Sum

All but IWM and NYA remain above all pivots, with SPY and VTI testing and quite successfully holding NovPs on the pullback low. But indexes have stalled in two major resistance areas - SPX YR2 / 2HR2 / Q4R2 for about 4 weeks, and NDX YR3 for the last 2 weeks. To me the configuration opens door for sellers next week, but given the strength of bounce from SPY NovP it is hard to be fully confident in any drop.

SPX / SPY / ES

SPX W: No selling from YR2; second bar of last 4 to have small advance and close under 2HR2.

SPY W: I will be surprised if we don't see a drop next week.

SPY D: Daily version view shows drop to NovP, and bounce back to resistance.

ES D: NovP exact on pullback low.

SPX set sum: Held above all pivots with a strong rebound after test of NovP (exact on futs and cash, near tag on ETF). Still in YR2 / 2HR2 / Q4R2 resistance area for the last 4 weeks.

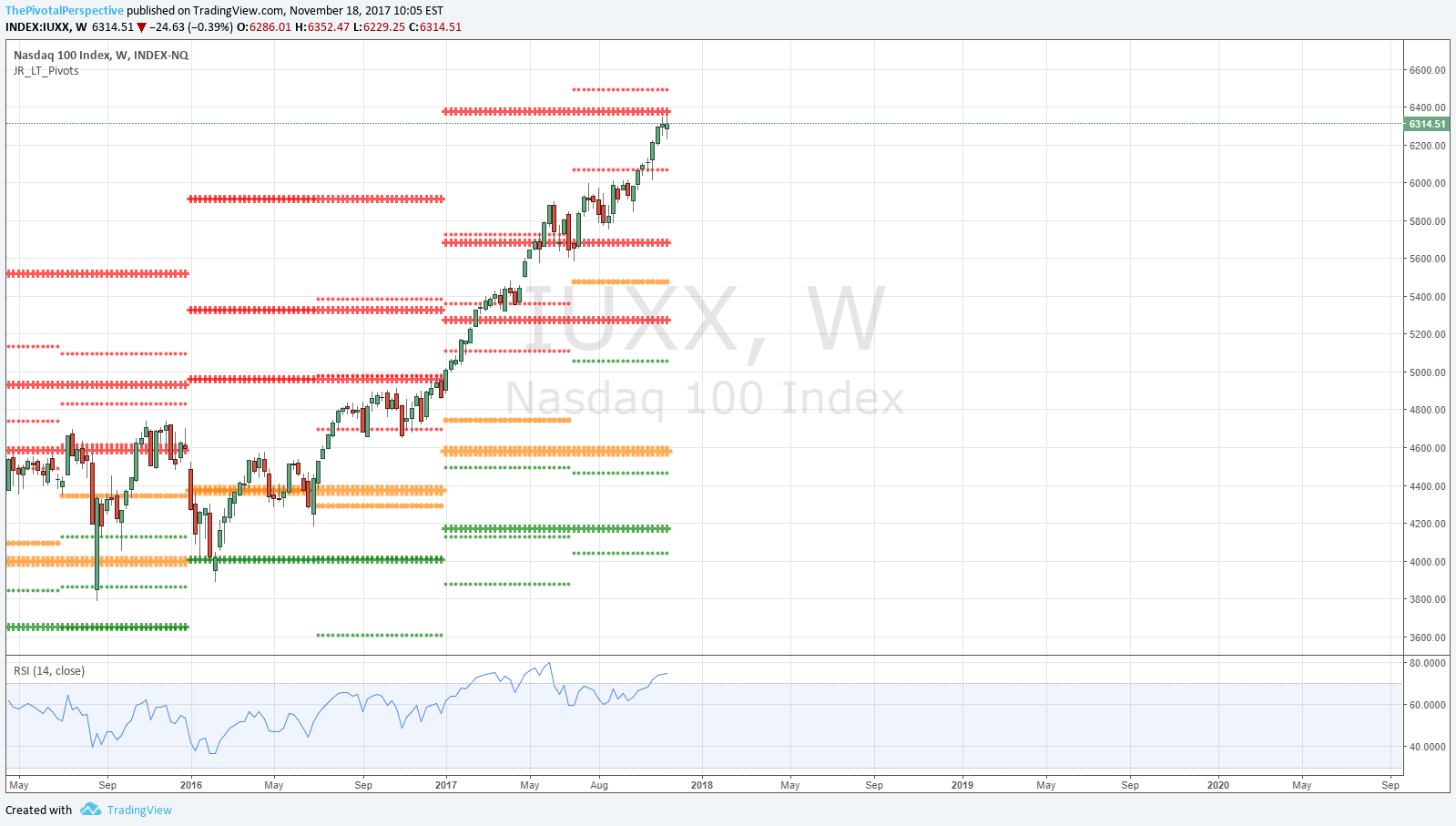

NDX / QQQ

NDX W: 2 small bars below YR3 - door open for sellers.

QQQ D: YR3 near exact on high.

DIA

Between levels.

IWM D

Low on NovS2 and 2HR1 combo, strong bounce back to NovP.

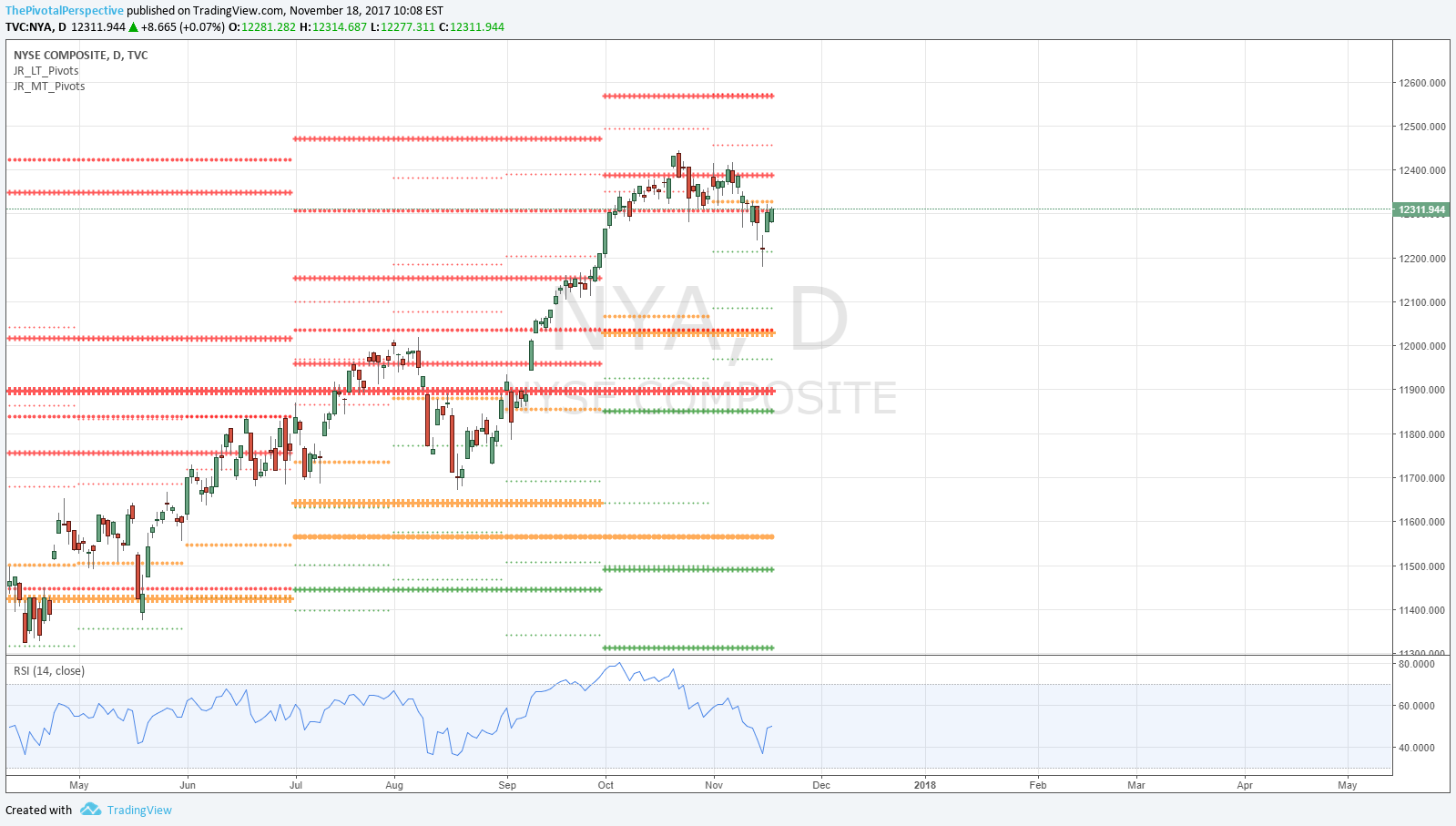

NYA

NYA low on NovS1, bounce back to NovP>

VTI

Also low on NovP, back to 2HR2 resistance.