Of the 5 USA main indexes, only 1 is at any pivot resistance level - IWM tagged JuneR1 today, with HR2 & YR2 not far above.

Typically tops take multiple indexes on resistance, so this is a bullish sign for the market. I was watching the new U contract resistance because some funny things can happen on the rollover futures contracts (that don't align with the ETFs & cash indexes) but so far those are resolving in bullish fashion.

TLT and GLD are weak, below all pivots.

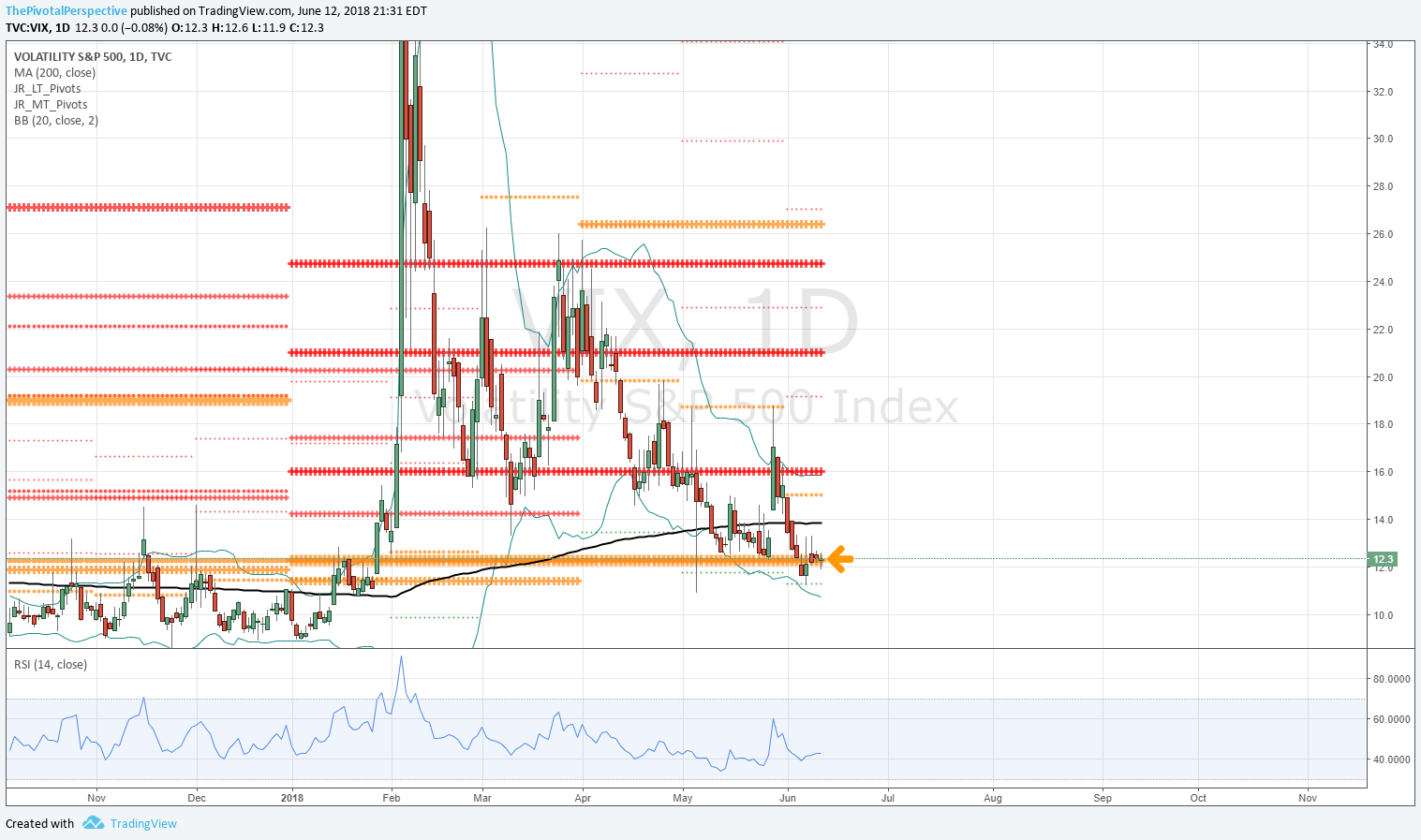

Only VIX - barely holding on to a close above a YP - suggests a possible top. This was partially canceled by VXX making a new low and closing under the JunS1. Seems like ball is still with the bulls.

SPY, IWM, ES (U) and VIX below.