Sum

Regardless of any opinion about how NKorea would play out, all USA indexes made convincing holds of various pivot areas last week, and by 9/1 all 5 above all pivots (first time since 8/2).

It is important to understand what was on the low to help recognize these days where the market is literally ringing a bell for a definitive turn. Weekly level major pivot only (ie, pivots, no support / resistance, and no monthly levels) and moving average charts included below for clarity of long term trend. On recent lows:

SPY weekly 20MA held, then recovered AugP 8/30 along with D20 and D50MAs.

QQQ weekly 10MA and 20MA cluster held, then all above AugP on daily close from 8/22 on; 8/29-30 recovered D20 and D50MA.

DIA weekly 10MA held; AugP and D50MA 8/29 bang on last week's lows.

IWM weekly 50MA and 2HS1 on lows; recovered 2HP & Q3P 8/30.

VTI weekly 20MA and near tag of Q3P; recovered AugP 8/30-31.

From here, SPY and VTI Q3R1s are in play but even if mild pullback then SepPs likely support on first test. With all USA indexes above all pivots, one really has to be bullish and expect higher targets. I will change this view if we see resistance rejections and SepP breaks.

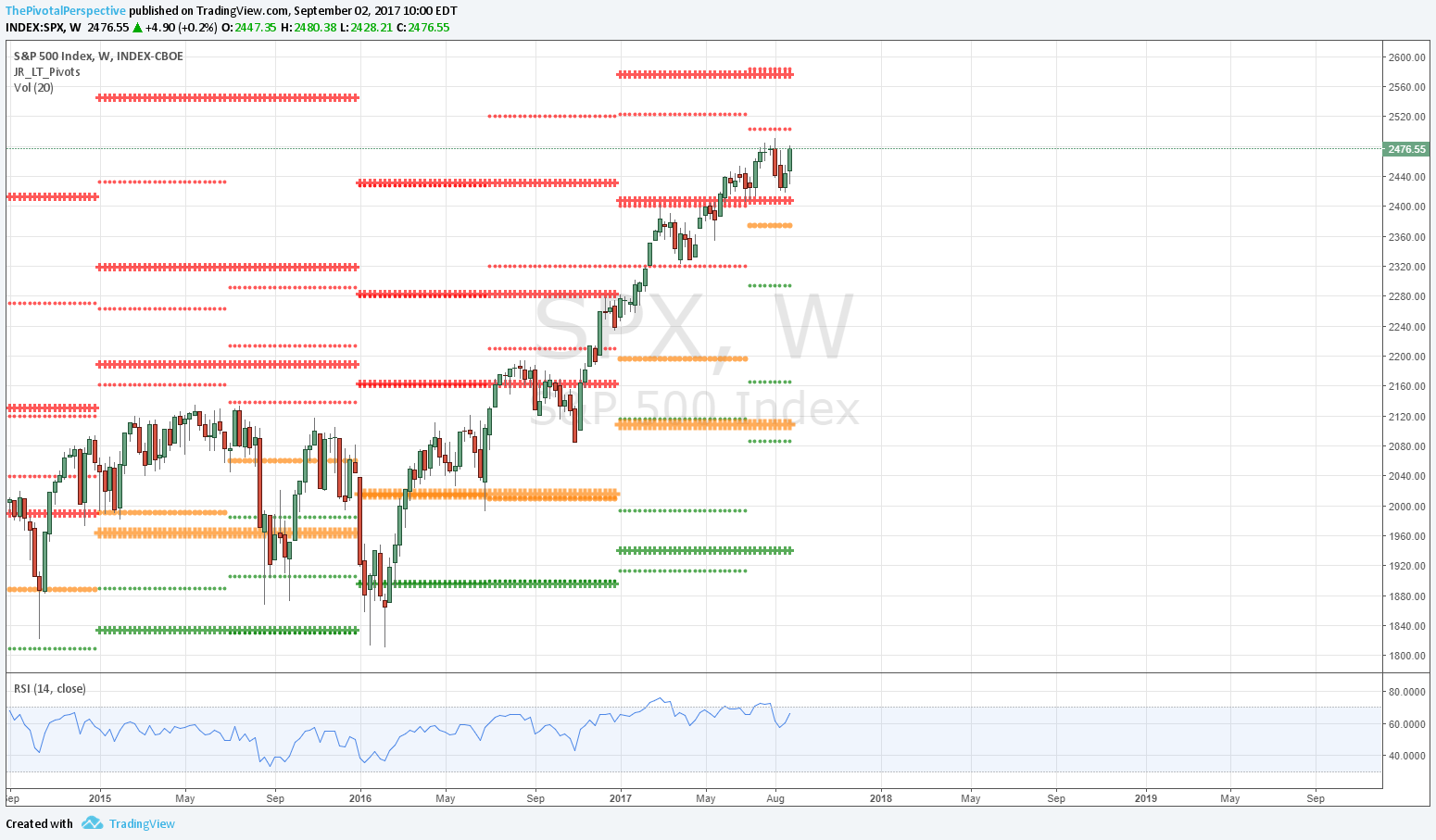

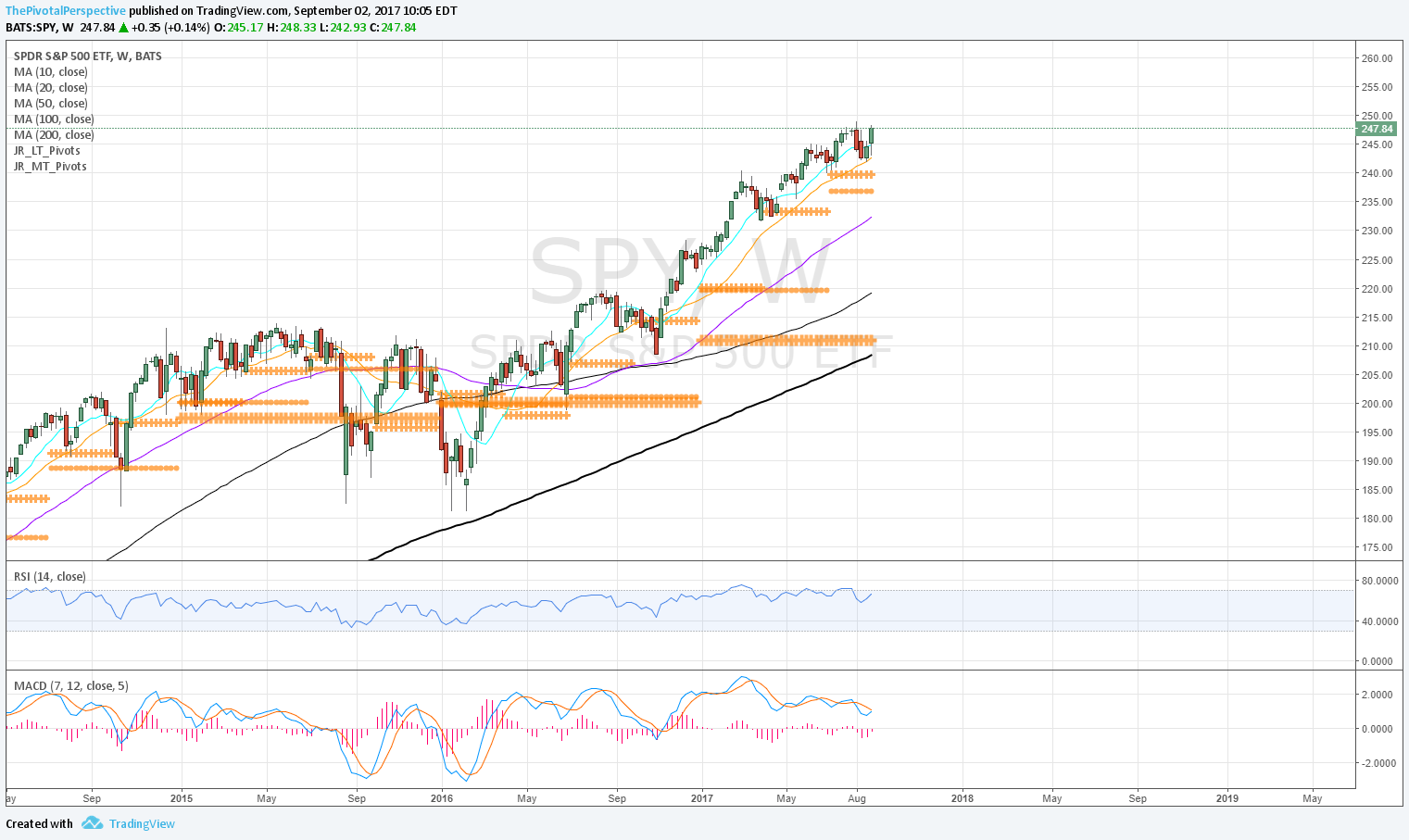

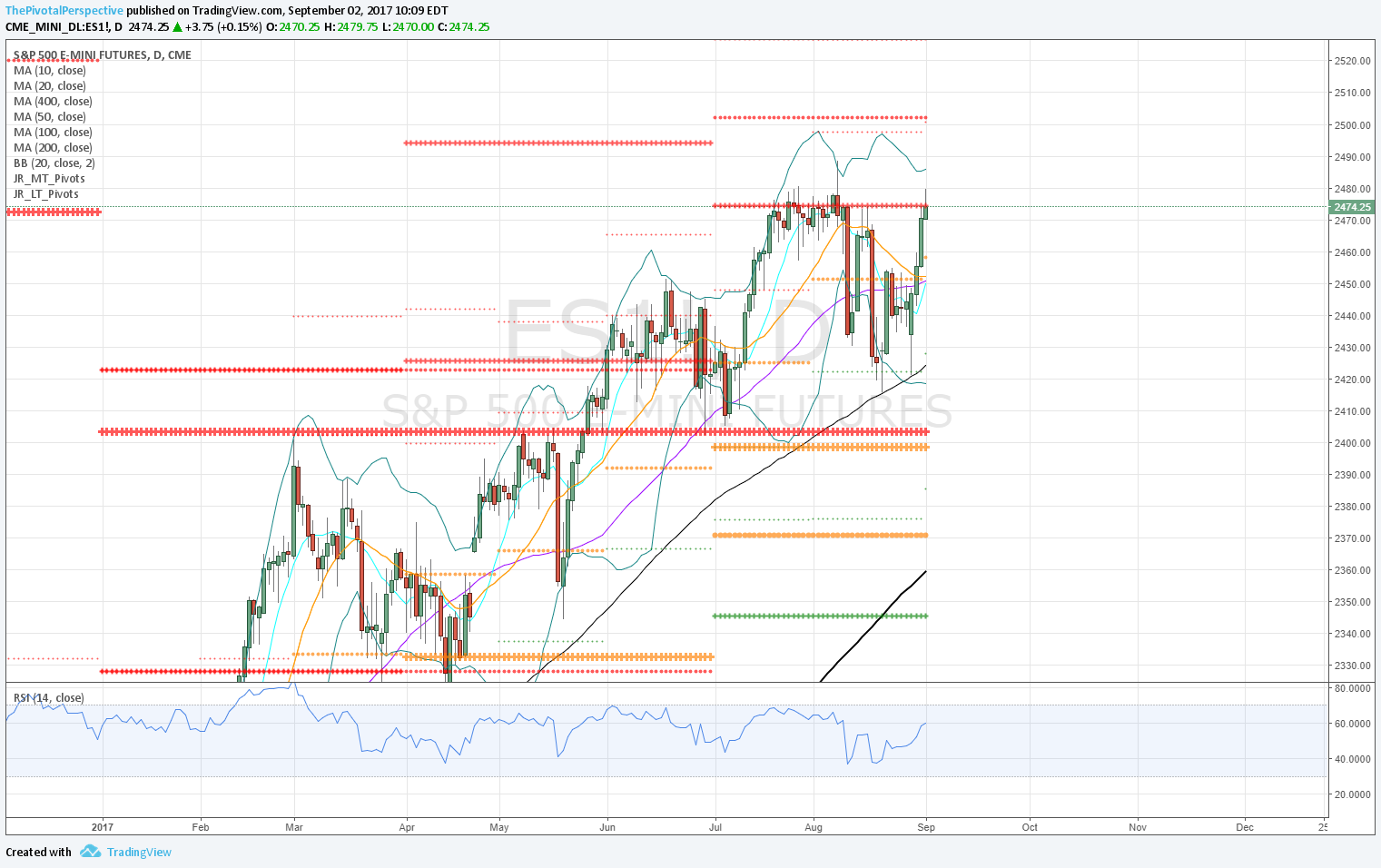

SPX / SPY / ESU / ES1

SPX W: From near lows of summer range to highs, but without tagging long term levels.

SPY W: Major pivots only (Y, Hs, Qs, no monthly) chart plus MAs; MACD+ from 11/2016, above rising 20MA entire ride.

SPY D: Back above all pivots as of 8/30.

ESU D: Back above all pivots and MAs on 8/30 close, as MACD flipped +. D100MA near enough on both llows.

ES1 D: At Q3R1.

SPX sum: Low on AugS1 and D100MA held for a second time, and from there fast move back above all pivots and MAs. Q3R1 in play. Above that will target 2HR1 2500, not far away.

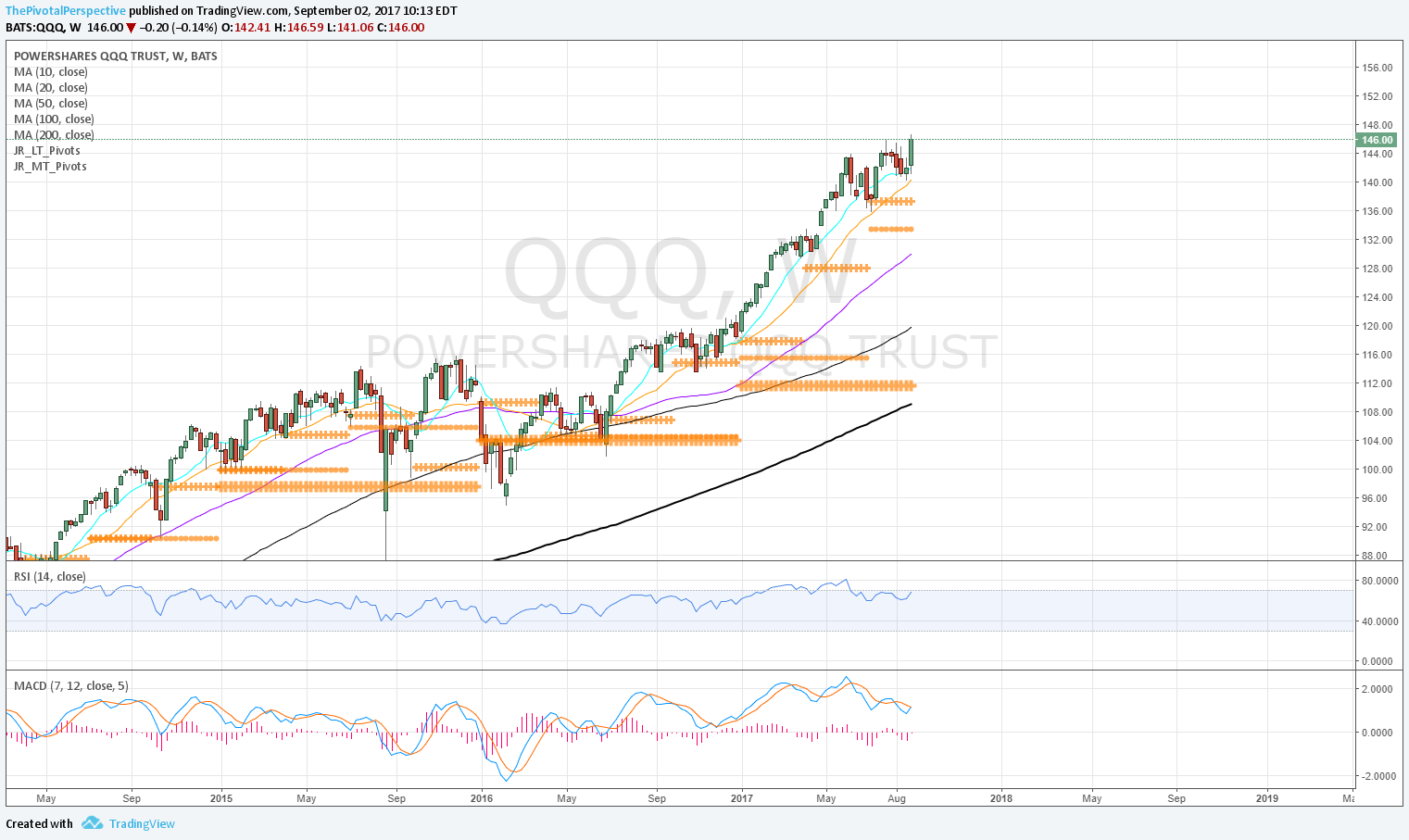

NDX / QQQ / NQU / NQ1

NDX W: Between levels.

QQQ W: Held 10MA and 20MA tag, with key low of Q3 bang on Q3P.

QQQ D: AugP 2 breaks, but held on daily close from 8/22 on.

NQ D: Above all pvits and MAs early 8/30.

NQ 1: About same.

NDX sum: Held test of weekly 10MA and 20MA; 2 minor breaks of AugP and definitive hold from 8/22 on.

INDU / DIA

INDU W: Back to 2HR1.

DIA W: Simple pullback to rising 10MA.

DIA D: Rising D50 and AugP convincing hold on 8/29.

RUT / IWM

RUT W: High on 2HR1, low on 2HS1 both near exact. Recovered 2HP.

IWM W: Rising W50MA on the low as well.

IWM D: Pivot cluster on lows, back above all pivots as of 9/1.

NYA & VTI

NYA W: Back above YR1.

NYA W: Hold of rising 20MA and near tag of Q3P.

NYA D: Above YR1 is bullish, with SepP not far below as support as well.

VTI W: YR1 held as support from 8/22 on.

VTI W: Rising 20MA and near tag of Q3P on the lows.

VTI D: At Q3R1.