USA mains: SPY QQQ DIA IWM VTI

Safe havens: VIX XIV GLD TLT AGG

Sectors: XBI SMH XLF XLE

Global: ACWI EEM FXI SHC INDA RSX EWZ

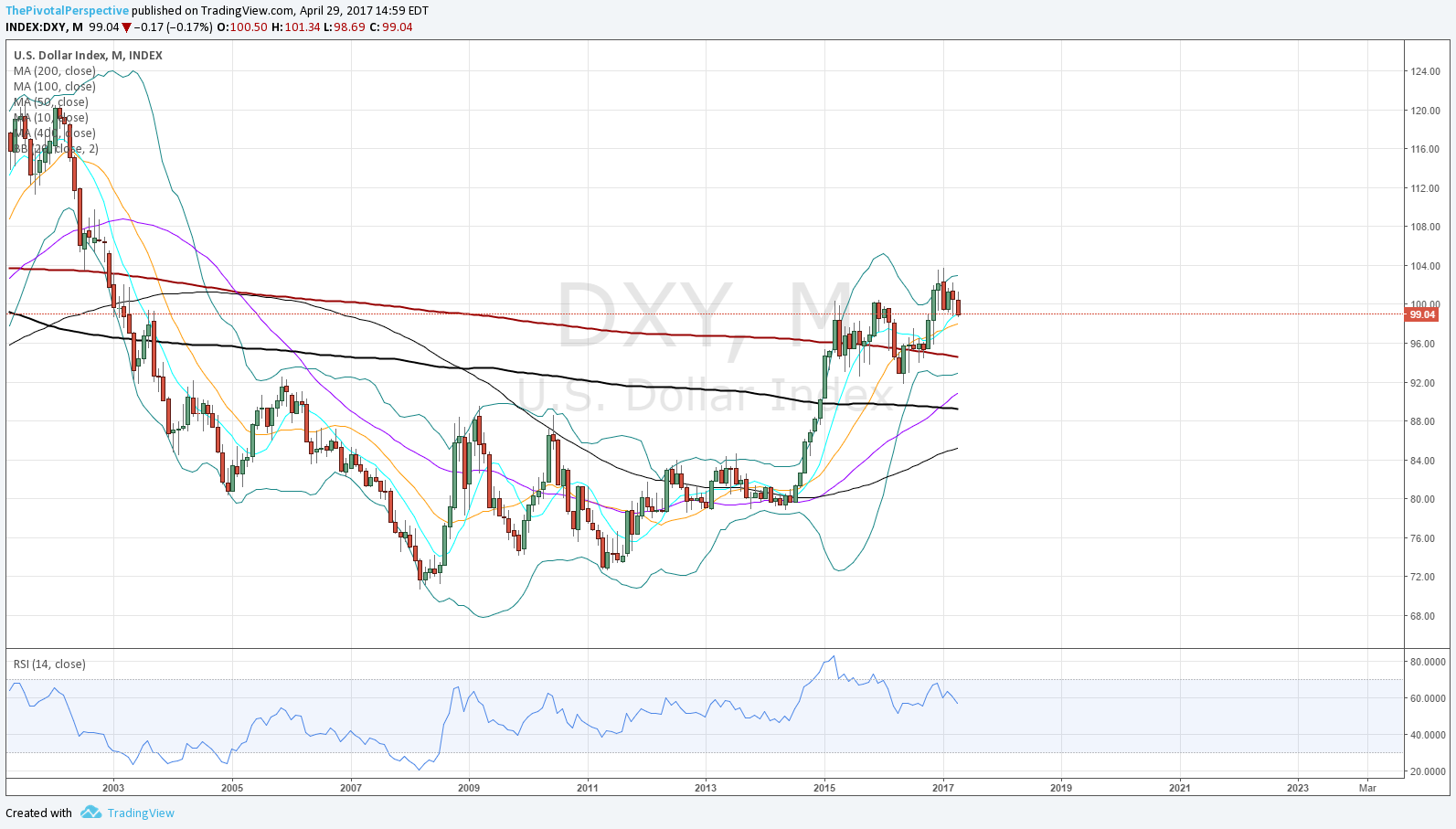

Currency & commodity: DXY CL1 USO

Sum

QQQ amazing and leading all. But other USA indexes showing Bollinger band divergence, a warning sign of potential turn. Trend still gets benefit the doubt.

VIX and XIV supportive of risk assets. GLD reclaiming 50MA, a positive. Both bond ETFs decent advances but my guess is down for the next bar.

Biotechs looks positive, but semis putting in textbook doji bar something to watch. XLE hanging by a thread.

Global stocks mostly strong, especially ACWI, EEM, FXI, and INDA. SHC, EWZ and RSX less so - RSX potential short.

DXY holding MAs, but sliding, no call. Oil looks better on CL1 chart but ETF is terrible.

SPY

Trend up but BB (Bollinger band) divergence, potential negative. RSI still above 70 helps. A combination of BB & RSI divergence would be more clearly negative.

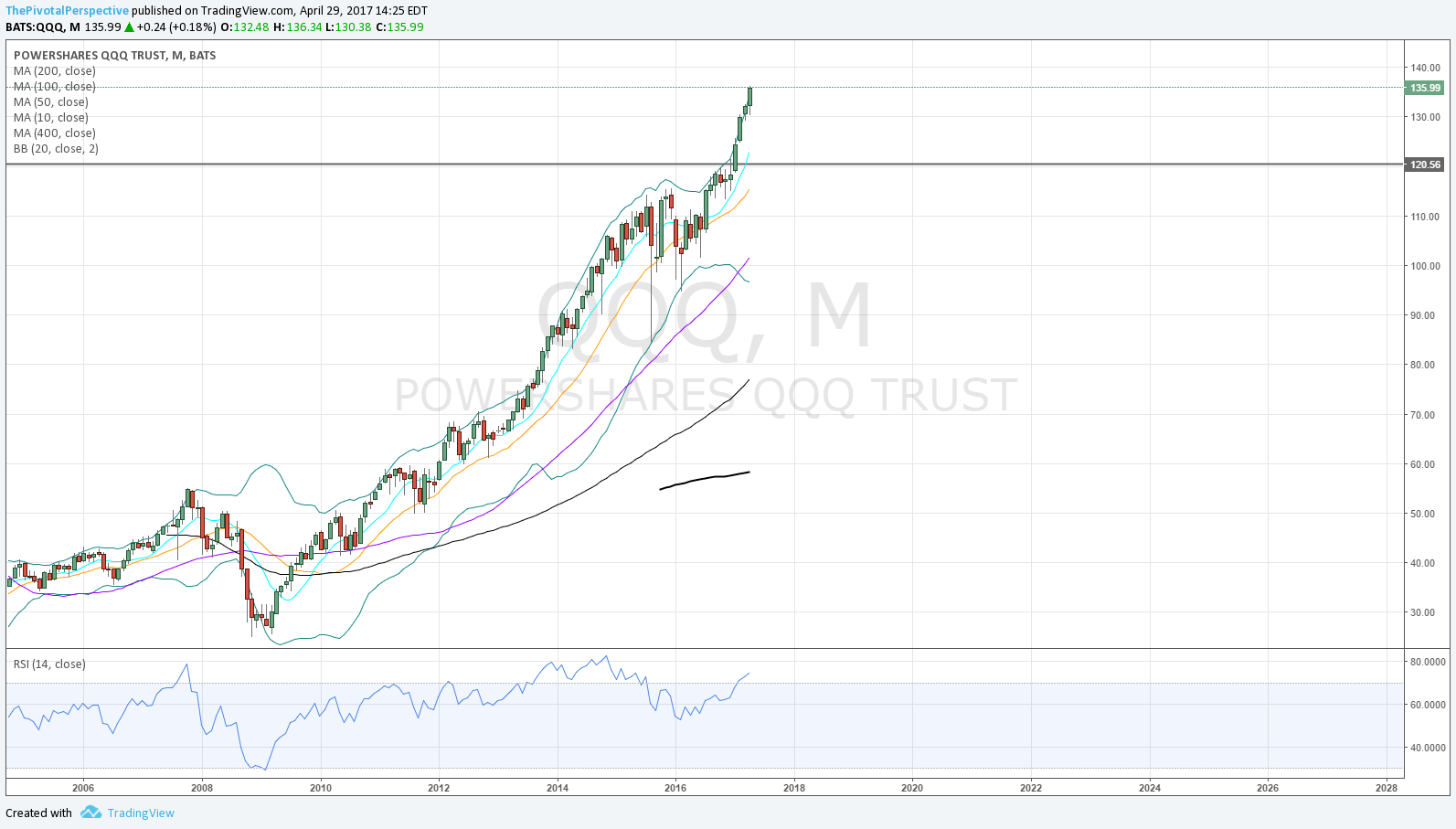

QQQ

Amazing.

DIA

Bollinger band divergence, and April close barely above the last up close of February.

IWM

Bollinger band divergence, and wick invites sellers.

VTI

Bollinger band divergence.

VIX

10.42 is the monthly close low of 1/2007.

XIV

Holy camoly - fell back inside BB only to rally back and close outside.

GLD

Above M50MA for the 2nd time since 4/2013.

TLT

Rallied back above M50MA, but wick invites selling.

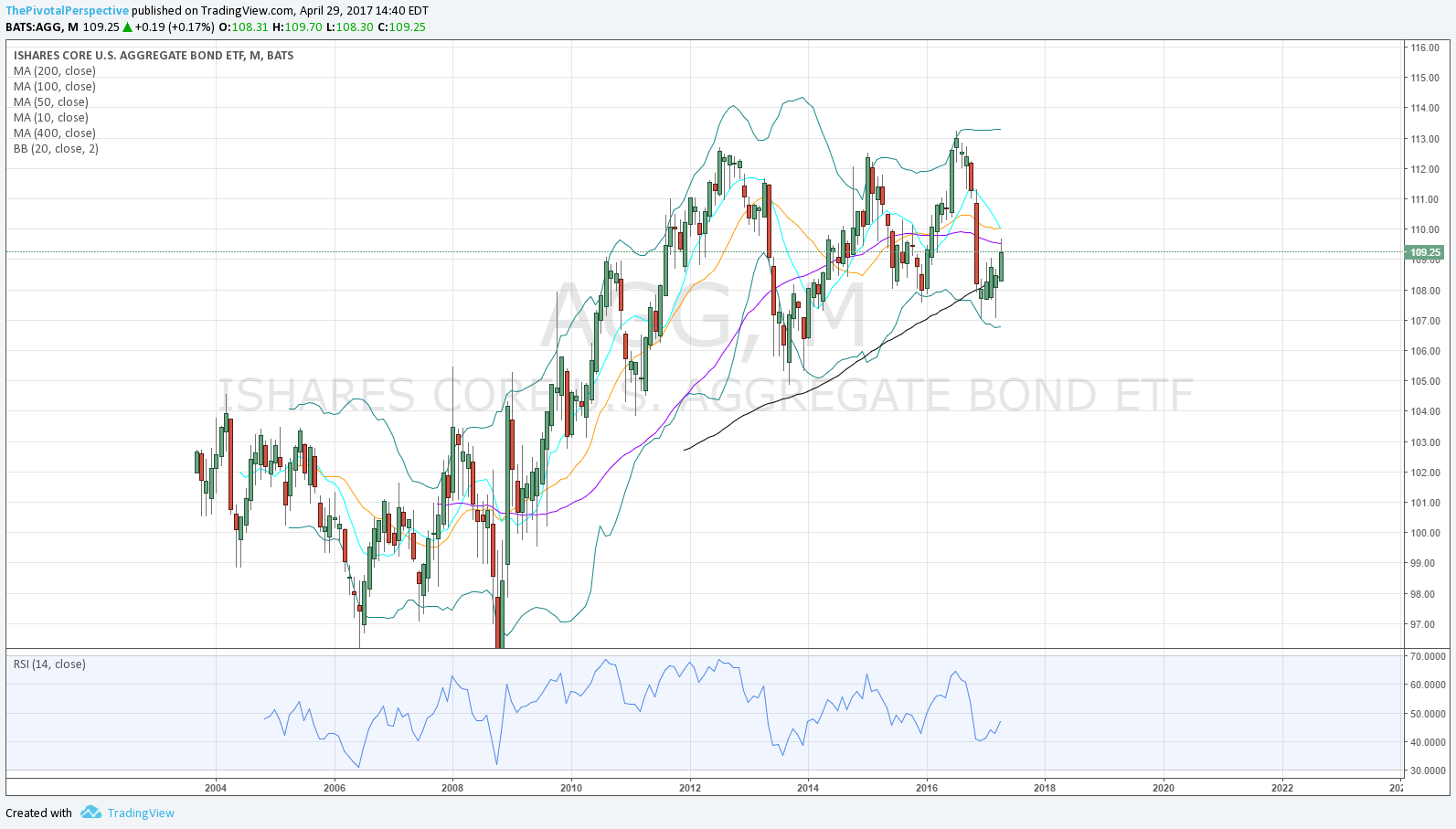

AGG

Decent advance, and above M100MA helps, but stopped at falling M50MA.

XBI

M50MA held on the lows for several months. Approaching 61% Fib level.

SMH

Perfect doji bar! Potential monthly CIT based on this, according to candlestick theory.

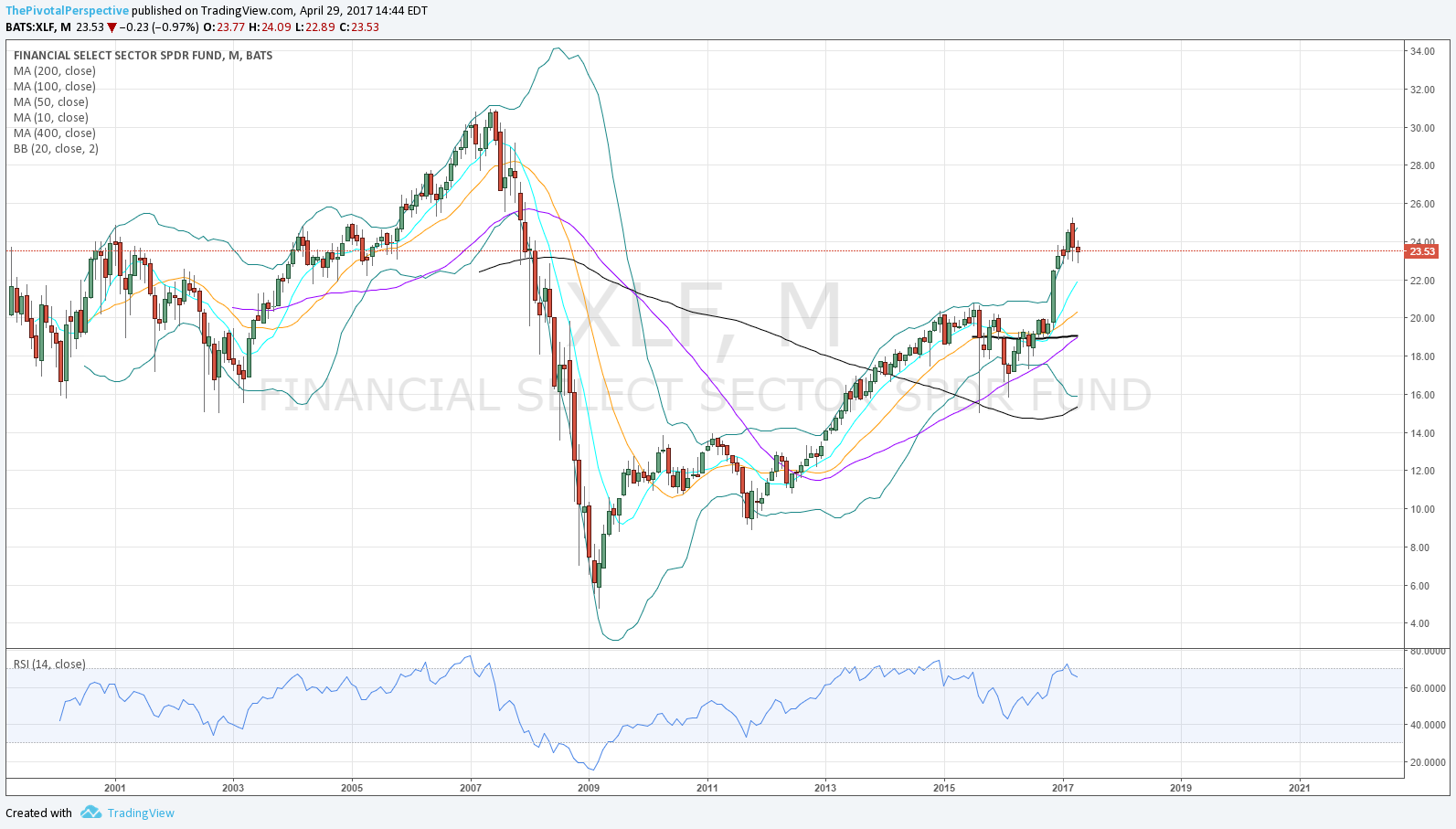

XLF

Not keeping pace this year, but small down bar invites buying.

XLE

I didn't play the short, but did recognize that the 50MA (purple) and BB would be resistance back in 12/2016. Currently holding M20MA, but if any lower, below all monthly MAs!

ACWI

No BB divergence like most USA indexes. Breakout above 2015 highs is bullish.

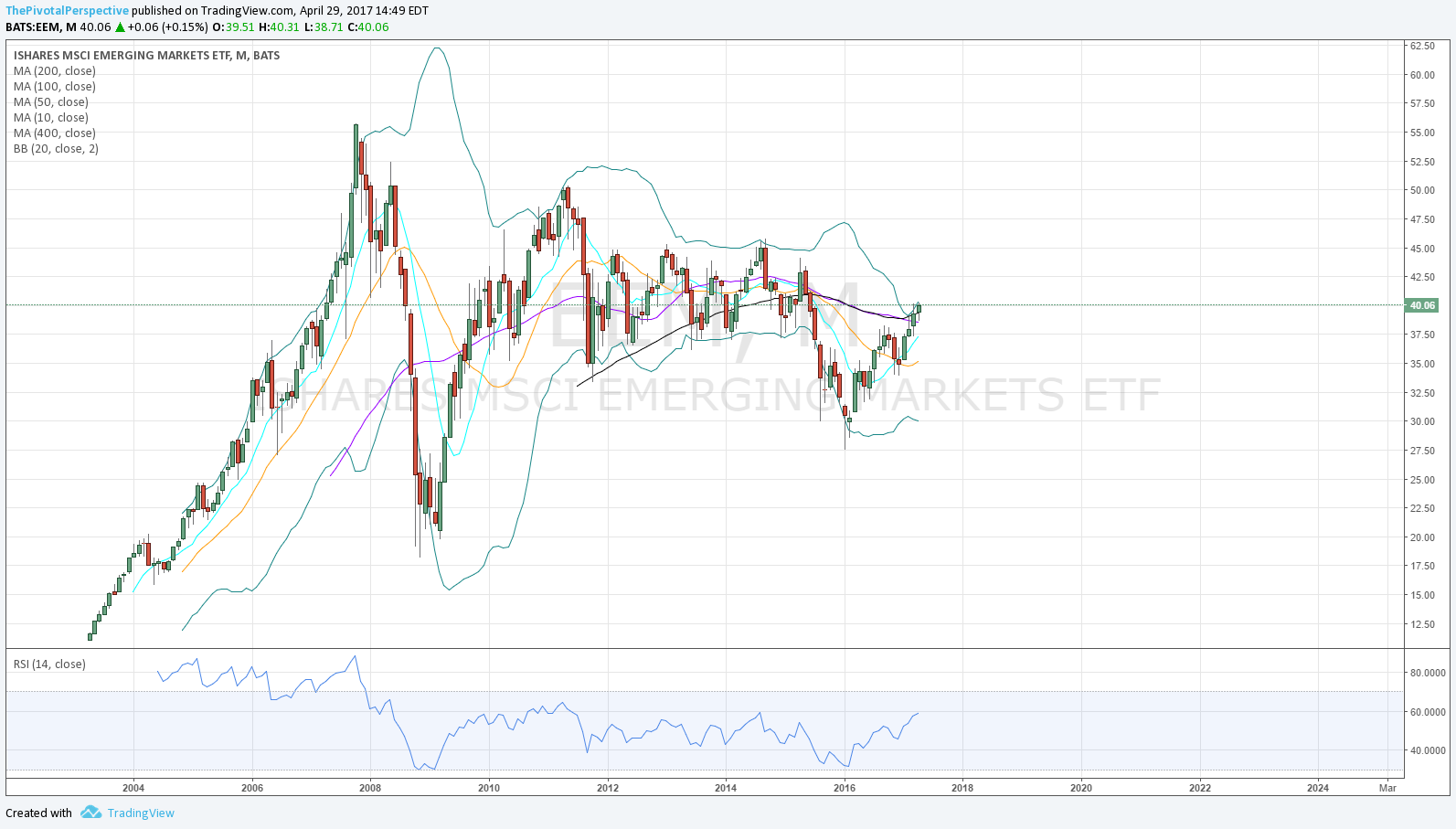

EEM

Above M50MA and M100MA, pushing the BB. RSI plenty of room to go up. Bullish.

FXI

Weak selling that held above M10, M50 and M100.

SHComp

Holding 10MA and 20MA potentially bullish.

INDA

Looking good!

RSX M

Two weak up bars that have held 10MA, but under the falling 50MA. Potential short.

EWZ

Closed under the M50MA as well. Looks better than RSX but still could drop.

DXY

Slight close above 10MA and 20MA, but sliding. Tough call.

CL1 continuous

Not the worst.

USO M

Terrible. Below all MAs, all falling slope.