a head start to holiday vacations.

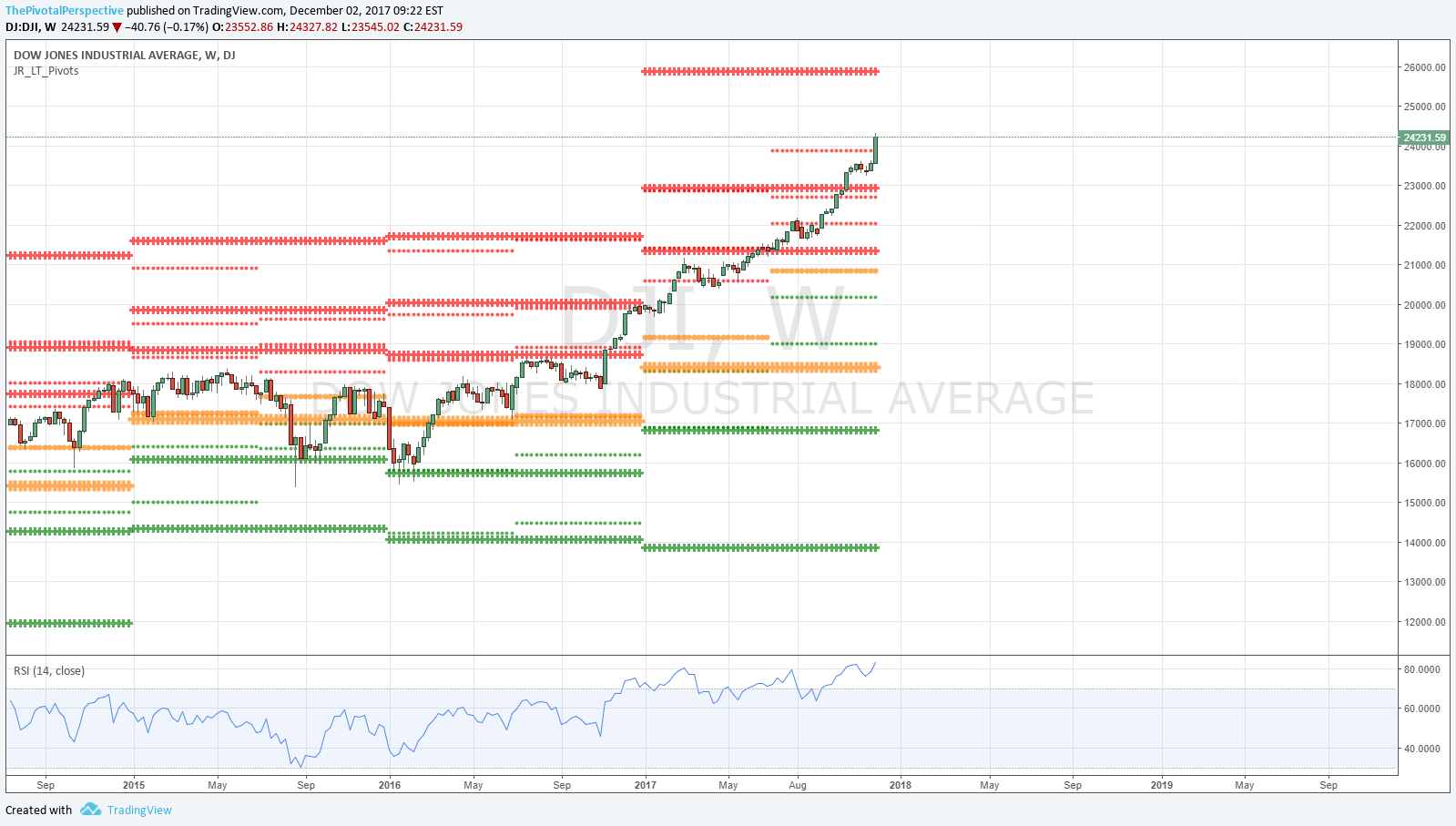

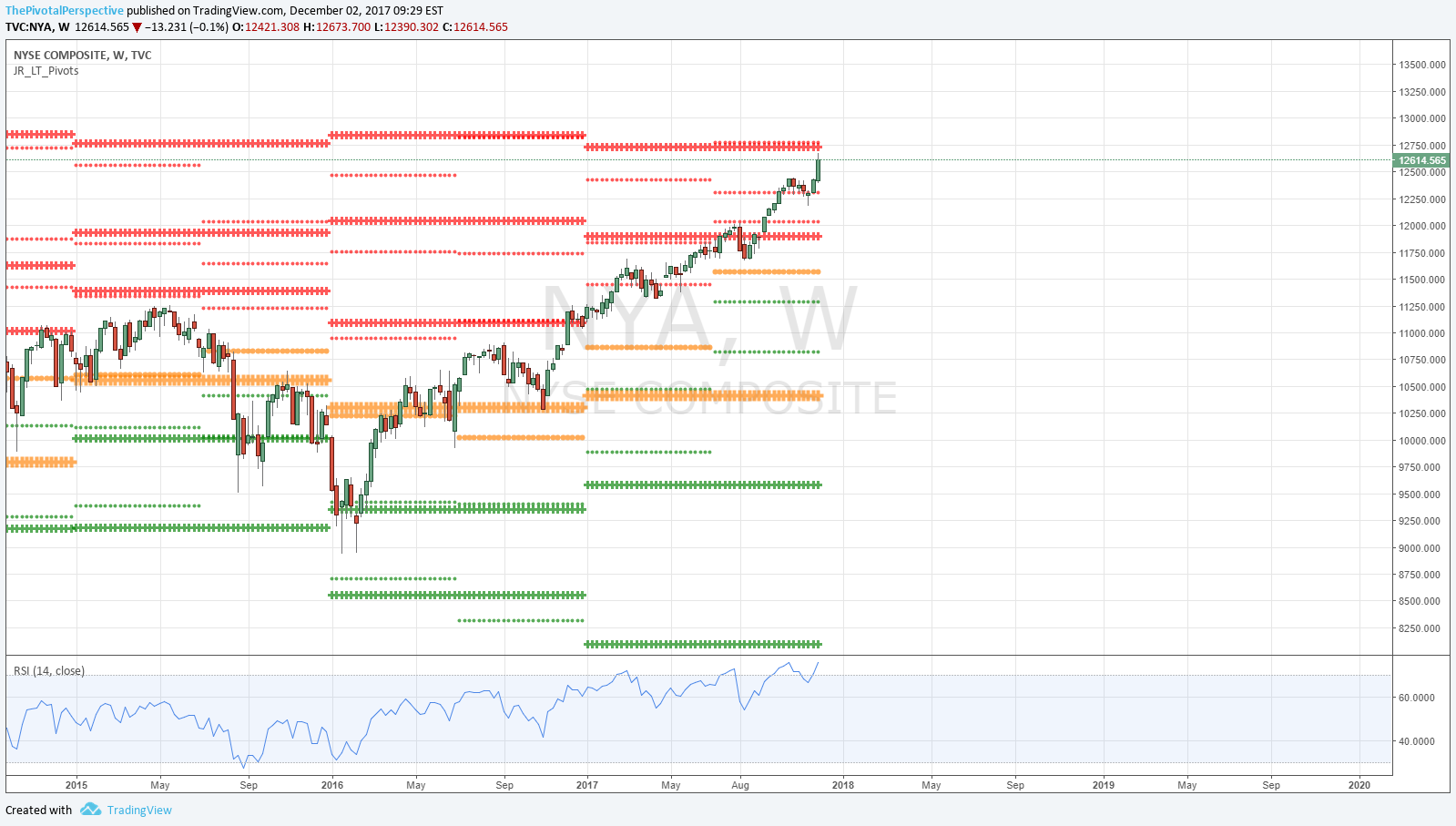

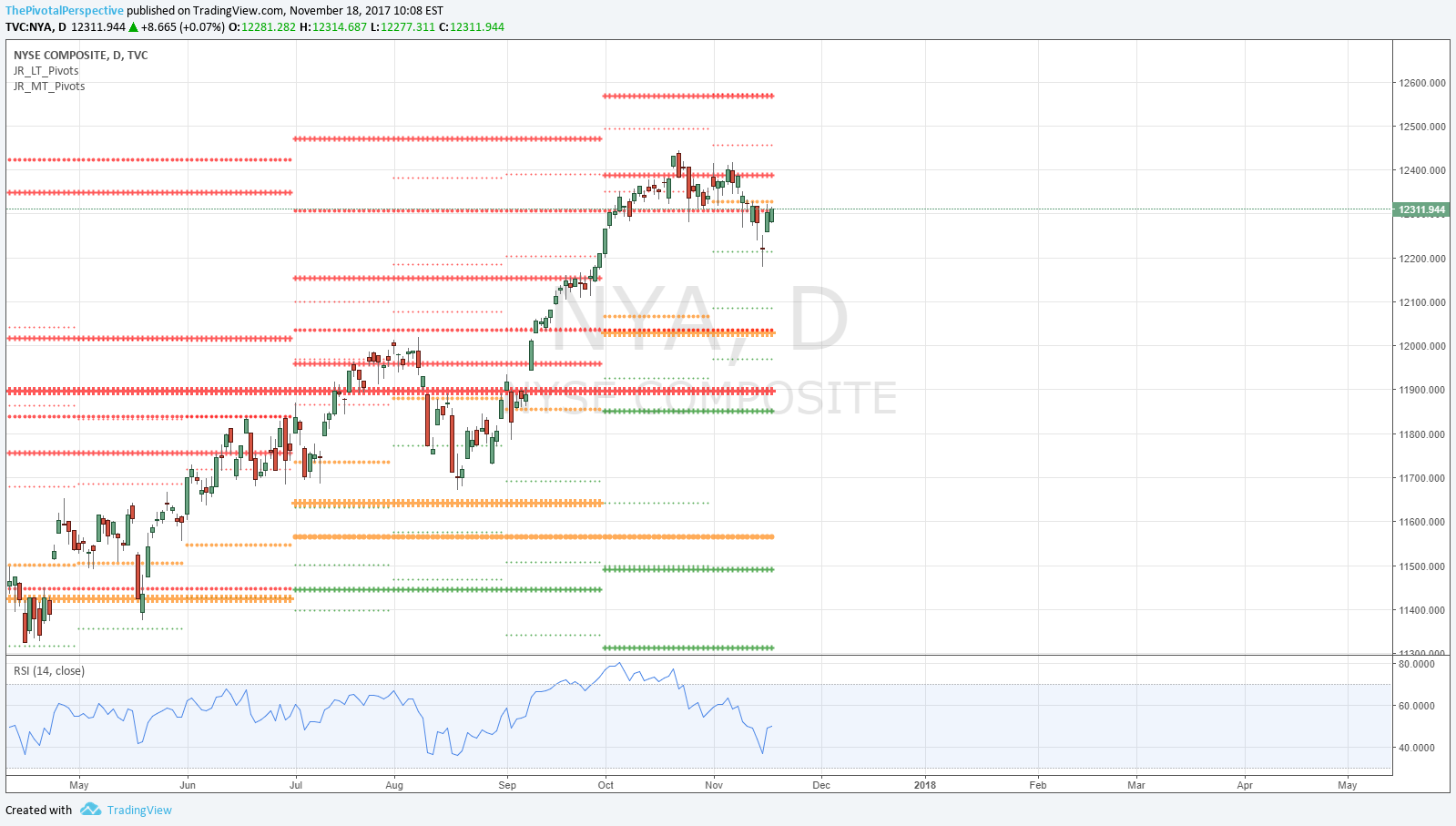

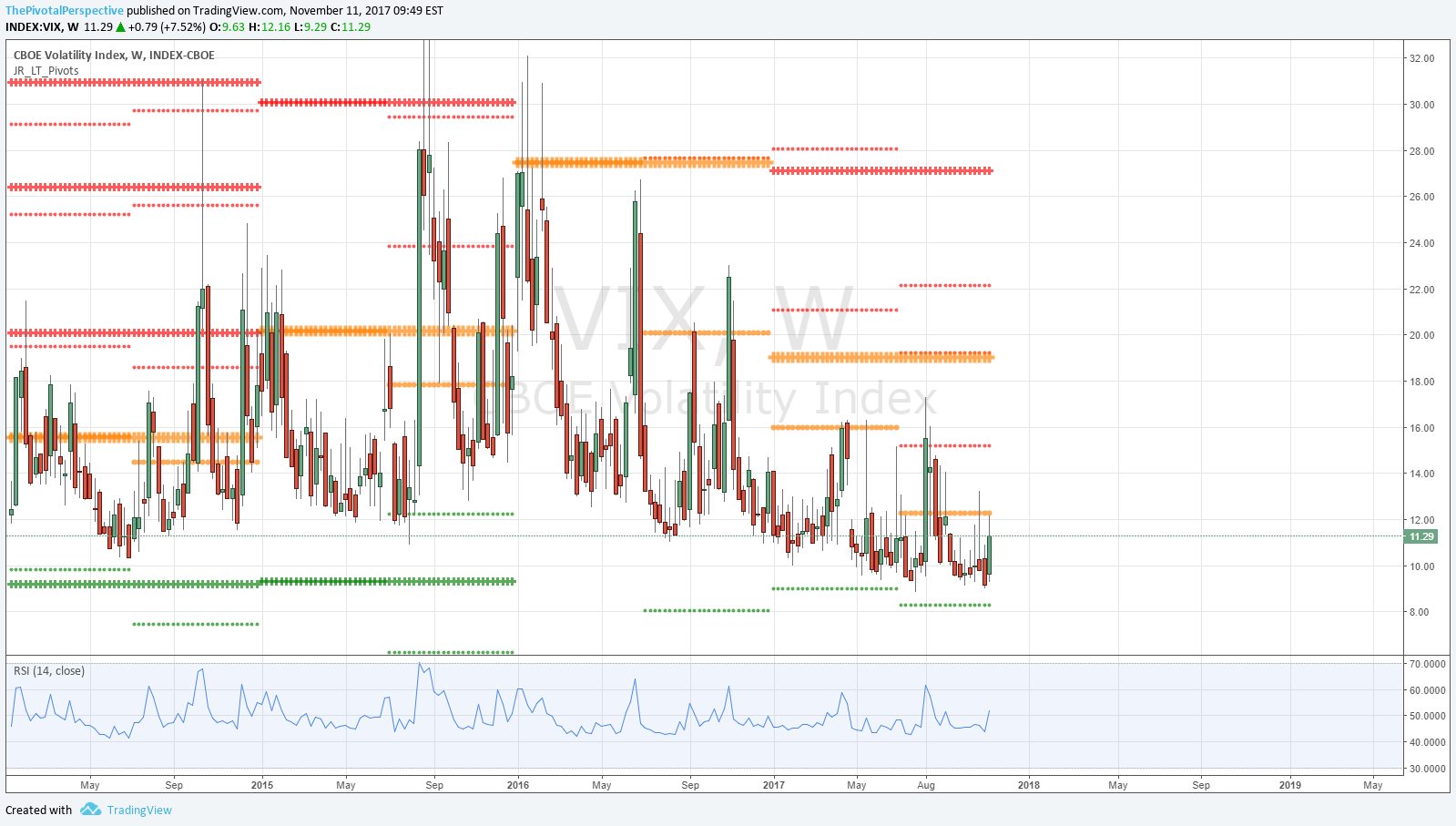

Although there are major resistance levels worth watching - SPY & VTI Q4R3s, QQQ YR3, IWM YR1 and NYA YR2 - the trend gets the benefit of the doubt especially with all USA mains above all pivots. VIX and XIV fully supportive of risk assets, and most other safe havens not threatening risk.

Given FOMC, futures rollover and option expiration I think some choppy consolidation is the most likely move.

PIVOTS

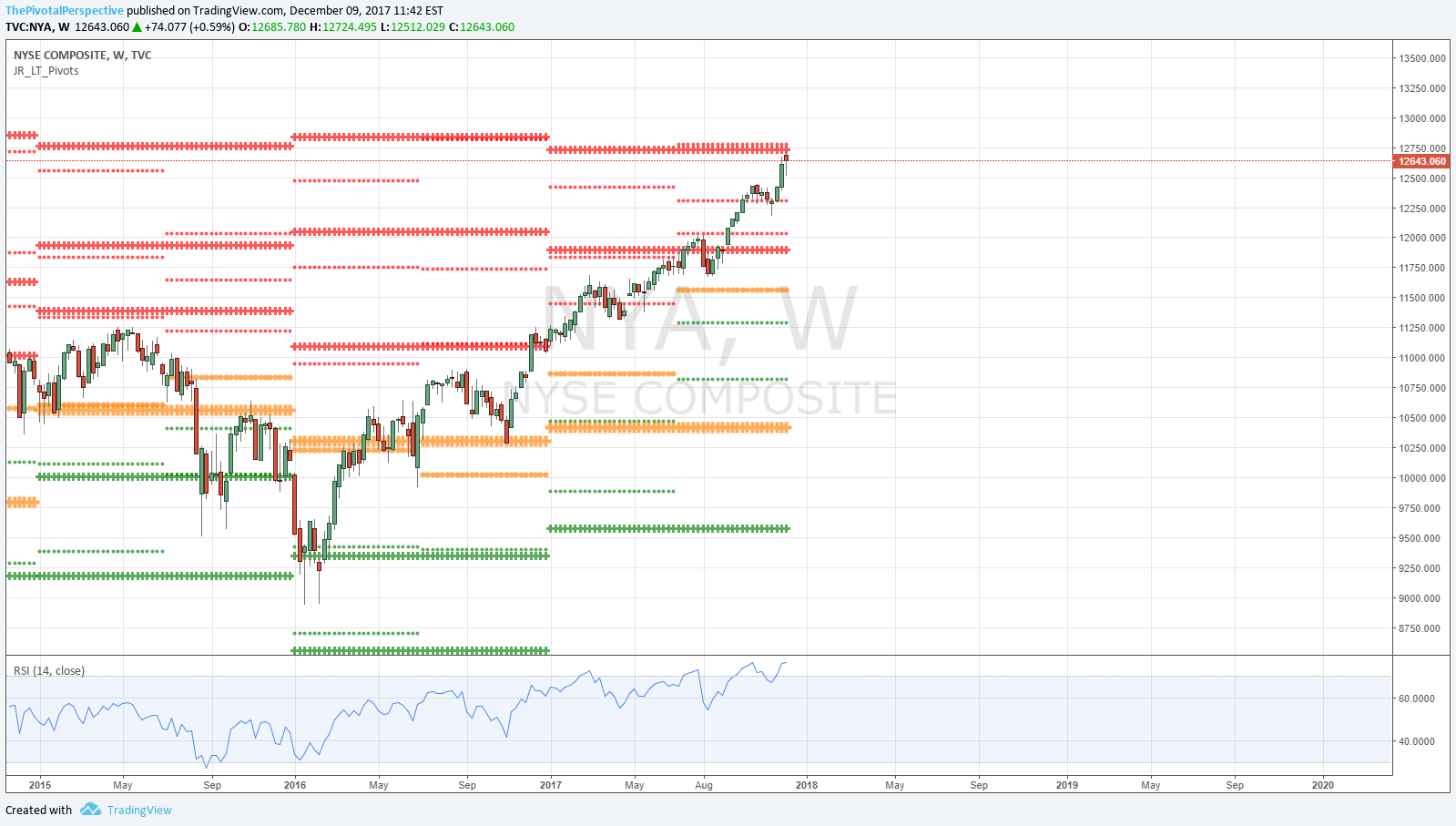

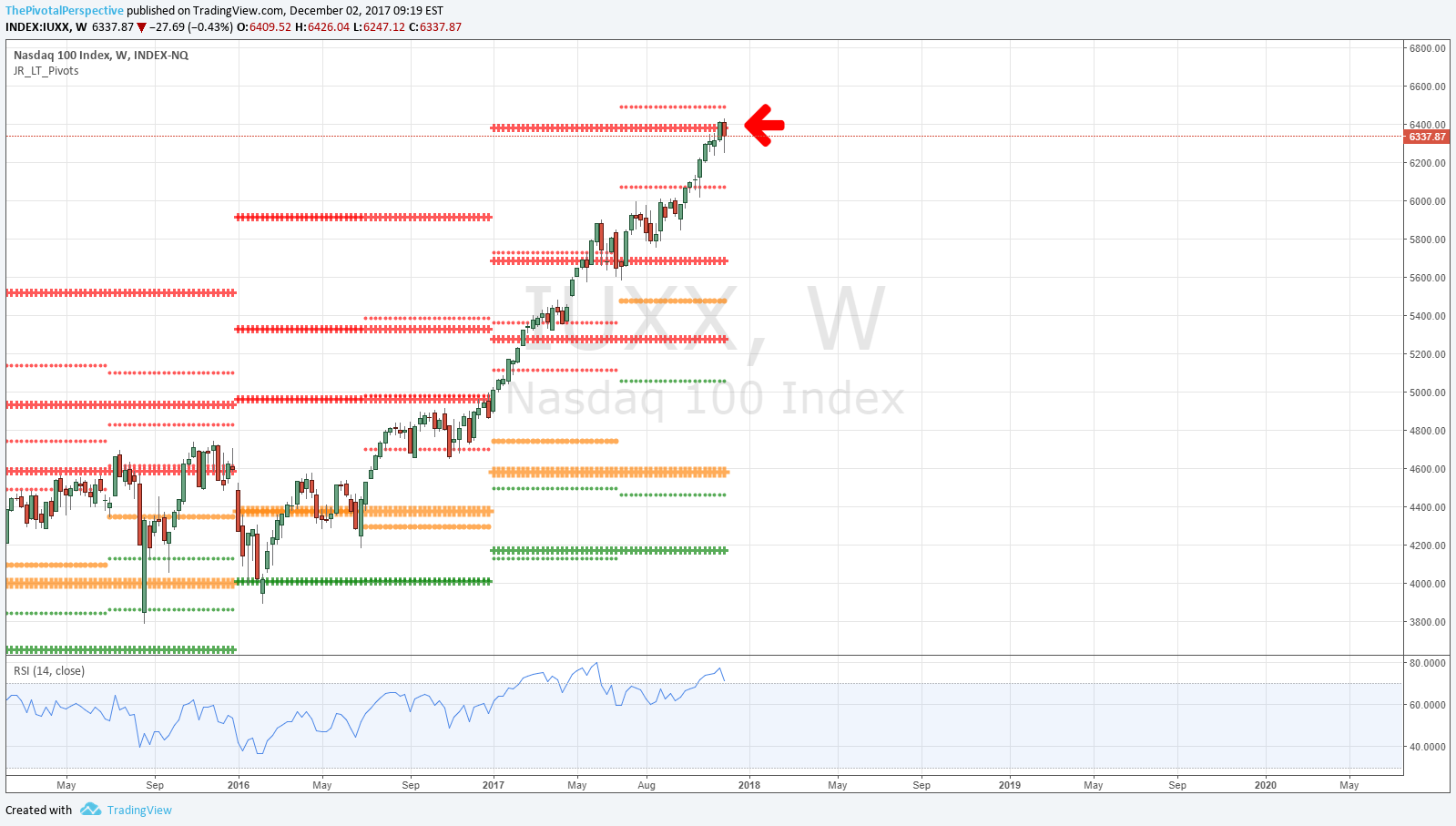

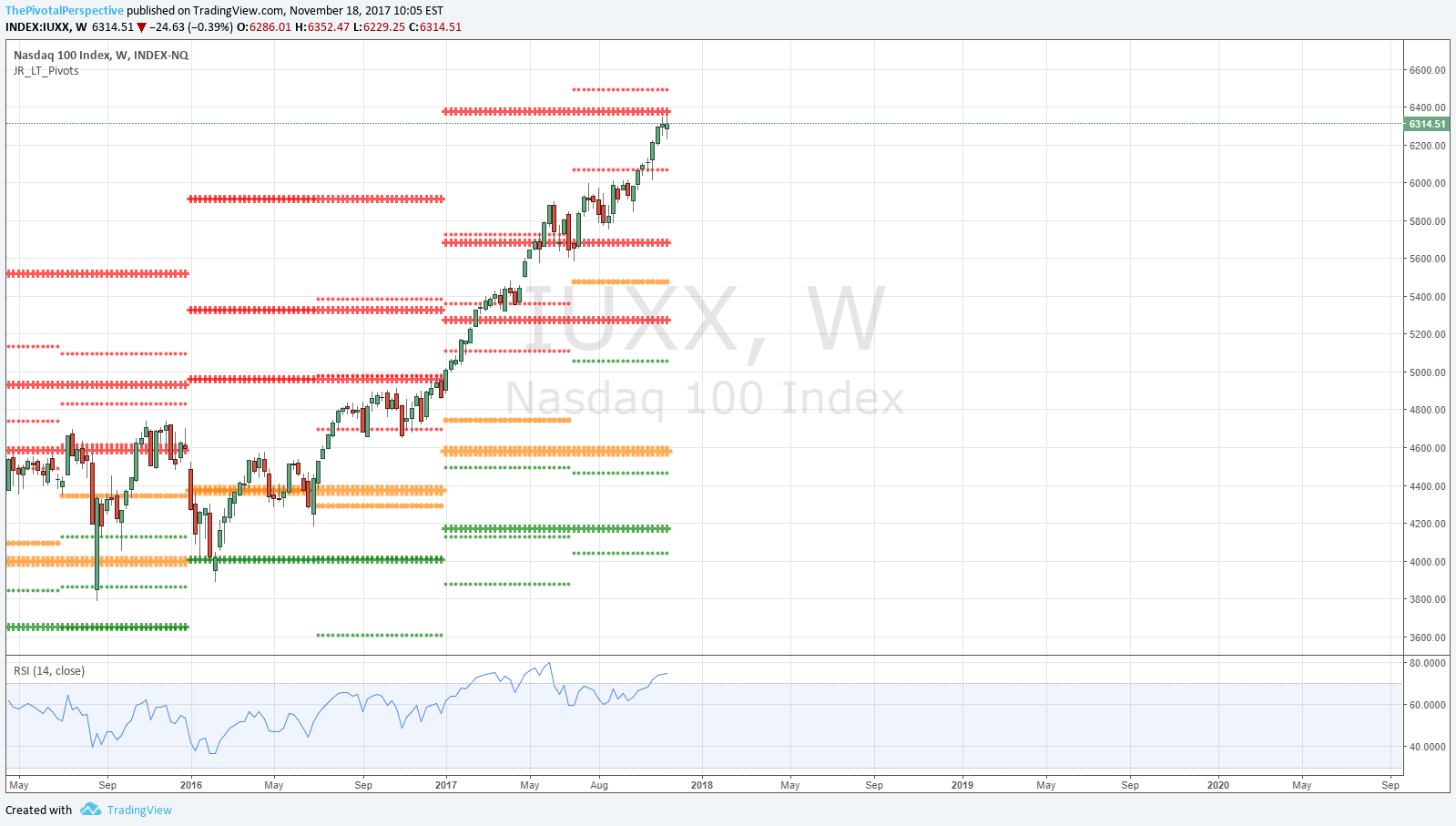

USA main indexes - Three yearly levels in play; QQQ testing YR3, IWM YR1 and NYA YR2.

Safe havens - VIX and XIV continue to deliver reliable market clues.

Sectors of note - SMH hedge recently made up for several small dings on this strategy.

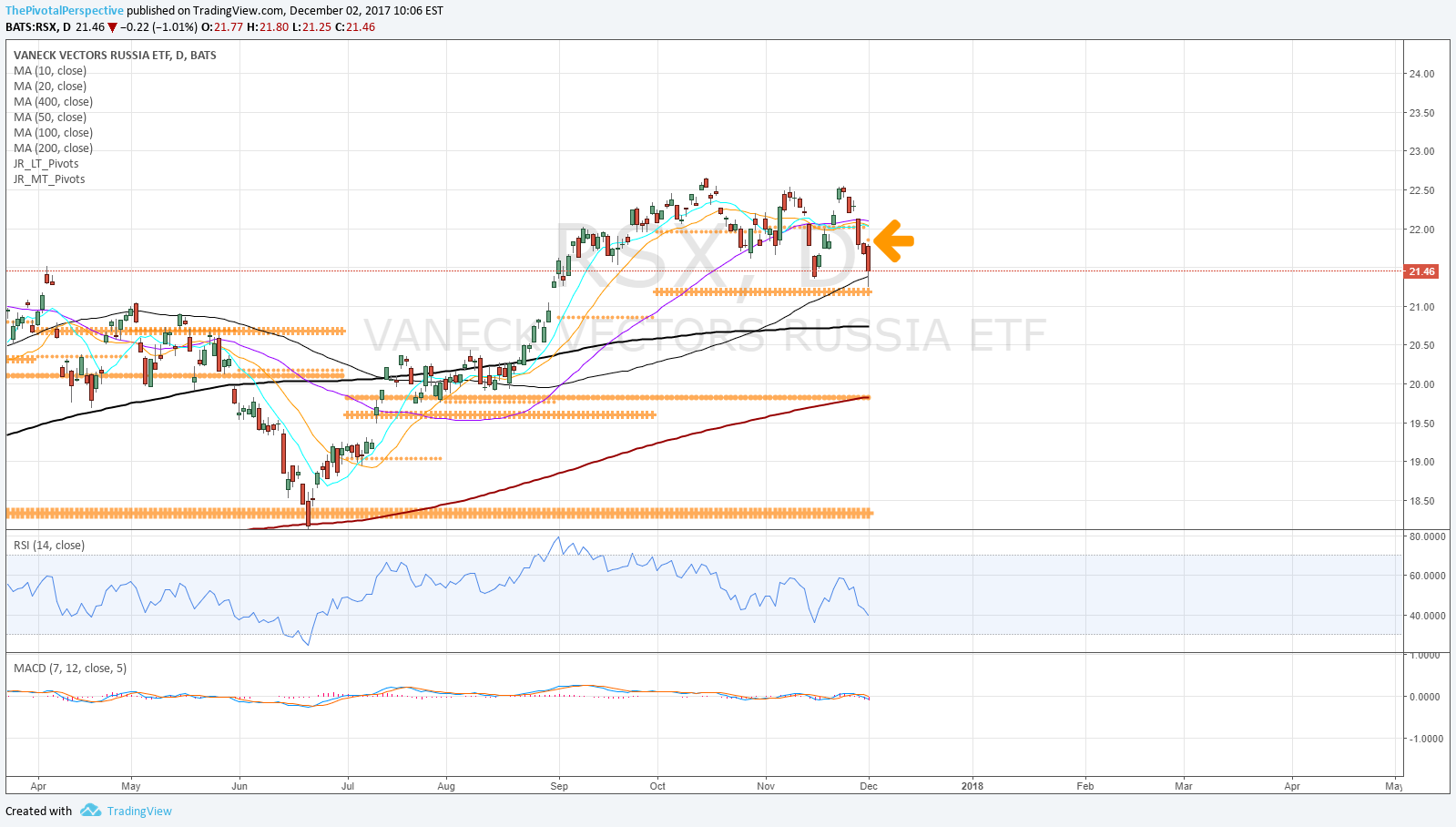

Global indexes - Ditto on FXI. INDA now taking the year end lead. Of global indexes I track, only ACWI and INDA above all pivots. Recent status changes below DecP - FXI, KWEB, EEM. RSX already weaker and under DecP. SHComp is notably weaker, under Q4P, joining EWZ also under Q4P.

Currency and commodity - OK, I may return to bitcoin coverage soon. In case you think i am totally late to this party, please see "Interesting buy idea" from 2/16/2016 at BTCUSD 406.

OTHER TECHNICALS

The best technicals in a trending environment are to hold above quarterly or long term pivots and/or hold above rising slope moving averages. Anything else that suggests resistance has been mostly an exercise in frustration: pivot resistance levels, overbought readings on RSI, upper Bollinger bands, etc.

This has been a very expansive rally with most major indexes above all pivots for most of the year. Shoring below pivots has not been so easy unless getting into individual stocks which I simply don't have time to do. In fact, of the asset classes I track, the status of "below all pivots" has been quite rare; in 2017, what comes to mind are DXY, oil/XLE, and recently SLV.

Point: As years change often major themes change, and one of the things I am thinking about for 2018 is a change from a trending environment to a range environment. If this were to play out, many of the strategies that haven't worked in the last 12 months will suddenly look like genius, and the buy and hold crowd may be tested either through a drawdown or by sideways churn. Perhaps more on this topic closer to 2018.

VALUATION AND FUNDAMENTALS

SPX well above 18X forward earnings for several weeks now. Given the Economic Surprise Index I am surprised that TLT is this strong.

SENTIMENT

Standard put-call at 3.5 year lows. This implies more downside risk or at least limited upside.

TIMING

As it turned out, 7 dates provided for August. 2 were the high and low of the month. 2 were the second high and second low of the month. 2 were milder turns. 1 was non event.

September dates

9/4-5 - 9/4 mild pullback low

9/13 - QQQ high and TLT low

9/22 (+/-1) - stock index high 9/20 (miss)

9/26 - stock pullback low 9/25 (-1)

9/29 - non event

October dates (listed from 10/1)

10/6-9 - 10/9 mild pullback low

10/19 - pullback low

10/23-26 - 10/25 pullback low

November dates

11/13 mild (non event?)

11/19-20 risk off (mild pullback low 11/19)

11/22 risk on (markets up esp 11/21)

December dates

12/1 (pullback low)

12/12 (high?)

12/20-22