Sum

VIX and XIV remain very bullish for markets.

Other safe havens meaning primarily TLT and GLD, and somewhat AGG, HYG, GDX and SLV have been confirming risk on the last few weeks as well. Currently TLT and GLD are in areas where some bounce may happen especially on a stock fade. That said barring some crazy NKorea confrontation I am expecting to see higher rates and so lower TLT and GLD in Q4.

VIX

W: Weekly close low is being bought, but no real move higher yet.

D: Well under OctP. Little jump to falling 20MA was sold.

VIX: Big picture is that VIX below 2HP 12.28 & Q4P 11.87 is bullish for risk assets. If it can go higher, OctP 10.97 also resistance. At the same time we have a near test of all time low levels and a reversal bar; we'll see if follow through soon.

XIV

W: Launched above the YR3 / 2HR1 resistance that marked the highs in July.

D: Between levels. Not really any trade here unless tags OctR1 104.88.

XIV: Confirmed risk on 9/11 with jump back above all pivots. Confirmed stock strength with lift above YR3 9/28 and then above 2HR1 on 10/2.

TLT

W: Coming down hard in recent weeks, and already at key support area of W50MA, W200MA and lower BB.

W: YP rejection but 2HP holding.

D: 2HP and D200MA hold.

TLT sum: Fast drop from the early Sept high, and now testing 2HP and D200MA which are places for possible bounce. But given Citigroup Economic Surprise, FOMC QE reversal, ECB tapering, i think pro money is selling bonds and rates are going to make a bigger move up.

AGG

Below YP. Still above D200MA and 2HP.

HYG

A bit under OctP, above Q4P which is the real level that matters.

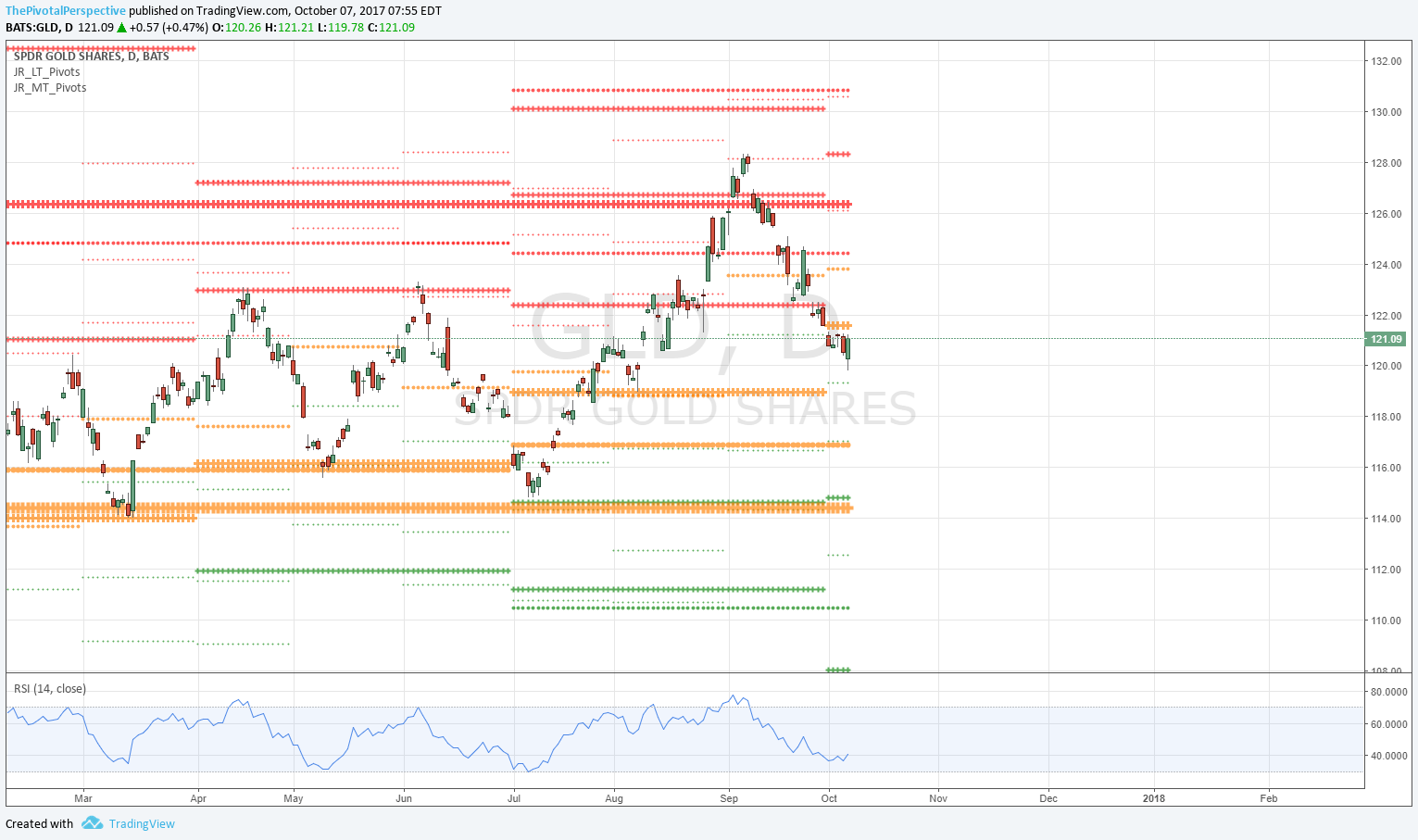

GLD

I did say err on side of taking gains 9/11 after holding longs for 2 months from 7/11 buy. But currently mixed condition is not best for trade. Above YP and 2HP, below Q4P. A pop above Q4P might be a short term way to play a stock fade.

GDX

Interestingly GDX held 2HP and D200MA on 10/2 and then recovered Q4P on 10/3. Better buy than GLD here although heading into falling D20 and OctP.

SLV

Fell under all pivots 9/26 but most gains on short wiped out with Friday pop. This was just too big a reversal for me to mess with but I may re-enter short with a move back under Q4P.