I used to do a weekly post on oil and caught the low here. I am showing the original post right on 2/12 to prove that this wasn't just a hindsight fantasy. No rewind on data chart feed!

Oil had another 2 month rally from early April lows to 6/8-9 highs. After a choppy rest of June, July has been down hard. To my surprise, 2HP didn't even try to bounce.

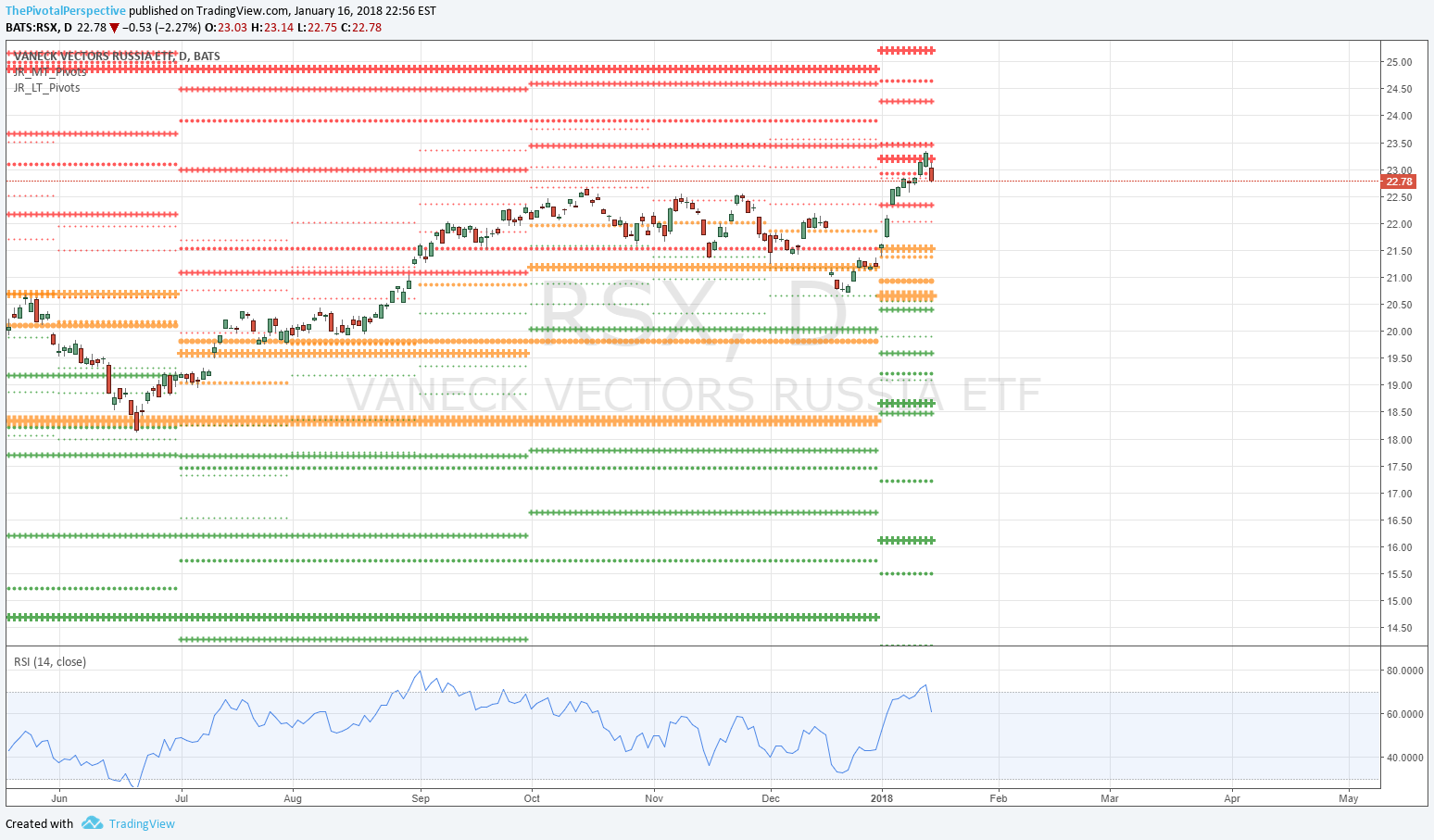

If oil keeps dropping then stocks more likely to fade, and safe havens resume rally. Oil related vehicles like EWZ and RSX that have put in massive rallies this year should drop, as well as XLE. But if oil rebounds then USA stocks likely continue higher, safe havens maybe more in range, oil related obviously supported too.

For oil we can look at the current contract, but with the rollover I think CL1 continuous is really the definitive chart. We can also look at the ETF USO if we wanted to be thorough.

CL1

Weekly chart with long term levels here. The low was basically a slightly lower low / re-test on YS1 / 1HS1 combo. It rallied to YP / 1HP and after some shuffle went all the way - almost! - to 1HR1. Then fell back to support. YP has broken but I thought the 2HP would at least try to bounce somewhat but instead has caved barring a big rally today which seems unlikely.