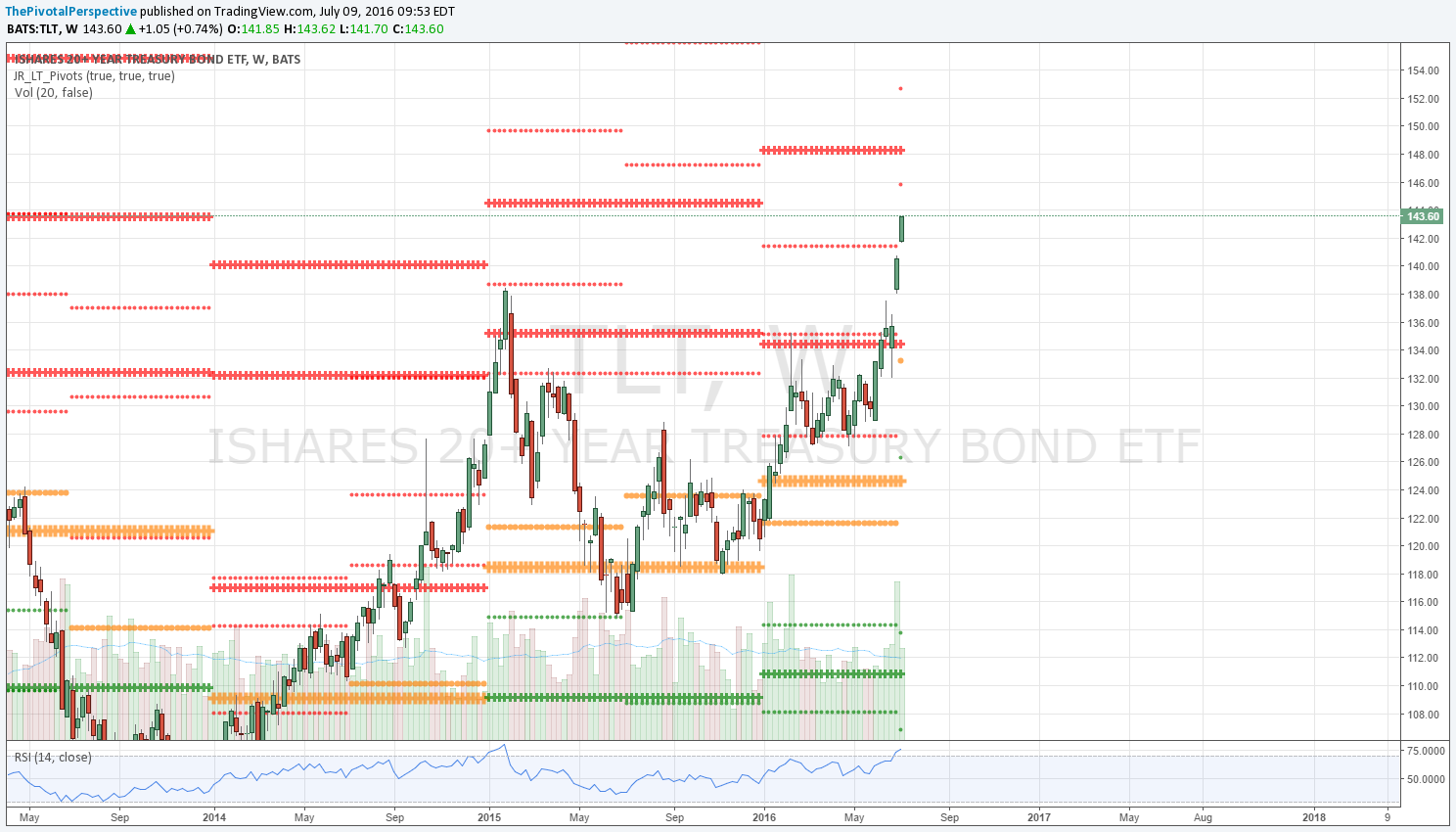

TLT

Wow, melt-up in process. Looks like going for 2HR1 - YR2 145-148. Long term buy and hold the first two weeks of 2016 have done very well, and even if shaken out of some portion after the February top and drop, every reason to be bullish from mid March on with clear holds of 1HR1 as support. That said RSI in historical extreme area and some reaction down more likely.

Daily chart already at Q3R1, with RSI fully OB (overbought) every day this quarter so far. Pushing higher despite the move in stocks on Friday is quite remarkable. From here a move to 145-148 looks very doable, but I'd kinda rather see a shakeout with a reaction down from this Q3R1 first.

GLD

Also looks quite healthy and likely to see 2HR1 / YR2 before the year is out. Near term bang on Q3R1 and RSIs OB.

VIX

VIX made a rare disappointing wrong move on 6/23 when it suggested to buy in front of the vote. But it has more than made up for it on 6/27-28 when it showed no panic on 6/27 despite indexes being sharply lower, and gave all clear for significant longs on 6/28. The only problem here is that we are less likely to see major support for a stock top because the level is so low - Q3S1 is is 9.84, so I'll give extra attention to XIV.

XIV

Above its 2HP, Q3P and JulP, but well under the YP. Plenty of room to move up and more bullish above Q3P 26.43