REVIEW

8/13/2017 Total market view: "Simply stated, I think is it is the time to err on side of waiting for dust to settle and let indexes drop further, rather than jumping right back into risk after such a minor drop."

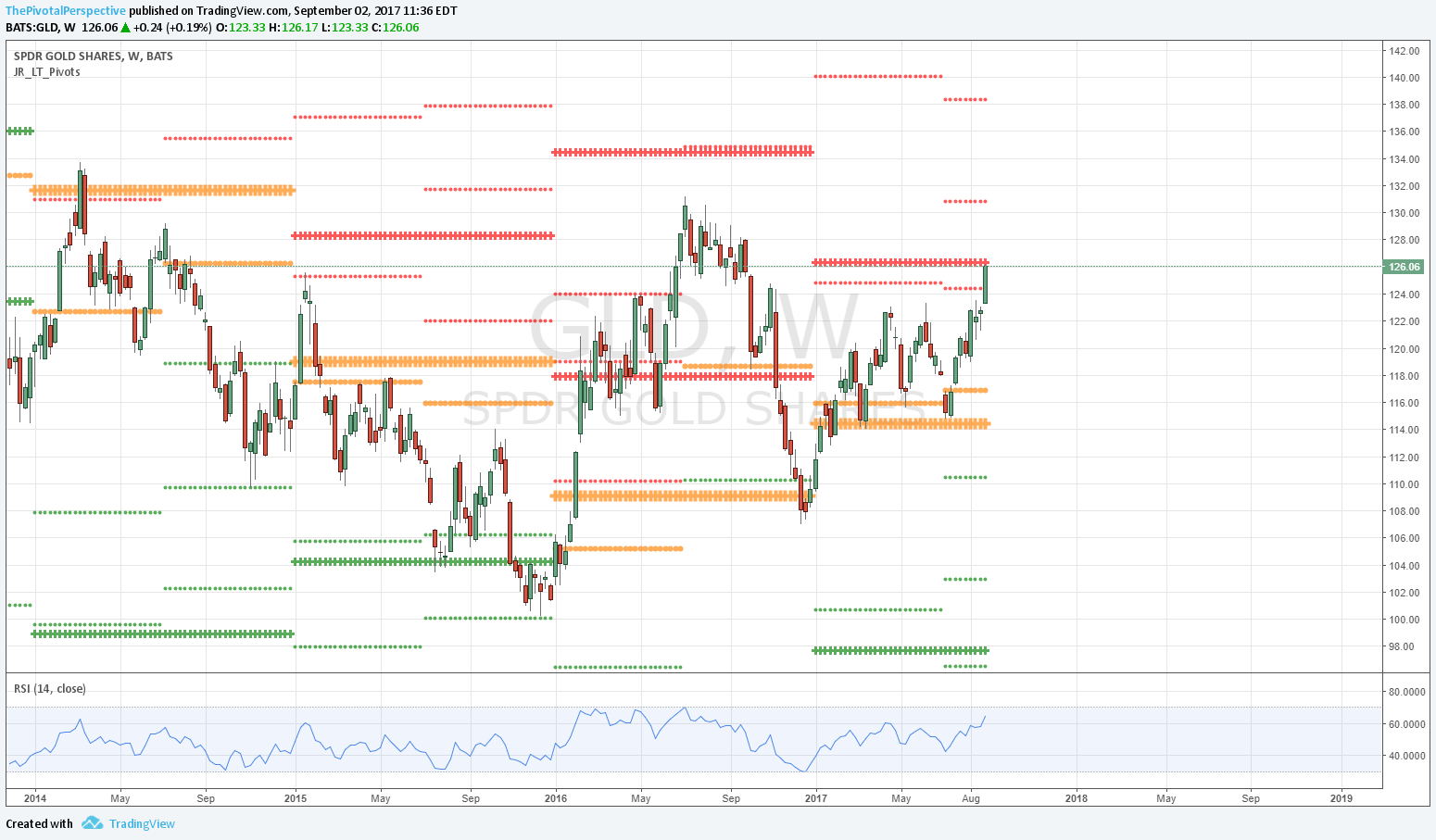

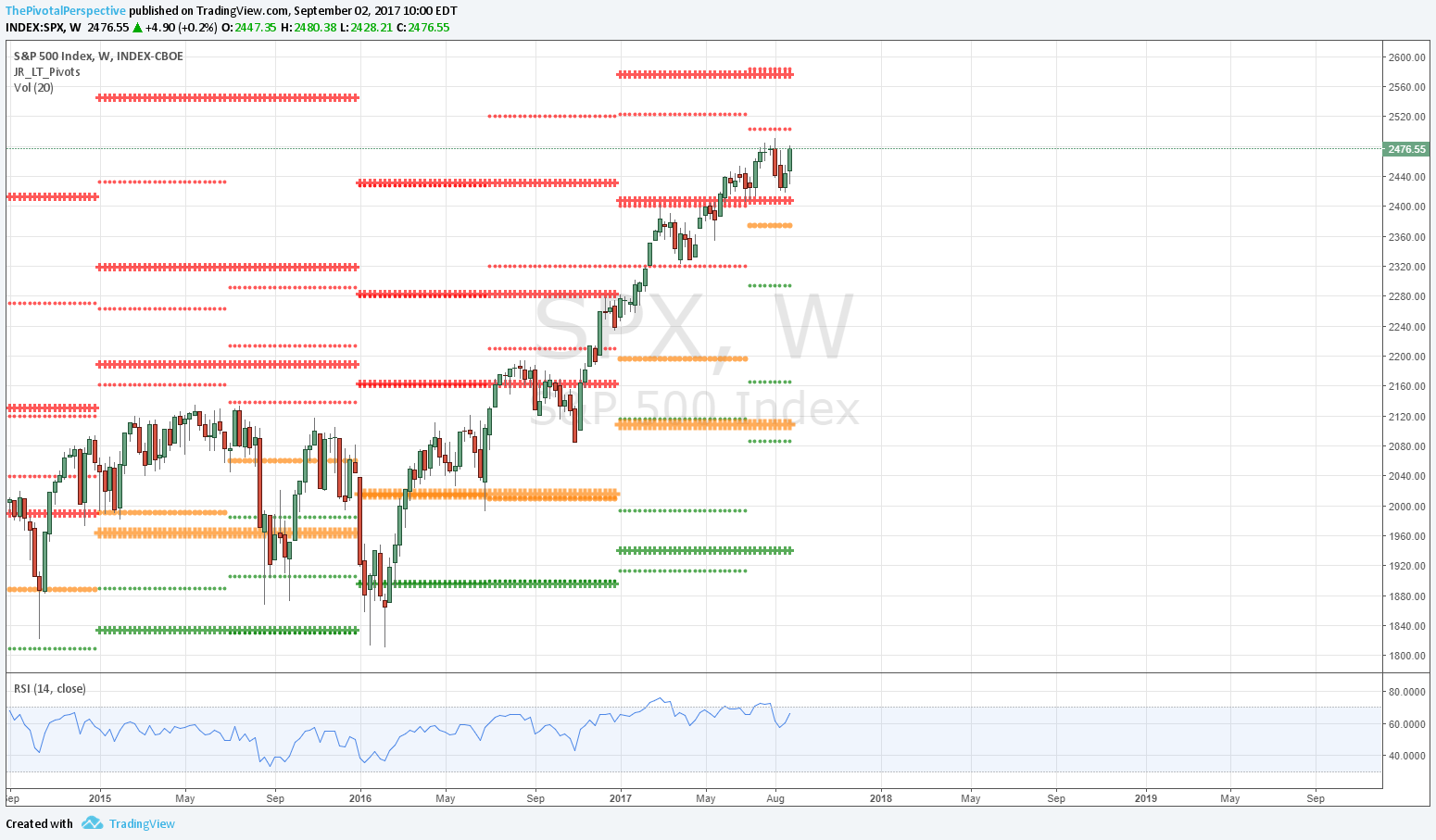

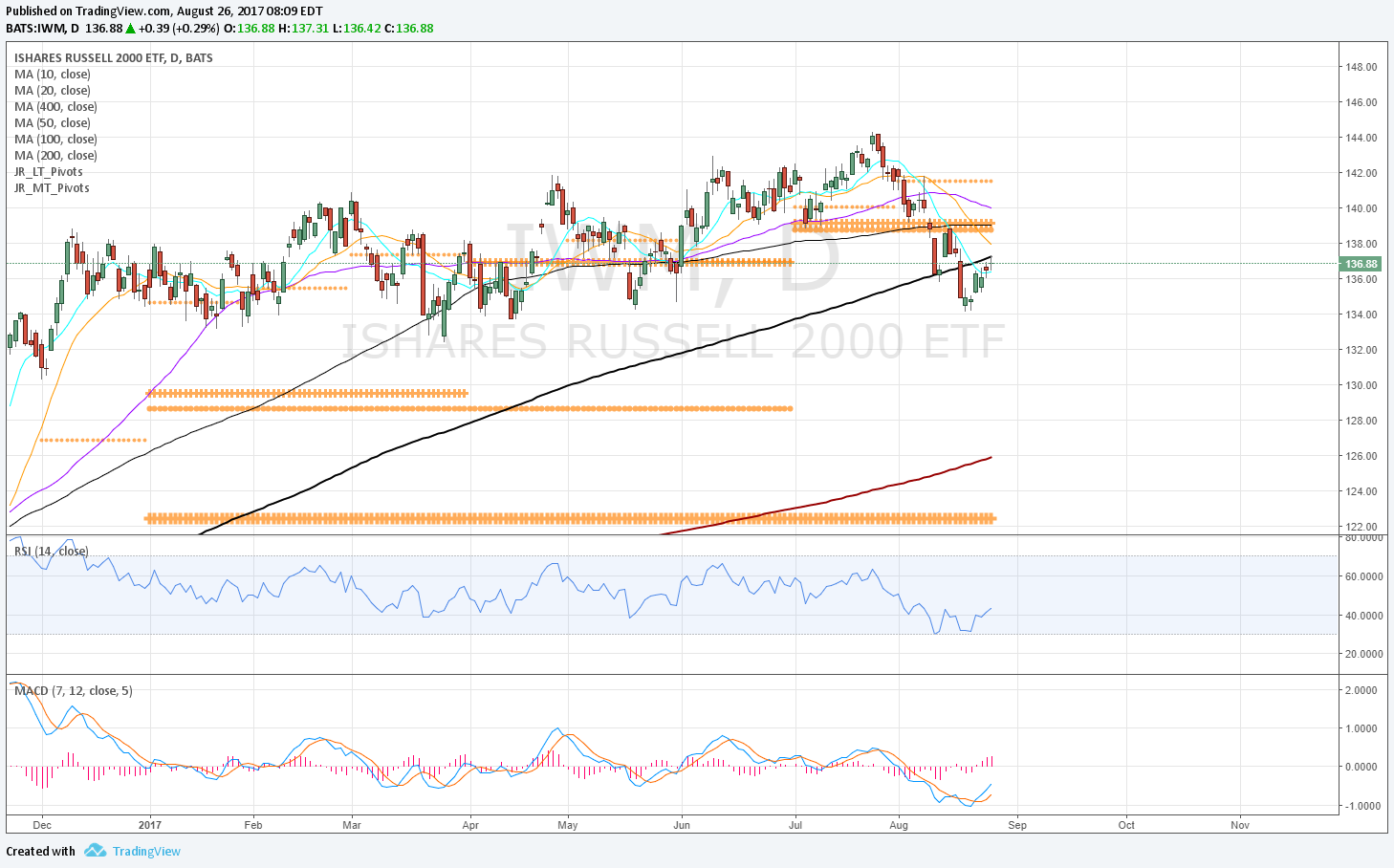

No Total market view 8/19-20 weekend. The Pivotal Perspective has been cautious from 7/23. While SPX has not yet dropped as much as the mildly preferred -5-6%, VIX has spiked twice, IWM -7%, and safe havens GLD and TLT near 2017 highs in the ensuing month. Shifting defensive has been the right thing to do.

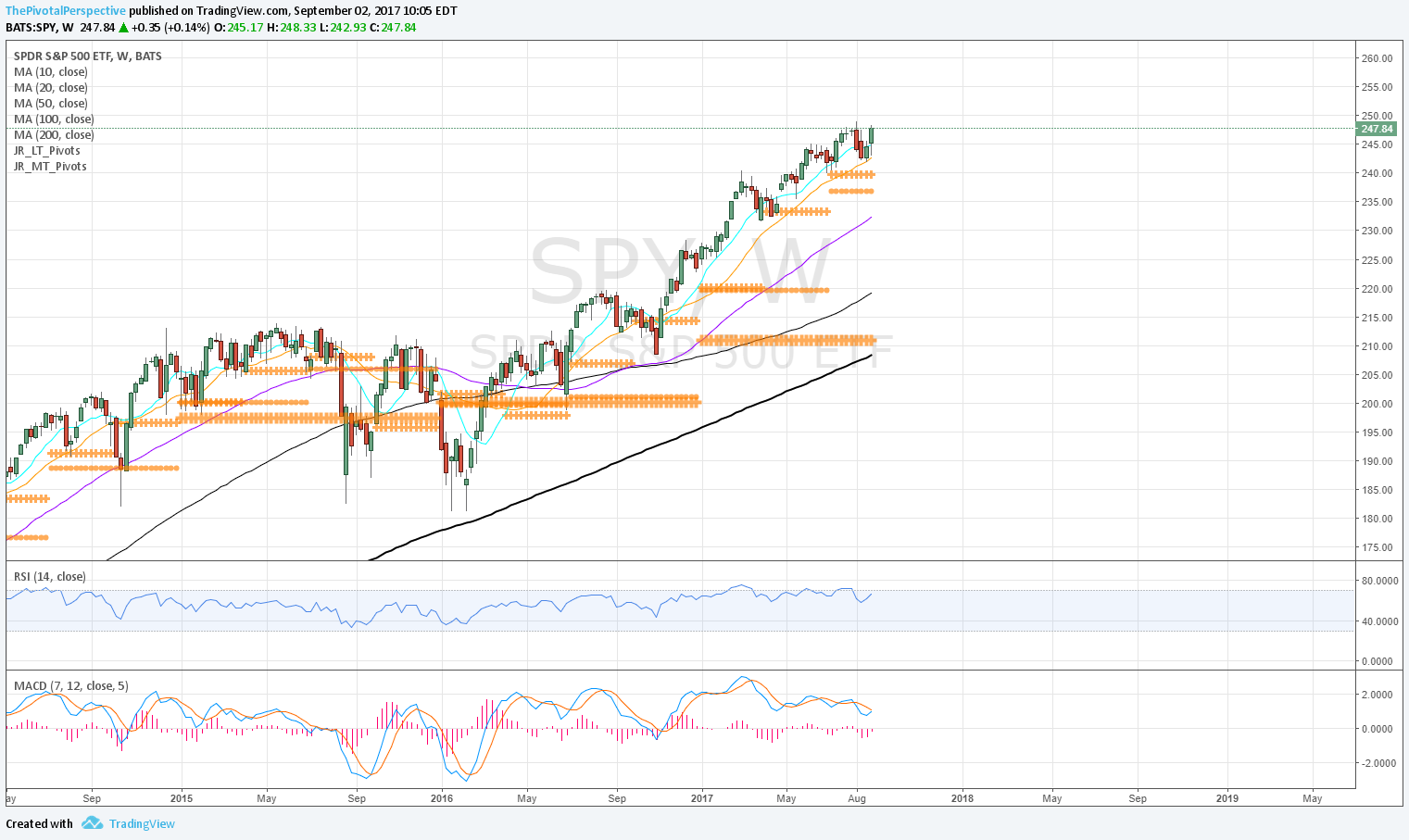

8/21/2017 Daily comment: "SPY tested and held AugS1 today, though the bounce for session seemed weak. But factor in moving averages, Bollinger bands and RSI, one has to conclude a 'maybe' low. For SPY, this was the nearest test of D100MA since the election; also, a close back inside the Bollinger band after 2 closes outside; as RSI near lows for 2017. In addition, this is happening as sentiment via standard put-call near highs for the year and CNN Fear & Greed Index at major lows."

And indexes indeed bounced with the 8/21 low holding so far.

SUM

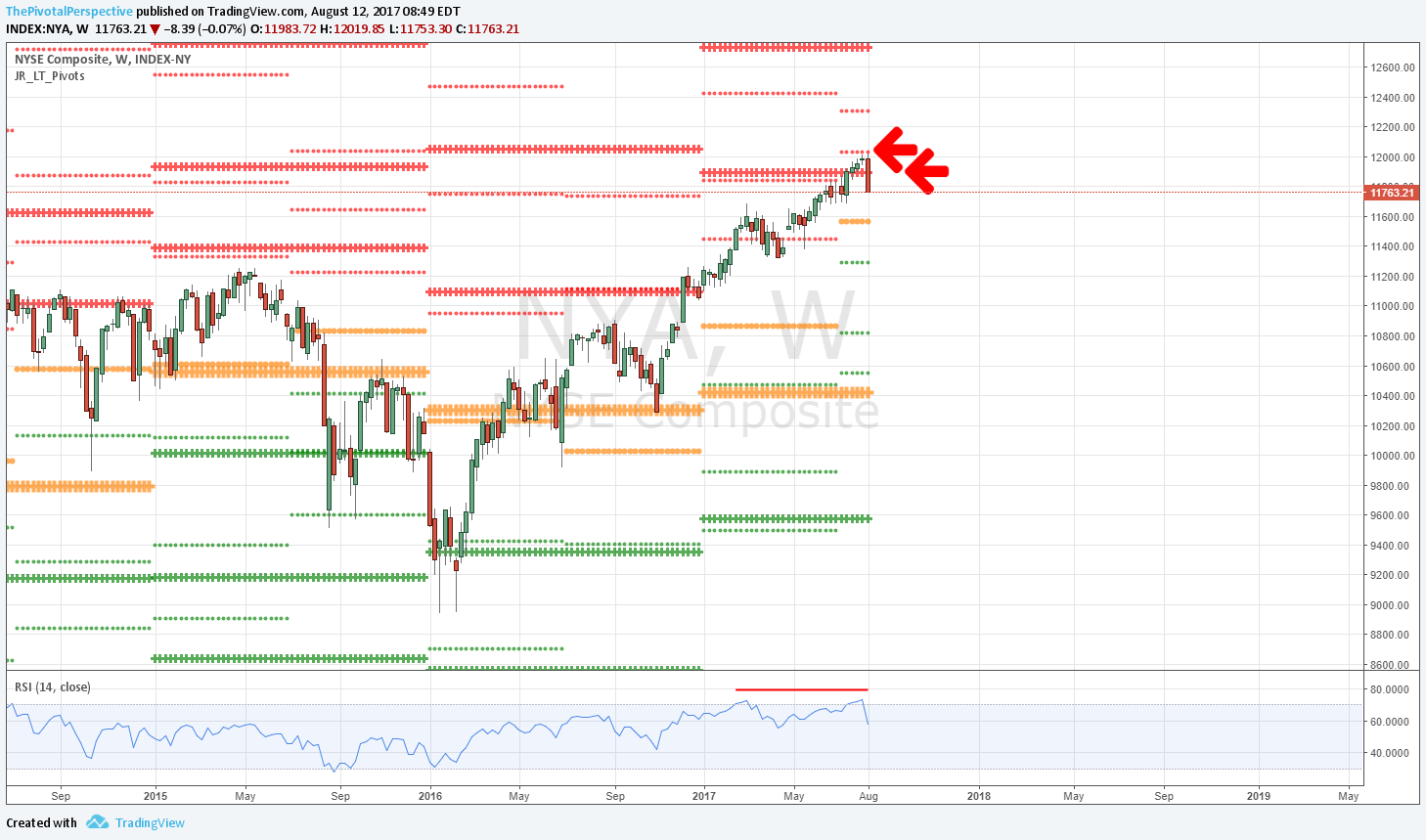

Main question from here is whether the 8/21 low and -2.95% decline for SPX was 'it.' There are indications of at least maybe: weekly charts of USA main indexes have had typical pullback to rising moving averages, sentiment picture has changed sufficiently, and VIX at 15+ has been the two other primary buying opportunities this year. In addition, global indexes especially China, are very strong.

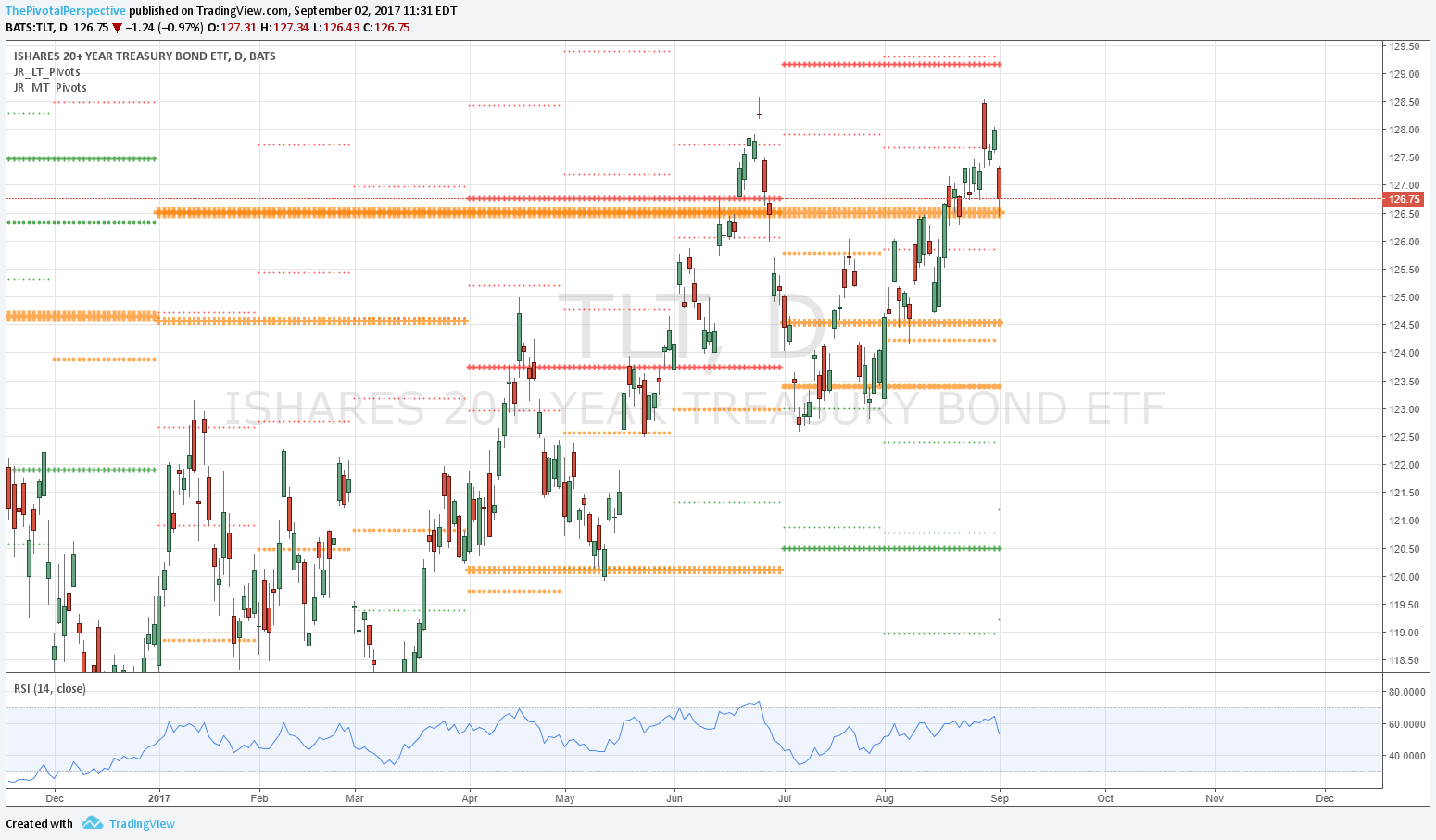

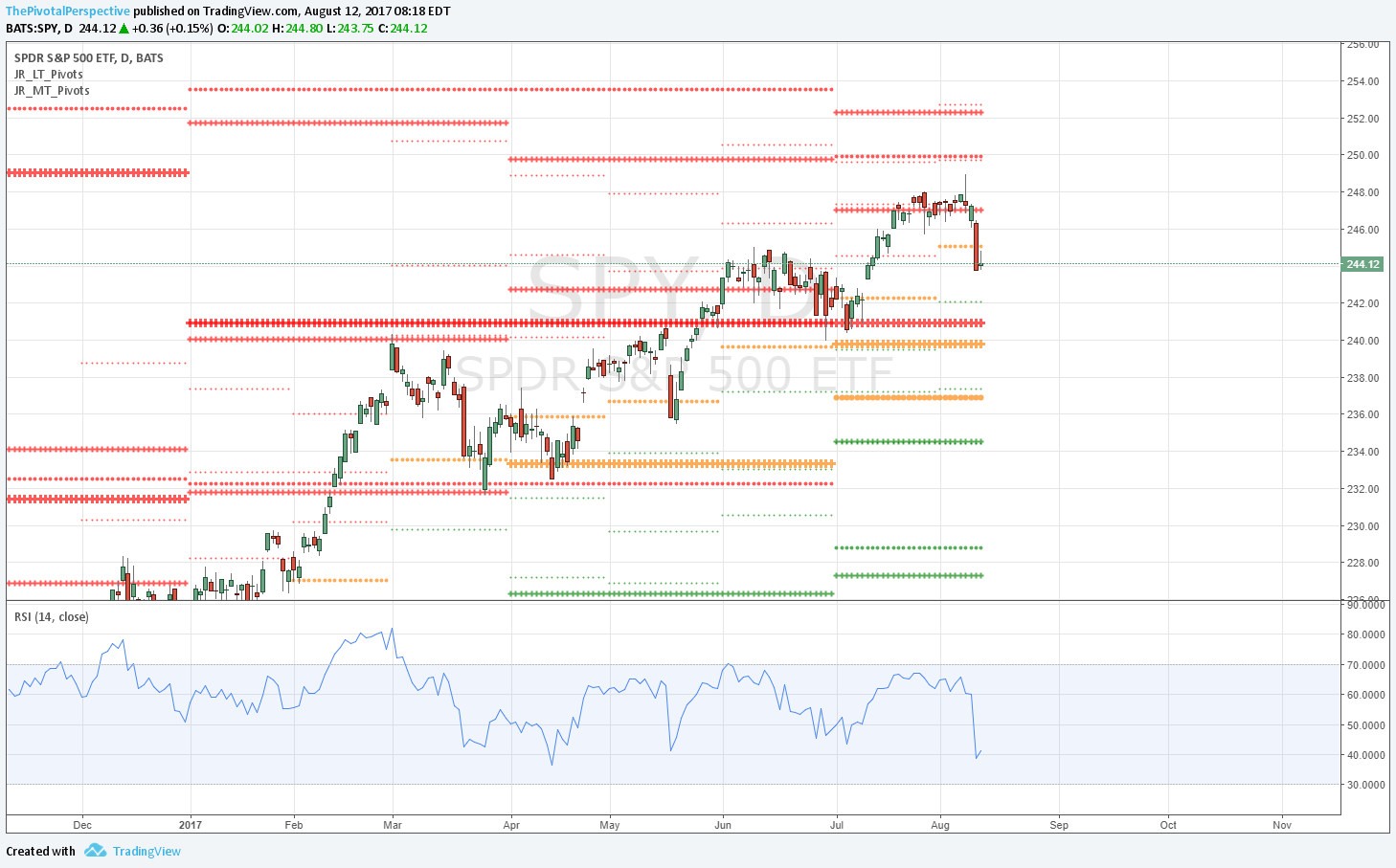

However - TLT has rallied above its YP to be above all pivots. This was not in the Wall Street script for 2017 and points to risk of another drop for stocks. Also, AugP for SPY has acted as resistance for 3 days in a row. While SPY may be able to clear this next week, a monthly pivot acting as resistance has occurred in declines like August 2015 and December 2015.

Following a Pivotal Momentum strategy, one would be concentrated in global indexes (especially China). See this post from 8/21. One would also have DIA and SMH/QQQ, and of course, GLD and TLT, and possibly a recent add on GDX per this post. I haven't been mentioning EWZ much this year (got lots of attention in 2016) as EEM, FXI and INDA leading, but it did hold a nicely rising D20MA and above all pivots on 8/10 as USA breaking down.

Bottom line - Until SPY and VTI clear the monthly pivot, and VIX drops below its monthly pivot, stocks are not yet in the clear. While it paid to be buying back some positions on 8/21, it is not yet full green light for 100% risk and certainly not the place for leverage yet.

PIVOTS

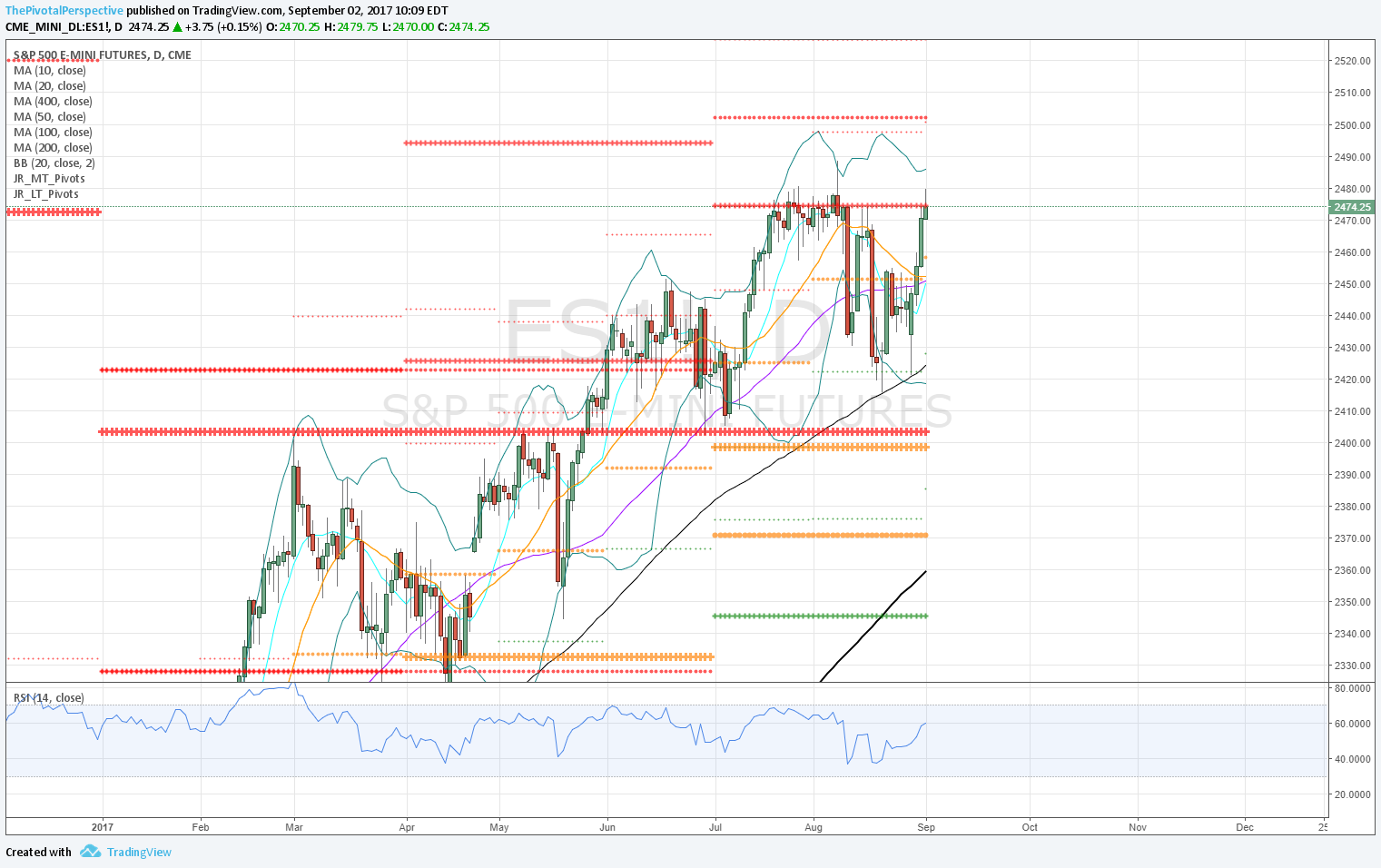

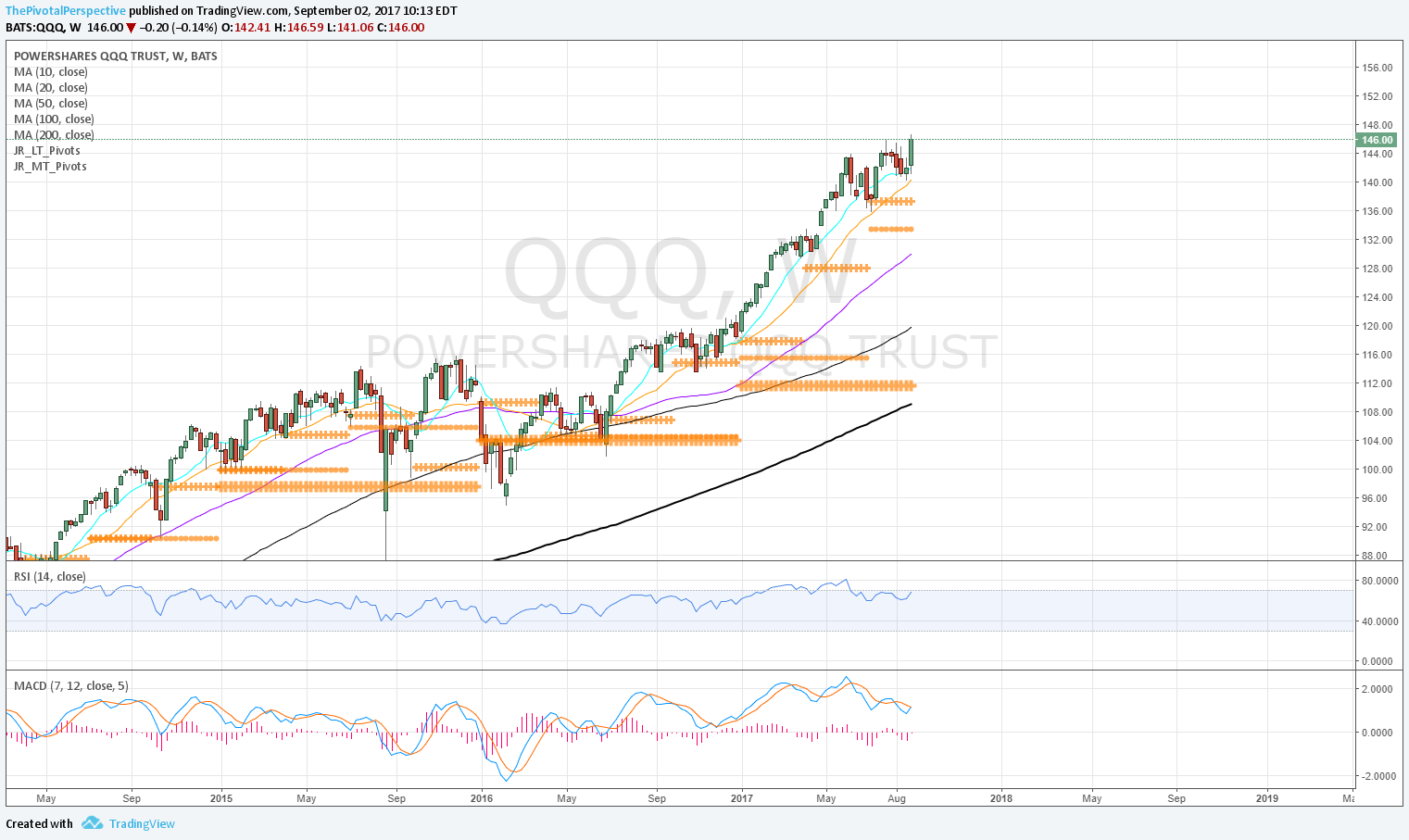

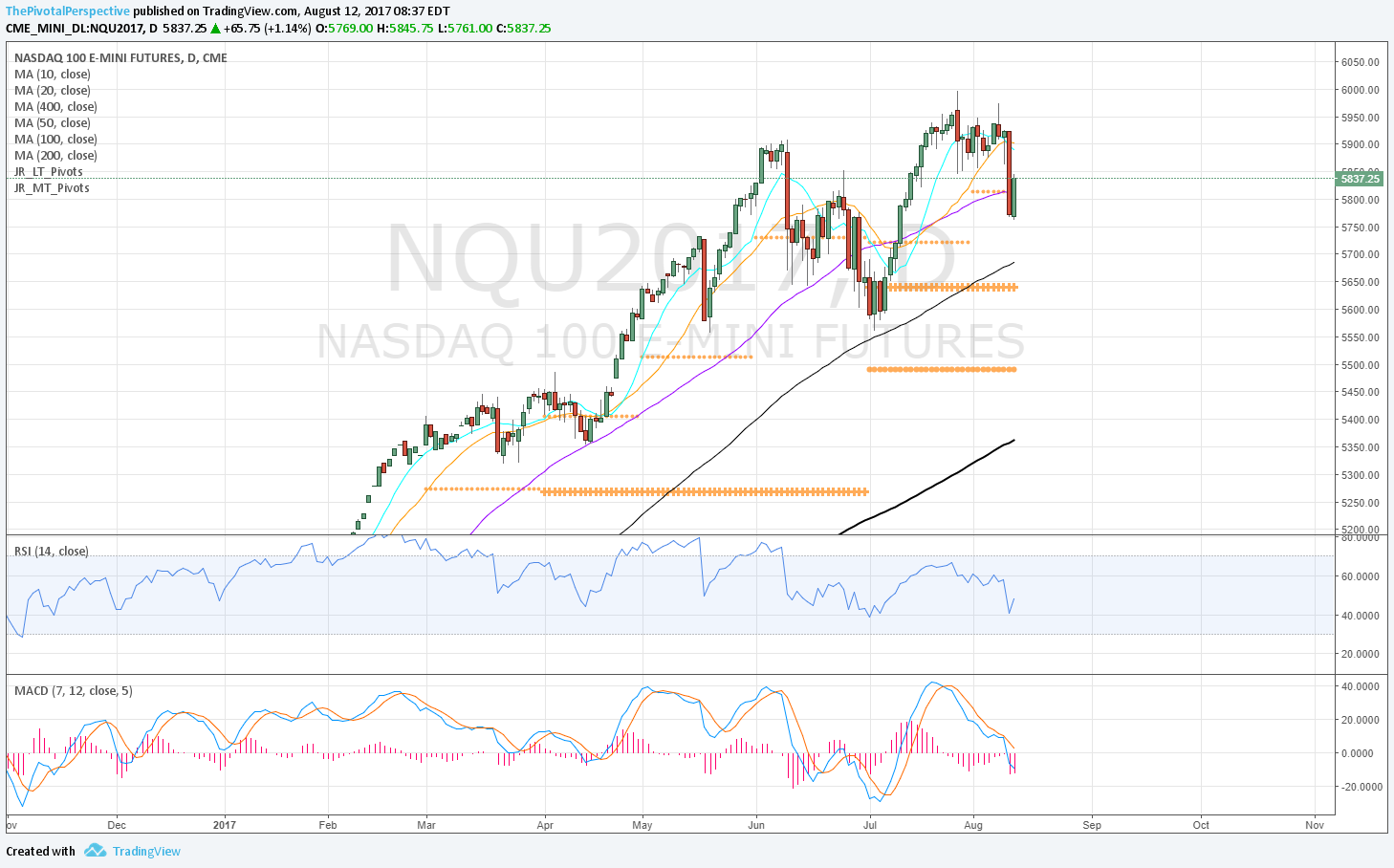

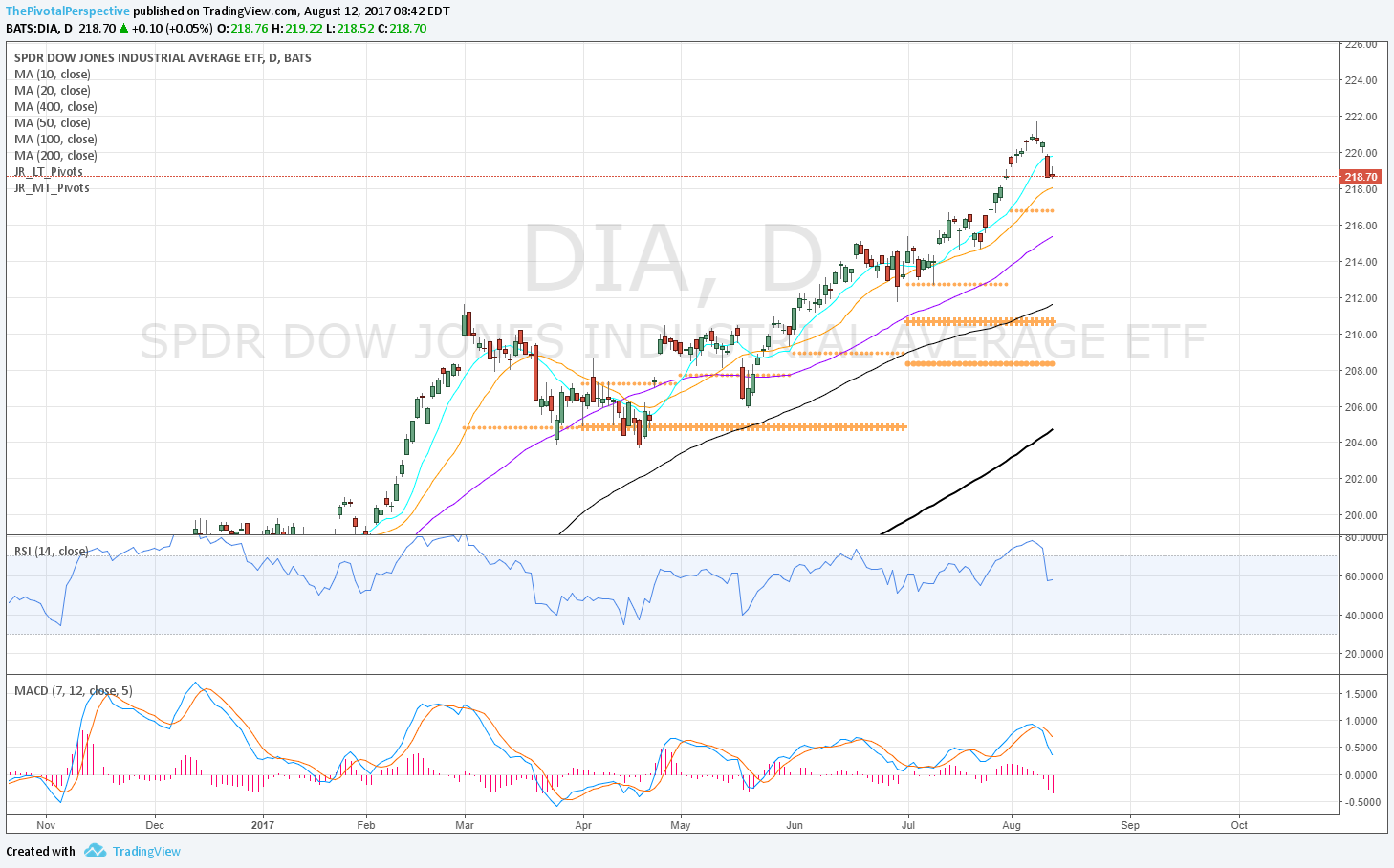

USA main indexes - DIA and QQQ above all pivots. SPY and VTI below AugP. IWM weak yet bouncing from 2HS1 / Q3S1 area.

Safe havens - VIX below crisis level of 12.23, but still above AugP. TLT pushed above its YP, and GLD holding above Q3R1.

Sectors of note - I've seen professionals recommend XLE for months now, expecting mean reversion. First, according to The Pivotal Perspective, it would have been significant underweight / avoid from February 2017; if trying to re-establish positions, only sufficient technical setups were: 3/27-28 (2 week bounce followed), 5/4-5, 7/7-8 and 8/18-21. XLF holding up well considering the bond move, but under AugP since 8/17.

Global indexes - ACWI, EEM, FXI, SHComp, KWEB, INDA, RSX and EWZ (in other words, all that i track!) - all above all pivots!

Currency and commodity - DXY plunged through 2HS1 support on 8/25. The last trading day above a monthly pivot was 4/11. Oil seems like it is trying to perk up but still rather stuck.

OTHER TECHNICALS

USA main index weekly charts

SPY pullback to weekly 20MA

QQQ pullback to weekly 10MA and now near 20MA

DIA pullback to weekly 10MA

IWM pullback to weekly 50MA and lower weekly BB

VTI pullback to weekly 20MA

These are all rising and so bounce was the more likely move. However, bounce looks rather tepid so far and I would not be surprised to see another downdraft.

Analysis of new highs new lows.

VALUATION AND FUNDAMENTALS

18X forward earnings (or more accurately, the 10 week moving average of 18x) worked very well as a level to reduce risk.

SENTIMENT

After reaching bullish extremes near the end of July, sentiment meters have taken a sharp move the other way. Put-call at high levels, and Equity put-call at highs for the year. Indexes may still move lower, but with sentiment already stretched the short squeezes will make shorting difficult from here. IWM short would have worked as a hedge, and otherwise safe haven longs were easier $.

TIMING

Proprietary work in progress model that I am still maintaining in bare bones form due to calls like this.

August dates first posted 7/23/2017

8/2 - not much event

8/8 - key stock high

8/11 - low

8/16 - high

8/21 - key low

8/25 - high?

8/30

For those who are reading this far, August timing turning our rather amazing don't you think? What are the statistics in 4 turn dates in a row? If markets drop on Monday, 8/25 will be the 5th.

This is a non algorithmic, proprietary, judgment based timing system.

September dates

9/4-5

9/13

9/22

9/26