If an analyst on Wall Street caught the low of the year in oil after an 18 month crash, the key low in stocks after the worst start to a year in a century, and then somehow managed to recommend a short in bonds literally AT THE HIGHS, not to mention turning bullish on bonds early in January and bullish on gold later January, oh yes, there's more, calling for a key turn in stocks just after 6/9 and then was steadfastly bullish on stocks 6/27+, then that analyst would probably would be in for a 6 figure bonus, maybe 7 even, and/or starting up his own consulting agency a la Tom Lee at FundStrat, or at least getting some CNBC TV spots, don't you think?

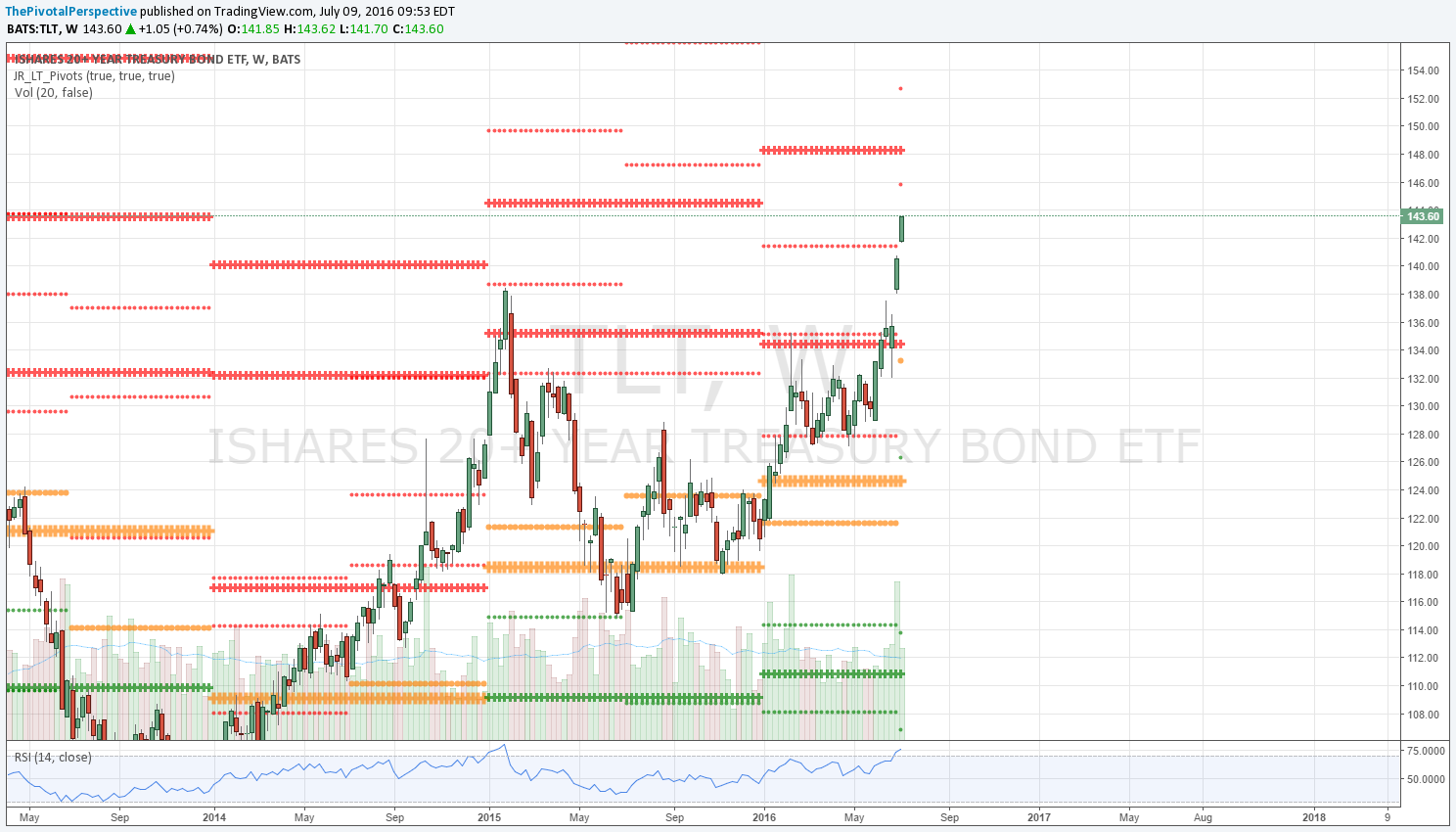

This would especially be the case if that analyst was not trying to buy oil all the way down, only on the low of 2015 and low of 2016; went out of his way to say don't buy yet regarding stocks in January, but started to buy in February, then added on the way up; said buy bonds then ADD, buy gold then ADD in January and February; and said short bonds ONLY ONCE this year year, on 7/6, within .02 of the exact high in TLT!? In other words, that analyst was not a broken clock right twice a day, but have nailed the key turns this year in oil, stocks and so far, bonds too; and been on the right side of all the major trends of the year. And could even go on with other recommendations in EWZ, RSX, EEM, SOXX, even bitcoin!

Well I am that person - and sad to say, no Wall St bonus coming my way within sight thus far, but if you are fund interested in someone with proven capability of making these kinds of calls, - I'm available!

So yes, here are the quotes:

7/2 on TYX daily chart: "From The Pivotal Perspective, downtrend in force below Q3P at 2.43 and still long term bearish below 2HP at 2.52. First target Q3S1 at 2.10, then 2HS1 2.02."

"Also RSI extreme with some divergence. A reaction move would be normal, but given the momentum think we will ultimately see lower."

7/6: "Interestingly, as "analysts" are starting to sound calls for TNX 1.0 (the % not a computer program version), I am increasingly wondering about a major turn in bonds based on major levels and RSI. TNX came very close to reaching YS2 today and remember the big turns that seem impossible happen on the big levels, just like the USA stock low of the year on RUT YS2 exact. Remember, resistance levels are better used as profit areas on longs instead of shorts - but if you want to take stabs at speculative trades (ie short above all pivots), then multiple RSI extremes and levels are the place to try. Watch reactions on these levels: JulR1 reached today, then Q3R1 just slightly higher 143.64 which would be a good tag area for a setup. If above that then I'll start thinking 2HR1 / YR2 combo 145-148."

7/9: "So we saw 2.10 last week. We are starting to be in an area where a turn is possible..."

And 7/11-15 was the worst week for bonds in a year, and the TLT high according to my data feed was 143.62.

To be completely thorough, we could check pivots and other technicals on ALL of these:

TLT

TYX

TNX

ZB current contract

ZN current contract

ZB continuous contract

ZN continuous contract

On all appropriate timeframes. :)

So if you are still reading, thanks, and I will try to boil it down to the most important charts.

Lows

Very simply, TYX above 2015 low of 2.22 is bullish, and TNX above its 2012 low of 1.39 is bullish.

Pivots

TNX within a hair of YS2. Note 2015 low of year very near YS1.