Very slight increase in new lows but one cannot argue with the strength of new highs.

INDU RSI peaks

This post is a follow up to the analysis of quarterly chart RSI peaks from a few weeks ago. Today I'm looking at the monthly version.

The chart below goes back to 1915. Yes I know it is hard to see the price. I'll zoom into the specific incidences soon enough. The point is that RSI is in historically rare territory and we want to examine what has happened in the past when it has been up at these levels.

1925

1928-29

1945

1955

1959

1986-87

1996-97

2017

1925-29

The first of these was a momentum high that was enough to pause the market for several months. The index went fractionally above but did not close higher; and a -16% drop to near support followed. After that, parabolic move began.

There was a cluster of months in 1928 when the monthly RSI was at today's level or higher; 3 months powered higher, then a 5 month sideways pullback, before a zoom to the final top. There was a -13% decline before the real trouble began. I think something similar 'should' be the case today. There was some divergence on the final high via Bollinger bands but RSI was not glaring and the decline was rather sudden, crashing -49% in just 3 months.

Note the later highs in 1936 reached 80 but not 82+ of today.

1945

Similar to 1925, the first high was not 'it' but a few months later a bit higher high in price with notably lower high in RSI was followed by a -25% drop over 6 months that then had to stabilize for more than 2.5 years before another rally took off.

1955 & 1959

This was the nicest RSI peaks. 1955 went steadily higher for another year before putting in a clear RSI divergence high shown at the slanted red arrows.

1959 had a high retest before a drop of -17% into 1960.

Note the high that really mattered in 1966 happened with much lower RSI.

1986-87

Like the late 20s, 1986 had a series of months above current RSI level but most of the gains were in before a sideways period & pullback, then another massive trust to the top. That red bar in 9/1986 was a -10% pullback, something we have not seen in 20 months!

1987 really did come out of the blue and while indexes faded back inside the BB I would not have guessed that a single 1 day drop of -20% was on the way.

1996-97

This was an amazing move as the first RSI above 82 was just 1 year into the run! While I doubt we are in the same scenario i could be wrong. There was a lengthy topping process with all kinds of crystal clear divergence on the 2000 top. But now that everyone is looking for a top like this it may not play out in the same way.

2017

What is the next move? While this could go higher by a few or several bars, the more likely move according to history is a slowing of the pace, some pullback, then a higher high or at least a high test with RSI divergence. No divergence means no worry and no premature top picking just yet, even though i do think YR2 is the place for some pause this quarter.

The only thing that bothers me with this idea is that now everyone is looking for a topping process like 2000 or 2007. Who knows, the market may be kind enough to give us a year of stall before a truly painful drop, but at the same time, given algos that are now in charge, we may see something rather sudden at some point down the line.

The point with the two red horizontal lines is that the post election move was not really about Trump but the blast off above the 2015 highs which had stalled the market for quite some time and had started to look like resistance. From that breakout a massive one way move has followed.

Safe havens

Sum

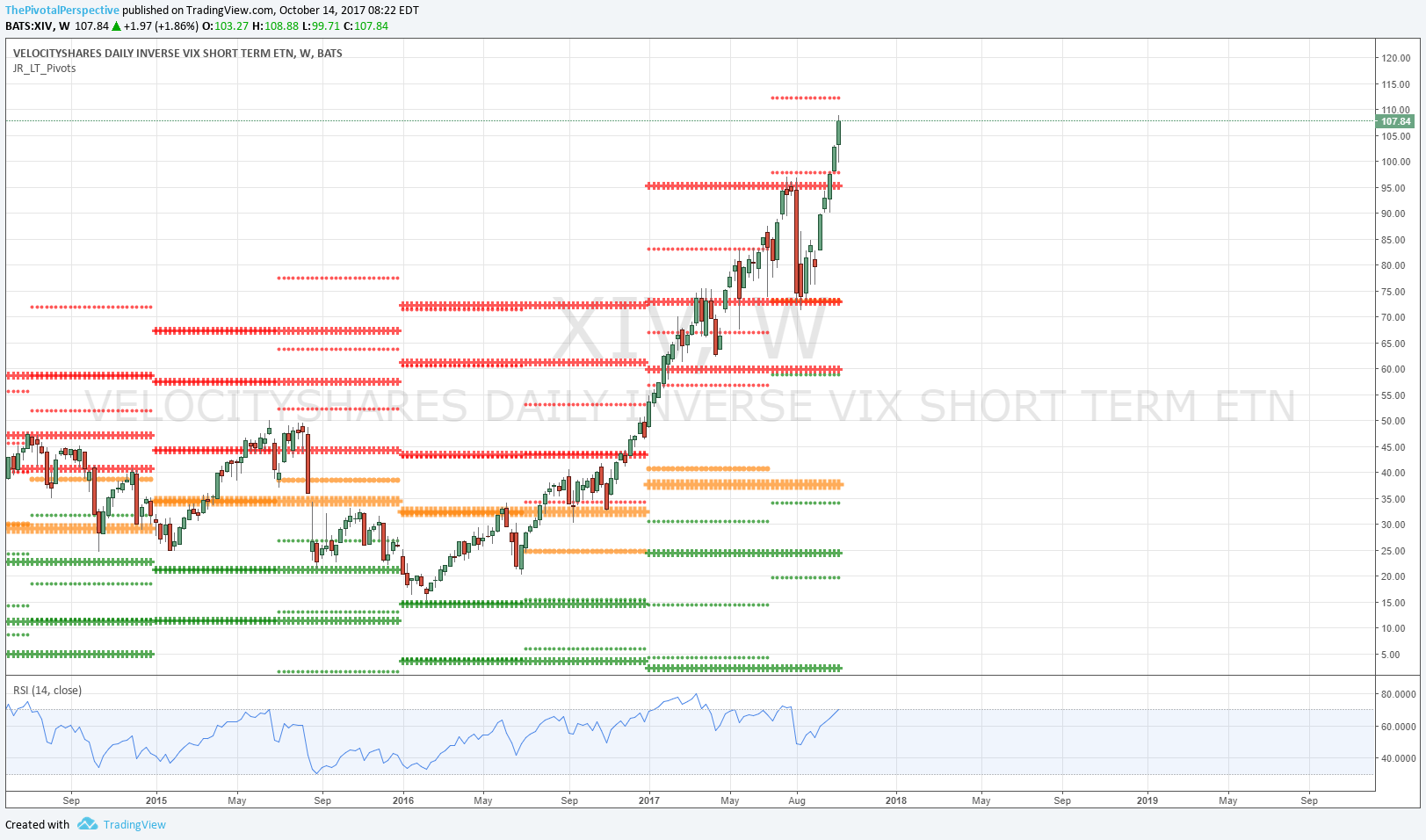

VIX and XIV continue to signal risk on. I have mentioned several times and may continue to mention that VIX helped confirm stock buys from 8/22 on by dropping back under all pivots on daily close, and has maintained that status since. XIV jumped above all pivots on 9/11, and has maintained that status since. Further, XIV cleared long term resistance 9/28-10/2 helping confirm the strength in stocks.

But last week I mentioned that TLT and GLD were "in places that usually would bounce" and that is exactly what happened. In fact both put in respectable moves, which should increase the risk to stocks. AGG added to clues by reclaiming YP last week, and HYG traded under its OctP for the last 3 trading days. Should HYG break Q4P, stock fade more likely underway.

VIX

W: Back under 10 but so far above the weekly low close reached in July.

D: Back under all pivots on daily close from 8/22 worked very well as confirming stock buys from there.

D: If lower, watching the BB for support because to reach a pivot support level it would have to drop into the 8s (which i doubt will happen).

XIV

W: Still powering up; RSI reaching 70 and with crowded trade on VIX shorts I am watching this for a trade again.

D: This soared above Q4R1 on Friday so for a pivot entry we would want to see back under that level or above to 2HR2. Note: back above all pivots on 9/11 worked very well as confirmation to add stock longs. Then above long term resistance 9/28-10/2 helped confirm the breakout.

TLT

W: Holding W200 and W50 as planned; probably a bit more bounce than I thought would happen.

W: Held 2HP.

D: Held D200 on the low; lifted back above Q4P; still under OctP and YP.

TLT sum: Saved long term support by making a decent bounce from 2HP, D200MA and near W200 and W50 as well. TLT strength is some warning for stocks.

AGG

Brief dip below YP but came right back. Currently above YP, 2HP and Q4P.

HYG

Below OctP for 3 trading days, but holding Q4P. Risk to stock indexes will increase if Q4P breaks.

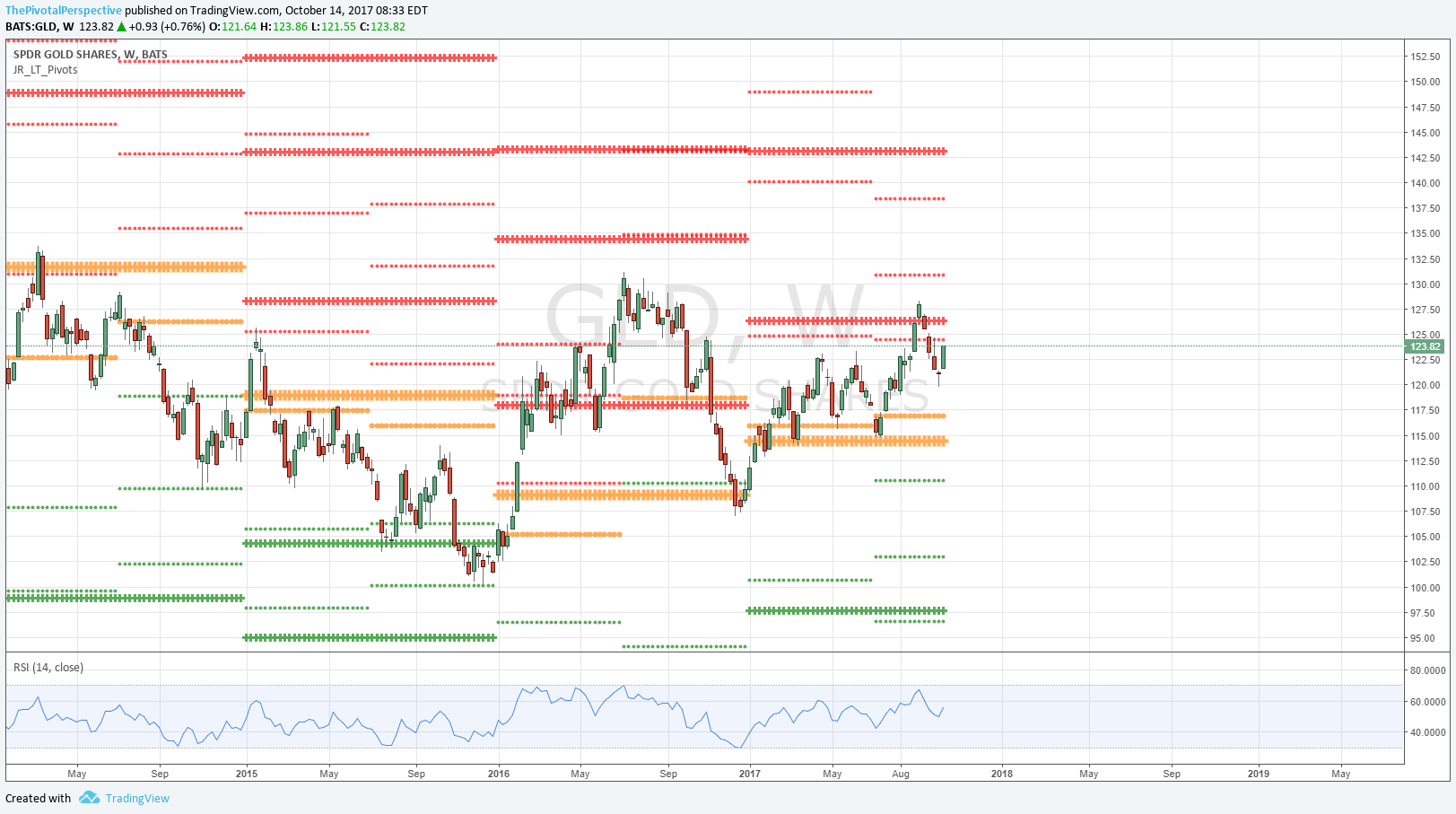

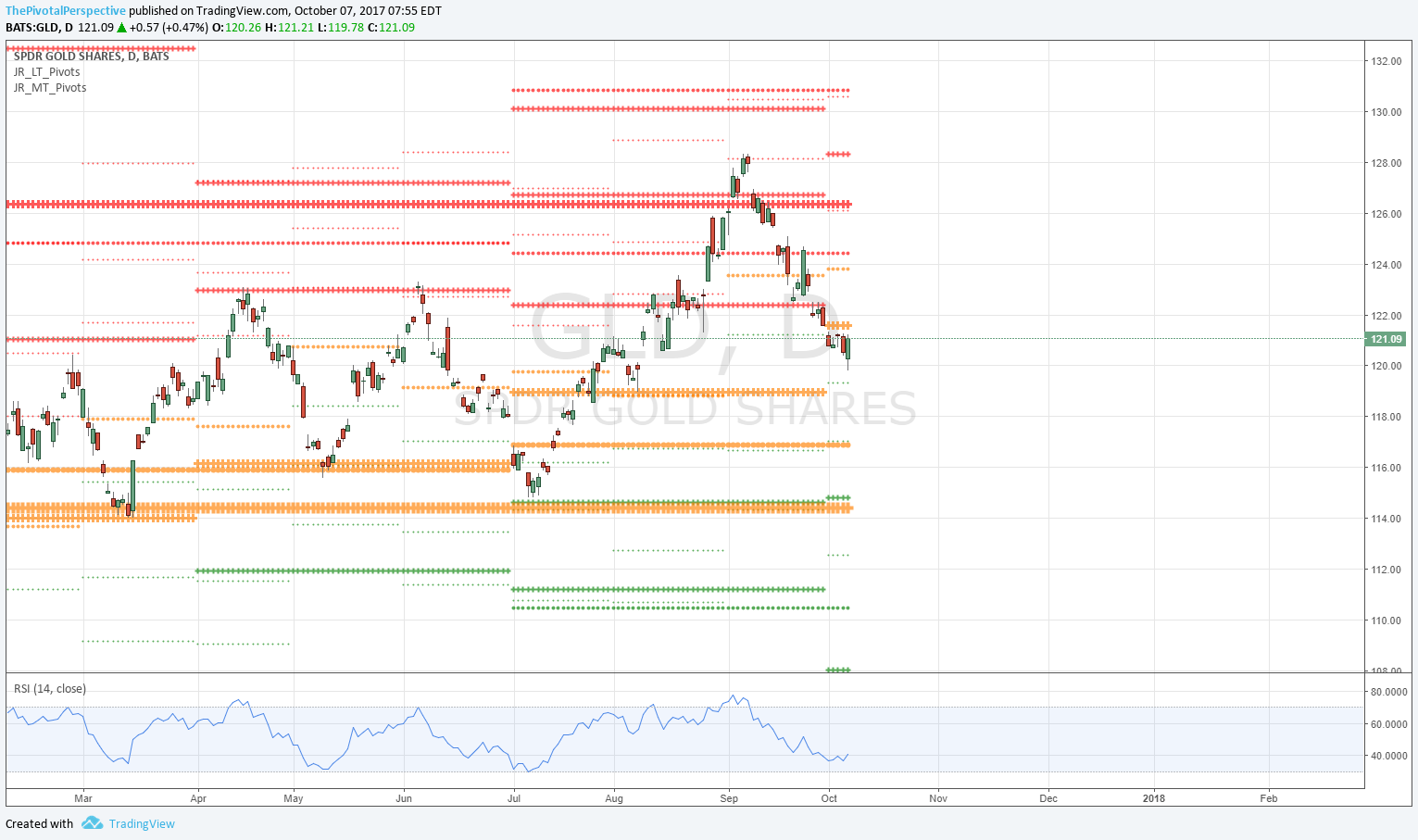

GLD

W: Respectable bounce back above rising W20 and W10.

W: If higher back to 2HR1 and YR1.

D: Back above Q4P 10/9 was much easier than trying to short stocks. Testing OctP.

GDX

Hold of 2HP, D200MA then Q4P all 10/2-3. Slightly above all pivots.

USA main indexes

Sum

Last week I pointed out all the major levels that all 5 USA mains were testing. With exception of NDX/QQQ, all 5 are under these levels. There wasn't a rejection, but so far the momentum has slowed.

SPX/SPY testing Q4R1s 2556; if higher YR2 2576 not far.

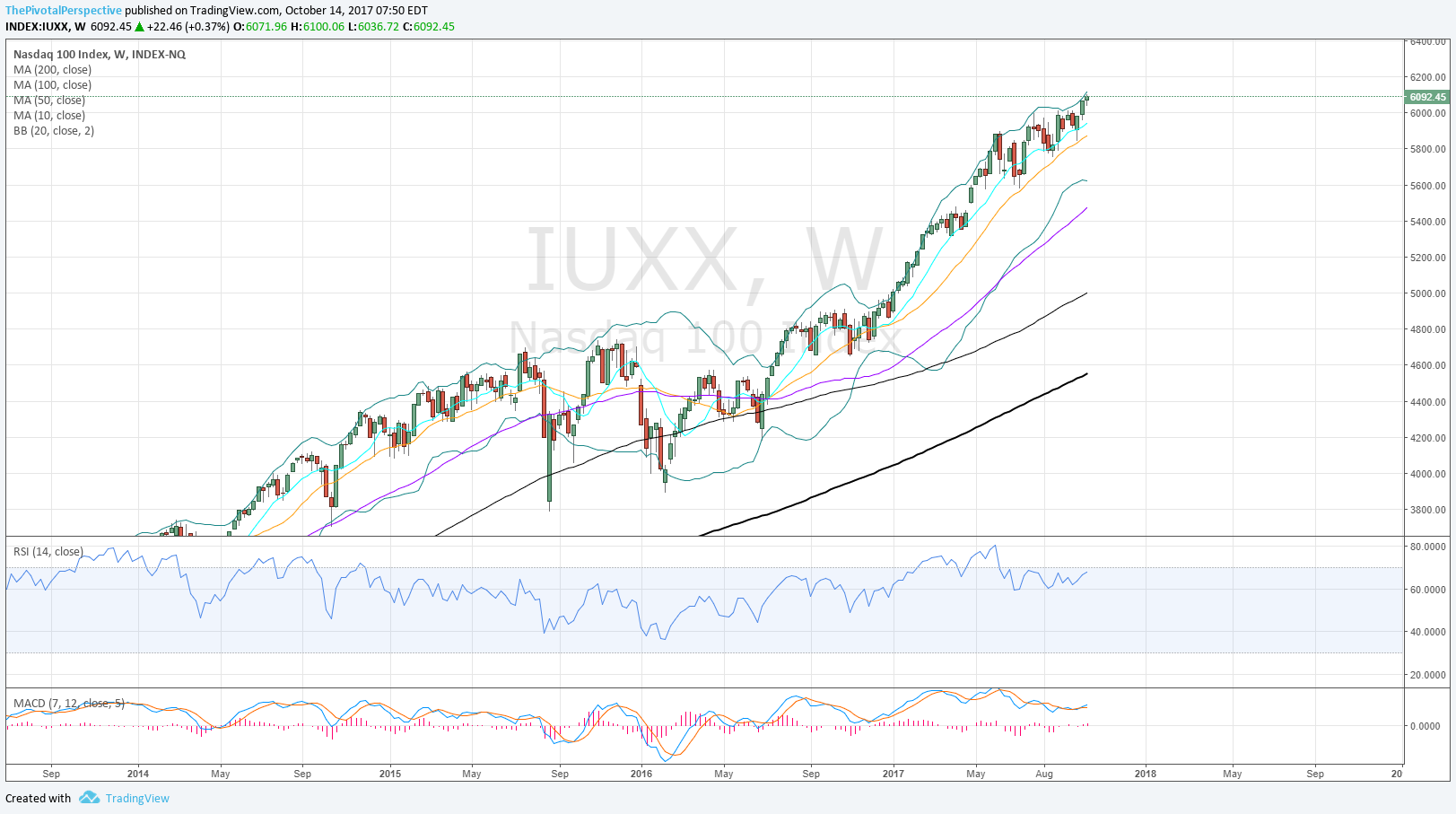

NDX/QQQ lifting above 2HR1 6068 slightly; may tag its Q4R1

INDU/DIA testing YR2 22937!

RUT/IWM fading a bit from YR1 1518 near test.

NYA & VTI both tagged Q4R1s and had mild reaction lower from there.

RSIs across timeframes (Q M W and D) are above 70 with exception of NDX/QQQ on weekly and daily charts. While this is a sign of strength to set up a divergence high later, near term increases the risk of a fade.

Even if the market can go higher into this week and INDU clears its YR2, then markets will be running into SPX YR2 and RUT back at it YR1.

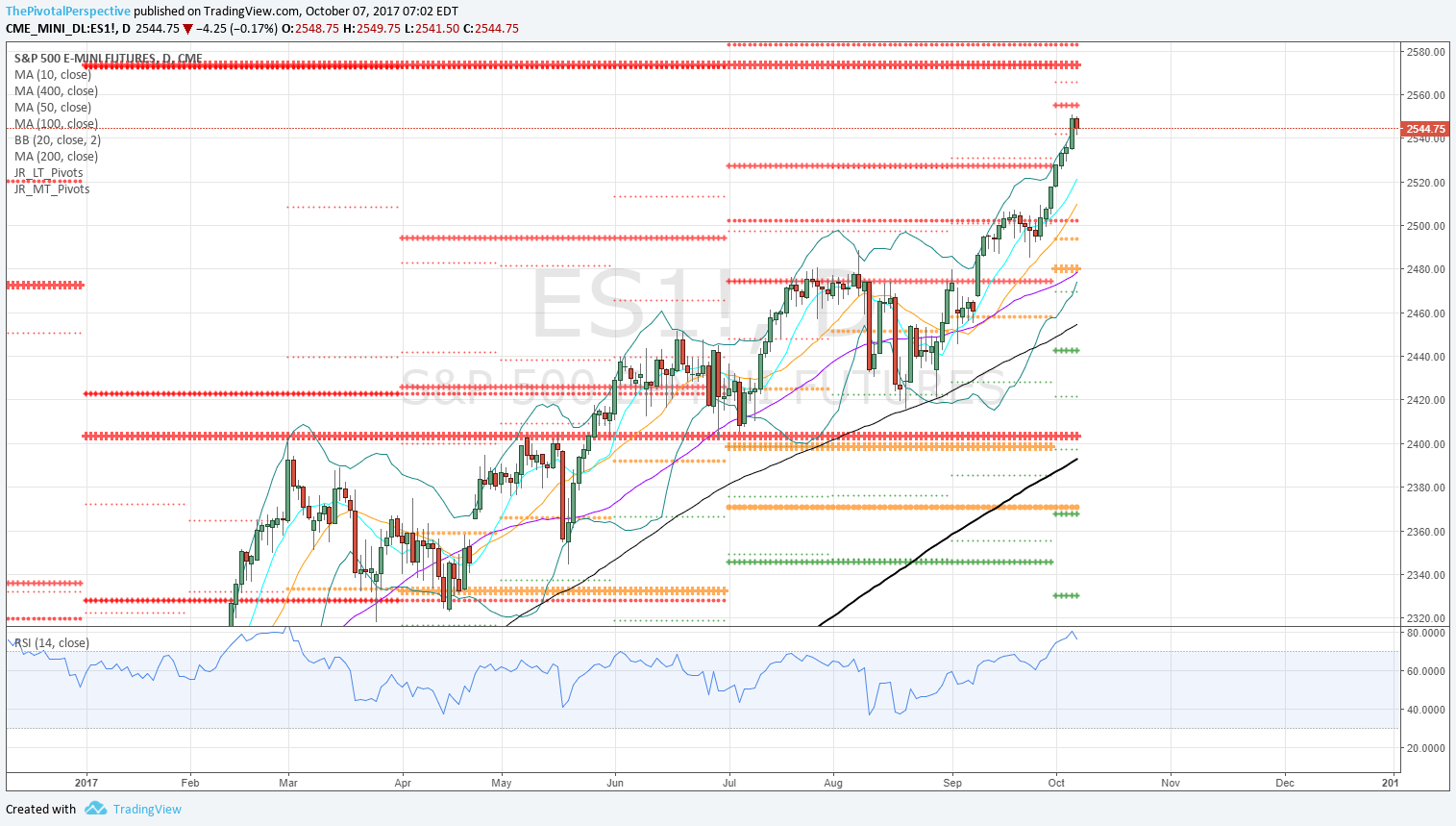

SPX / SPY / ES

SPX W: Doji bar outside BB with RSI near 75 invites selling.

SPX W: Probably we will see YR2 2576 by year end.

SPY D: Testing Q4R1; OctR2 just above.

ES Z D: Back above all pivots and MAs on 8/30; and from there above all pivots since, with just 2 days below 10MA.

ES 1 D: Smart $ pivot traders bought AugS1 at 2422; probably some taking profits up here 2555 or maybe some holding out for 2573.

SPX sum: We will probably see YR2 2576 by year end, but currently at Q4R1 with RSIs overbought across timeframes and outside weekly BB means fade is more likely next move.

NDX / QQQ / NQ

NDX W: Inside BB and RSI not yet at 70 like other indexes - room to go up.

NDX W: Bullish to be poking above 2HR1.

QQQ: Also lifting above 2HR1, and may reach next level up at Q4R1.

NQZ: Recently back on buy 9/27-29 after failing 9/25.

NDX sum: Bullish to be lifting above 2HR1; RSIs not quite overbought and may have more room to go up than the others.

INDU / DIA

INDU W: 2 closes outside the BB is rare; RSI quite high.

INDU W: Testing YR2!

DIA D: Almost YR2 tag.

INDU Sum: Strong but just 32 points from reaching YR2. I think some near term reaction lower is the more likely move.

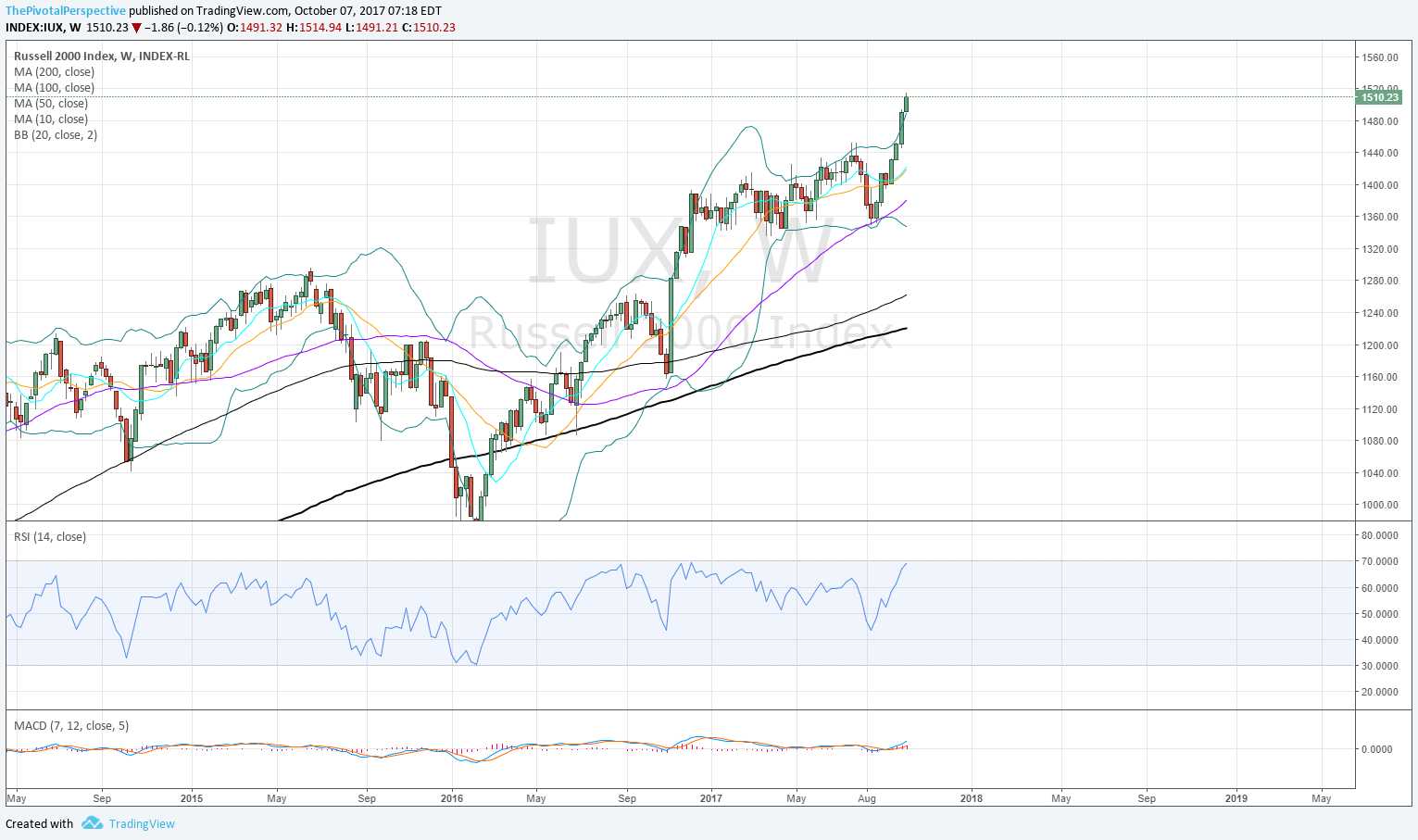

RUT / IWM

RUT W: Bit of a fade.

RUT W: Looks more significant from the Pivotal Perspective; dropping from YR1.

IWM D: Huge rally in Sept, but no follow through up in Q4 so far. Still above 2HR2 as support though.

RUT sum: Some pause after near YR1 tag but given structure not enough to say rejection yet. Still, this may turn into first choice for USA equity short hedges again (like much of the year until August lows).

NYA & VTI

NYA W: Bullish to be above 2HR2, but still need to watch that level to see if it holds.

NYA D: High on Q4R1.

VTI W: Between long term levels.

NYA D: Also on Q4R1.

Sum: Both have highs on Q4R1s with some minor selling so far.

Valuation and fundamentals

This is the third week in a row that SPX has closed above the 10 week moving average of 18X forward earnings.

Here's an interesting list of 2017 values from my spreadsheet, taking numbers from Thomson each week. Key point - never above 18.

17.18

17.19

17.21

17.17

17.40

17.18

17.34

17.77

17.88

17.99

17.76

17.93

17.68

17.76

17.54

17.47

17.40

17.75

17.57

17.65

17.34

17.68

17.57

17.73

17.77

17.74

17.78

17.59

17.67

17.93

17.95

17.78

17.75

17.72

17.54

17.64

17.57

17.81

17.92

17.89

17.97

This would imply selling pressure soon enough!

FWIW FAANG equal weight forward P/E has risen from 52 to 58 since August.

Not sure why bond yields are dropping with this index maintaining positive.

Total market view

REVIEW

10/1/2017 Total market view: "Bottom line - SPY and VTI just broke out above long term resistance as TLT fell back under its YP and GLD continued to fail from its breakout attempt. In addition, weekly charts on many global indexes look similar to USA indexes in August - in other words, a normal pullback in an uptrend. Stock bulls have the ball."

Result

USA indexes powered up and many global indexes raced back to highs as well.

SUM

Q4 has started with a bang but all 5 USA main indexes have reached major resistance (quarterly or higher), with NDX, RUT and NYA at long term levels. This is enough for some top.

Given other technicals, the usual move would be some pullback or quick shakeout, then another move up to test highs. So I'm not calling for a big drop yet, and given the trend it is likely that we will see higher prices by year end. But all 5 USA indexes on major resistance levels, RSIs overbought across the board (Q, M, W and D charts for most USA indexes, excepting QQQ W & D and IWM W just about there), Bollinger band overthrows, and a more important timing date than many, I'm locking in some gains and may play some vehicles for a quick drop.

Bottom line - Agile traders with margin can lock in some gains at these levels by holding longs and taking some hedging positions on the same vehicles against the longs. For me this is actually easier to do than sell and re-enter long, because the stop on the hedge can be very tight for minimal cost to account if wrong on the fade idea.

In Q3 a lot of people were expecting a pullback and this did occur on the IWM but SPY stayed under -3% so let's just say not much happened. At this point a lot of people think Q4 will continue to soar up and up but I'm preparing for a more volatile period than most are expecting.

PIVOTS

USA main indexes - the list of major pivot resistance:

SPX at Q4R1 2556, with YR1 2576 likely to trade by year end.

NDX at 2HR1 now, bang on 6068.

INDU at Q4R1 22789, slightly above 2HR 222711 with YR2 22937 above.

RUT at YR1 1518.

NYA at 2HR1 12307; VTI at Q3R1.

Safe havens - VIX and XIV saying all clear, with TLT and GLD in places that usually would bounce.

Sectors of note - XLF so far trading above its YR1 with decent breakout above all week.

Global indexes - Several of the global indexes I track had pullback bars last week and indeed jumped back to highs last week. Yet at the same time, a few of these dropped off those highs too. I would not be surprised at more downside ahead.

Currency and commodity - USO back under all pivots. Not sure how much the hurricane was impacting but charts look terrible again. This could also pressure EWZ and RSX as they have rallied along with oil from June lows.

Other technicals

New highs and new lows very impressive for maintaining gains even if market fades somewhat as planned in the coming week.

Also, here's a long term investing plan with technicals. It is my version of an improvement over a Meb Faber method that uses the monthly 10MA exclusively. Also, if considering higher yielding assets, one MUST use total return for these types of decisions!

Valuation and fundamentals

The last 2 weeks are the first time since I've been tracking that have closed above the 10 week average of 18X forward earnings.

Sentiment

ISEE spike high early last week but their site is having problems so not sure how much to rely on that. CNN Fear Greed is tossed around a lot on Twitter and this is some toppy consideration. The problem with it is some of the measures are actual positives and not merely sentiment extremes. For example, strong new high vs new low values are indeed positive for the market and not a top indicator by itself.

TIMING

As it turned out, 7 dates provided for August. 2 were the high and low of the month. 2 were the second high and second low of the month. 2 were milder turns. 1 was non event.

September dates

9/4-5 - 9/4 mild pullback low

9/13 - QQQ high and TLT low

9/22 (+/-1) - stock index high 9/20 (miss)

9/26 - stock pullback low 9/25 (-1)

9/29 - non event

October dates (listed from 10/1)

10/6-9 - stock high?

10/19

10/23-26

Long term investing with technicals

Much of this site is written for the agile trader or hedge fund like vehicle or trading. But just as I believe there is an intelligent approach combining pivots, other technicals, valuation, sentiment and timing to shorter duration moves of 1 week to 3+ months, there is a way to properly position long term beyond simply allocate and hold.

I will have more to say about this in coming posts but here are the basics of my theory.

The main point is to maintain exposure and avoid a deep drawdown. While we immediately think of 2008 and perhaps the tech crash of 2000-02, there have been several such moves this decade. XLE got sliced in half from 2014 top to 2016 low; this dragged down EEM and other names like EWZ as well. EEM is having a great year but it was painful especially from 2015 Q2 to the 2016 lows with about -35% drop.

GLD had a phenomenal run for many years, but if you didn't change your mind in 2013 then you may have seen a -40% decline before recovering some losses.

And these moves aren't just commodities. Biotechs via XBI also dropped about -45% from highs in a mostly similar span, from 2015 Q3 to early 2016 lows. China via FXI wasn't really down due to oil yet it too dropped about -45% from 2015 highs to 2016 lows.

When markets are up, the trends will take care of themselves. It is more important to avoid a big drop than to try to top tick strength and re-enter. Of course I do a lot of top ticking here on this site so you want to do that by all means but it isn't really long term investing where ideal holding period is 1 year plus.

Oh yes the taxation issue. That complicates matters for taxable accounts but the solution there could be inverse ETF or options.

Back to the principle - large drawdowns are avoided using a few simple guides. The weekly 50 moving average and its slope, and the yearly pivot (YP for short).

But it is very important that we use total return when doing this, and the only site that I am aware of to make this easy is stockcharts.com. The problem with stockcharts is their historical data but still this method will be good enough to review key holdings once in a while (once a month, once a quarter) to see if you are 'holding the bag' on something that is turning into real trouble. If an asset is getting close to a decision then you may want to monitor more often.

Above or below YP? Above YP, OK to hold. Below YP, consider underweight, hedge or exit.

Above or below W50MA? Above W50MA, OK to hold. Below W50MA, consider underweight, hedge or exit.

W50MA slope rising or falling? If slope rising, OK to hold. If slope falling, consider underweight, hedge or exit.

Positive change of status? Ie move from below YP to above? From below W50MA to above? Consider allocating capital.

If all three criteria are positive then there isn't much to think about except if you want to overweight that asset. Occasionally there will be a mixed condition like above the YP, below the W50MA with a flat slope. But if the asset is below its YP and below a falling W50MA, then that is serious trouble and best to just get out of the way in whatever method makes sense for your account.

I don't have a backtest on this and there can be some chop, like EEM 2012-15 had a few ins and outs before getting out of the way of the big drop and then getting back in on the big rally.

Anyway, here's the idea:

Go to stockcharts.com (free version fine for this purpose unless you want to start saving portfolios).

Pull up any asset; the default here is total return.

Select weekly on the pulldown, then update.

Remove Simple Moving Average 200 in the Overlay section at the bottom, and replace with "Pivot Points."

The weekly chart view uses yearly pivots only.

Then perform analysis as above.

Obviously most asset classes are up. This post has gone on long enough so I'll keep an eye on things and post again into year end. Stocks are not likely to change status anytime soon - but bonds might be something to watch, especially the long duration TLT.

New highs new lows

Very strong.

Safe havens

Sum

VIX and XIV remain very bullish for markets.

Other safe havens meaning primarily TLT and GLD, and somewhat AGG, HYG, GDX and SLV have been confirming risk on the last few weeks as well. Currently TLT and GLD are in areas where some bounce may happen especially on a stock fade. That said barring some crazy NKorea confrontation I am expecting to see higher rates and so lower TLT and GLD in Q4.

VIX

W: Weekly close low is being bought, but no real move higher yet.

D: Well under OctP. Little jump to falling 20MA was sold.

VIX: Big picture is that VIX below 2HP 12.28 & Q4P 11.87 is bullish for risk assets. If it can go higher, OctP 10.97 also resistance. At the same time we have a near test of all time low levels and a reversal bar; we'll see if follow through soon.

XIV

W: Launched above the YR3 / 2HR1 resistance that marked the highs in July.

D: Between levels. Not really any trade here unless tags OctR1 104.88.

XIV: Confirmed risk on 9/11 with jump back above all pivots. Confirmed stock strength with lift above YR3 9/28 and then above 2HR1 on 10/2.

TLT

W: Coming down hard in recent weeks, and already at key support area of W50MA, W200MA and lower BB.

W: YP rejection but 2HP holding.

D: 2HP and D200MA hold.

TLT sum: Fast drop from the early Sept high, and now testing 2HP and D200MA which are places for possible bounce. But given Citigroup Economic Surprise, FOMC QE reversal, ECB tapering, i think pro money is selling bonds and rates are going to make a bigger move up.

AGG

Below YP. Still above D200MA and 2HP.

HYG

A bit under OctP, above Q4P which is the real level that matters.

GLD

I did say err on side of taking gains 9/11 after holding longs for 2 months from 7/11 buy. But currently mixed condition is not best for trade. Above YP and 2HP, below Q4P. A pop above Q4P might be a short term way to play a stock fade.

GDX

Interestingly GDX held 2HP and D200MA on 10/2 and then recovered Q4P on 10/3. Better buy than GLD here although heading into falling D20 and OctP.

SLV

Fell under all pivots 9/26 but most gains on short wiped out with Friday pop. This was just too big a reversal for me to mess with but I may re-enter short with a move back under Q4P.

USA main indexes

Sum

Q4 has started in impressive fashion with power moves up for USA indexes. But several of the long term targets I mentioned last week have already been reached. All 5 USA main indexes are at resistance levels with enough long term levels (Y & 2H) to make a real turn possible. In addition, Bollinger band overthrows and RSI overbought likely to fade. However, first drop off highs usually not the big move so projected path is some drop, back up to test and then we'll see.

SPX at Q4R1 2556, with YR1 2576 likely to trade by year end.

NDX at 2HR1 now, bang on 6068.

INDU at Q4R1 22789, slightly above 2HR 222711 with YR2 22937 above.

RUT at YR1 1518.

NYA at 2HR1 12307; VTI at Q3R1.

SPX / SPY / ES

SPX W: Strong, but BB overshoot more likely to fade soon.

SPX W: YR2 2576 within reach.

SPY D: For now Q4R1 decent resistance especially after test.

ESZ D: Nice results after going back on buy 8/30-31; entirely above all pivots since then, above all MAs excepting 9/25-26.

ES 1 D: Q4R1 just a bit higher.

Sum: SPX looking great and fast move to Q4R1 which should be enough for a pause and some shakeout. Still Expect to see YR2 2576 by year end.

NDX / QQQ / NQ

NDX W: Healthy with another lift from W20MA, but has been laggy in 2H as others have taken over leadership.

NDX W: Testing 2HR1.

QQQ D: QQQ Almost at 2HR1, slightly above OctR1.

NQ: Unlike ES, actually fell under AugP and D50MA on last drop.

NQ: 2HR1 slightly above.

NDX sum: Careful observers already know that NDX hasn't been too zippy in 2H. Q4 is starting OK with move to new highs but at major resistance already at 2HR1. Recent longs should watch to take gains and this may even turn out to be the hedging vehicle for USA mains compared to IWM in 1H.

INDU / DIA

INDU W: Blast off.

INDU W: Slightly above 2HR2; YR2 not far away.

DIA: Like SPY, already at Q4R1.

INDU Sum: Expect to see YR2 by year end, but for now Q4R1 enough for a pause.

RUT / IWM

RUT W: Power move up after holding W50MA and lower BB in August. 2 weekly closes outside the BB.

RUT W: At YR1!

IWM D: Above 2HR2, but just under YR1 on this version. Cash index was 4 points from tag of level.

RUT: What a move from August lows. But YR1 should be enough for some drop as next move.

NYA & VTI

NYA W: At 2HR2.

NYA D: OctR1 on exact high, for now maintaining above 2HR2.

VTI W: Between levels.

VTI D: At Q4R1 or near enough.

Valuation and fundamentals

For the second week in a row, SPX traded well above 18X forward earnings (a smoothed 10 week moving average version of that). 19X is about 100 points higher.

Pet project: equal weight FAANG P/E climbed from 55 to 57.

Citigroup Economic Surprise finally lifted back above zero. This is helping $USD and bond yields.

Total market view

REVIEW

9/23/2017 Total market view: "Some key indexes are testing resistance - SPY and VTI are both testing 2HR1s. With sudden strength of IWM, XLF, and oil, as global indexes excepting INDA maintaining strength, I just cannot be that bearish. That said, given pivots, other technicals and valuation I expect to see some selling attempts on SPY in the coming week."

Result

Indexes fell mildly on Monday and Tuesday with a selling attempt from SPX 2500 area, then came roaring back to finish higher on the week.

SUM

Often definitive moves begin around the end of quarters or beginning of the next. This happens as major institutions are adjusting allocations, and of these can set the tone for a considerable period ahead. A few examples this year: 1) all USA main stock indexes jumped above all pivots on 1/3/2017, despite some fade into year end 2016, then went on to strong performance for two months; 2) TLT held its Q2P on 4/3/2017, and then was stable or up making its high for the quarter late in June; 3) EEM held its Q3P (near test) 7/6-7, and went on to substantially more gains. This list goes on.

While these three examples happened to be days early in the new quarters, these moves can also happen in the 1-3 days of the prior quarter. A notable case was the last two days of 2015 that set the stage for an ugly January 2016 for stocks, and as it happens, the last real correction.

With this in mind, we just saw most USA stock indexes breaking out higher, safe havens fading, and many emerging market indexes bouncing after holding support. As sentiment gets more toppy, more timeframes reach RSI overbought, and more charts experience resistance at upper Bollinger bands, we may see some fade - but for now stage is set for more stock gains in the coming week.

Bottom line - SPY and VTI just broke out above long term resistance as TLT fell back under its YP and GLD continued to fail from its breakout attempt. In addition, weekly charts on many global indexes look similar to USA indexes in August - in other words, a normal pullback in an uptrend. Stock bulls have the ball. New Q4 and Oct levels in play Monday.

PIVOTS

USA main indexes - SPX/SPY above 2HR1 2503 opens door to YR2 2576 by year end. RUT/IWM 2HR2 level to watch.

Safe havens - XIV testing 2HR1, level to watch. Last week TLT broke under its YP with a monster gap, and AGG is also now testing its YP. GLD will likely be near its Q4P. SLV was below all pivots the last 4 trading days in Sept. Point here is that continued weakness in safe havens will help confirm strength in stocks.

Sectors of note - No stopping semiconductors. 9/20 looked like YR2 rejection, and after brief dip back to higher highs.

Global indexes - Many of these dropped last week as $DXY tried to rally, and a lot look similar technically to USA index weekly charts in August. Meaning - EEM, FXI, KWEB and EWZ all pulled backed to weekly 10MAs, and I think bounce is the more likely next move. INDA went lower and broke 20MA. Of those I track, only SHComp and RSX not really making the same move.

Currency and commodity - USO tagged its YP and rejected. I have been emphasizing oil in the last few weeks seeing signs of strength but move from here is a toss up (and recommended at least partial exit last week). DXY has lifted for a few weeks and even traded above a monthly pivot for 4 days but hasn't gotten very far.

OTHER TECHNICALS

New highs & new lows very bullish condition for stocks.

Also, a study of Dow quarterly chart RSI peaks leads me to conclude that stocks probably have more room to run until we see more excess (quarterly chart RSI 85+) or quarterly chart RSI divergence. Neither is happening right now.

VALUATION and FUNDAMENTALS

SPX first close above the 10 week average of 18X forward earnings, currently 2505. Wall Street likely expecting positive earnings season, but this is still a level to watch. Citigroup Economic Surprise Index staying in negative territory; a move to positive will help bond yields rally.

SENTIMENT

CNN FearGreed is up there, but other sentiment meters I track are not that toppy. Also, though widely quoted, FearGreed is not just sentiment but actual positives and negatives in the market such as stock/bond differential and new highs & new lows. So just because it is high doesn't mean sentiment is frothy.

TIMING

As it turned out, 7 dates provided for August. 2 were the high and low of the month. 2 were the second high and second low of the month. 2 were milder turns. 1 was non event.

September dates

9/4-5 - 9/4 mild pullback low

9/13 - QQQ high and TLT low

9/22 (+/-1) - stock index high 9/20 (miss)

9/26 - stock pullback low 9/25 (-1)

9/29 - stock high?

October dates

10/6-9

10/19

10/23-26

New highs new lows

Slight turn up on new lows but new highs accelerating up.

If 10MA of new lows (thick red) crosses above the 20MA (thin red)...

And the 10MA of new highs (thick blue) falls under the 20MA (thin blue)...

Then we have a reason for concern but until then, long and strong is correct approach.

Safe havens

Sum

Safe havens are echoing the move in stocks - risk on.

VIX just set new quarterly & monthly close lows according to TradingView data. XIV powering up above YR3 and previous highs, and now testing 2HR1 which is a level to watch for next week.

TLT failing below YP is a point for risk on. AGG is now testing its YP, so that's another level to watch for next week especially for those in rising rate camp and long financials. HYG looks fine.

GLD after looking so exciting with the breakout FAILED and back under the level. GDX was part of the clue, not breaking out above the early 2017 highs. SLV under all pivots with YP and 2HP rejection, and this was mentioned as a short idea in daily comments last week. The market may surprise me but if it does that is OK because cost will be minimal (barring nuclear explosion over the weekend but if that is a real worry i guess you should be in UVXY, SPY puts, GLD calls and cash).

In some there was a case for top at SPX 2500 area if GLD maintained its breakout, TLT held its YP and XIV stopped at its YR3 and fell. But everything went the other way and bulls have the ball heading into seasonally strong Q4.

VIX

Q: New quarterly close low.

M: New monthly close low.

W: Still above 7/17 close low 9.26 which according to my data is the all time weekly close low.

W: Not sure we'll see that 2HS1 in the 8s.

XIV

M: Held rising 10MA on the low. Some RSI and BB divergence but higher close high is bullish.

W: Potential RSI div setting up but above the prior close highs is bullish.

W: Above YR3, testing 2HR1. Interesting level to watch for next week.

TLT

Q: Not terrible but below a falling 10MA.

M: Nearly 50% bounce from 2017H to 2016L.

W: Room to drop to lower BB area.

W: Two rally attempts above YP both failed. First time 2HP held as support. That is key area going forward.

AGG

W: Testing YP, key level to watch next week.

HYG

W: doing fine.

GLD

Q: Did not clear falling 20MA despite the chance to do so.

M: Oops! to the longs. The 100MA resistance near top of BB was part of exit decision 9/11.

W: Under breakout area is bearish.

W: 2HR1 rejection.

GDX

W: 2HR1 rejection, testing 2HP. Lack of breakout here part of GLD exit decision.

SLV

Hard to imagine a rebalance move into SLV for 2017 Q4 but market may surprise. Yup, i'm short based on 2HP and YP rejections.

INDU RSI peaks

In this post I am going to explore RSI peaks on the quarterly charts for INDU, or Dow Industrials. TradingView data goes back to 1914 with RSIs kicking in 1918 on the quarterly chart. Red line is drawn at the current level.

Sum

Both 1929 and 1987 tops were followed by violent drops that came rather suddenly, with little warning or time. However, both moves had rallied much more excessively than today.

1954 RSI peak didn't have a high that really mattered until 1961, and even that after a drop was followed by another rally to higher highs in 1965. Similarly, the 1999 top gave plenty of warnings through RSI divergence and a nice long period to see distribution to get out.

Sudden top and sharp drop, or gradual slowdown in momentum and time before rolling over? So far we don't have the excesses of 1929 or 1987 in RSI terms, nor do we have any slowdown or divergence in RSI. We only have four examples but I think the conclusion is to remain bullish until we see more excess (RSI 85+) or RSI slowdown & divergence.

Quarterly RSI values have exceeded the current level in:

1927-29

1954-56

1986-87

1995-99

3 out of 4 of these are rather glaring tops at the end, so let's explore them all in more detail.

1927-29

This amazing run accelerated with the move above the 1925-26 sideways period in 1927. From 1927 Q3, 7 of 9 bars closed outside the Bollinger Band (BB) before the massive drop. RSI reached a peak of 91 on the top.

The current environment while impressive is nowhere near the excesses of 1927-29. But let's file that for other indexes - Q chart RSI 90 is a potential sell.

That said when 1929 came apart it was in a massive way - if i see a candle like 1929 Q3, i will be OUT and probably short.

1954-56

This is a lot more comforting because even though the RSI peak was 1956 Q1 that was just the first in a series of higher highs. There was a sideways period and pullback to 1957 Q4, anther rally to 1959 and 1961 highs, and sharper drop to 1962 lows, then another strong rally to 1965-66 highs. These were the highs that mattered as ~15 years of sideways followed.

If only the current environment would play out like this... we can sleep comfortably until we see a noticeable divergence top, ideally both on RSIs and Bollinger bands such as 1961 Q4 with RSI merely 71 and the highs all inside the BB compared to prior two peaks. These are highlighted by the red arrows on price and RSI in the chart below.

But it is not inconceivable that the current move could end like 1962 - a sudden drop out of the blue.

1986-87

The power move really began in 1985 Q2, with the jump above the prior 1983 highs, but RSI was still only 68 then. From 1985 Q4 6 bars out of 8 closed outside the Q BB before the massive drop.

The worrisome point about this chart is no warning like 1929 or 1961; out of the blue, higher highs in RSI, a mild wick but nothing that screamed sell.

1995-99

Q chart RSI was an amazingly above 90 from 1996 Q2 to 1998 Q2, before a sudden shakeout during 1998. Also note how many quarterly bars were closing outside the BB - a run of 10 in a row from 1995 Q2 to 1997 Q3, a pause, then one more in 1998 Q1.

I like the 2000 top, and probably everyone does. Crystal clear divergence. A nice long time to get out. Plenty of warnings and time.

2017

USA main indexes

Since both quarterly and monthly pivots change over for Monday, the format is a bit different. I'll do quarterly chart, monthly chart, weekly chart, and weekly pivots chart for each.

Sum

Obviously indexes are up but the more important point is signs of strength are everywhere. Whether we look at Bollinger bands or RSIs across timeframes or pivots, everything is resolving to upside. What do I mean by this?

RSIs are powering up on quarterly and monthly charts without any divergence (exception NDX slightly divergence on M chart). Some charts are pushing outside Bollinger bands - rare, but these usually involve higher highs inside the band later. Clearing pivots mean indexes then set their sights on next levels up.

But how high is too high? RSIs are getting up in historically rare territory, and since there is the most data on the INDU I will address that in detail in a separate post.

For now SPX pointing to 2576 if remains above 2503; NDX 6068, INDU 22710-940, RUT 1493-1519, NYA 12307 are long term resistance level targets.

SPX

SPX Q: Q chart RSI 80.8, powering up and pushing the BB. Key thing here is no divergence on the quarterly chart RSI (ie lower high in RSI as price goes higher).

SPX M: RSI 79.03, matching the 2007 top and only exceeded by a handful of bars in 1995-98 bull stampede.

SPX W: At this point some possible divergence on SPX weekly and pushing the BB.

SPX W pivots: Looks like we should see 2576 as long as SPX remains above 2503.

NDX / COMPQ

COMPQ Q: RSI 82.49, outside BB is sign of strength.

COMPQ M: RSI 77.94, on the high side.

NDX M: Some divergence here at 76.17 lower than 5/2017 close at 77.59.

NDX W: 3 holds of S20 so far.

NDX W: 2HR1 not far above; YR3 seems more like a stretch.

INDU

INDU Q: RSI 80.46 exceeded 1927-29, 1954-56, 1986-87, 1995-99. 2 of these had divergence tops but 2 did not.

INDU M: RSI near this level several different times. Probably worth its own blog post to look at these in more detail. The interesting thing is there WAS divergence for both 1929 and 1987 moves, although this still might be easier to see in hindsight than real time.

INDU W: All above rising 10MA on weekly close since 4/24/17 bar.

INDU W: Dow 23K? YR2 is 22937.

RUT

Q: RSI lifting above 2007 and 2014 peaks; only exceeded in 1996-98.

M: RSI Slightly above 70.

W: Breakout!

W: Already at 2HR2, YR1 at 1519 not far off.

NYA

Q: Bullish for RSI to be jumping above 70.

M: Also lifting above 70 on the monthly.

W: 3rd bar outside the BB! This is pretty rare.

W: the jump above YR1 and clearing 2HR1 has been a good tell.

Valuation and fundamentals

Wow - the first weekly close above the 10 period moving average of 18X forward P/E. Valuation in blue, SPX weekly close price in orange. Data shows this year but it goes far beyond that.

Here's a weekly version from Ed Yardeni that goes back further. His 18X is a bit higher; he is using last week's number (due to reporting lag I suspect), which may be higher than my current 10MA.

In case you are curious here's the monthly version. The point here is that SPX rallied above 20X valuation only in 1998-2000. The 1987 peak was at 15X earnings. LOL, now that seems cheap!

FAANG equal weight P/E again 55.

Citigroup Economic Surprise Index cannot really get it going. This would help interest rates and $USD to rally further.

Total market view

REVIEW

9/17/2017 Total market view: "Bottom line - 6 weeks into the seasonal weaker months of August and September, and SPX had a minor dip of -2.95% and raced back to highs. IWM took the brunt of the hit at -7%. I'm going with the trend until price action forces defensive moves the other way, meaning VIX above 2HP / Q3P, and at least some USA indexes showing rejections of resistance levels and breaking monthly pivots. The questions from here are the global emphasis given their run up and potential $USD stabilization, tech suddenly a bit laggy, and which way TLT moves on its yearly pivot."

Result

Stocks continued uptrends, and safe havens were weaker.

SUM

Nearly all stock indexes remain in uptrends, above all pivots. VIX has been below all pivots from 8/22, and XIV above all pivots from 9/11. Safe havens were weaker last week, with TLT breaking its YP and GLD breaking SepP. The environment is bullish for risk assets.

Some key indexes are testing resistance - SPY and VTI are both testing 2HR1s. With sudden strength of IWM, XLF, and oil, as global indexes excepting INDA maintaining strength, I just cannot be that bearish. That said, given pivots, other technicals and valuation I expect to see some selling attempts on SPY in the coming week.

Bottom line - some of the recently suggested rotations into XLF and USO have been working. As long as safe havens are supportive of risk assets, I prefer to be fully invested. However, some selling from SPY long term resistance is possible. If that happens the best place to play weakness for USA likely will be QQQ, and possibly re-entry longs on GLD if above all pivots or TLT if back above its YP.

PIVOTS

USA main indexes - SPY testing 2HR1 249.91, and QQQ testing SepP 144.19.

Safe havens - TLT slightly under its YP. XIV also near resistance and could be worth watching again for another trade.

Sectors of note - SMH YR2 rejection but not dropping like INDA with move from the same level.

Global indexes - Excepting INDA, all others that I track above all pivots.

Currency and commodity - DXY 2016 low 91.91. Above that has a shot at rally, though current weekly DXY chart looks ready to drop further.

OTHER TECHNICALS

New highs & new lows on a daily level look great.

VALUATION AND FUNDAMENTALS

SPX sitting on 10 week average of 18X forward P/E, currently 2504.

TIMING

As it turned out, 7 dates provided for August. 2 were the high and low of the month. 2 were the second high and second low of the month. 2 were milder turns. 1 was non event.

September dates (editing from last week)

9/4-5 - 9/4 mild pullback low

9/13 - QQQ high and TLT low

9/22 (+/-1) more important date possible; so far stock high & safe haven low

9/26 - looks bullish for risk

9/29 - bearish for risk

Caution for India

Indian indexes and ETFs have been on fire for most of 2017 but last week showed some comparative weakness that we haven't seen in quite some time.

Active Pivotal Momentum traders already know this, with INDA the only one of 8 global indexes & ETFs that I track to be under its SepP.

There was also bearish action - meaning clear rejections - from long term resistance on two key indexes and the ETF.

Longer term investors might give this a week and see what happens at the new Q4P in October but given everything we are seeing - YR2 rejections after high tests, RSI divergence, break of SepP, all happening as 7 other global indexes/ETFs are above all pivots - I'd err on the side of caution.

NIFTY W

Double top with BB divergence and glaring RSI divergence.

NIFTY W

2nd rejection of YR2 / 2HR1 combo looks definitive, especially with the RSI divergence.

INDA W

This move is being echoed in the INDA ETF despite the currency headwind of falling $USD.

INDA D

Several larger selling bars with weaker up bars before the breakdown; regardless, below D50 and below SepP.

New highs new lows

Weekly chart

10 week average of NYSE new highs in blue, new lows in red. Other new lows of recent magnitude involved more than -2.9% drop.

Daily

Places where new highs (blue) crosses back above new lows (red) have been good places to recommit to bullish view. Also, fewer new 52 week lows on NYSE than at any point since late February. Until we see that line increasing, i view fewer new lows as bullish for stocks.