Market risk is getting real! But dedicated readers of The Pivotal Perspective should be quite comfortable and if you are really listening then quite green this week.

Consider -

Throughout Q2 I have been pointing to weakness in most of the international indexes I track; these have been avoids or shorts (SComp, FXI, EEM, KWEB, INDA, RSX, EWZ, ACWI). Therefore you have been spared EWZ / FXI / EEM meltdown or better caught some on shorts.

TPP emphatically urged to take profits on IWM the week of 6/17 if we saw a HR2 / YR2 tag, and even mentioned a speculative short. (YR2 near exact on the high.)

I tweeted on 6/19 that momentum trades such as IWM and FAANG would be sideways at best 6/26 to August and more likely down, and added potential for a significant market drop. So far key high 6/20.

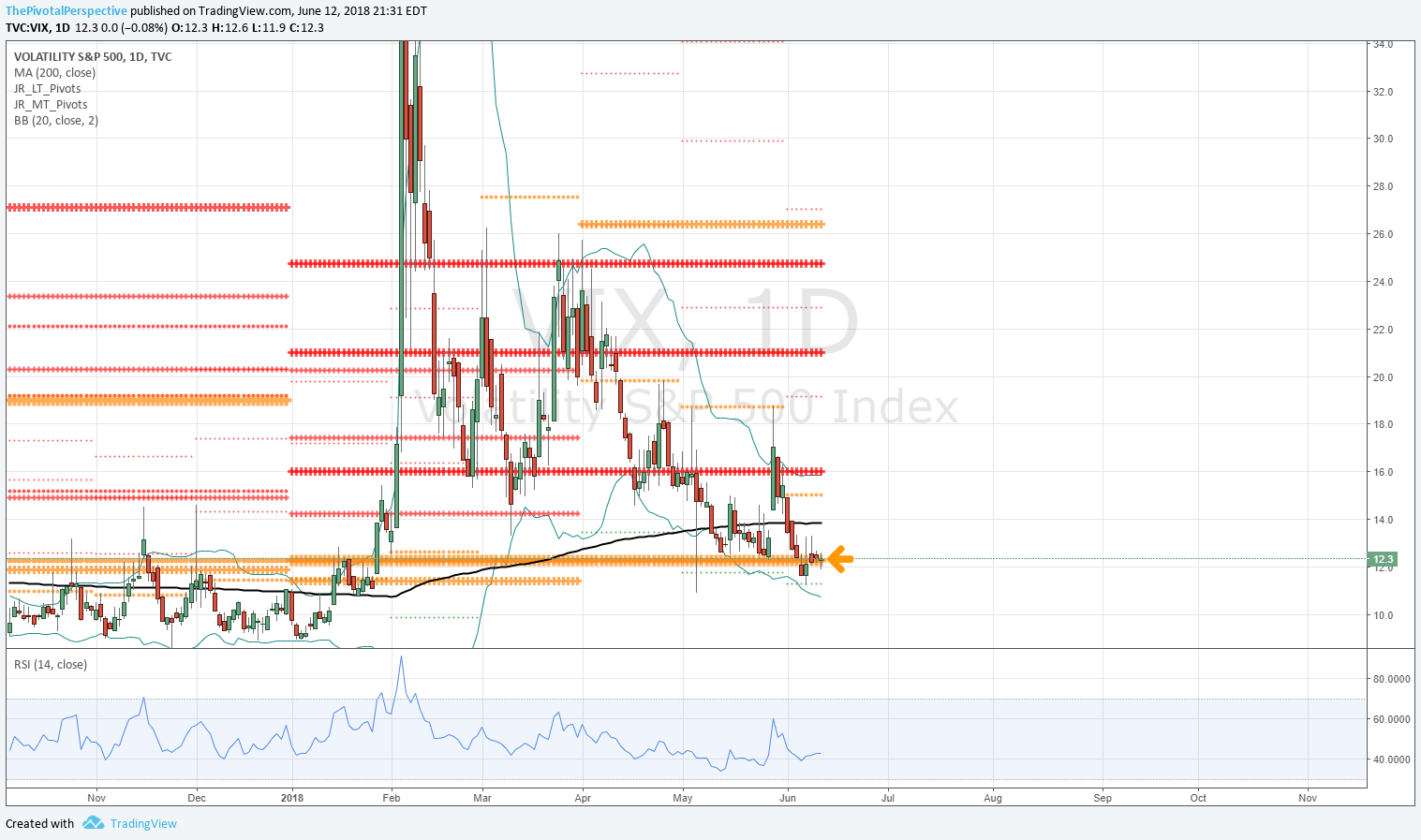

Daily comment mentioned a VIX hedge for the first time in months on 6/20.

6/21 Daily comment recognized the threats - "That is quite a lot in the bear column and not much in the bull side. Although Friday could be a sideways day or limited bounce, my conclusion here is that today is not the low and more downside to come."

Other recent recommendations - TLT long as early as 5/23 and again emphasized last week; speculative short on SMH one day from the high; IWM speculative short near the high; raising cash in general, and most recent trend trade rec from the last Total market view was XLF short (along with TLT long).

There have been times when I have been defensive and wrong and such as October 2017 or May 2018 but in these weeks the small dings on hedges are made up for quite significantly when risk gets real such as the recent turn, and this time I have been more vocally urging the speculative shorts and not just hedges.

OK now what? Are risk assets near a bounce or are they going lower?

Actually, I think both. Likely near to some short term bounce, in the bigger picture going lower.

SPY heading towards QP MP and D200MA test; but on track to open below 2HP! If that happens and 2HP continues to act as resistance then that is long term weakness.

QQQ leading lower, on track to open below JulP.

DIA decisive rejection of MP and D200MA today - bearish. On track to open below 2HP, Q3P, and JulP.

IWM biggest main index loser today, and that tells you the move is not all about China trade. It is about the unwind of momentum. Now also on track to open below JulP.

NYA HP break along with D200MA rejection - bearish.

TLT exploded above QP. VIX higher close, but an argument for the bounce is not higher in price than Monday.

XLF is testing its YP as TLT is set to open above 2HP, Q3P and JulP - the market is NOT prepared for this.

All that said, it is possible that we could see some bounce if SPY tests and holds the QP / D200A area in the next 1-2 days.

SPY, IWM, XLF and TLT below.