Sum

VIX and XIV continue to signal risk on. I have mentioned several times and may continue to mention that VIX helped confirm stock buys from 8/22 on by dropping back under all pivots on daily close, and has maintained that status since. XIV jumped above all pivots on 9/11, and has maintained that status since. Further, XIV cleared long term resistance 9/28-10/2 helping confirm the strength in stocks.

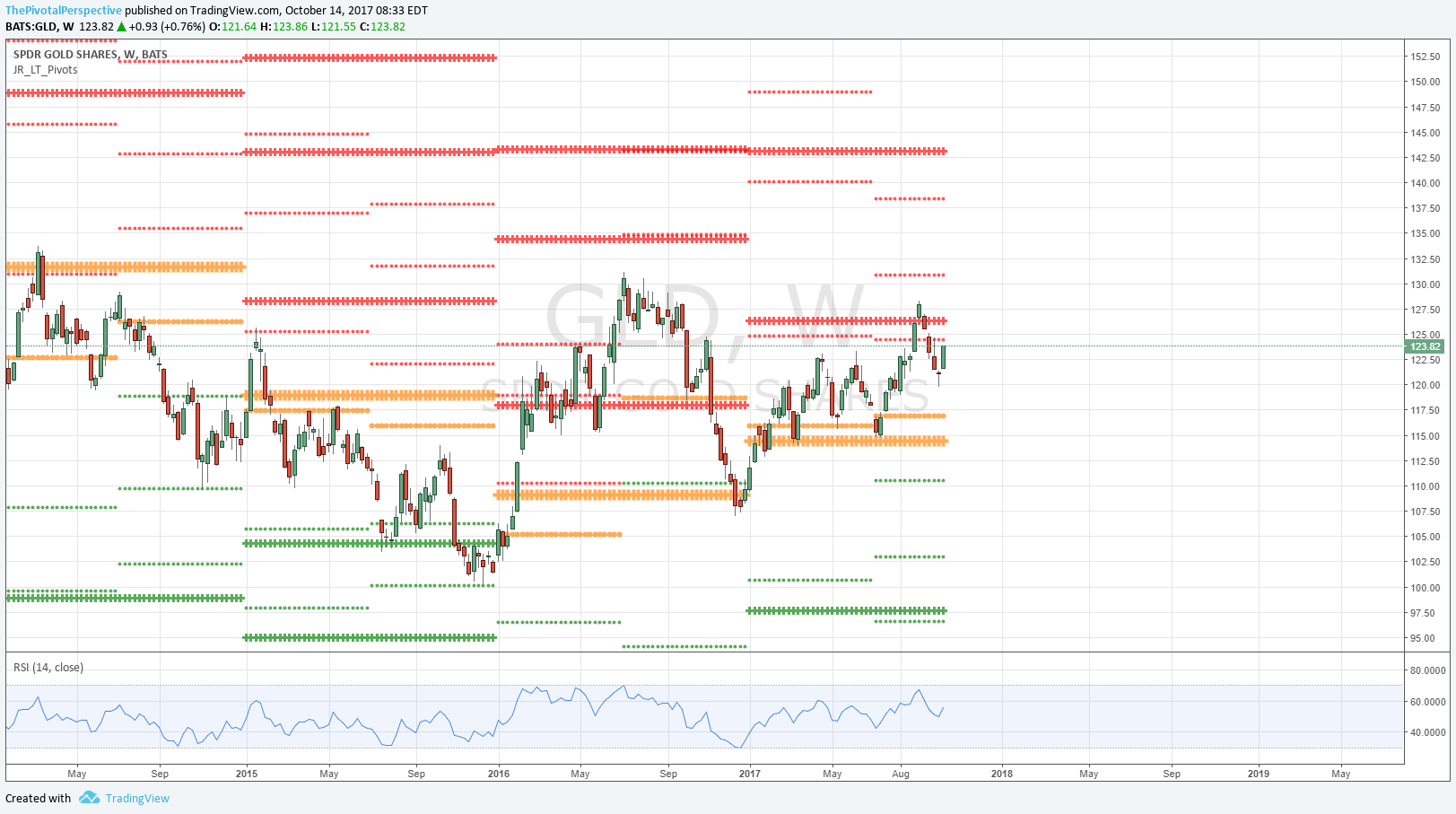

But last week I mentioned that TLT and GLD were "in places that usually would bounce" and that is exactly what happened. In fact both put in respectable moves, which should increase the risk to stocks. AGG added to clues by reclaiming YP last week, and HYG traded under its OctP for the last 3 trading days. Should HYG break Q4P, stock fade more likely underway.

VIX

W: Back under 10 but so far above the weekly low close reached in July.

D: Back under all pivots on daily close from 8/22 worked very well as confirming stock buys from there.

D: If lower, watching the BB for support because to reach a pivot support level it would have to drop into the 8s (which i doubt will happen).

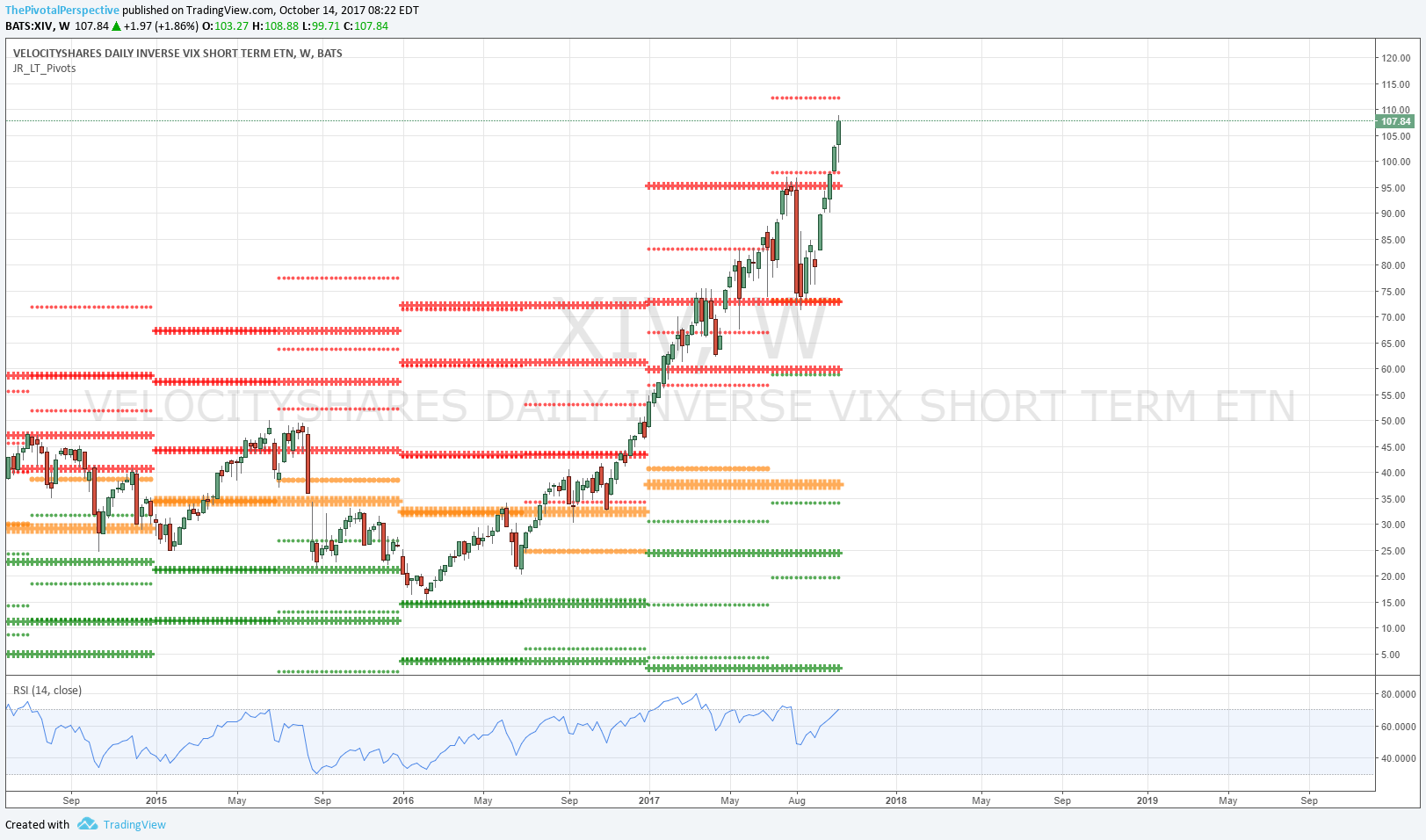

XIV

W: Still powering up; RSI reaching 70 and with crowded trade on VIX shorts I am watching this for a trade again.

D: This soared above Q4R1 on Friday so for a pivot entry we would want to see back under that level or above to 2HR2. Note: back above all pivots on 9/11 worked very well as confirmation to add stock longs. Then above long term resistance 9/28-10/2 helped confirm the breakout.

TLT

W: Holding W200 and W50 as planned; probably a bit more bounce than I thought would happen.

W: Held 2HP.

D: Held D200 on the low; lifted back above Q4P; still under OctP and YP.

TLT sum: Saved long term support by making a decent bounce from 2HP, D200MA and near W200 and W50 as well. TLT strength is some warning for stocks.

AGG

Brief dip below YP but came right back. Currently above YP, 2HP and Q4P.

HYG

Below OctP for 3 trading days, but holding Q4P. Risk to stock indexes will increase if Q4P breaks.

GLD

W: Respectable bounce back above rising W20 and W10.

W: If higher back to 2HR1 and YR1.

D: Back above Q4P 10/9 was much easier than trying to short stocks. Testing OctP.

GDX

Hold of 2HP, D200MA then Q4P all 10/2-3. Slightly above all pivots.