REVIEW

4/23 Total market view: "The fact is by the end of last week nearly all USA main indexes recovered Q2Ps, an overbought VIX was rejected by 1HP, and these were happening as some sentiment meters were recently bearish. These are often the best times to take a stab on risk assets."

Risk taking indeed rewarded with the gap up on Monday and one of the better weekly gains for the the markets in 2017.

Sum

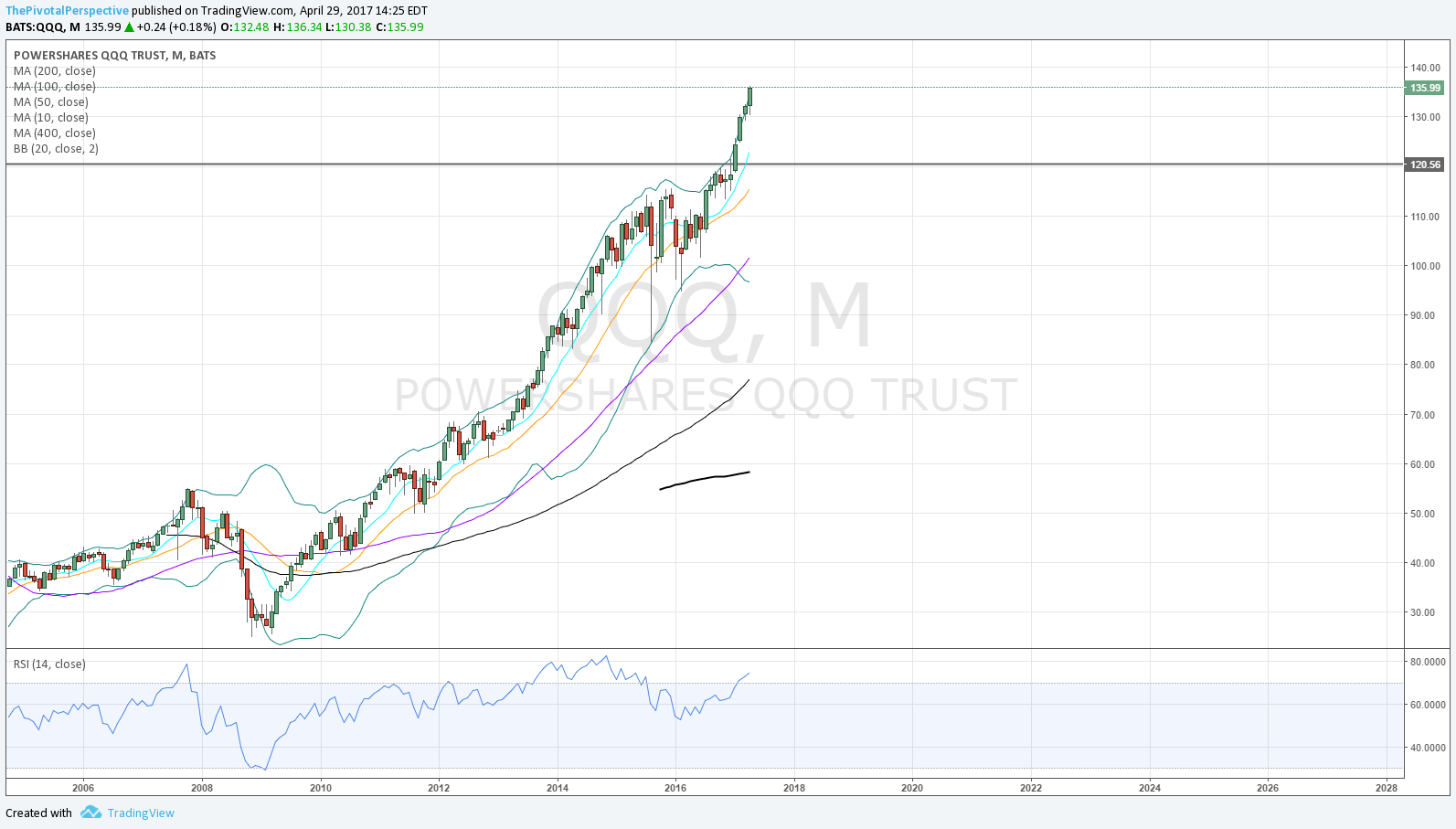

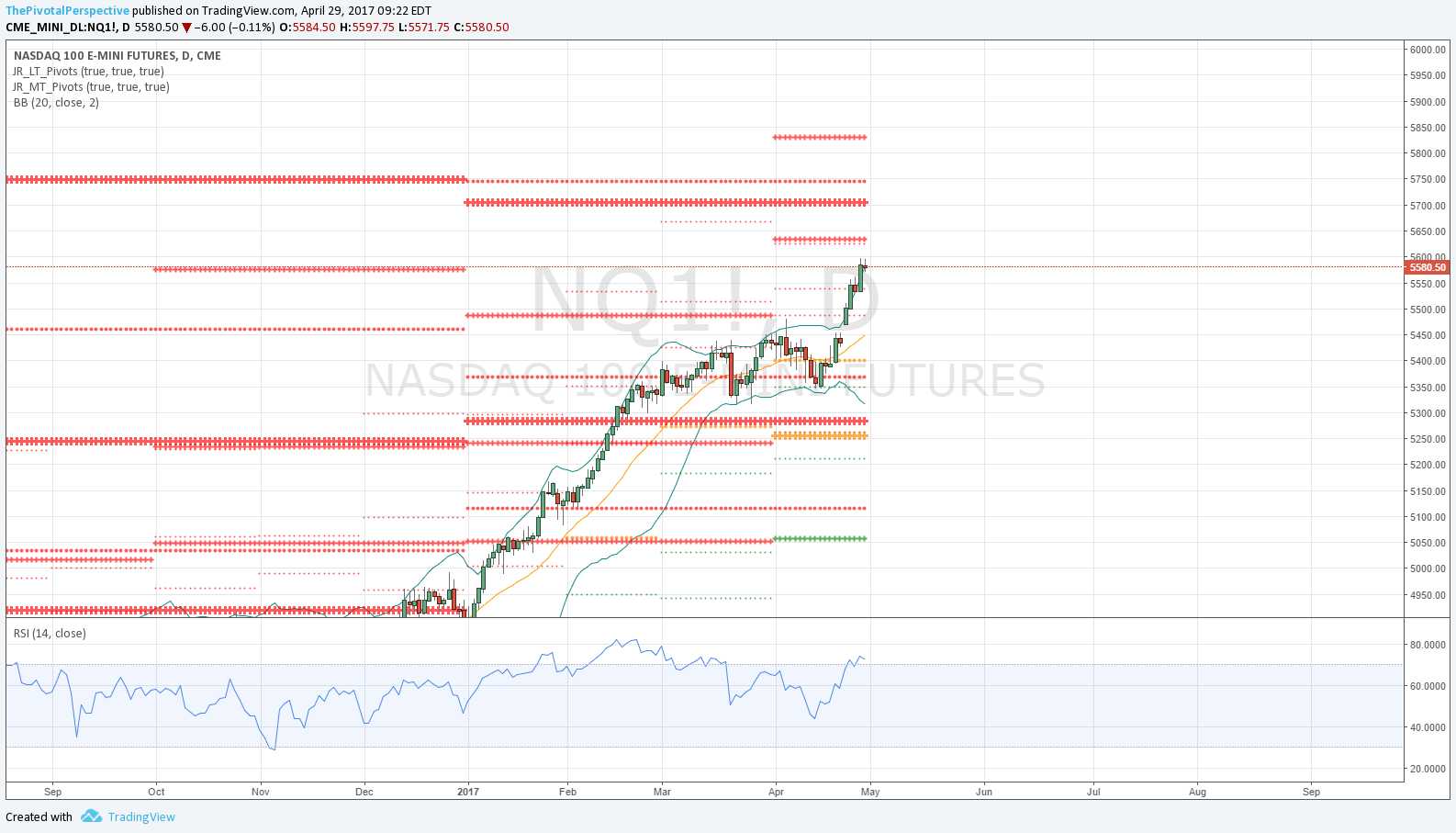

2017 USA main index leader QQQ is doing great. A case could be made for staying bullish risk assets as long as the leader is above Q2P. But as I am not long entirely all QQQ means it is warranted to pay attention to other indexes, and there are several signs of caution. These are:

SPX set near 1HR2 tag and rejection.

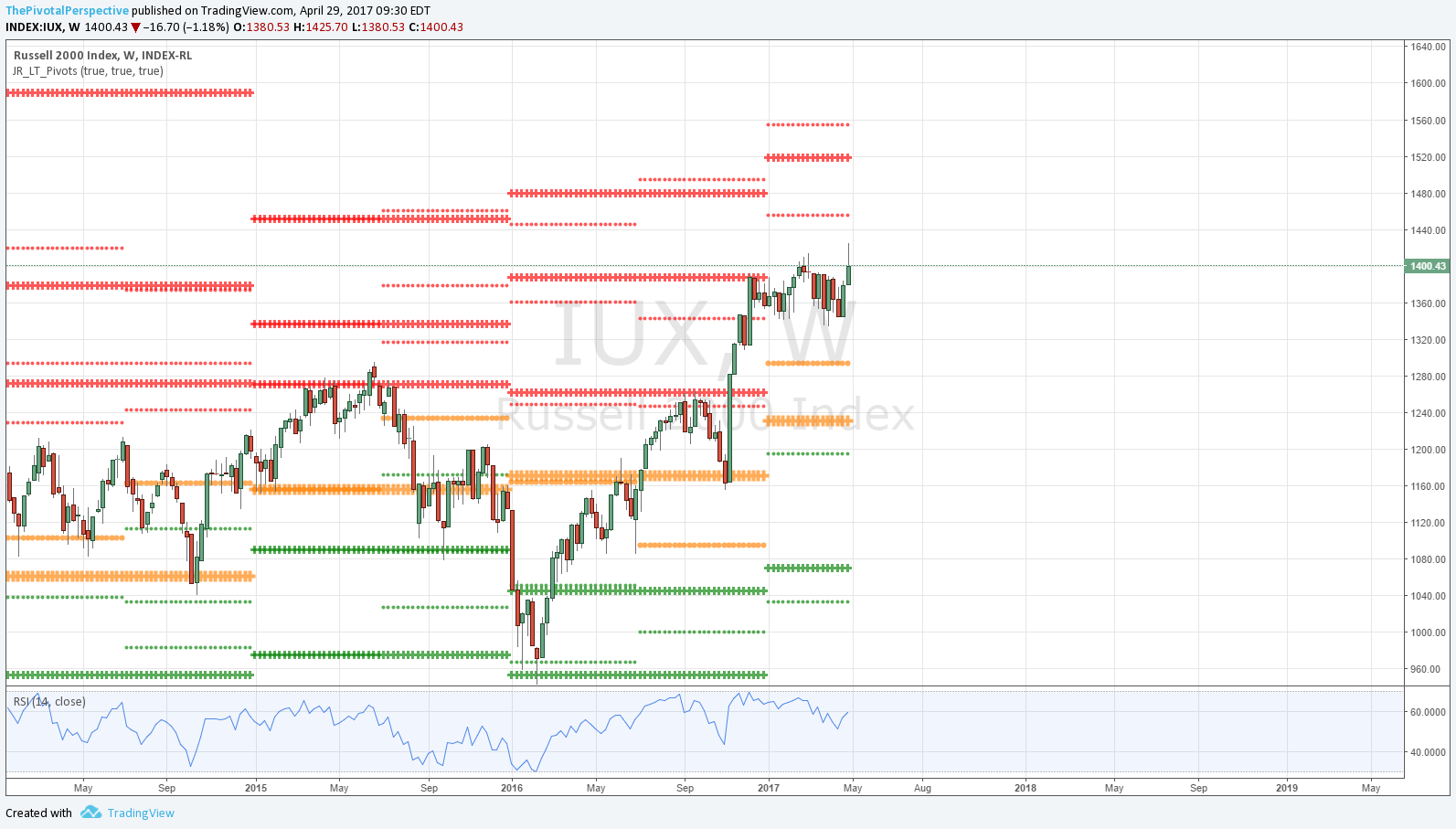

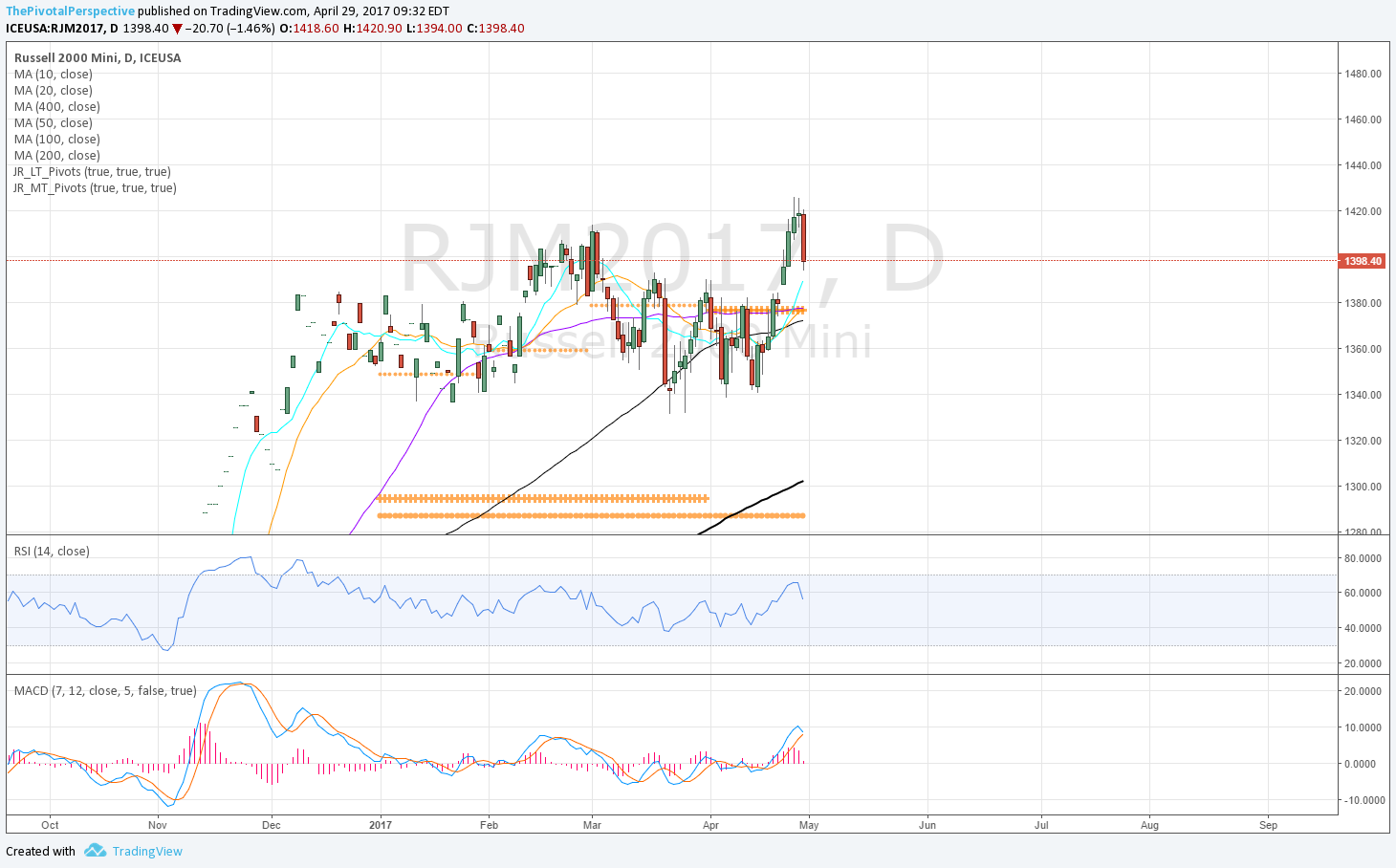

Smart money double top as outlined on that post, as well as NYA/VTI similar move, and RUT/IWM high failure.

Valuation at 18x forward earnings, and fundamentals disappointing.

Sentiment meters picking up including an ISEE spike on 4/27, often limiting upside.

Several monthly USA main index charts showing Bollinger band divergence, often prelude to a turn.

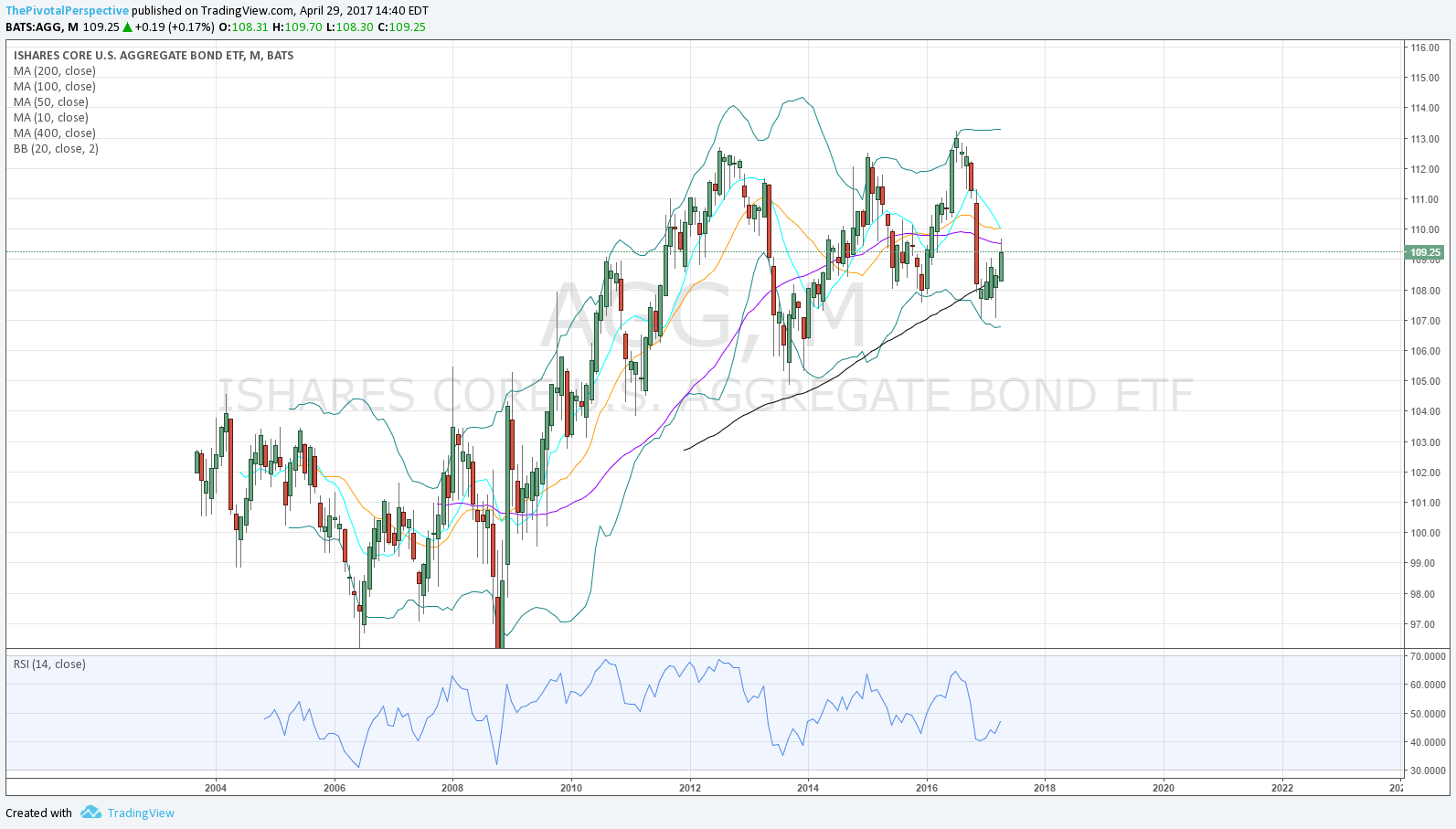

Ongoing Q2 safe haven strength.

Advance decline volume difference chart indicates risk of larger drop.

Reasons to stay long:

Trend is up, and USA mains will likely be above all pivots.

VIX below all pivots, XIV above.

Only 1 sentiment extreme often not enough to really turn.

Better top at multiple long term resistance levels like SPY YR1, QQQ YR2, DIA YR1, VTI YR1 (IWM is ?), as outlined here in this target post.

Bottom line

Market is really a toss up here, so we will see if MayPs hold for USA main indexes this week. If so, will maintain positioning. Even before the rally last week thought this leg would not have the same gains as Nov to Dec or Jan to March for USA indexes. But if MayPs hold there is the chance we see the higher target levels listed above.

Positioning

Still somewhat aggressive despite not liking IWM action on Friday and concerns above.

PIVOTS

New May pivots this week. The monthly levels were clear resistance for several USA main indexes in April, and that led to a test of Q2Ps. Reducing in front of the drop and buying the dip was a good move.

USA main indexes - A nicer top would be at more pivot resistance levels, although IWM clear rejection from Q2R1.

Safe havens - VIX and XIV supporting risk, but GLD above all pivots, and TLT & AGG strong comeback after first fade.

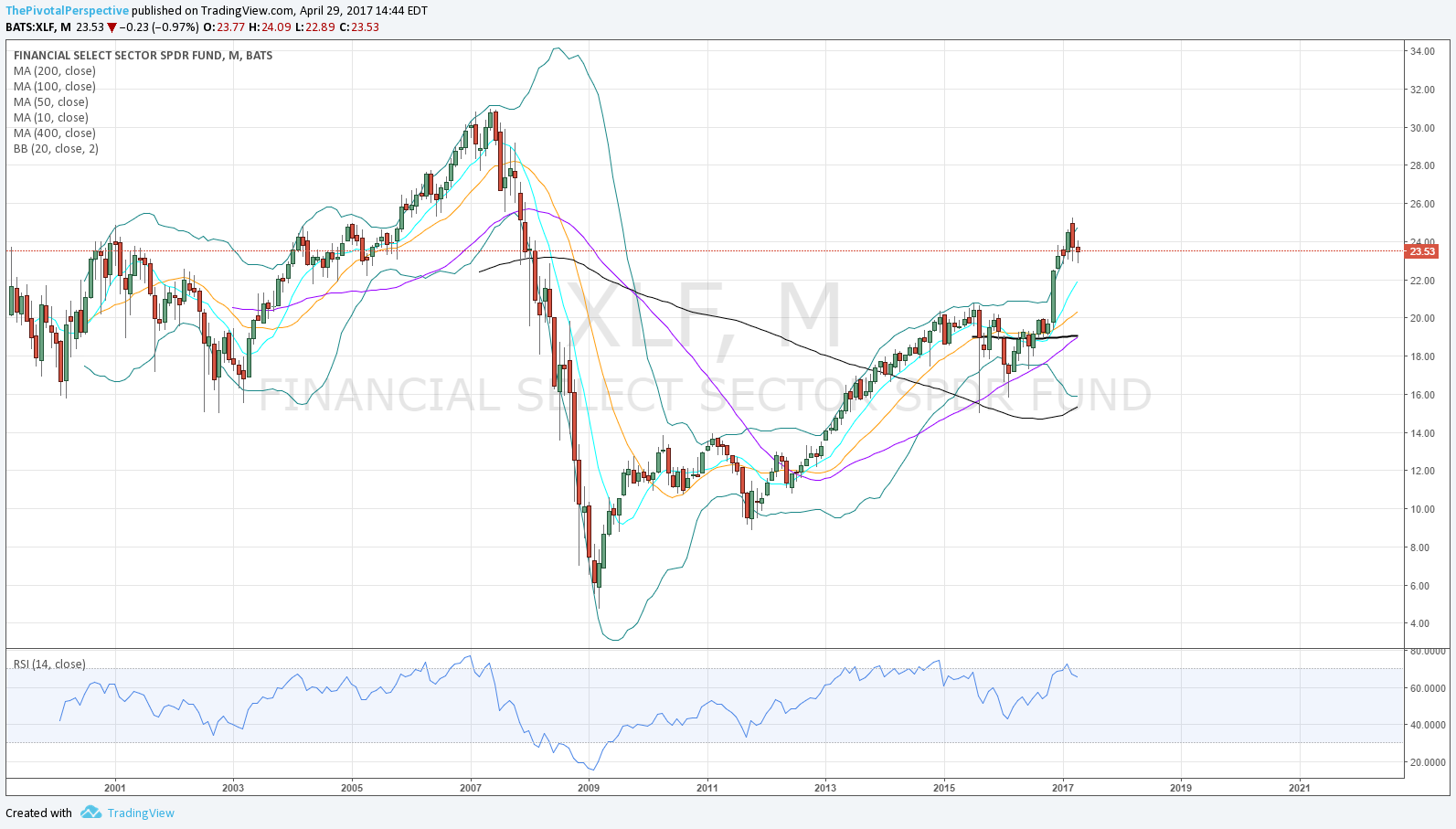

Sectors of note - XLE hanging by a thread. In addition, SMH monthly chart vulnerable to selling.

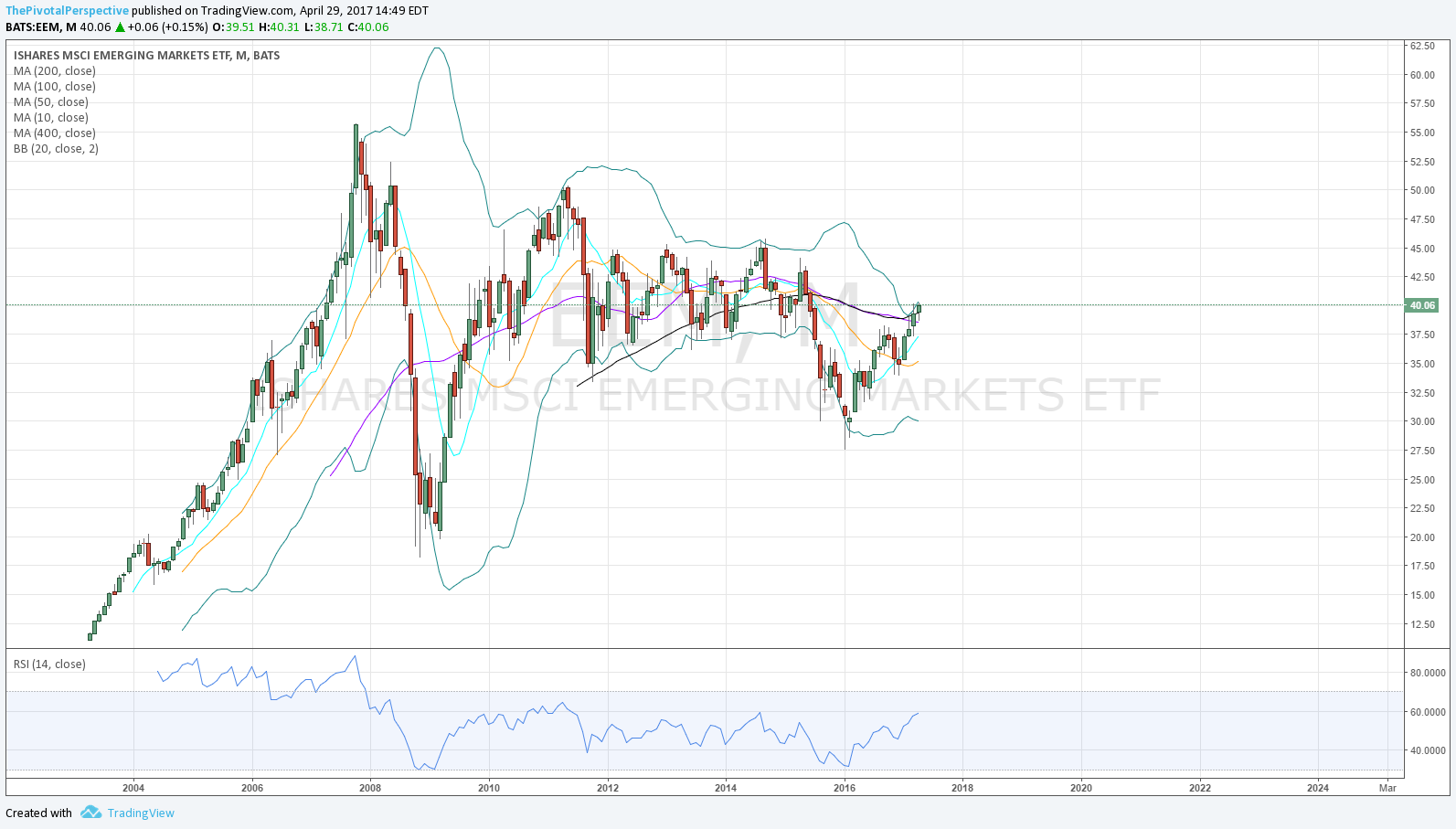

Global stocks - ACWI, INDA and EEM all doing great. RSX possible short.

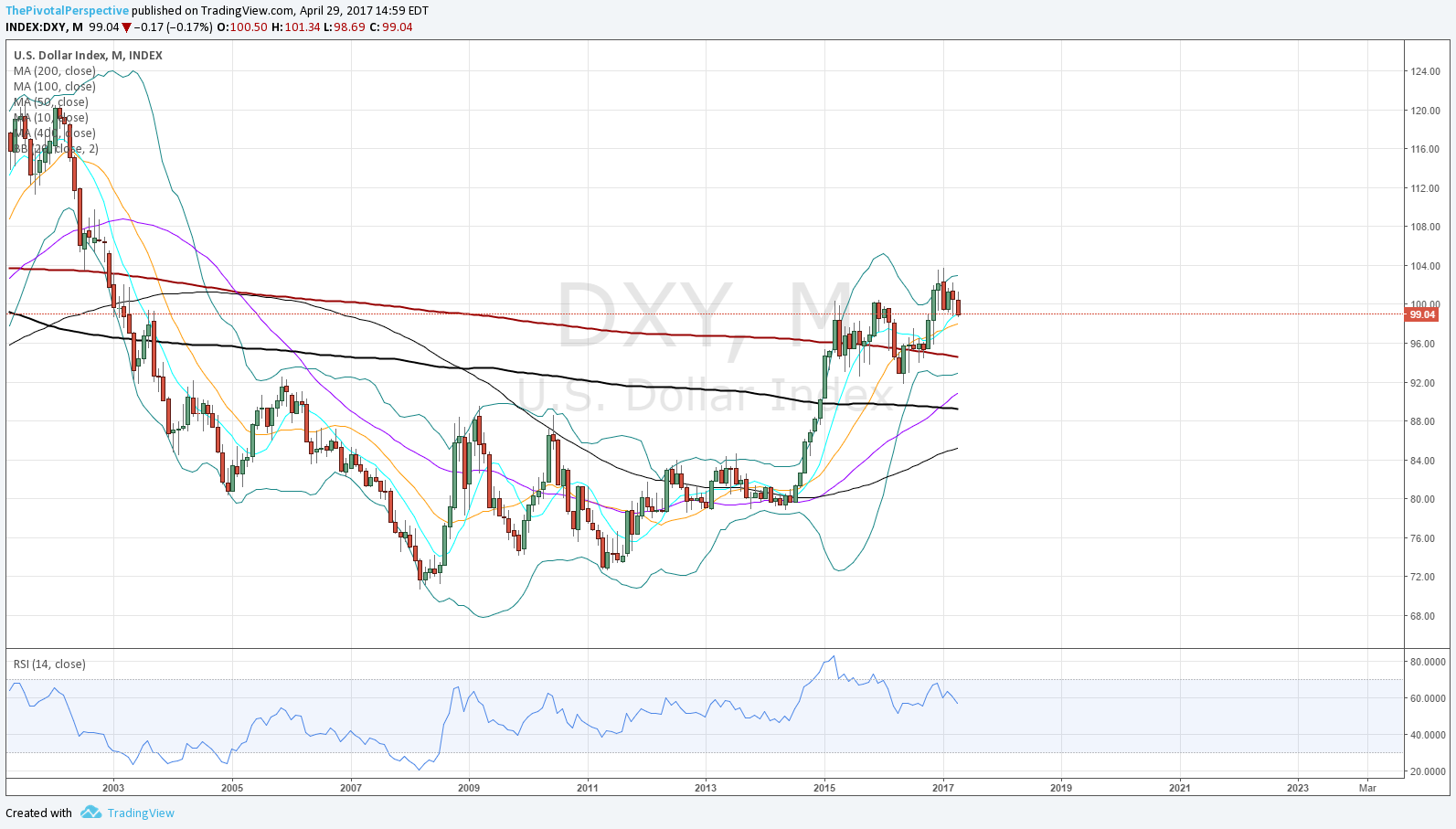

Currency and commodity - Oil still above some pivots on the CL1 contract which I have found to give the better signals. DXY under all pivots the last week, which helps support the global positioning.

OTHER TECHNICALS

Rundown of monthly charts here. Not a lot of strong edges. USA stock indexes all up, but some divergence. See the sum at the top of that post.

Advance decline volume difference is one of the list of concerns above. I wish there were more history to this and will check further this week into other sources. Point is 7/2015, 12/2015 and 10/2016 were all times the level was similar to today, and the market put in larger decline than a -2%.

VALUATION & FUNDAMENTALS

Not helping. Based on Citigroup Economic Surprise, there is slim chance of powerful new highs.

SENTIMENT

ISEE spike with market at highs tends to limit upside in weeks ahead. AAII bearish sentiment alleviated.

TIMING

(Proprietary experimental work in progress model)

See this post for a recent timing score.

April dates

4/6-7 - minor stock low

4/10 - key lower high for USA main indexes

4/19-20 - 4/18 safe haven high (-1 day

4/26 (listed all month turning out some high for SPY, DIA, IWM & VTI)

May dates

5/3-4

5/19 (stronger)