REVIEW

5/13/2018 Total market view: "Bottom line - if you followed recommendations of the past few weeks, you have been long oil, small caps, tech and most recently semi-conductors and did well on the recent rally. It is time to watch to lock in some of those gains, but if indexes continue to show strength then letting the trend play out further will be the right decision."

Result - In the past week USO and IWM cleared resistance levels, but QQQ ans SMH/SOX gave back some gains.

SUM

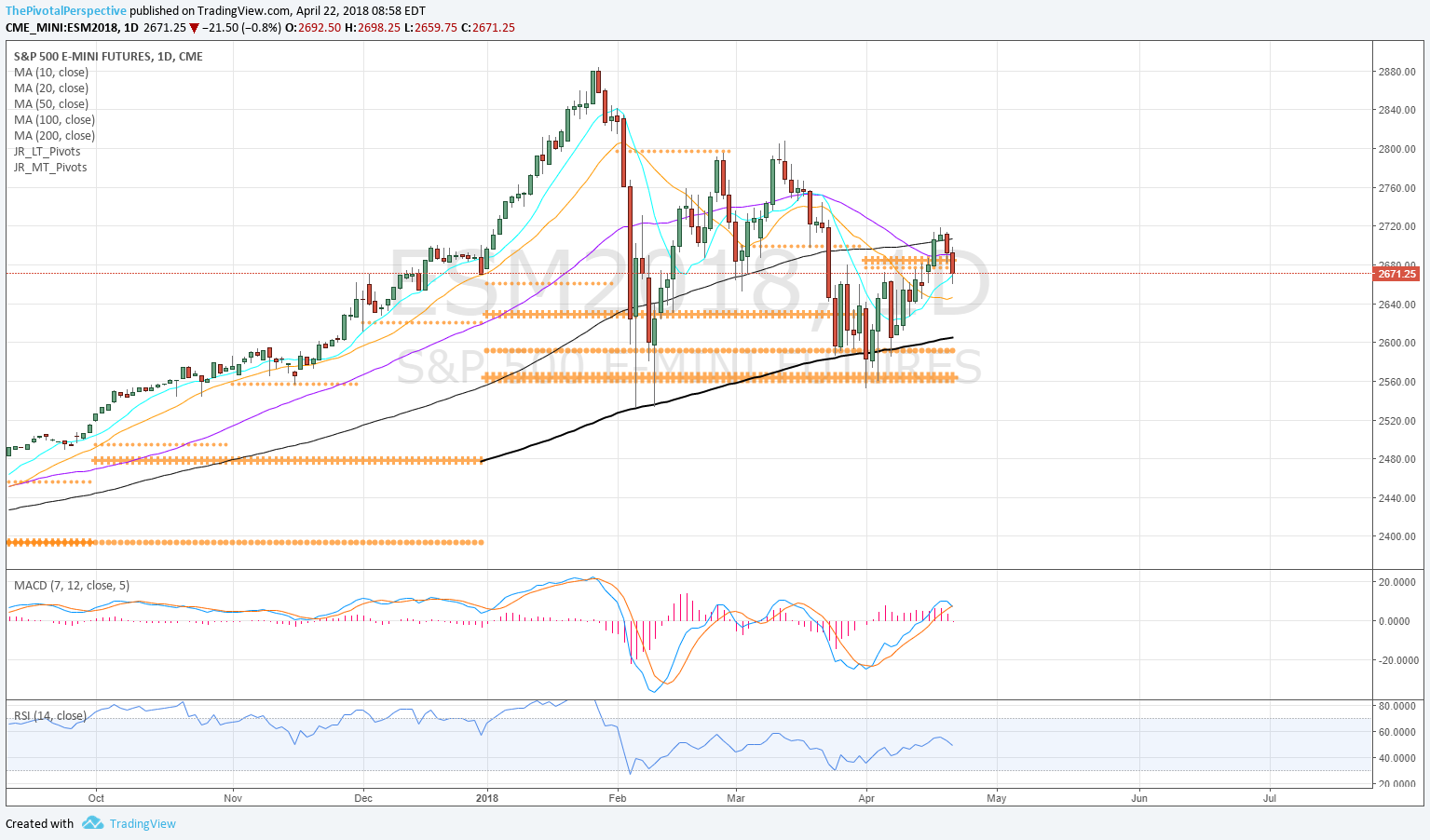

Stocks indexes are in uptrends, with all 5 USA mains still above long term and medium term pivots. However, most of these had a mild reaction down from resistance last week: SPY MR1, QQQ YR1, DIA MR1 and NYA MR1. Only IWM had brief pullback and finished the week above resistance.

This was mostly as expected per last week's USA main index review: "Indexes are at resistance in the context of a bull move. The task is to judge the likely path - immediate clear (less likely to my eyes), pause or small pullback then clear (possible), or decent drop (also possible)."

To use this language again, only IWM had small pullback then clear; and others had a small pullback and next larger move is still TBD.

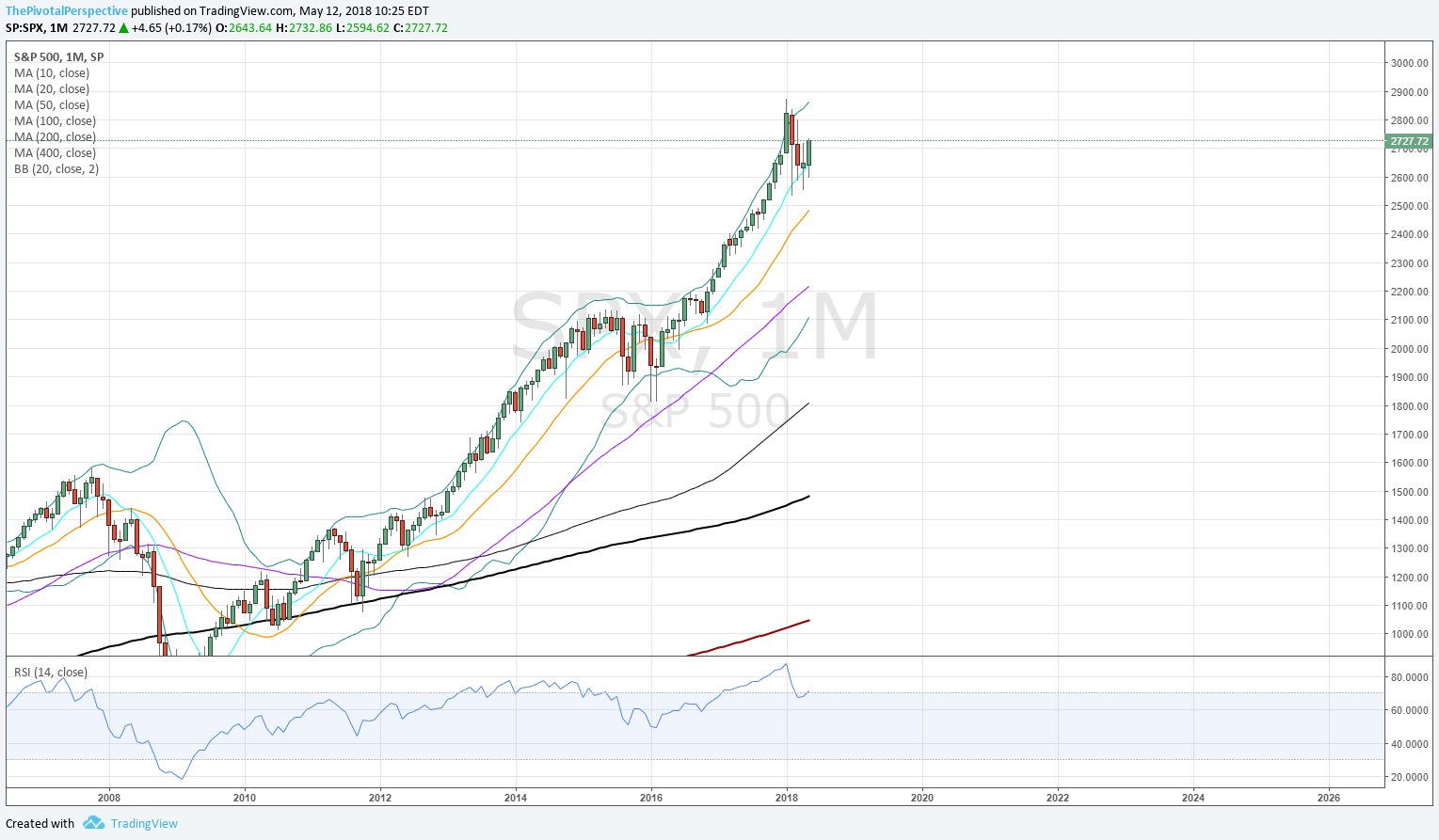

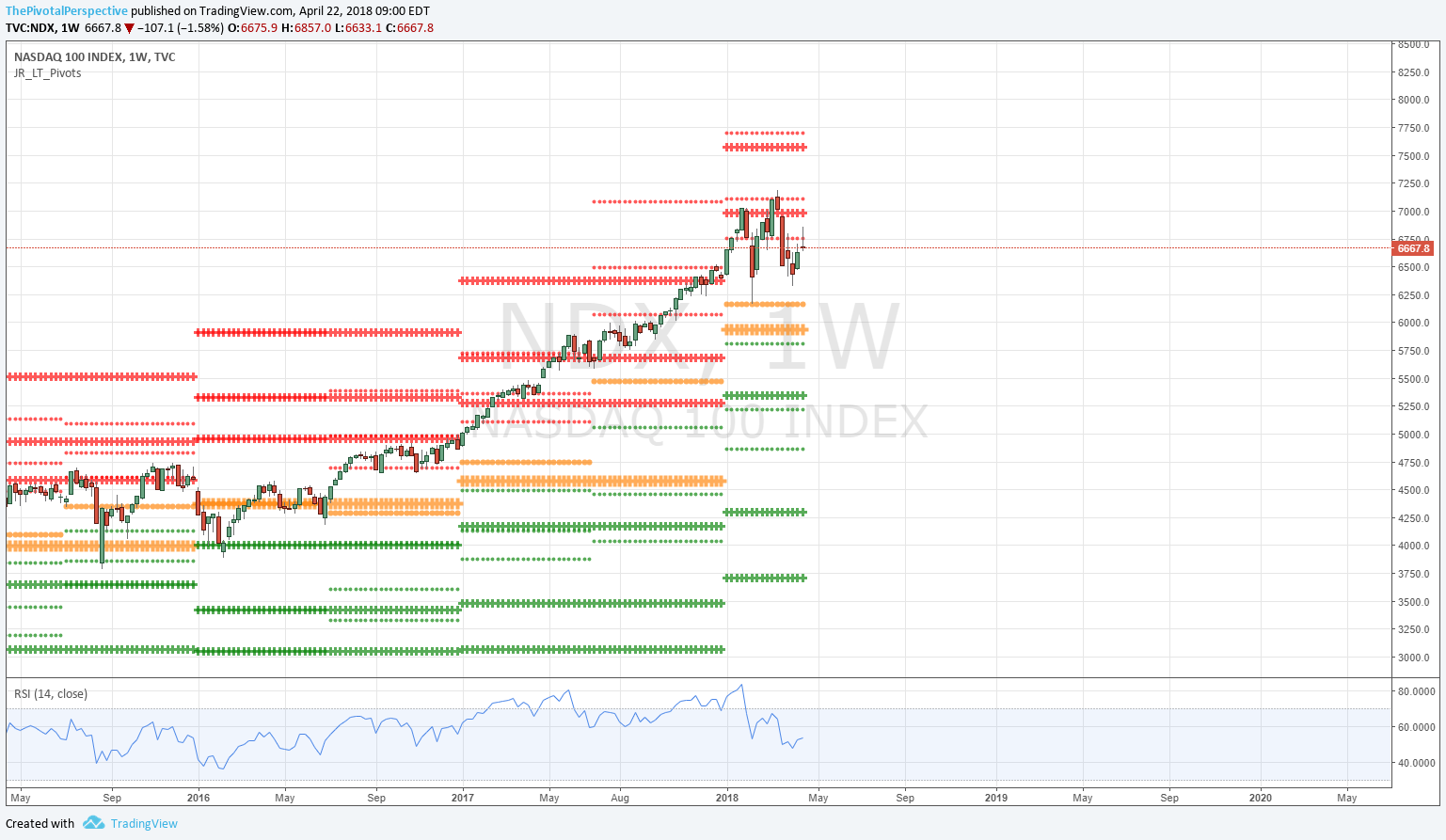

I think we are seeing signs of professional selling which means that next larger move will be down. SPX quarterly Bollinger band is 2742 and that was the exact high to the point. NDX got whacked from its YR1 level which also happened to be near its monthly close high. The Dow Q2 high at 25K is still outside its quarterly Bollinger band and so far it seems to be falling back inside the band.

If this idea is correct then we will soon see DIA and NYA break under their QPs and other USA mains join QQQ below WPs (weekly pivots) as a short term tell; or at very least upside will remain limited on rallies with pros selling near the highs.

The flip side is that small caps are leading the rally, daily new highs / new lows look strong, and forward valuations under 17X SPX are not terrible. In addition, VXX is below all pivots and VIX looks rather weak. Typically we will see breadth weaken, VIX & VXX get in gear, new lows increasing and other safe havens show signs of caution before a big drop. We aren't really seeing those yet.

Emerging markets have been weaker throughout Q2. In fact this is not a function of their respective indexes, as Sensex, Bovespa, and Micex look far better than INDA, EWZ and RSX - but their currencies have been in freefall vs the USD. Following a pivotal momentum approach, one could have played EWZ and RSX off the 2/9 low but definitely not these names (along with KWEB, FXI, EEM, INDA) in Q2.

Commodities have been strong this year although this seems to be a function of oil and related, as GLD is muted and agriculturals have been mixed. Though USO cleared YR2, that level is right on the highs on the CL1 contract so further gains may be less likely. XLE also so far topped on its YR1.

Bottom line - if you have avoided bonds (per Pivotal Perspective clear repeated warning from the beginning of the year), were watching for commodity longs per many repeated comments of emphasis, played USA small caps and tech on the Q2 recent rally and out of the emerging markets, then you have done very well. Now as last week it is time to be watching to lock in gains. As usual how one goes about doing this depends on your role and flexibility in the market. One could simply reduce long exposure, or hedge tech longs with an inverse ETF, or have puts, etc.

Generally it is easier to be long the leaders and avoid spending too much time trying to catch shorts and buy the most beaten up names. But if my idea on pro selling in tech is correct, we are about to see further declines in QQQ and SOX/SMH, and possibly a TLT and bond bounce as oil pulls back from its high.

But what will be the next good looking typical momentum setup is tough to say - I'd be surprised at a coordinated move above Q2Ps in the emerging names although if my bear idea is wrong perhaps that could happen. Simiarly, GLD and TLT would have a lot of work to recover medium term pivots. Should VXX recover its HP, that would be a clear warning for stocks as well as a possible trade.

PIVOTS

USA main indexes - IWM above resistance cluster, but DIA and NYA back to testing Q2Ps.

Sectors of note - XLE top on YR1; XLF QP rejection seems to be pointing to a bond bounce. SMH/SOX still above QPs but if those break watch out.

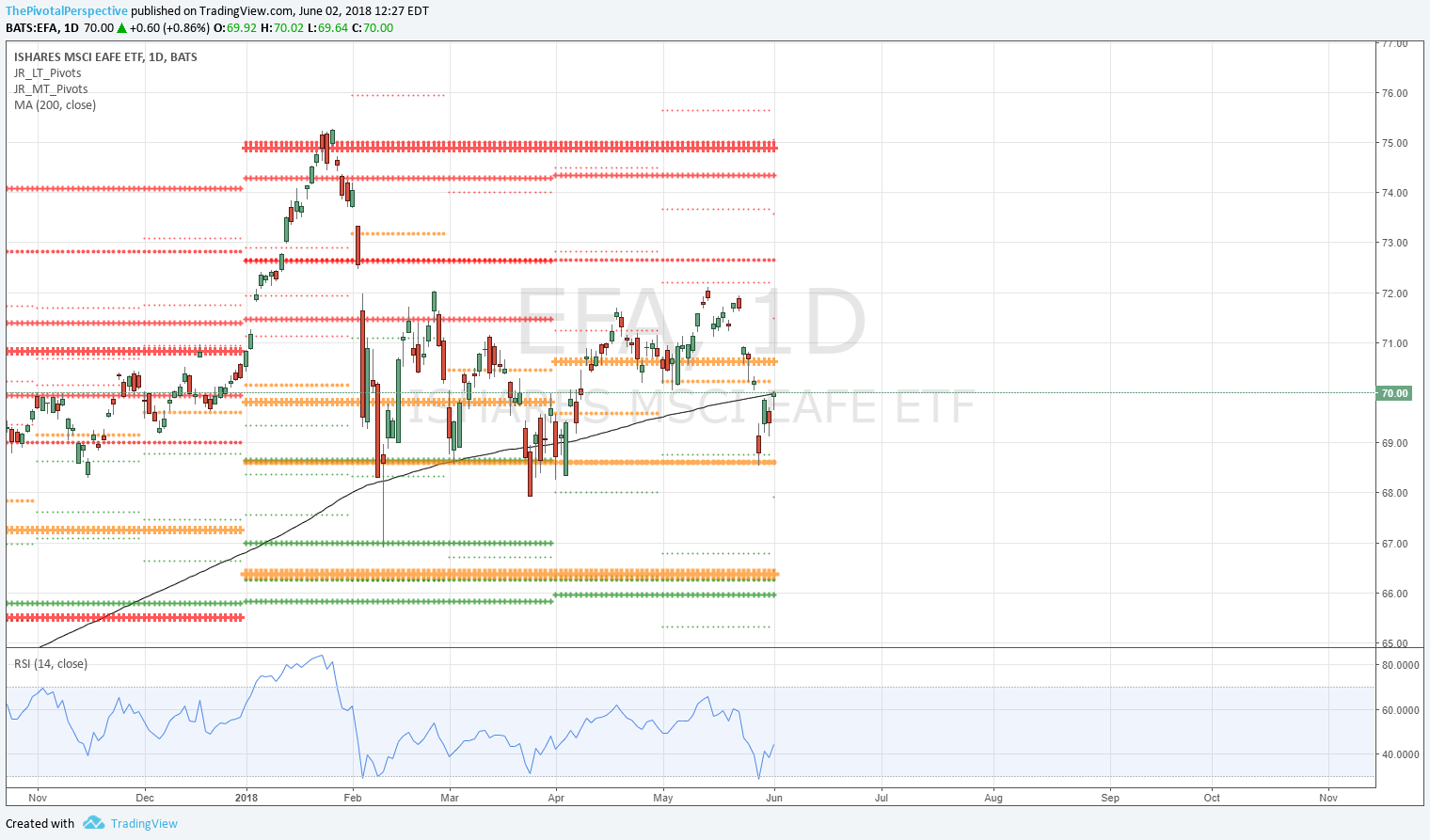

Global developed - EFA above all pivots but EWG and EWJ back near or under Q2Ps.

Global emerging - Only ACWI above all pivots with a similar look to EFA. Otherwise, SHComp below all except monthly despite a recent bounce; FXI, KWEB and RSX still below QPs, EEM below QP and MP, and EWZ and INDA diving below YPs.

Safe havens - VXX under all pivots from 5/10 was the bullish confirmation in stocks. However, VIX has not joined in this status so I think there is chance for VXX bounce. The world is bearish bonds but TLT bounced back after a new 2018 low and near tag of HS2 so this could be worth watching in weeks ahead. Metals have been stuck in very sideways trade this year.

Commodities - As mentioned USO and CL in toppy area YR2. I thought there might be a broader commodity rally this year but in fact so far USO was the easier play and then when XLE got in gear above pivots that delivered a very fast and powerful move.

Currencies - DXY traded above HP for 3 days last week, its first long term strength in months.

Cryptos - BTCUSD under all pivots and while it hasn't gone much lower yet this puts risk of 3K target area in play.

OTHER TECHNICALS

Bollinger bands should appeal to the quants out there as they are 2 standard deviations from a 20 period average. So far SPX Q2 BB at 2742 is the exact Q2 high to the point.

New high new lows look zippy on the daily chart but much less so on the weekly chart. Perhaps more on this soon.

SENTIMENT

Not at extremes.

VALUATION

SPX nearly 20 at the January high and dropped into the 16s on the pullback. Currently about 17X.

TIMING

April dates

4/2 - USA main index low, date listed per 3/18 Total market view

4/13 (mild)

4/18 - so far stock high

4/23 - 4/24 close low, 4/25 price low slight miss

Why do I quietly persist in this timing project? Because of 4 dates listed for April (from the end of March!)

- one was the low of the month across the board for USA stock indexes, and same date TLT high

- the date listed as mild was mostly non event, perhaps a small pullback low on SPY and other stocks

- 4/18 was the high of the month for stocks

- 4/23 slight miss, 4/24 close low 2 weeks with 4/25 slightly lower lows

Not bad eh?

May dates (listed end of April)

5/6 (could be 5/4 session or 5/6 globex) - non event

5/11 for currencies esp - USD pullback 5/11-14

5/15-16 area looks important change of character - so far 5/14 USA main index top