REVIEW

4/9 Total market view: "... at the end of last week safe havens perked up in a way that we haven't seen since before the election: VIX closed above a quarterly pivot, XIV closed under a monthly pivot, and TLT also closed above a quarterly pivot. If we ignore 1 day fractional break on XIV, then none of these have happened since before the election. In mid-March GLD tested and held its YP and since then rallied to be above all pivots as well. I think the combined effect of strength in safe havens increases the chances for further declines for stocks, or at least will limit upside."

"Staying long risk with hedges that can quickly be covered, should the warning signals given by safe havens diminish."

Result

USA indexes dropped last week as safe havens continued higher.

SUM

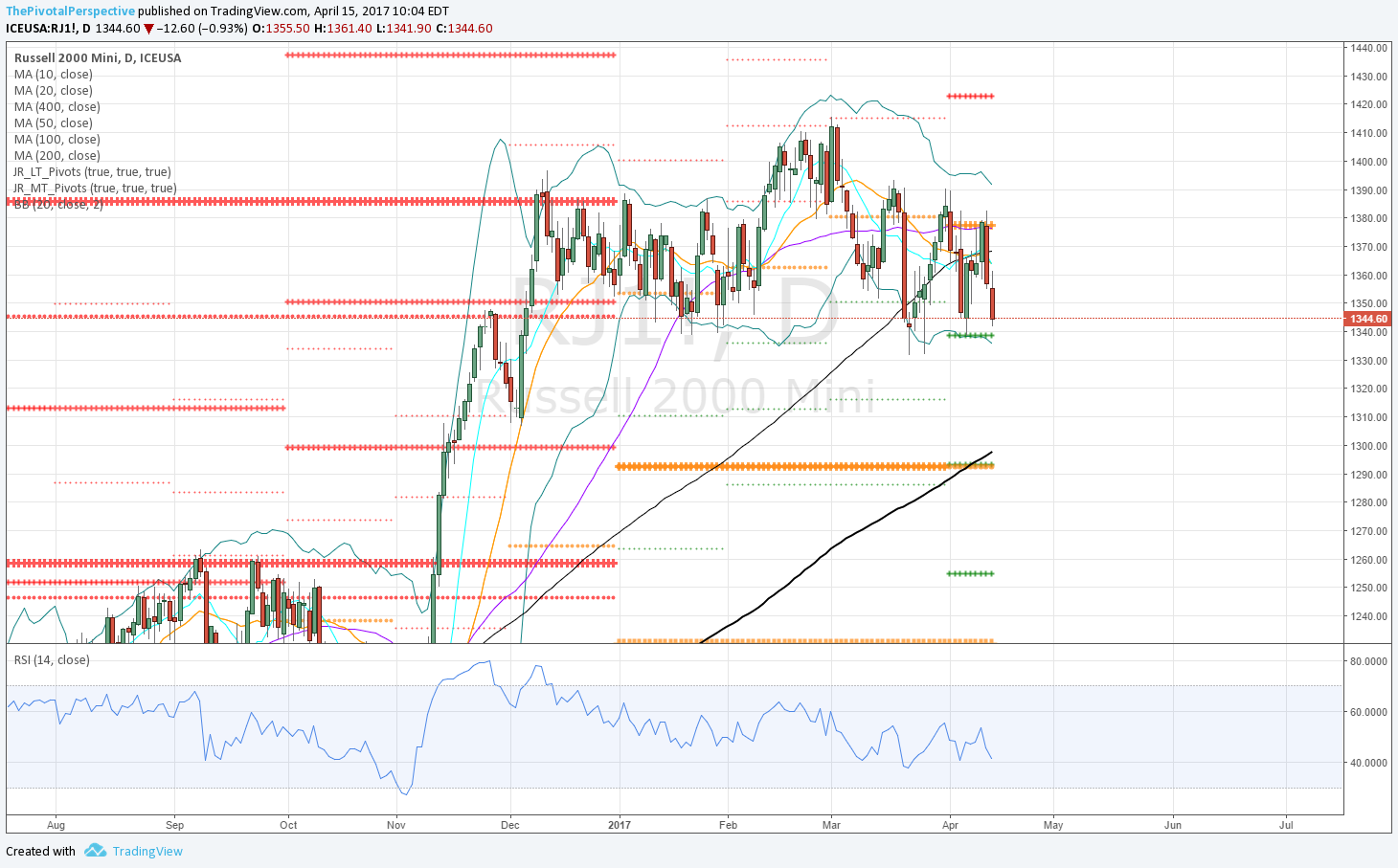

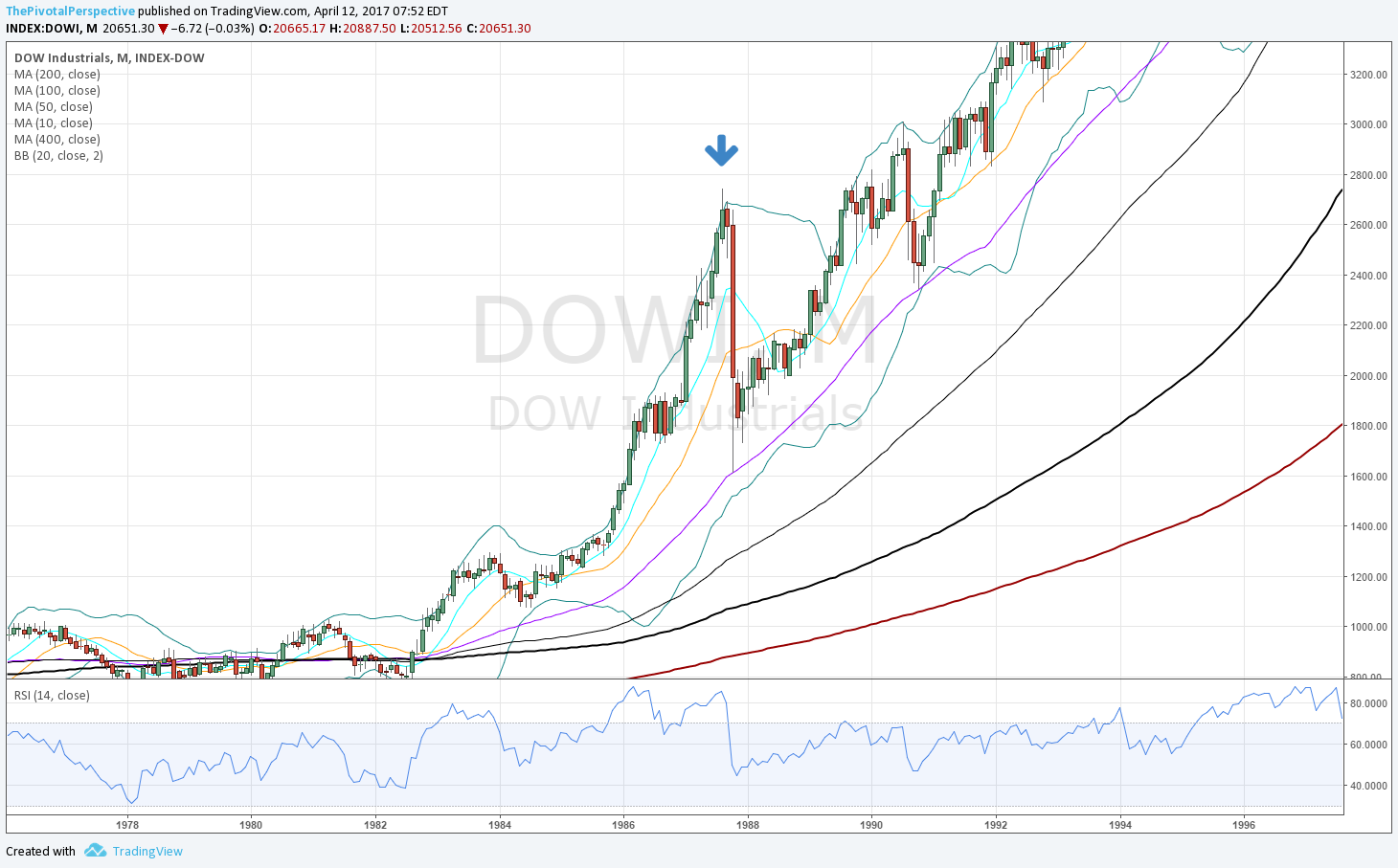

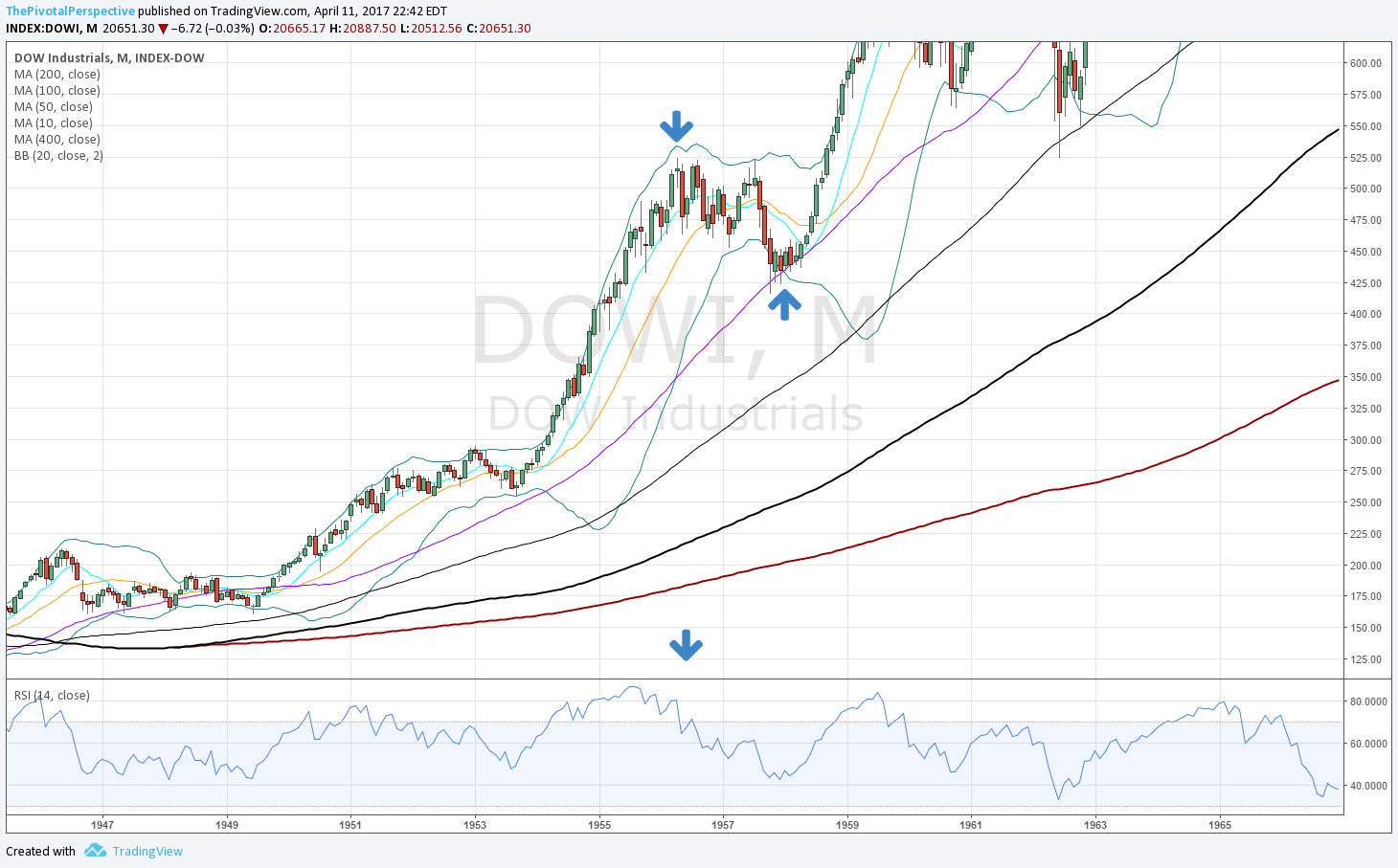

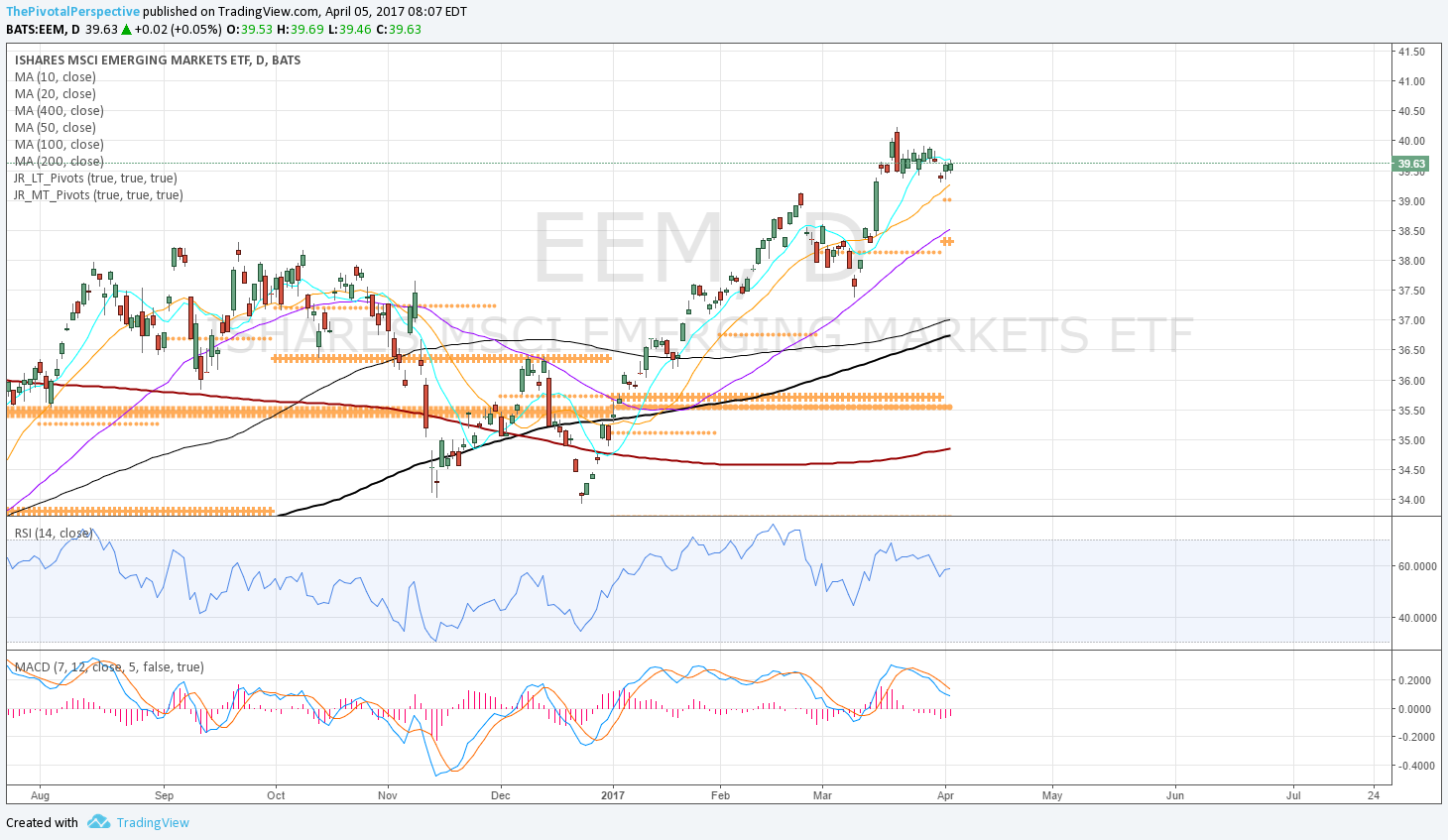

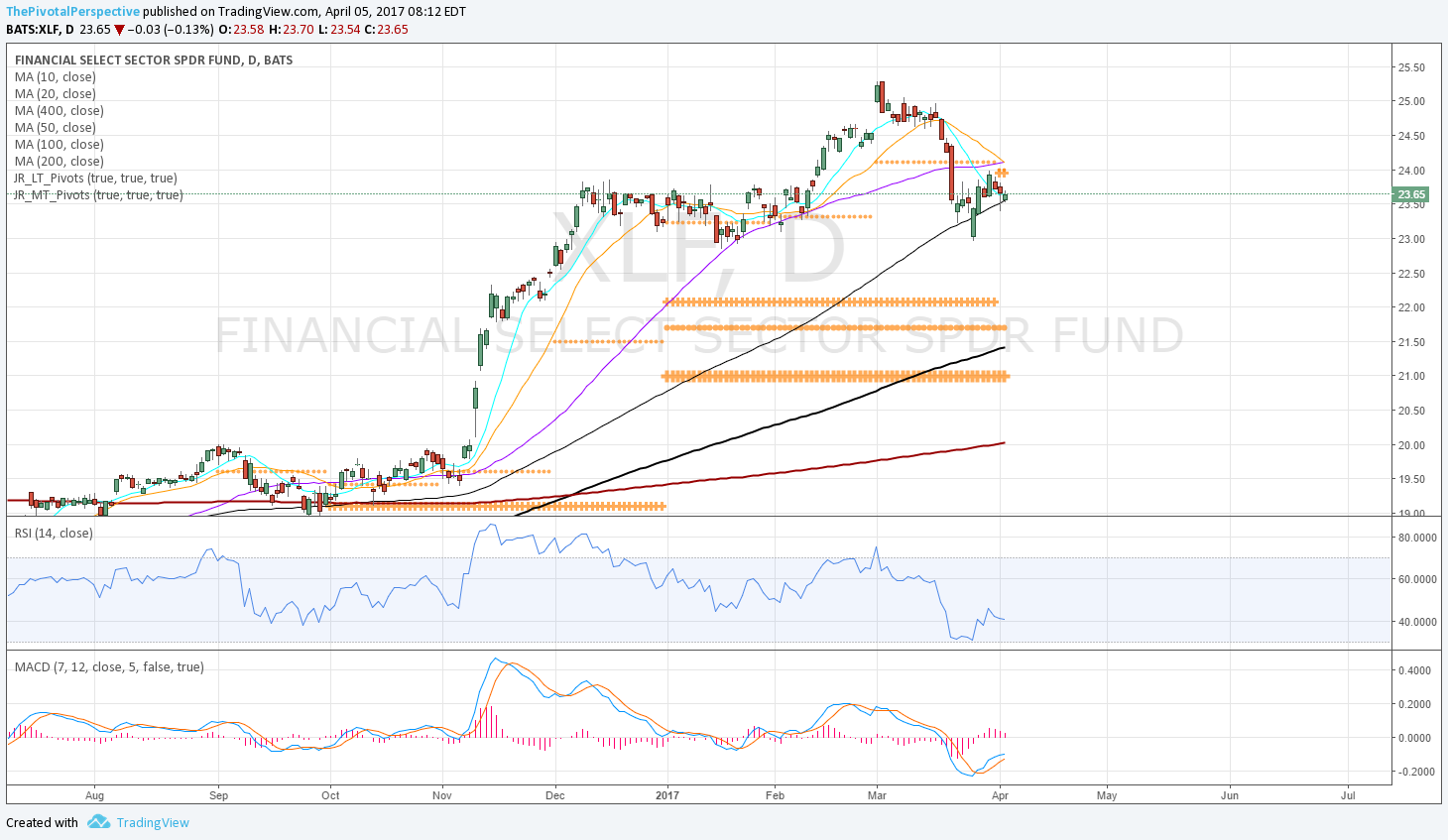

Stocks - USA mains, sectors, & global - have mostly been in rally phase since early November after the election. USA Small caps and financials led in 2016 Q4; and as they have softened in 2017, tech and global stocks have taken over market leadership, making tremendous rallies this year.

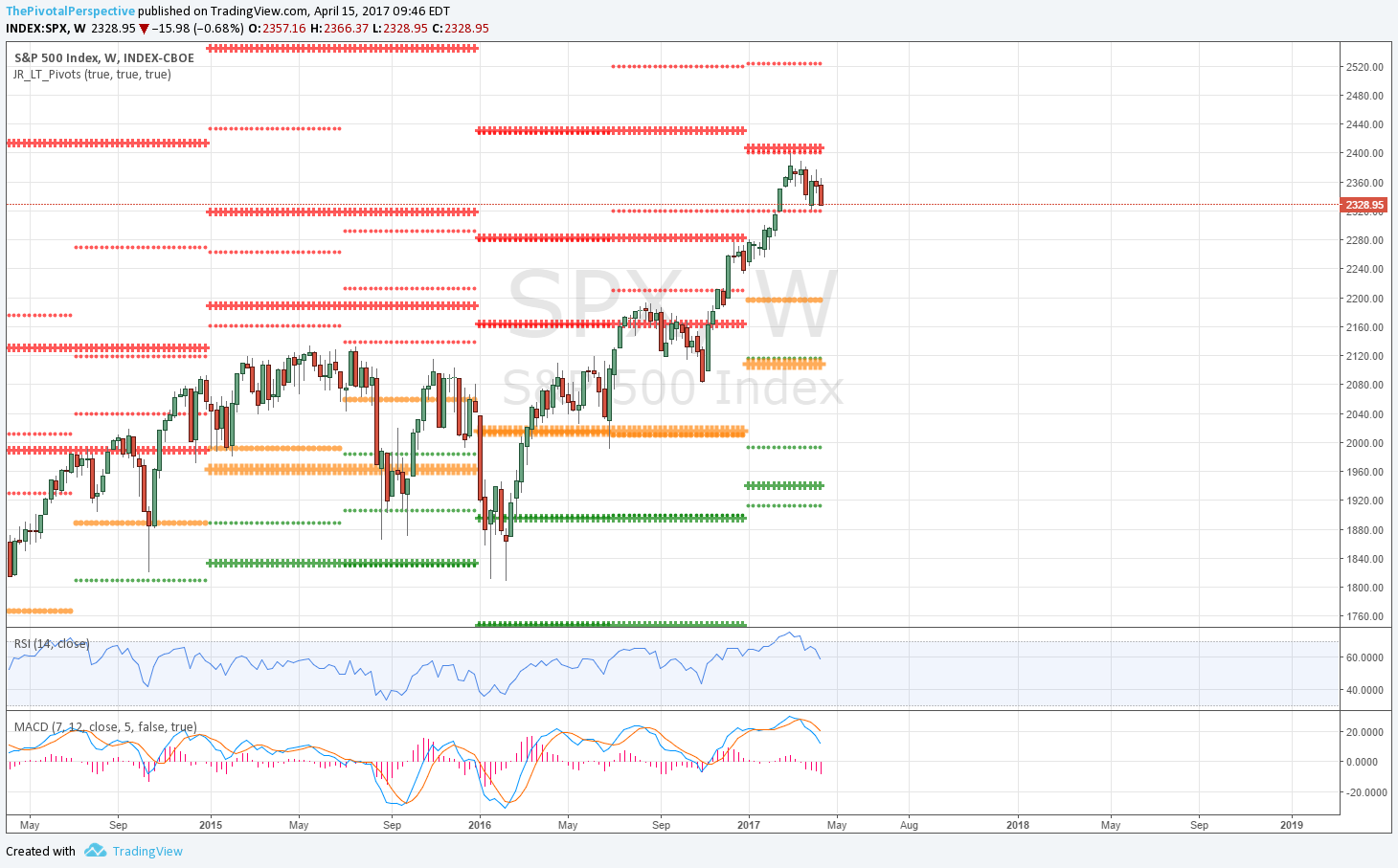

Benchmark SPX rallied 15.2% from 11/4/16 lows to 3/1/17 highs, spanning ~84 trading days. After reaching YR1 and 18x forward earnings, The Pivotal Perspective was that upside would be limited (to SPX or INDU YR1s), and this is exactly what has occurred. On 4/5, I issued a "semi-trouble alert" and reduced long exposure to the lowest it has been since before the election. Most stocks indexes have gone lower since then.

Thus far the correction of -3.2% tick to tick on SPX over 18 trading days has been completely normal. The question is - what now?

Though N Korea worries seem to have ebbed over the weekend, there are still political concerns ahead with the French vote. It is possible that VIX remains elevated, or USA stocks bounce and then fail. It is a week to stay nimble, because a hold here could be one of the better buying opportunities of the year; yet in this environment there is the risk of lower before the bottom that matters.

Bottom line

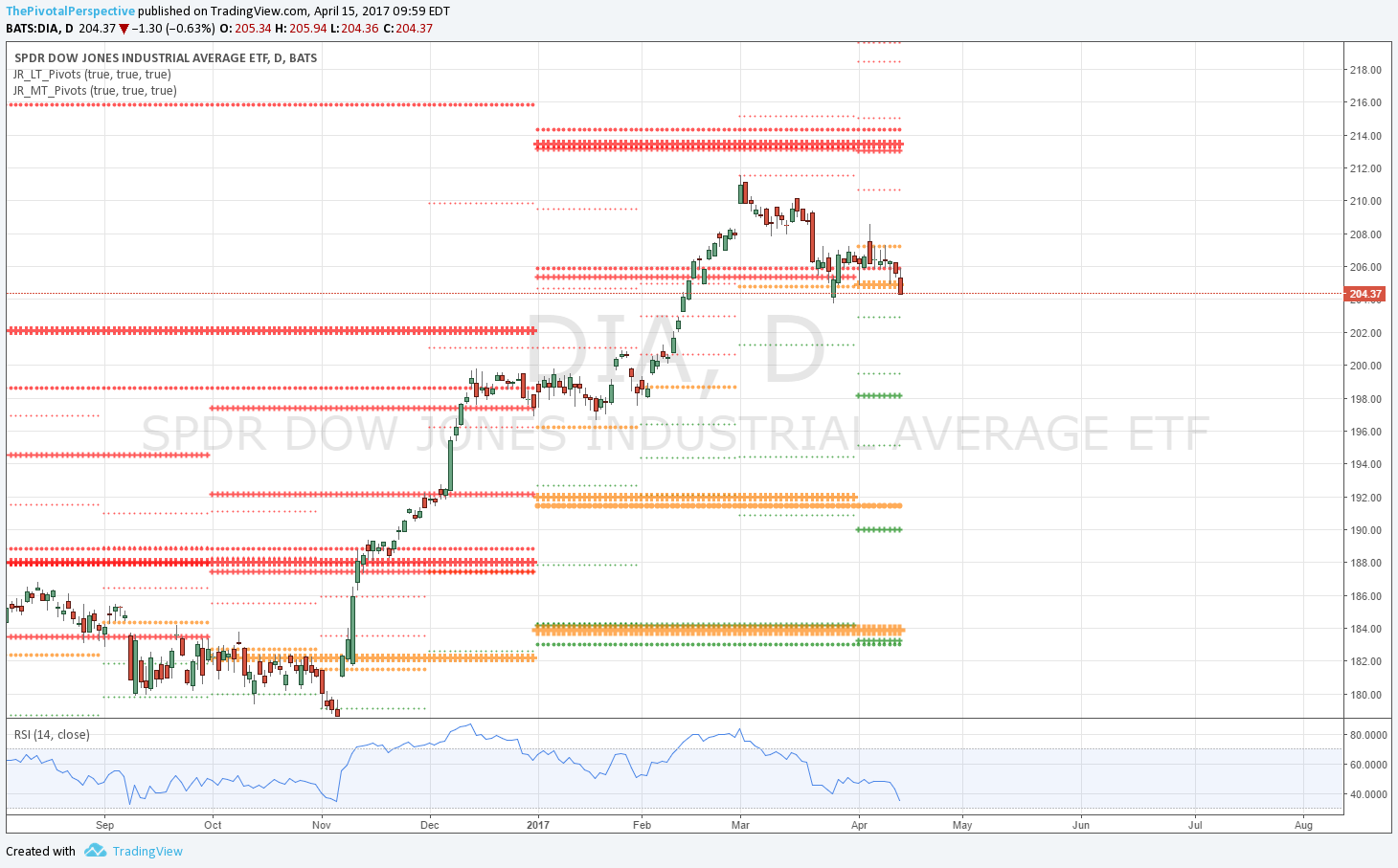

VIX closing just under its 1HP of 15.99, and some SPX and INDU variations within striking distance of recovering Q2Ps, make a bounce a possibility. Should this happen with VIX reversing lower from 1HP, the portfolio will return more long, continuing to emphasize what has shown pivotal strength during this pullback. If lower, then I will likely reduce the USA index positions further.

Positioning

Currently 40% net long, with 4 global longs, and 2 USA longs hedged with 2 weaker IWM shorts.

Note - from here I will add the safe havens as positioning options since I am looking at them carefully anyway. For example, GLD long 3/15-21 would have been better than any short hedge idea.

Though I have designed this site for the active ETF investor/trader, there is another way to use levels and that would be on high leverage under certain circumstances - meaning when several of these elements combine to produce a high likelihood of a turn. A fund with nimbleness and leverage could choose to "go big" during these times. A recent example would have been shorting the 3/1 highs with SPX YR1 and valuation levels reached, in addition to several RSI and BB extremes that were not likely to last. Another example could be long this week, if Q2Ps recover and VIX drops from 1HP.

PIVOTS

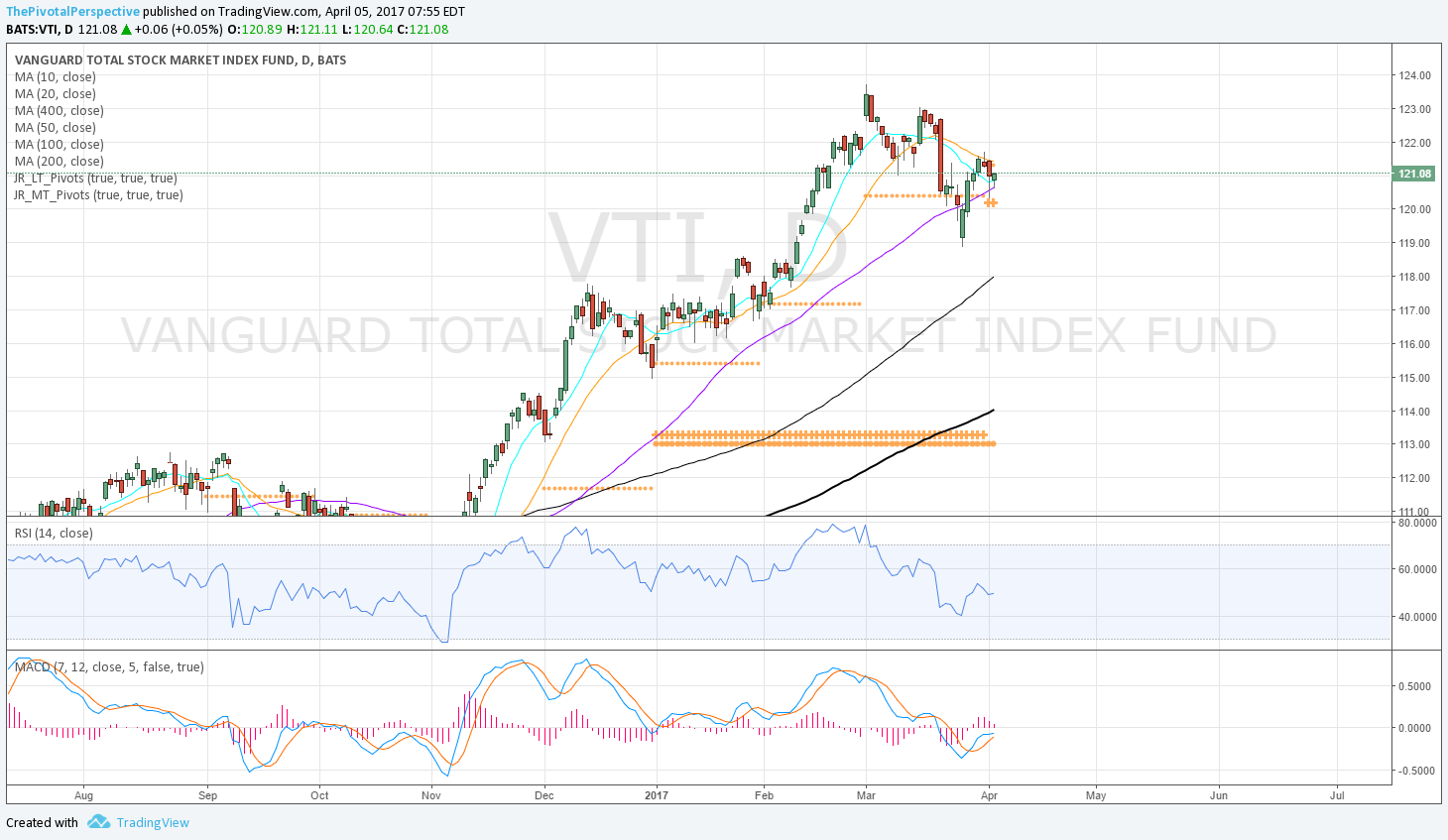

USA main indexes - If lower then watching IWM Q2S1. If recovery then we'd want to see decent liftoffs from Q2Ps on SPY, DIA and VTI.

Safe havens - VIX testing 1HP which I think this will be the key tell. GLD and TLT also on Q2R1s with AGG testing YP. So a lot of safe havens on key levels here.

Sectors of interest - Seems like IWM and XLF should reach Q2S1s during session for a low.

Global stocks - INDA, EEM, and SHComp remain above all pivots.

Currency & commodity - DXY held YP 3/27-28, then rejected Q2P 4/7-11. DXY above all pivots would likely put global longs more at risk.

OTHER TECHNICALS

Been a while since risk assets have been down for quarter and month. While I do think there is chance of a bounce this week, it is equally likely that real buying will not begin until indexes are lower.

VALUATION AND FUNDAMENTALS

18x forward earnings on SPX basically nailed the high. Decline not enough to attract value buyers yet.

SENTIMENT

Crowd already bearish pn 2 of 4 measures as of 4/6. This tends to limit damage and duration of stock declines and adds possibility to short squeezes.

TIMING

(Proprietary experimental work in progress model)

April dates

4/6-7 - minor stock low

4/10 - key lower high for USA main indexes

4/19-20 - looks bearish for stocks, positive for safe havens

4/26