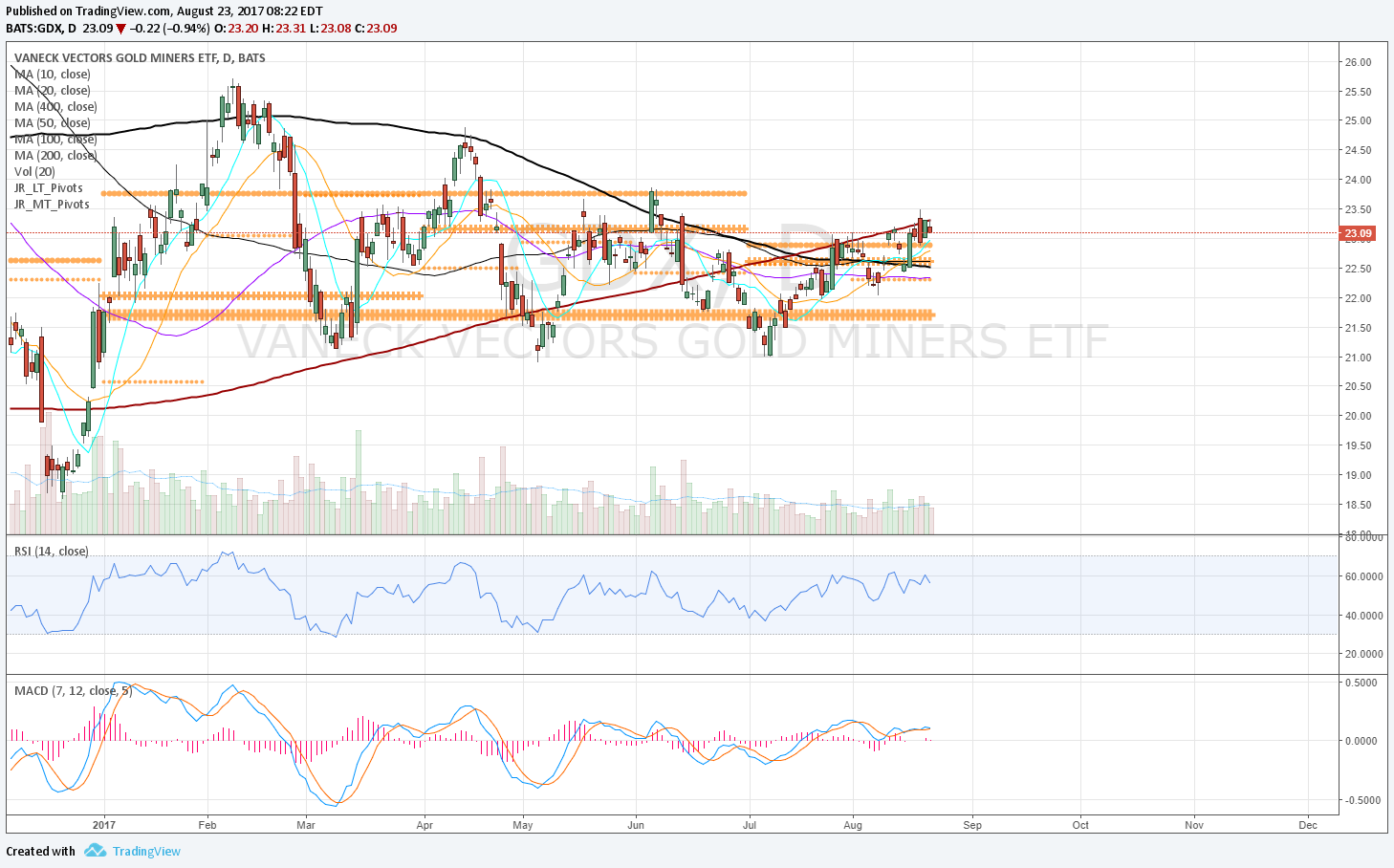

TPP gave a rec to buy GLD on 7/11 just after the YP hold, and I haven't seen any reason to sell yet. Here I'd like to point out that GDX has spent the last 5 trading days above its 2HP (ie above all pivots) which has been fairly rare this year.

In addition, SLV (not something I always track) has recently lifted back above its YP and held yesterday. SLV is a bit weaker, still under 2HP and Q3P and a falling D200MA, but may join the others above all pivots. SLV looks interesting here, and although I don't like to fight a falling D200MA, there have been several days of selling from this level and no downward motion. This could squeeze higher.

With DJT threatening shut-down, bonds are the less likely safe haven. Aside from sectors like utilities, institutions concerned about stock valuations can buy volatility, metals or raise cash should their funds allow that.

GLD, GDX and SLV below.