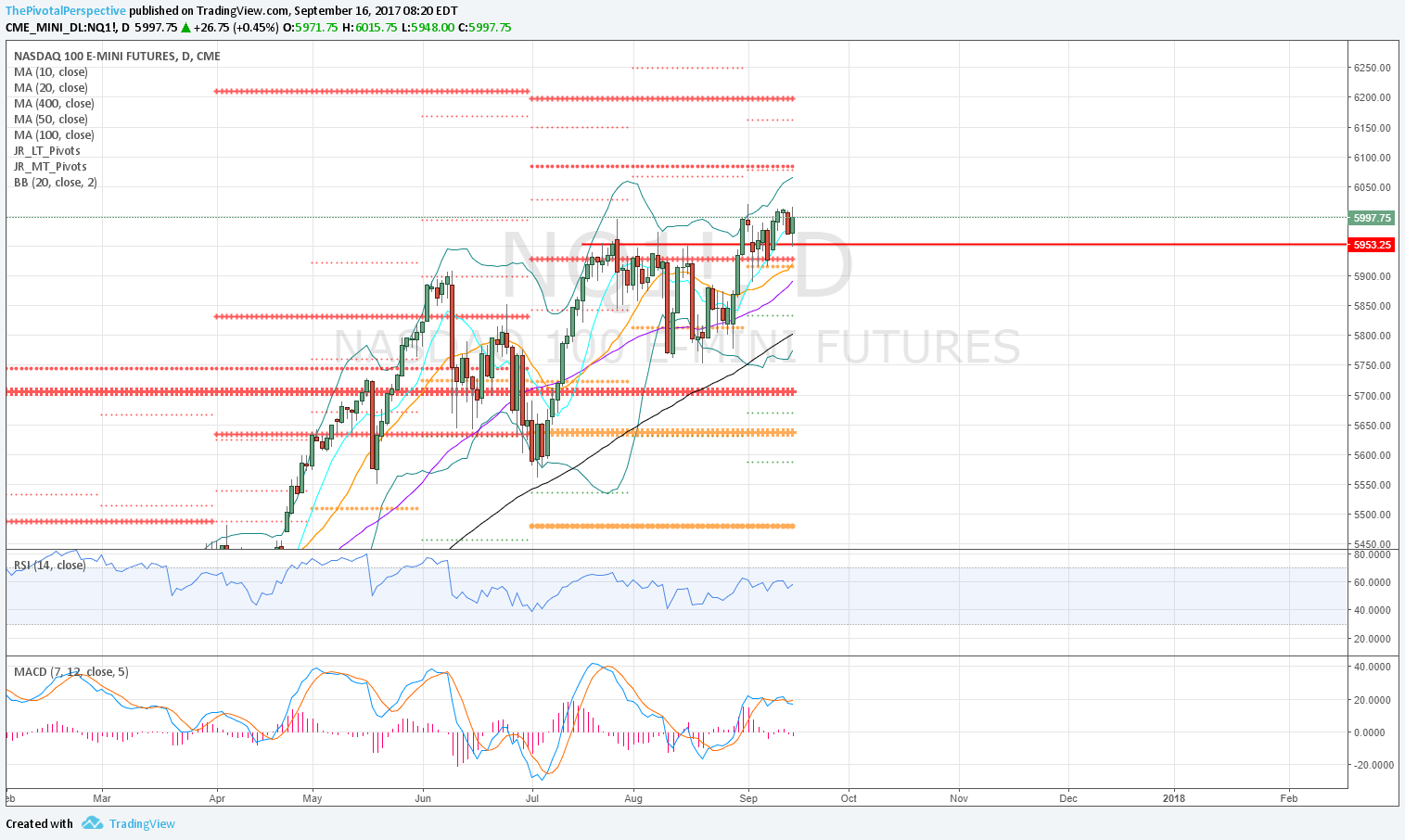

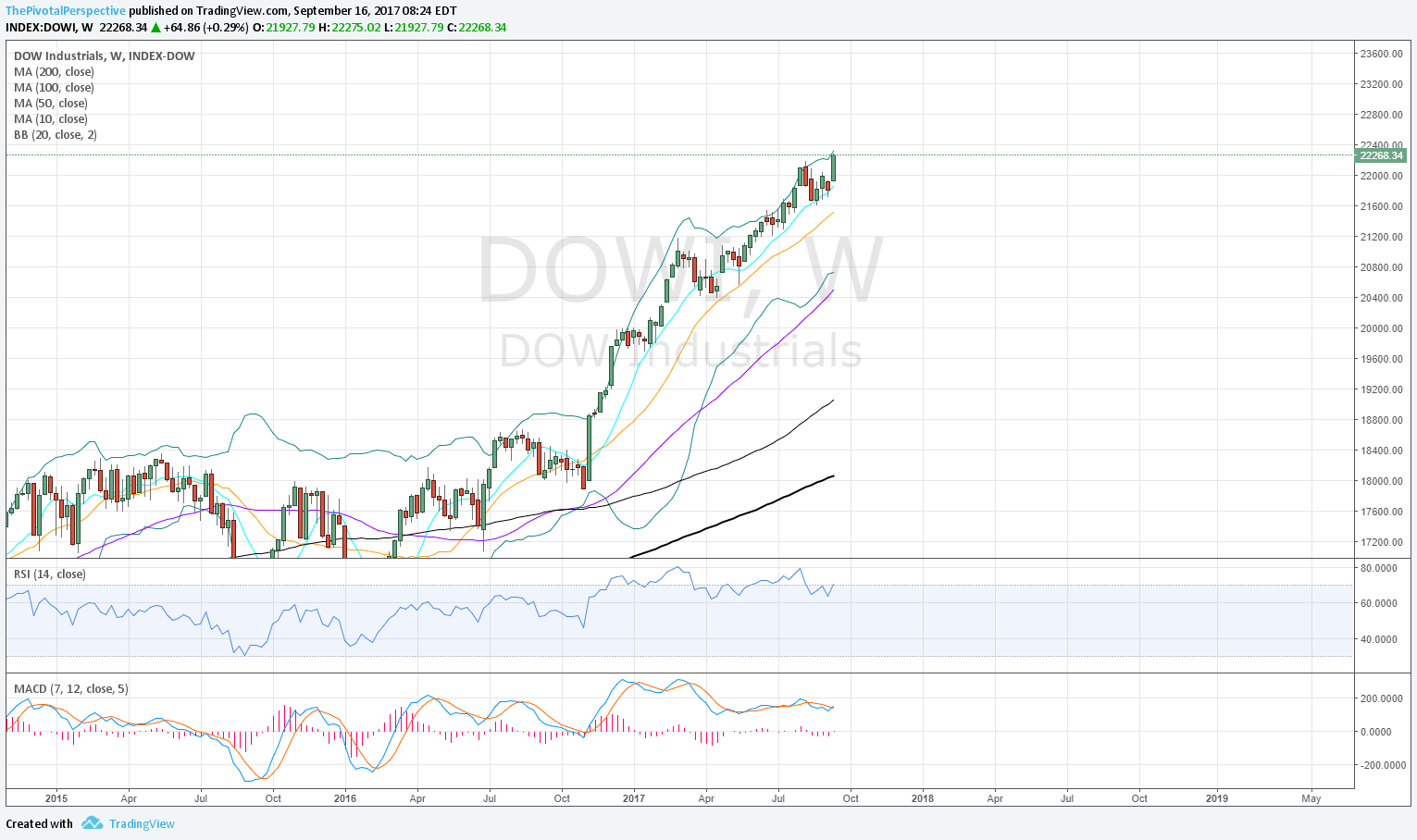

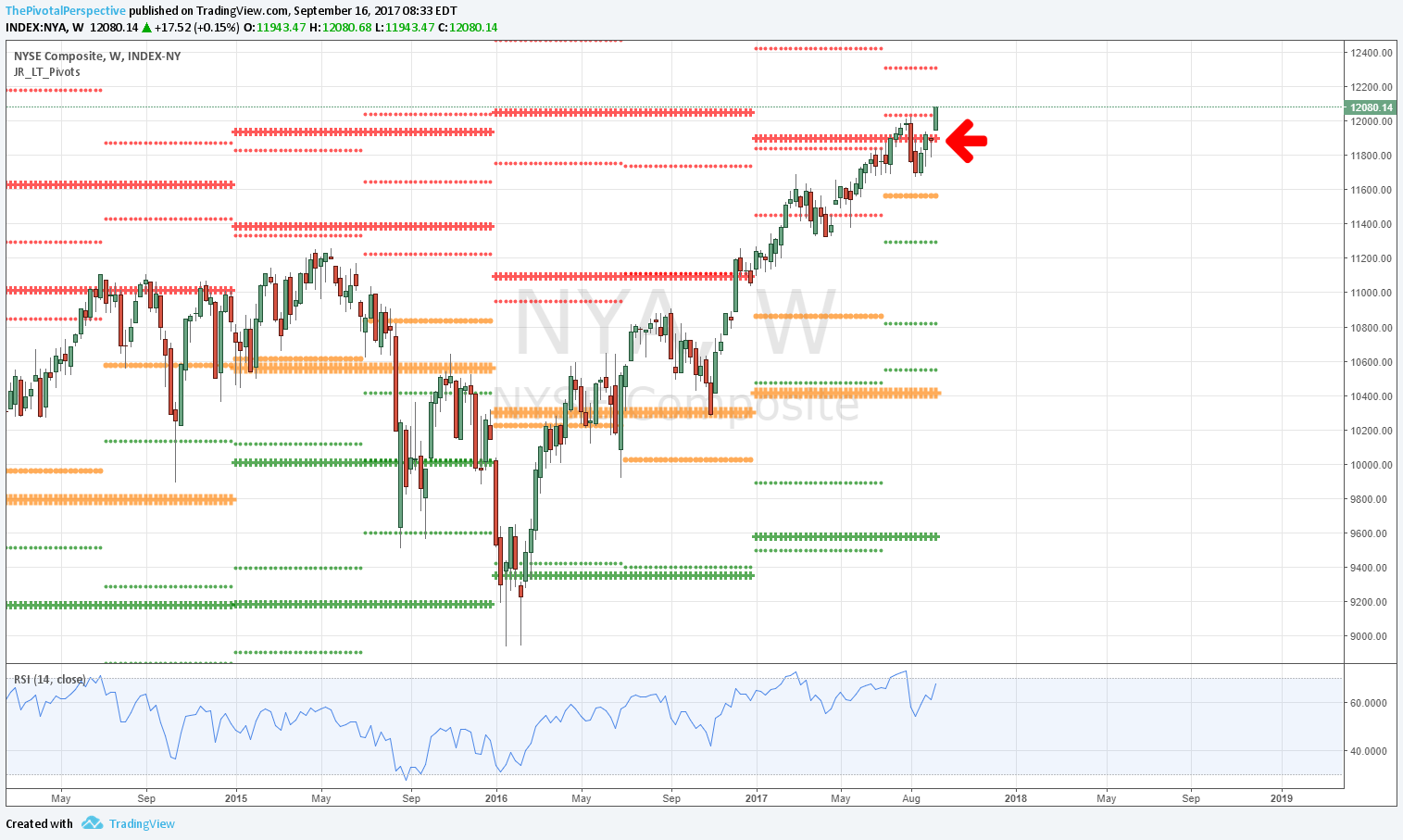

Sum

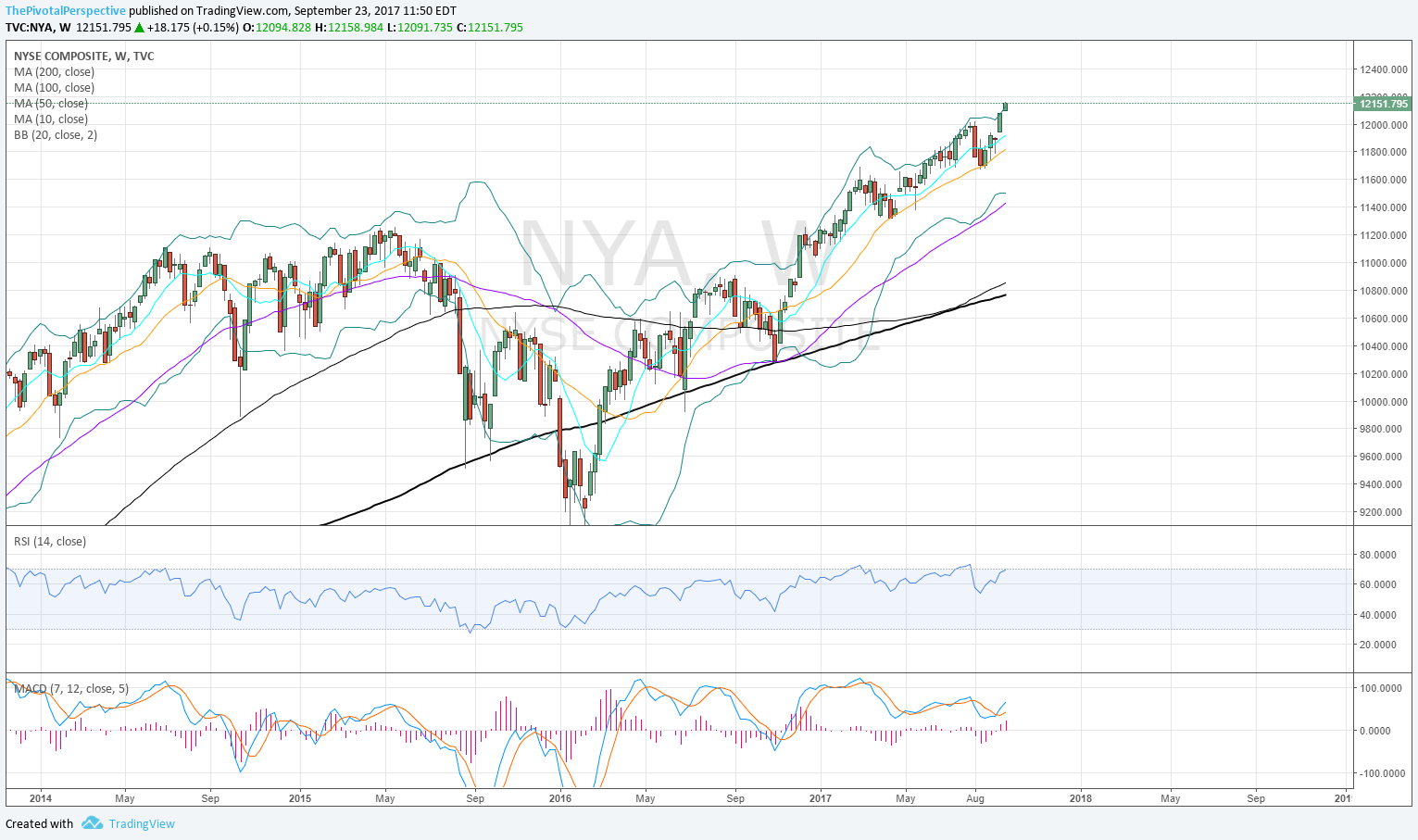

VIX has been saying all clear for risk since 8/22, and XIV joined in from 9/11. Safe havens have been weaker recently, with GLD and GDX getting whacked from long term resistance (YR1 and 2HR1 respectively), and now both under SepPs. Last week TLT fell under its YP - fractionally, and not enough to say rejection yet - but could have held. AGG also under its SepP from 9/12. HYG confirming risk on, above all pivots and MAs.

About the only thing I can say here is XIV faced some resistance at previous weekly close high, and TLT 'might' recover its YP. But right now conclusion of this group of safe havens is bullish for risk assets.

VIX

W: Back in single digits, with red line showing weekly close low.

W: Hard to imagine VIX seeing long term support near 8 but who knows.

D: Has been under all pivots on daily close all month.

VIX under all pivots on daily close all Sep, and under all MAs from 9/11. Still above 7/21-26 lows but these may test (daily close and price lows).

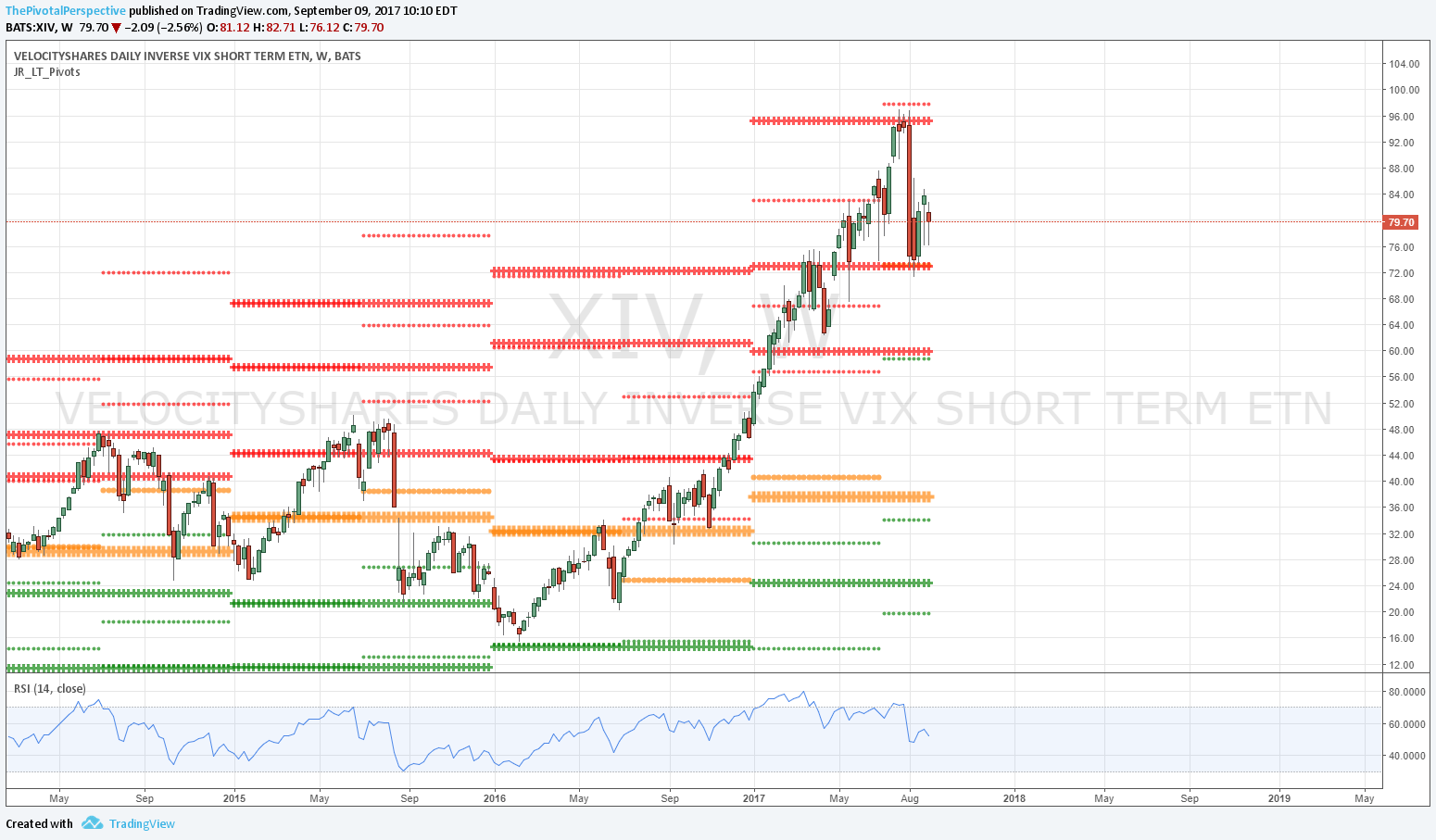

XIV

W: resistance at previous weekly close high.

W: Likely top zone from YR3 to possibly 2HR1.

D: Q3R1 but in play for 1 more week; above that YR1 and 2HR1 shown in red arrows.

TLT

W: Below YP, but with rally Friday doesn't quite have look of rejection. With level at 126.51 and close 126.20, i'm going to say too near to call.

D: Congested above rising 50MA and below falling 20MA. Still, could have held YP but didn't.

TLT sum: Weaker last week by falling under its YP. With Friday's rally close just .31 away I don't not count that as definitive rejection, especially by look of weekly chart. Anything lower will look more like rejection, anything higher could recover YP.

AGG

Below SepP from 9/12 on. No bounce at D50MA, but still above D100.

HYG

Doing fine, above all pivots and MAs.

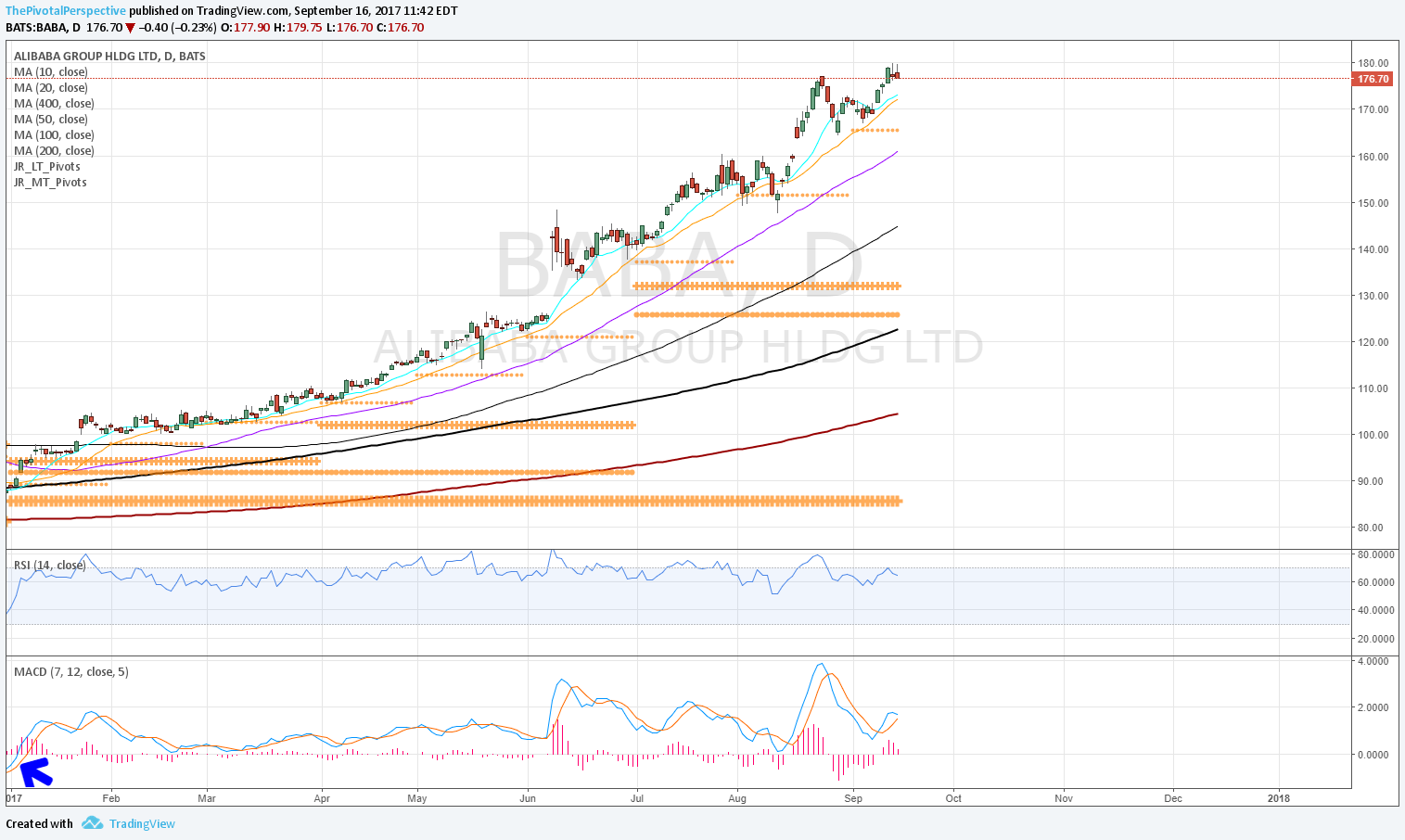

GLD W

W: Oops! Failed move above YR1 and high for year maybe in; also below 2HR1.

D: Under SepP.

D: Weak bounce from D50 so far.

GLD W: So far high of year on SepR1 and YR1 fakeout with fall back under and rejection that also broke 2HR1. Currently under SepP. Exit call 9/11-13 after holding long from 7/11 looks obvious now, but it was a judgment call at the time.

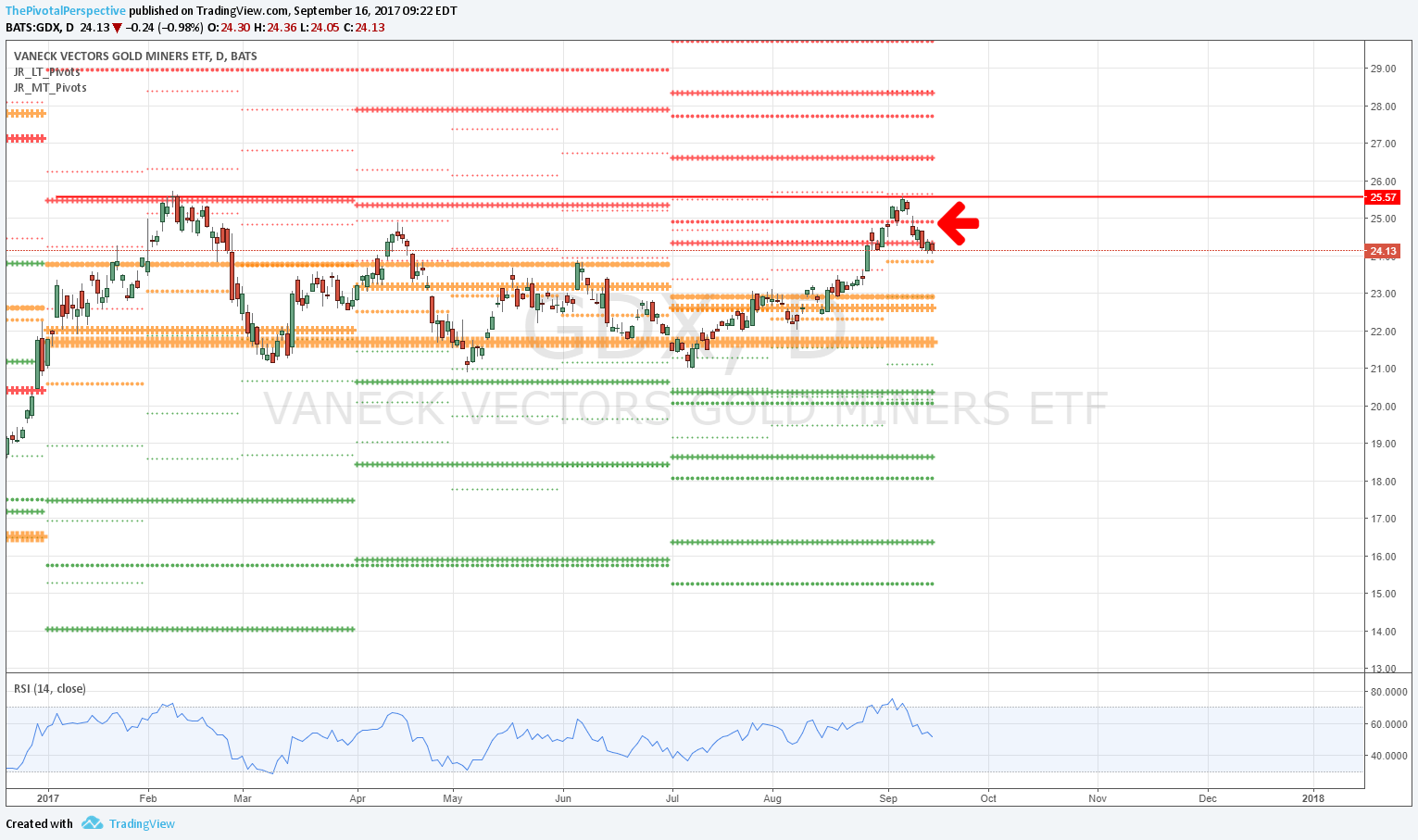

GDX

Also fell back under a long term resistance level 2HR1 and now under SepP. GDX failure at 2017 highs also part of decision to exit GLD.