Sum

First the positives: DIA above all pivots and all MAs except 10MA. QQQ broke AugP for 1 day and recovered. Also, only IWM is below Q3P. All the others (SPY QQQ DIA NYA/VTI) above Q3Ps, 2HP and of course YPs.

But - significant negatives. DIA, IWM and NYA had long term level bearish action. DIA top on 2HR1 and rejection, IWM 2HP break, and NYA 2HR1 and YR1 rejection. SPY had near tag of 2HR1 and rejection, and currently below AugP.

My interpretation of this is the move we just saw is not a 1 day bear wonder or false break. This opinion could change, but this means I am not expecting an immediate bullish resolution.

More bullish action would be SPY recovering AugP with look of support, and VTI bouncing from YR1 in decent reversal.

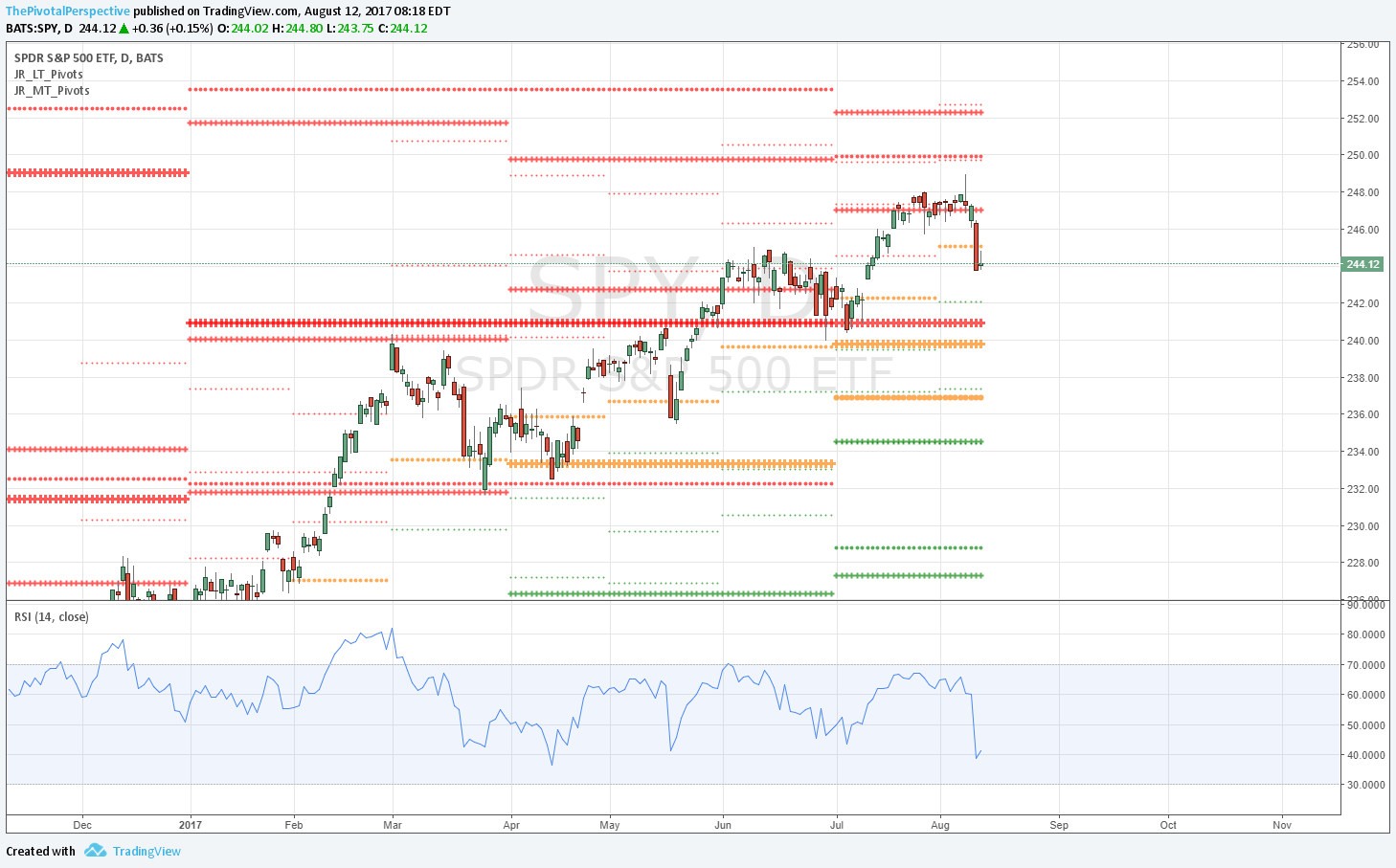

SPX / SPY / ESU / ES1

SPX W: Near tag of 2HR1 and down. Support at YR1, 2HP. RSI buy attempts likely in 50-60 zone.

SPY D: Q3R1 rejection and below AugP. Next support AugS1, YR1, Q3P. Or, recovery of AugP would look more bullish.

ESU: Break of D50MA.

ES1: 2 days outside the daily BB.

SPX sum: Below AugP means should go lower.

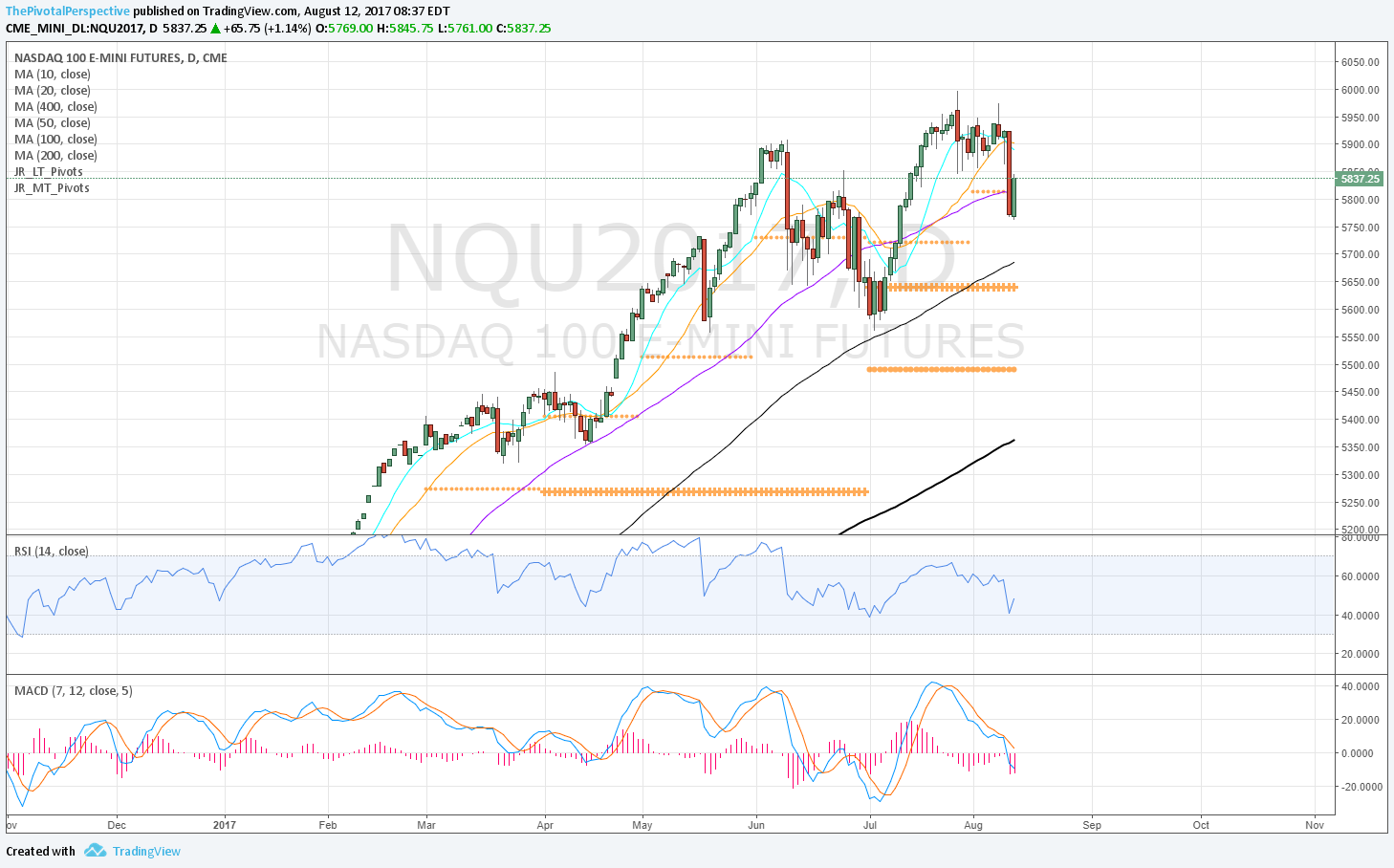

NDX / QQQ / NQU / NQ1

NDX W: Failing at prior high and RSI divergence. That said just looks like consolidation at this point.

QQQ D: Only 1 day below AugP.

NQU D: Also back above D50MA.

NQ1 D: 1 day outside lower BB.

NDX sum: 1 day break of AugP and recovery, also back above D50MA. This looks more like one day bear wonder.

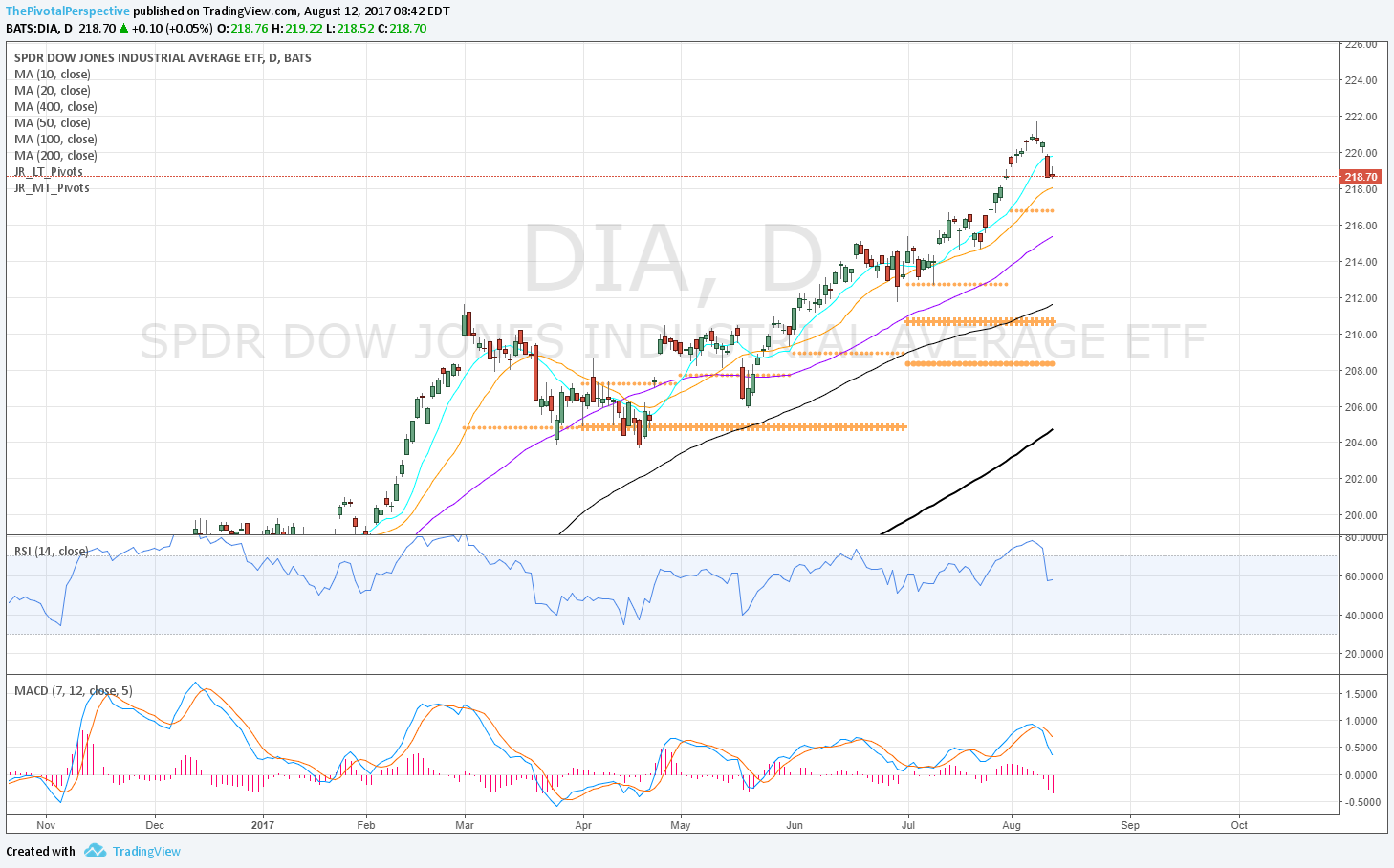

INDU / DIA

INDU W: Possible critical high on 2HR1.

DIA: High on Q3R2 / AugR1 combo, then 1 day rejection of 2HR1.

DIA: Still above all pivots, and all MAs except D20.

DIA: 2HR1 rejection is bearish, but still above all pviots and all daily MAs except 10.

RUT / IWM

RUT W: Break of 2HP! 2HS1 support not far.

IWM D: RSI oversold and near Q3S1, but below 2HP and Q3P, and of course AugP. Red line at 2016 close. Total return includes dividends and this is price, but still an important level for the market.

RUT sum: This is long term underweight based on break of 2HP. This index has been weaker all year, and you ca

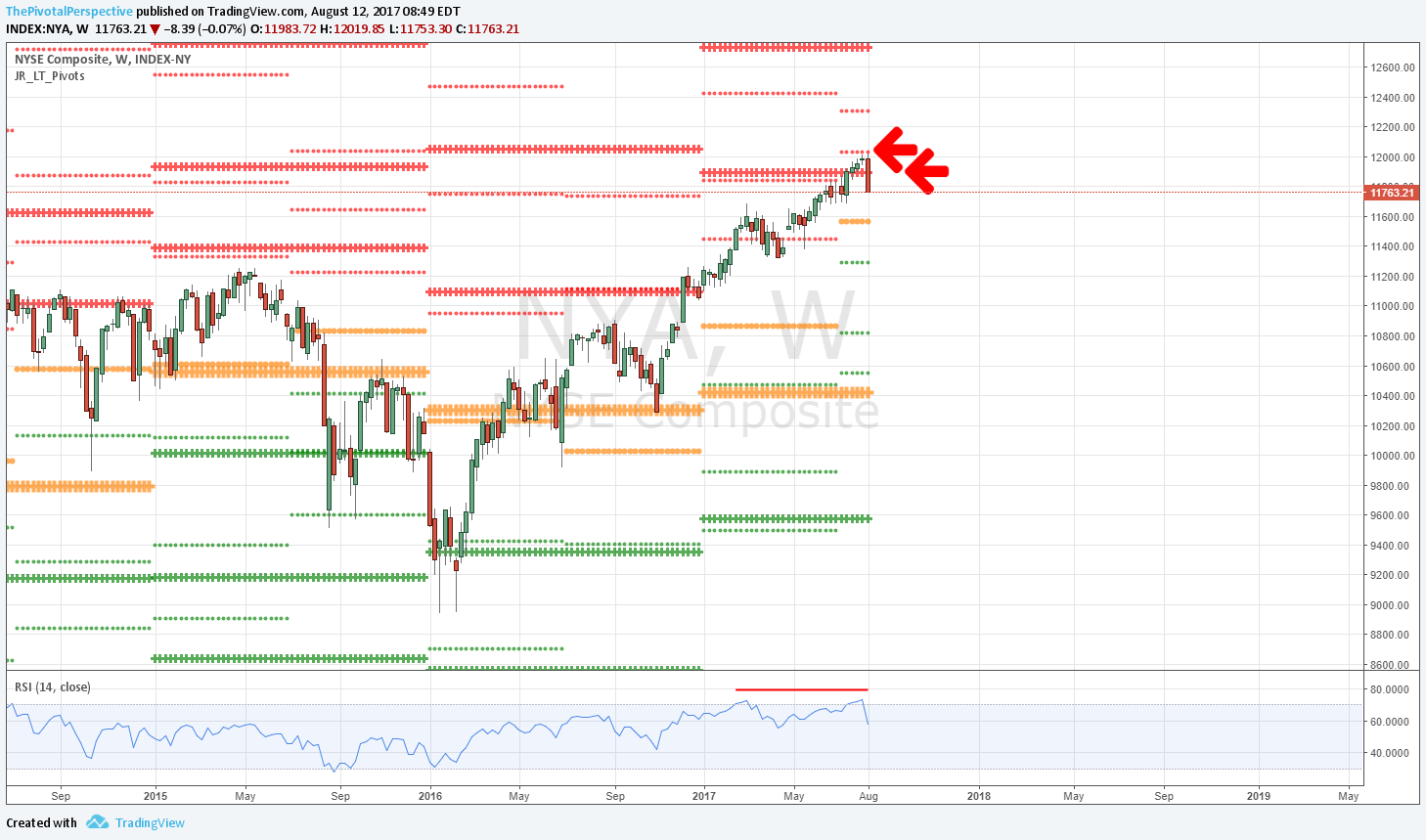

NYA & VTI

NYA W: Looks like critical high on 2HR1, and break of YR1 confirms selling. 2HP support.

NYA D: That near tag of 2HR1 and break of Q3R1 started the move. Massive rejection of YR1 on 8/10. Still under AugS1.

VTI W: Testing YR1 as support.

VTI D: Q3R1 rejection and so far holding YR1 but not much bounce.

NYA move adds to argument that market just made important top. VTI would join in that if YR1 breaks with look of rejection.