REVIEW

10/28/2017 Total market view: "Over the past few weeks I've been expecting some near term selling from INDU/DIA YR2 and/or SPX/SPY YR2. Dow simply soared above its level without one day of pause; but SPX/SPY did drop from YR2 for a few days last week. And then it erased 3 days of losses in 1 day. At this point I'm starting to think it may get through it, although I'll still be watching the resistance cluster of YR2 / 2HR1 at 2576-2582, with equivalent SPY levels 258.02-258.61."

And after a bit more shuffle from that SPX 2576-2582 cluster early in the week, SPX launched above 2582 on Friday.

SUM

Nothing seems to stop most indexes - as global leaders cool off USA tech again powers up to new highs. USA small caps IWM and Brazil EWZ being the glaring exceptions, both under NovPs after YR1 rejections. But nearly everything else is up.

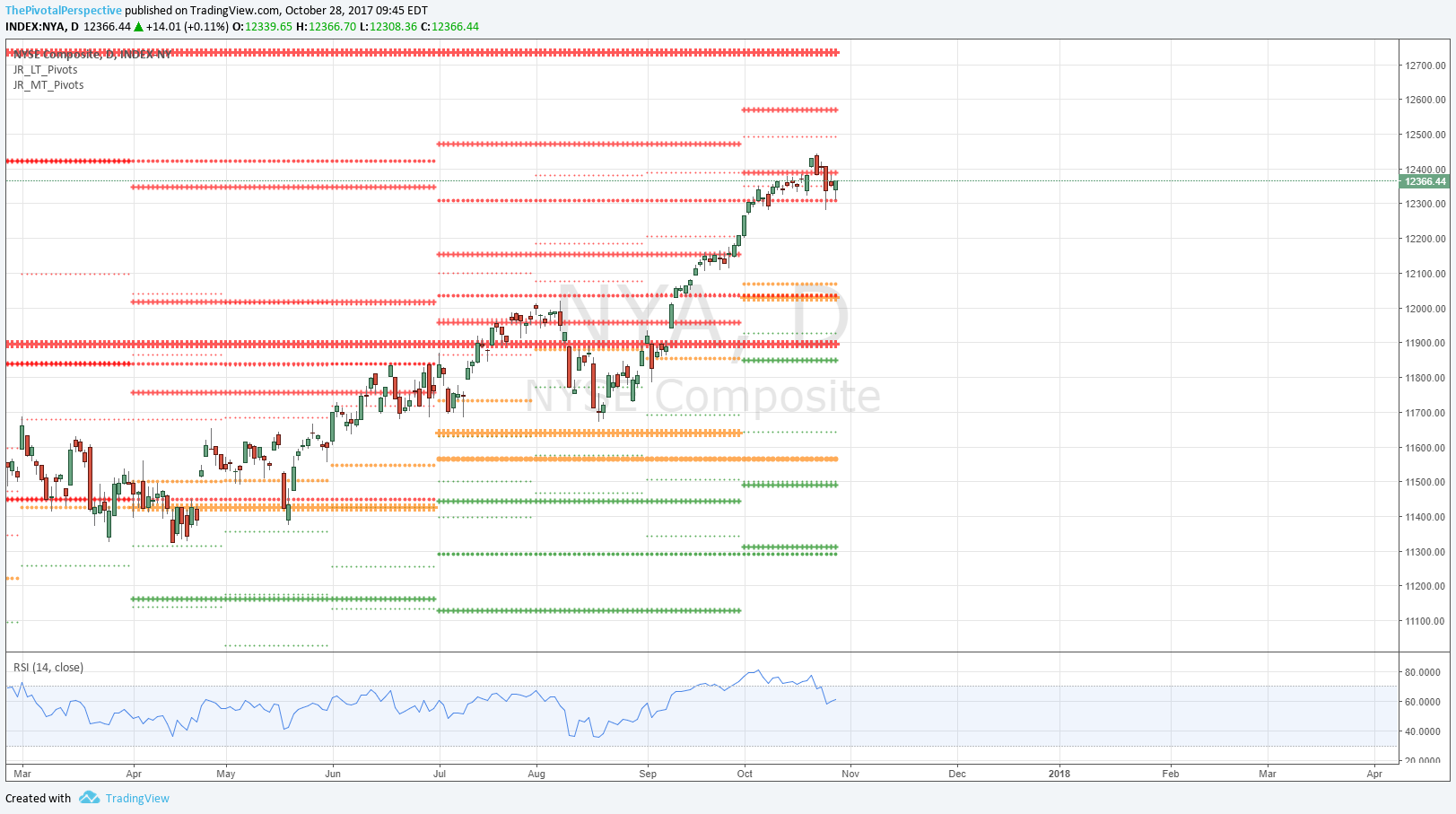

While it is possible to have trading turns on quarterly levels - SPY, QQQ and NYA all at Q4Rs right now - in my view clearing long term resistance as SPX did last week is the larger positive because now this can act as support.

Some sentiment measures are reaching extremes that we haven't seen since early August: equity put-call approaching relative lows of 2017, ISEE had two spike high readings in the last 6 trading days, and AAII bulls also jumped to one of the highest levels of the past 2 years. Normally this would add to downside risk but in this kind of environment perhaps we should see even more euphoria for the longest SPX rally without a -3% drop ever.* (* data from 1928.)

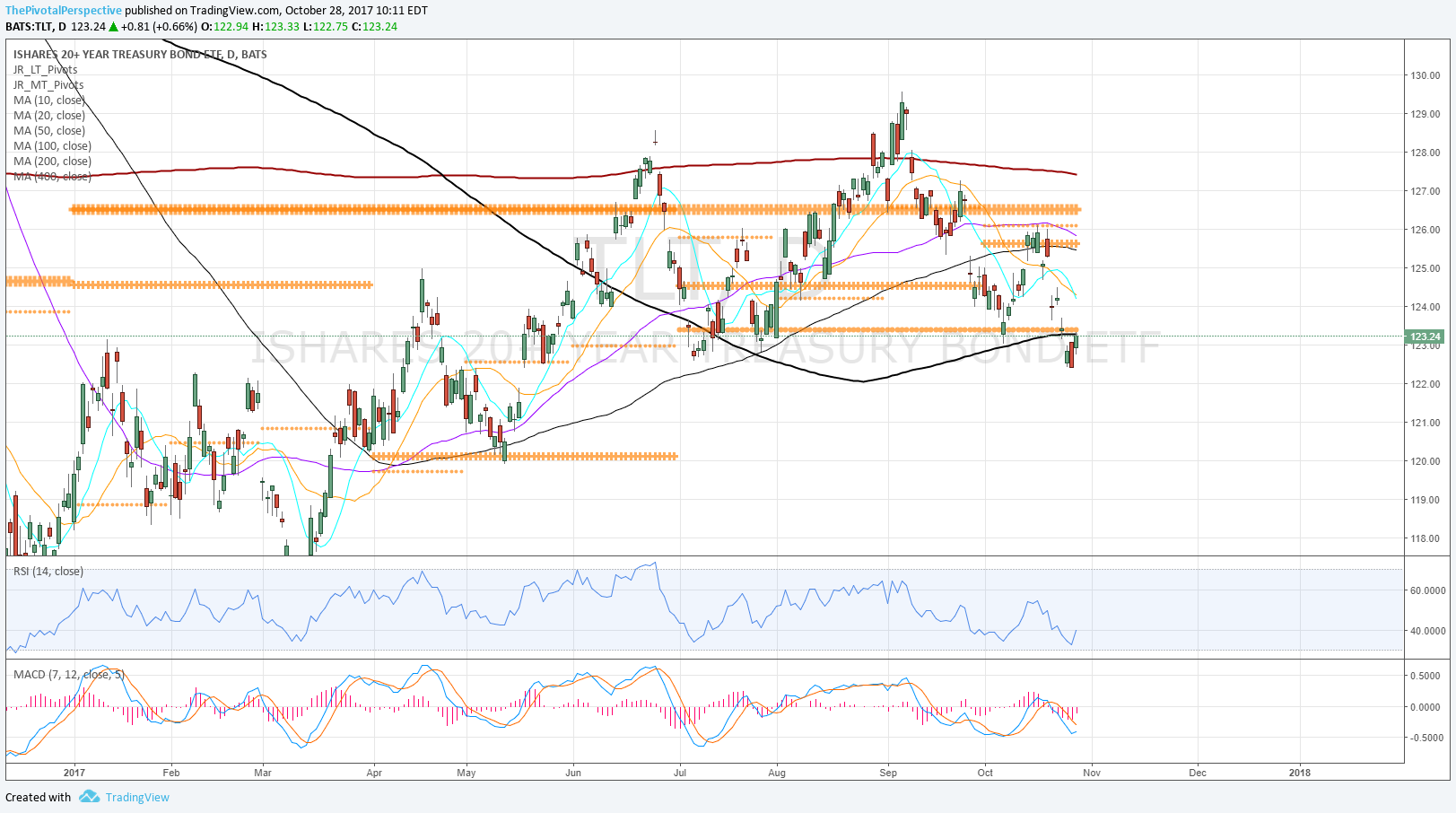

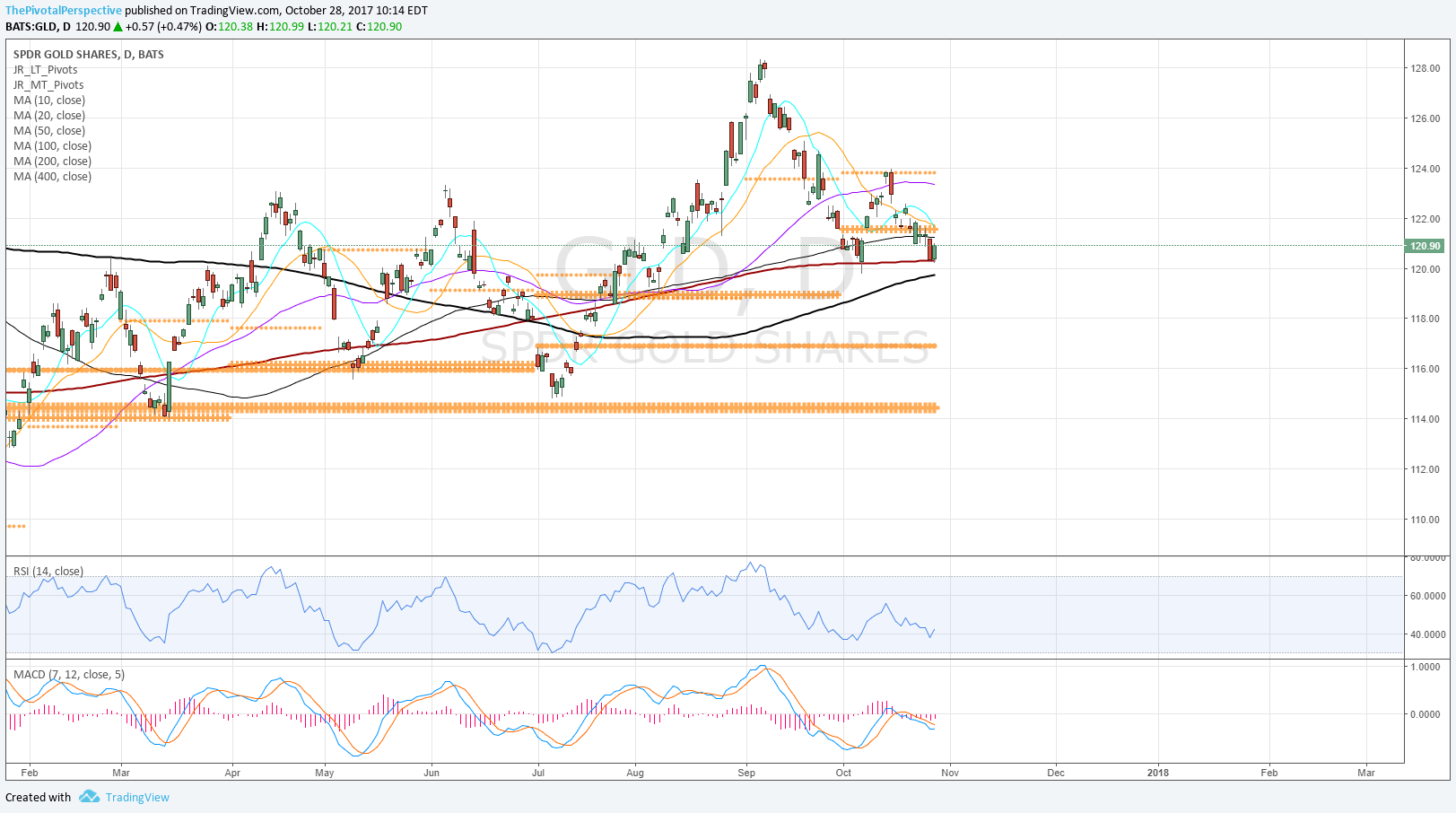

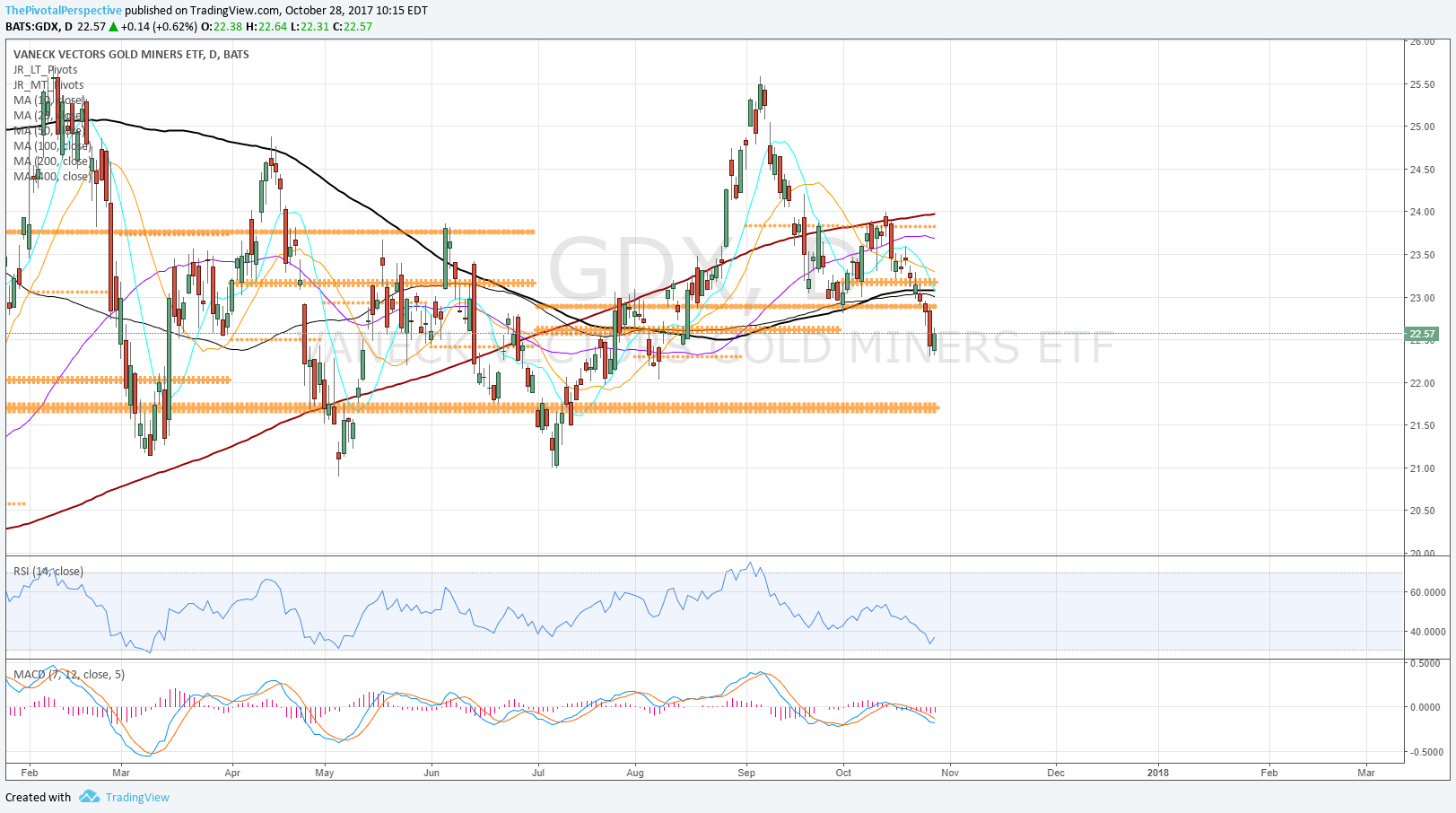

VIX and XIV remain great tells on the market - see safe haven section for details. The only fly in the ointment seems to be recent TLT & AGG strength combined with HYG weakness. HYG has anticipated several stock drops in the past, so currently below its Q4P is some warning for stocks.

That said I'll stay fully on the bull side with SPX above 2582. If one wants to reduce risk, IWM is a hedge candidate. Also, if we see more DXY strength and global weakness, i may hedge current FXI and INDA longs with an EEM short.

PIVOTS

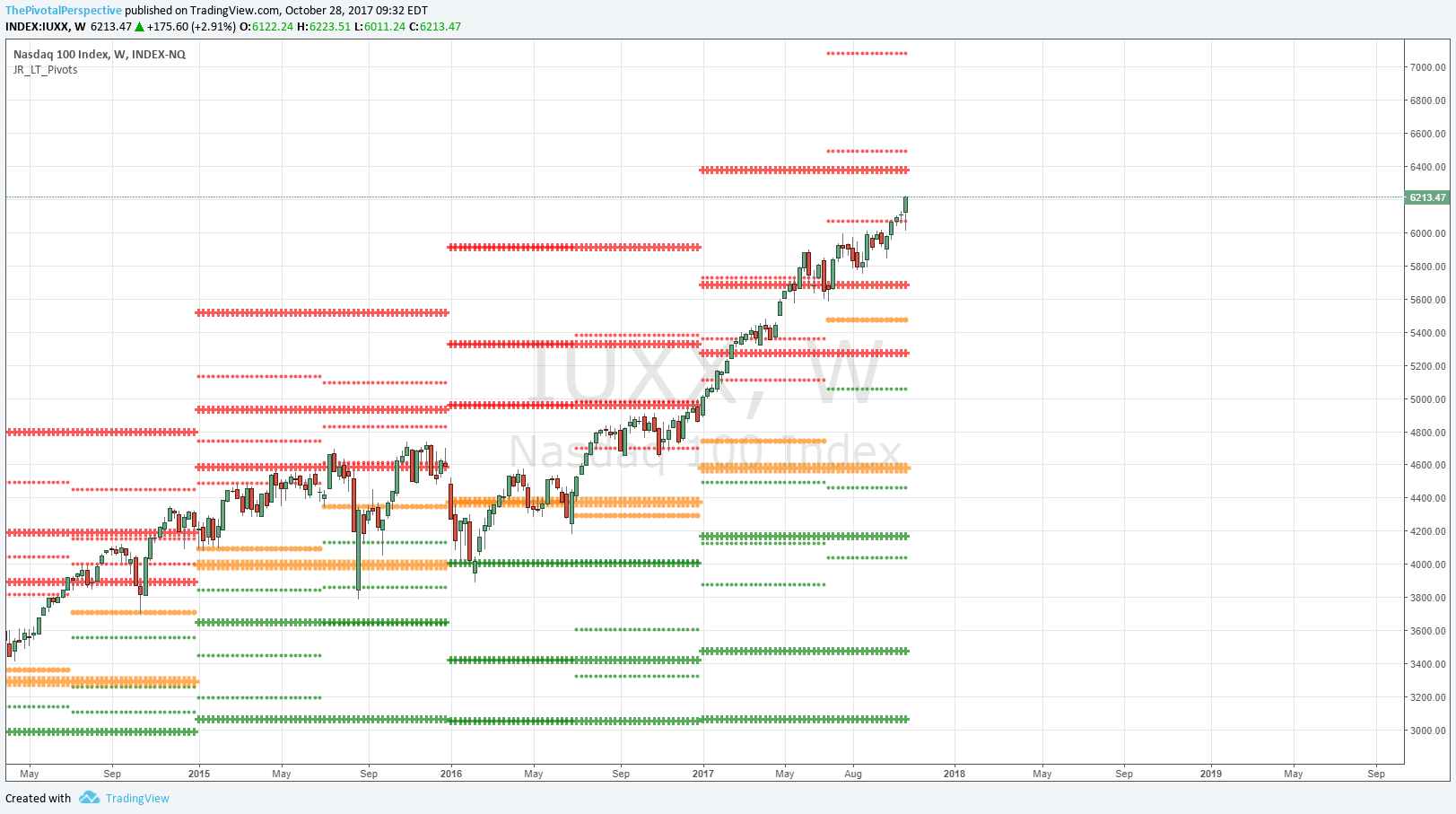

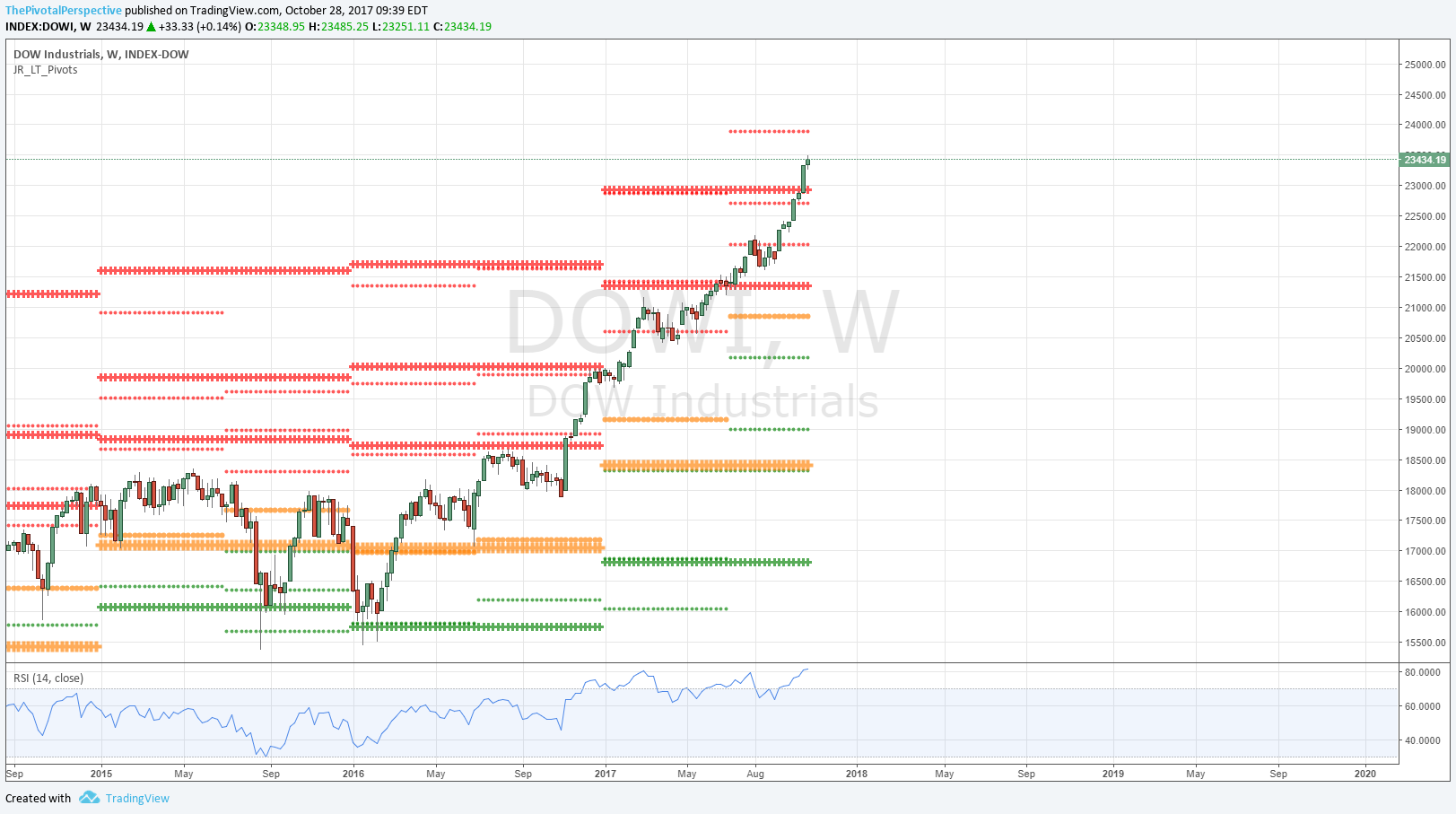

USA main indexes - SPX above both YR2 and 2HR2 2576-2582. NDX looks like it is going for YR3 6377.

Safe havens - VIX NovP rejection and XIV NovP hold both on 11/2 were the tells for the next move of stocks breaking out higher.

Sectors of interest - XBI and SMH both ~43-44% YTD. This site started pointing out SOXX / SMH in March 2016, and have mentioned SMH often this year. Admittedly I haven't been as focused on biotechs but YTD is impressive; SMH has been the easier trend.

Global indexes - China FXI and India INDA, and associated KWEB and EEM, are all looking good despite recent $DXY bounce.

OTHER TECHNICALS

New Lows oddly high considering indexes. Note NL level is equivalent to August that was in the middle of a sell-off. Currently reflected in IWM.

RSIs again approaching overbought on all timeframes on several indexes - Q M W & D. This historically increases the risk of a drop but again, like sentiment, we may see a blowoff instead.

VALUATION AND FUNDAMENTALS

SPX above 18X forward earnings for the last few weeks.

TIMING

As it turned out, 7 dates provided for August. 2 were the high and low of the month. 2 were the second high and second low of the month. 2 were milder turns. 1 was non event.

September dates

9/4-5 - 9/4 mild pullback low

9/13 - QQQ high and TLT low

9/22 (+/-1) - stock index high 9/20 (miss)

9/26 - stock pullback low 9/25 (-1)

9/29 - non event

October dates (listed from 10/1)

10/6-9 - 10/9 mild pullback low

10/19 - pullback low

10/23-26 - 10/25 pullback low

November dates

11/13 mild

11/19-20 risk off

11/22 risk on