Sum

VIX below critical 2HP / Q3P combo 12.28 from 8/22 on. Though 8/29 seemed threatening overnight and near the open, VIX fell most of NYSE session hours and back under the level from 11:00 am EDT on. If pro SPX traders were not worried about NKorea WWIII, then neither should you.

XIV mostly mirrored the move, yet is fractionally under its SepP - so this means XIV is not fully confirming VIX under all pivots yet.

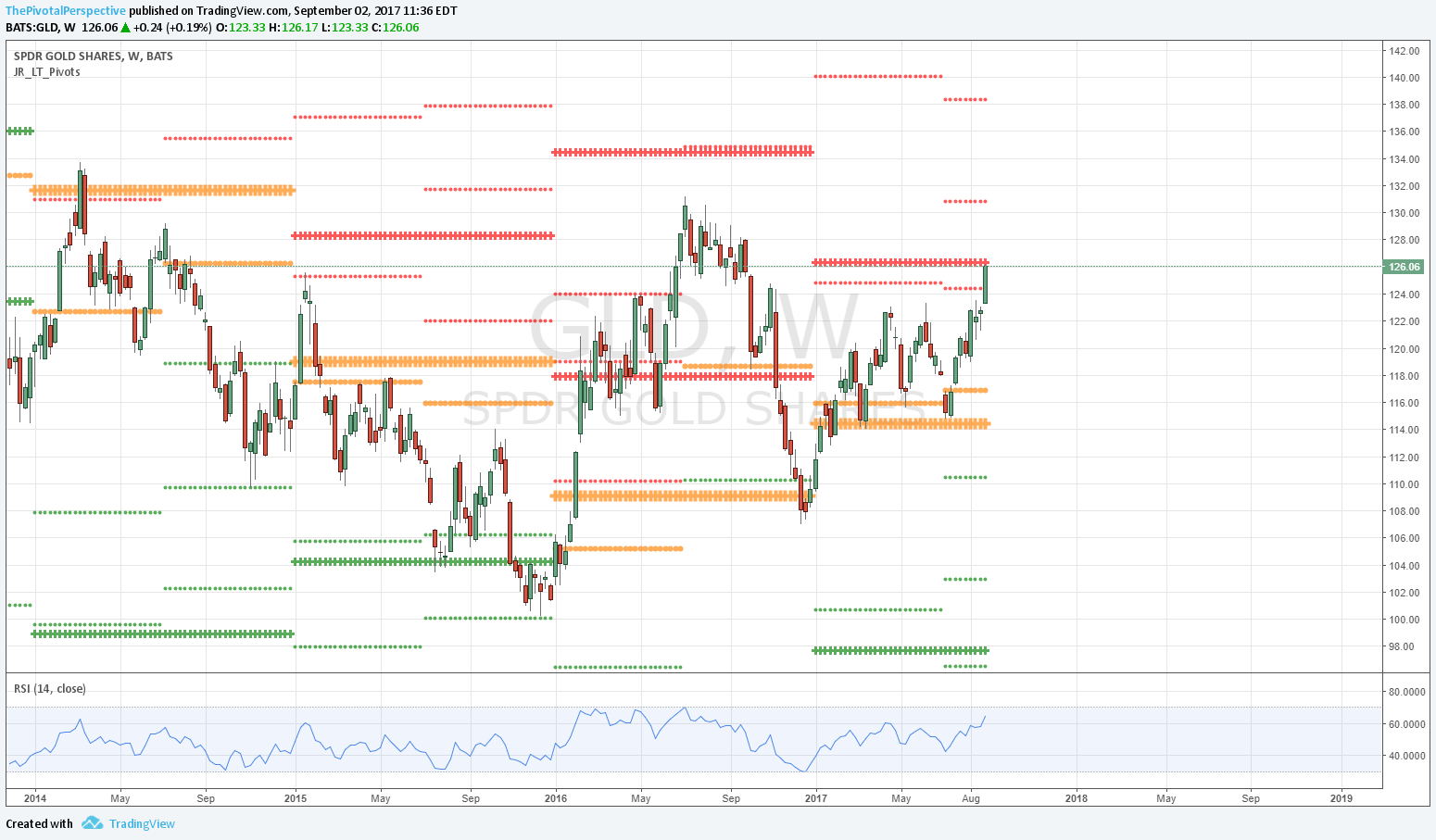

Meanwhile, TLT and GLD above all pivots. It still seems odd to me to have market at highs and safe havens so strong. Watching GLD YR1 / Q3R1 combo and GDX 2HR1 for reaction.

HYG has been giving good signals and I'm starting to include it in safe haven rotation, with a possible occasional glance at LQD as well. With higher dividend ETFs it is important to remember that these charts are not total return, but they still seem to respect the technicals here. HYG currently above all pivots, bullish for risk assets.

VIX

W: Not hard to imagine another visit into single digits.

D: VIX D below 2HP / Q3P combo on daily close from 8/22+. 8/29 seemed to be going the other way but dropped all day for session; back under critical levels about 11:00 EDT.

D: Green light below all pivots from 8/31 on. Bullish for risk with VIX below 12.28-46 which includes 2HP, Q3P and SepP.

XIV

W: High on YR3, pullback low near YR2.

D: Hard to see but SepP 83.87 so far resistance. So a bit of divergence between VIX and XIV here.

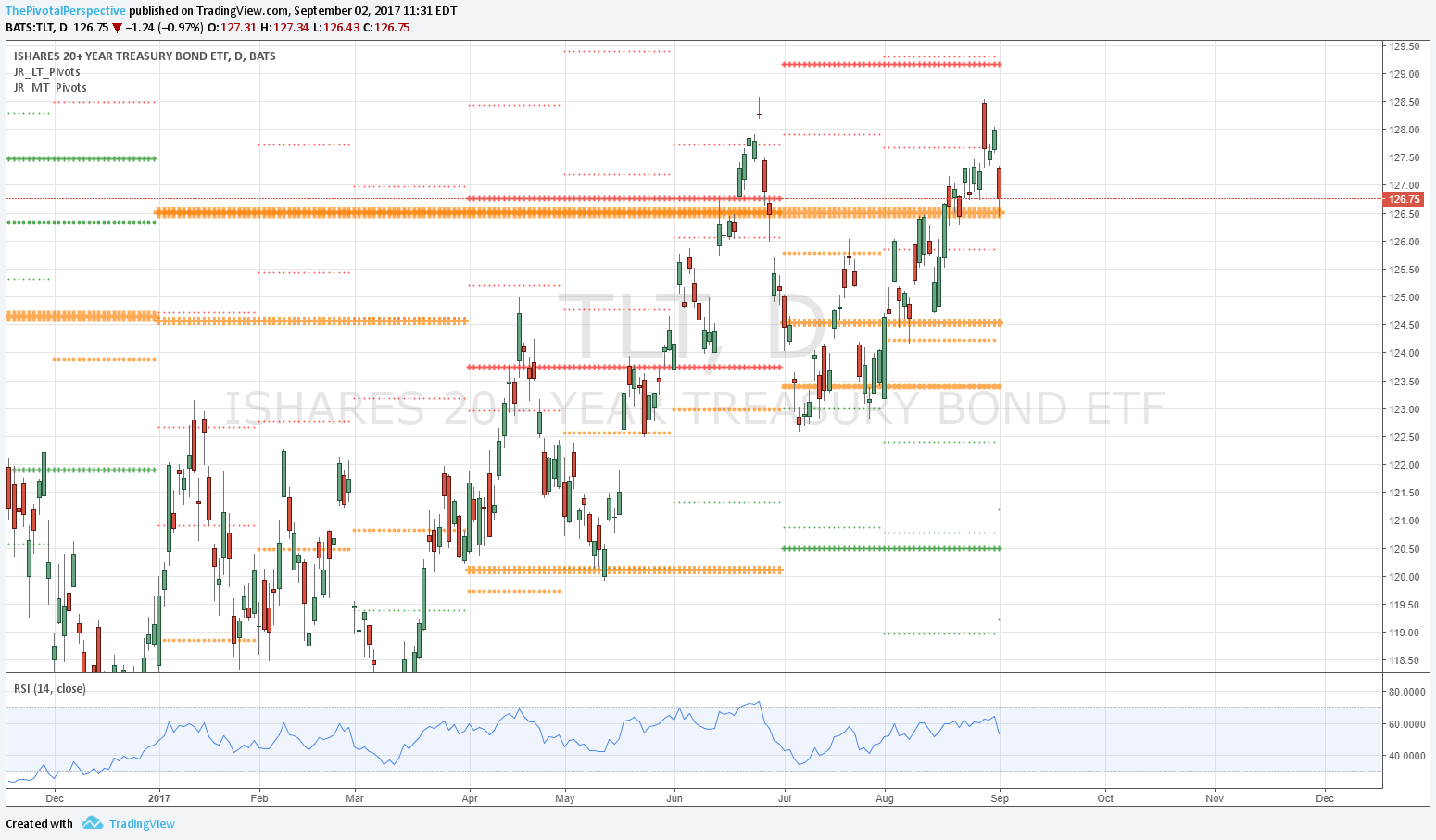

TLT

W: Still above YP.

D: Still above all pivots.

D: Above all pivots - below 10MA and 400MA (400 not used as much but consider proximity to monthly 20MA).

TLT sum: Still above all pivots and next move from YP will be interesting tell for market.

AGG

Above all pivots but Q3R1 on highs and rejection from there.

HYG

Pretty decent signals with 7/26-8/1 top and then similarly 8/18-22 low area. Currently above all pivots.

GLD

W: When everyone else was finally getting excited about GLD, The Pivotal Perspective is watching YR1 carefully to decide whether to lock in gains.

GLD: Testing YR1 with no rejection so far; Q3R1 just above. Could also hold above rising MAs and/or SepP near 123.

GDX

Testing 1HR1 area.