OK, the title sounds like horn-tooting and maybe so a little bit. But the main point of this post is to understand why i was making those calls 1/20-22 and what has played out since then, both in terms of money and aggravation saved and then perhaps more important, other opportunities.

First, on 1/20 blog post "Big turn?" indicated possibility of decent turn and what we needed to see.

1/22 post continued to point out all the yearly levels that had just held, along with oil.

At the very same time, I was saying not a big buy on 1/21.

Then clarified this seemingly contradictory view with a detailed post here on 1/22, "A turn but not a big buy."

Now, if you have a 1 week time-frame that is really short term swing trading which I am not addressing so much here. For that you'd want to be using daily, weekly, and some monthly pivots - and yes, the week of 1/25 SPY held its weekly pivot for the first time since the last week in 2015, so that was a decent buy for that kind of trading. But for those with longer term horizons, any buys 1/20-22 would likely be now under water.

But that wouldn't be the only cost! In fact, maybe you could take some small stop outs and it wouldn't be a big deal. If you are trying to catch bounces, the big S levels are where to do it. Although I think a better method is to swing trade the bounces when you get a good setup on the shorter term pivots (daily & weekly, sometimes monthly) and hold core positions aligned with longer term pivots (yearly, half-year, some quarterly).

The main point of this post is to point out what you would have missed if you focused on trying to catch the bounce in stocks - which at this point, is counter-trend move according to The Pivotal Perspective.

The charts below show why I focus on buying what is above pivots, and avoiding, shorting or hedging what is below pivots. If you focus on trying to buy support (S) levels, ie, what is below pivots, once in a while you pick a nice turn but you could just as easily have a year of headache. Stock indexes are below major pivots for the first time in years, as safe havens jump above. This situation may take several months to resolve, or longer!

Now for longer term short positions, yes, those yearly level holds were good places to take some profits or hedge a bounce. This is equivalent to taking some profits on big R (resistance) levels in an uptrend. That said, just tagging those levels is not an automatic all out - not by a long shot. Often you want to continue to hold some shorts if the index continues to trade below all pivots. I'll address this in a separate blog post soon and point out some examples.

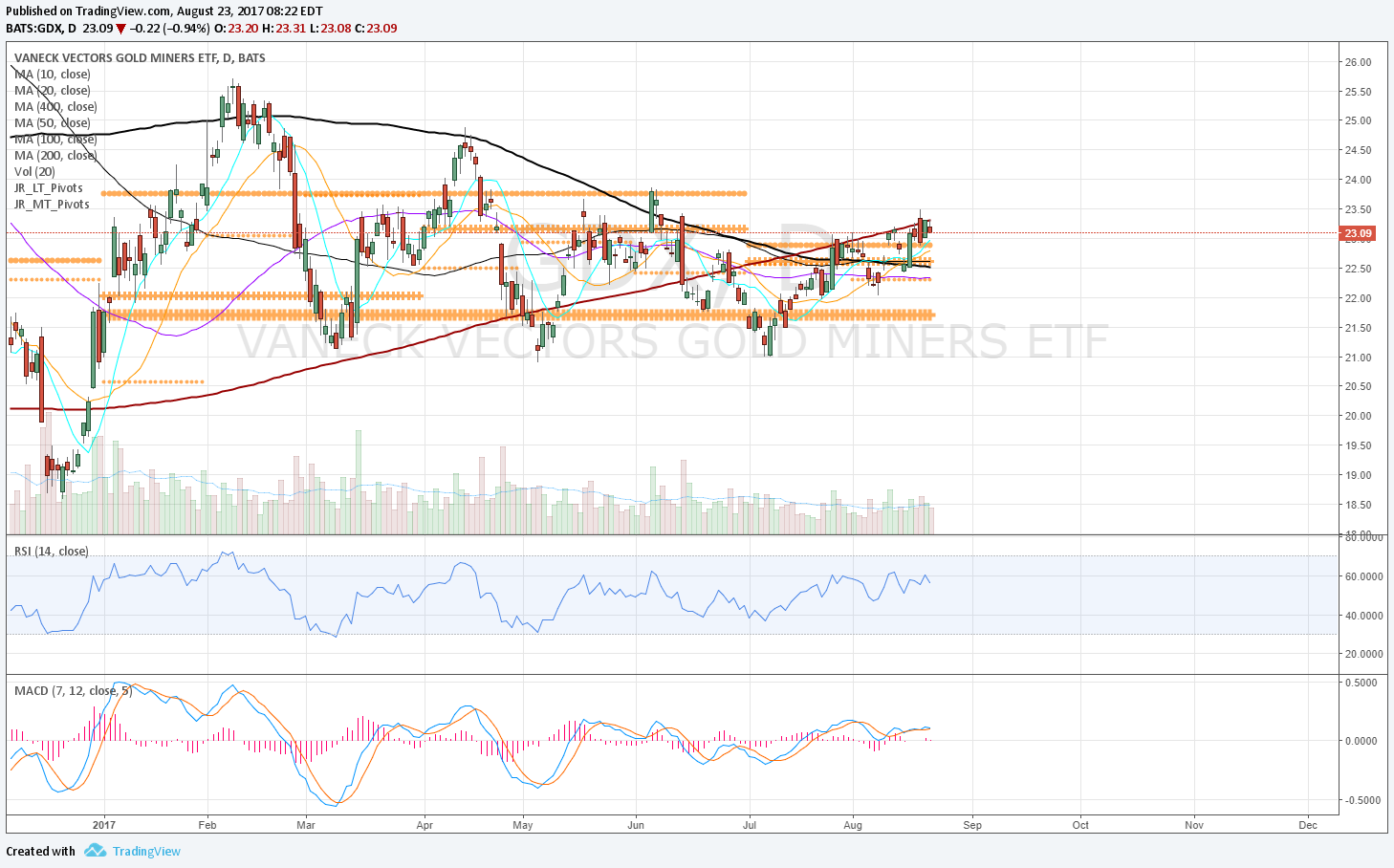

So by trying to buy the stock bounce you missed entries that we might not see again on TLT, GLD and GDX all below.

1. You missed a chance to add TLT longs as TLT held its YP as support 1/20-28. Showing long term pivots only here.