Sum

On Monday there was coordinated selling action on nearly all USA main indexes from various resistance levels: SPX/SPY Q4R3, NDX/QQQ YR3, RUT/IWM 2HR3 and Q4R1, NYA YR2 and VTI Q4R3. But the drop ended on Wednesday near SPY DecP (ES DecP near exact low), and from there indexes recovered back to highs. These levels are still worth watching, especially QQQ YR3, IWM YR1 and NYA YR2, but all trends remain up.

SPX / SPY / ES

SPX W: Comfortably above YR2.

SPY D: Highs on Q4R3 but again mild pullback and back up.

ESZ D: Held DecP on pullback; above all pivots since late August.

SPX sum: High on Q4R3 so far, but quick dip to DecP area bought and back up to highs.

NDX / QQQ / NQ

NDX W: 4 of last 5 bars stuck at YR3, but not really dropping.

QQQ D: Only 2 days of real selling from YR3 area; Friday reclaimed above all pivots.

NQZ D: Back above all pivots, slightly.

NDX Sum: YR3 area resistance still worth watching. But notable that decline did not even reach DecS1 before coming back towards highs.

INDU / DIA

INDU W: Comfortably above 2HR3.

DIA D: Held DecP on 12/1 and up from there. Not near resistance. Above 2HR3 and Q4R2 area from late November.

Sum: Above all pivots; last time at or below a monthly pivot was 9/8, amazing run. Not near resistance.

RUT / IWM

RUT W: High on 2HR3, but still above YR1.

IWM D: 3 days back under YR1 but Friday came back. Still area worth watching.

RUT sum: High on YR3 exact, and so far 3 days under YR1 came back to finish above on Friday. Still YR1 level to watch.

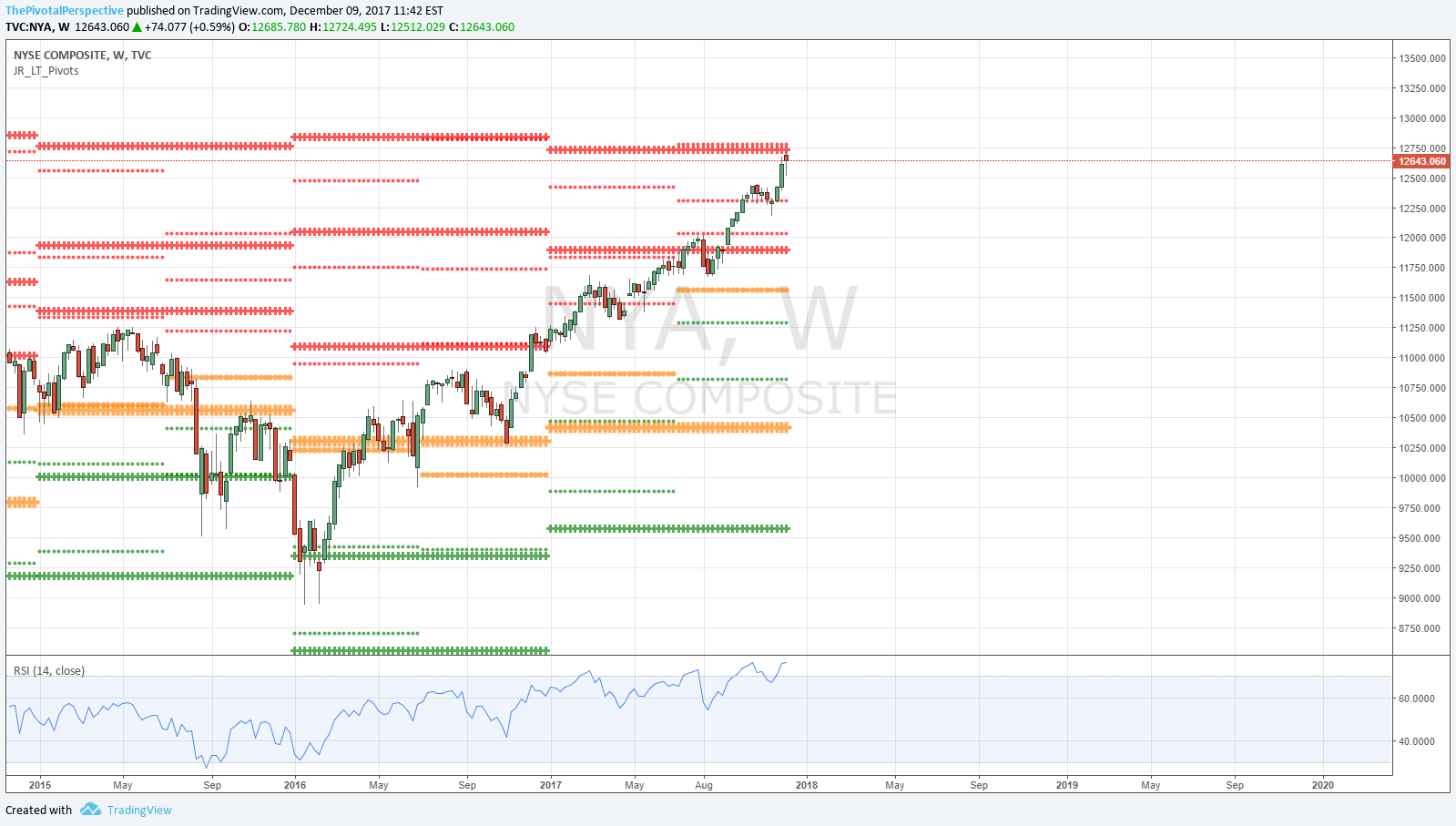

NYA & VTI

NYA W: High bang on YR2.

NYA D: YR2 rejection, but maintained above all pivots.

VTI W: Above YR2.

VTI D: Q4R2 selling, but held above all pivots.