Themes of the year continue today - stocks mixed, commodities namely oil up, bonds weak.

The question for most readers will be is if stocks just made an important trading turn. Obviously signs compared to yesterday have definitely increased with QQQ YR1 rejection, VIX YP hold, and NYA QP slight break.

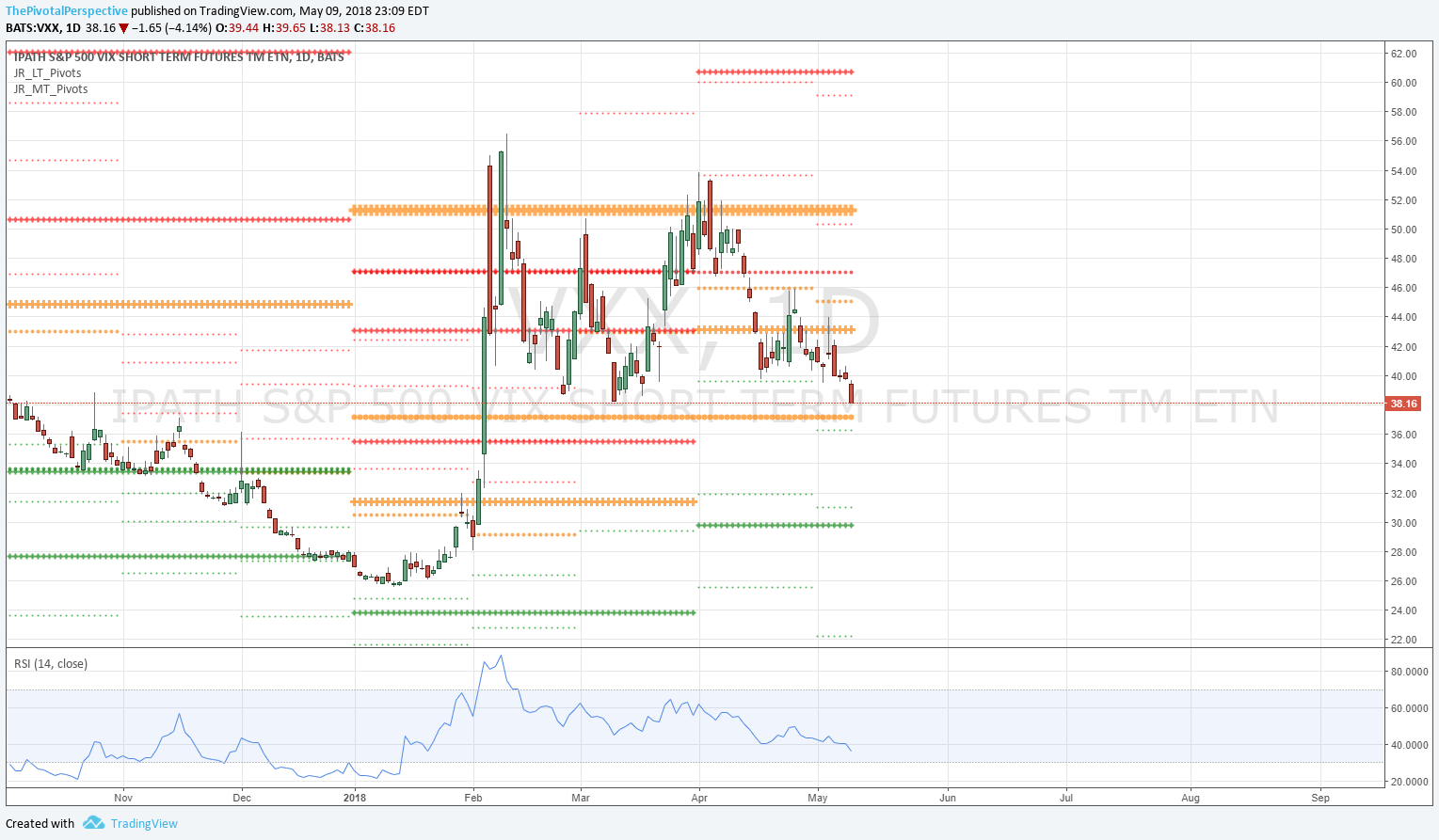

But bears didn't get everything today, and you could view this as simple pullback to SPY WP (weekly pivot) after a fantastic run. In addition, DIA held QP on the close, and VXX stopped cold at its HP, remaining under all pivots except DP.

My bias is bearish because I don't think QQQ will close outside its quarterly Bollinger band, and I think we just saw professional selling near the monthly close high of 169.40 on QQQ. That said, for any serious decline we will need to see more USA mains below weekly pivots and VXX confirm the selling by recovering its HP. In addition, DIA has been a great indicator as it historically often is, so a real decline will mean DIA moves under its QP with the look of rejection. For today, it held.

But with massive hold of YP on VIX, together with QQQ YR1 rejection and IWM cluster rejection, maintaining all longs seems not quite right either. Yesterday I mentioned taking profits from recent entries of 5/3-4. So far that has been the right thing to do.

PS: Bitcoin moving below all pivots tonight as I type and first major support is in the the 3000s.

SPY, QQQ, DIA and VXX below.