REVIEW

3/18/2018 Total market view: "The question now is whether the market is entering an extended sideways period to work off the RSI overbought condition of 2017 (and let's face it after a massive trend at some point things have to slow down) or if there is more threat to risk. Points in favor of sideways range... Points in favor of more downside risk... Any weakness in smaller timeframe charts may be a prelude to a further drop. This will be especially the case if Dow shows rejection of its MP."

Dow had clear rejections of its MP on 3/19 & 3/21 and mostly lower from there. Note scenarios above per 3/18 - sideways or down, and no significant upside scenario listed. That said main index lows of April have mostly tested and held the February lows thus far.

SUM

Once again in 2018, "resistance matters" with last week's bounce testing or nearly tagging new monthly and/or Q2 pivots on SPY, QQQ, DIA and IWM and sharply lower from there. None of the main indexes reclaimed status of above all pivots on the 4/5 high; essentially, a similar move from the February highs in the sense of monthly (and in this case, some quarterly) pivot rejections.

Volatility as measured by VIX, VXX and average true range remains high. VIX appeared to have a drop from its monthly pivots on 4/5, and was below its Q2P; this was not confirmed by VXX which stayed above both its monthly and quarterly pivots. Average true range (14 bars) of daily SPX is 50 points! In 2017 the highest value was about 18 points, and spent much of the year in a 12-15 point range.

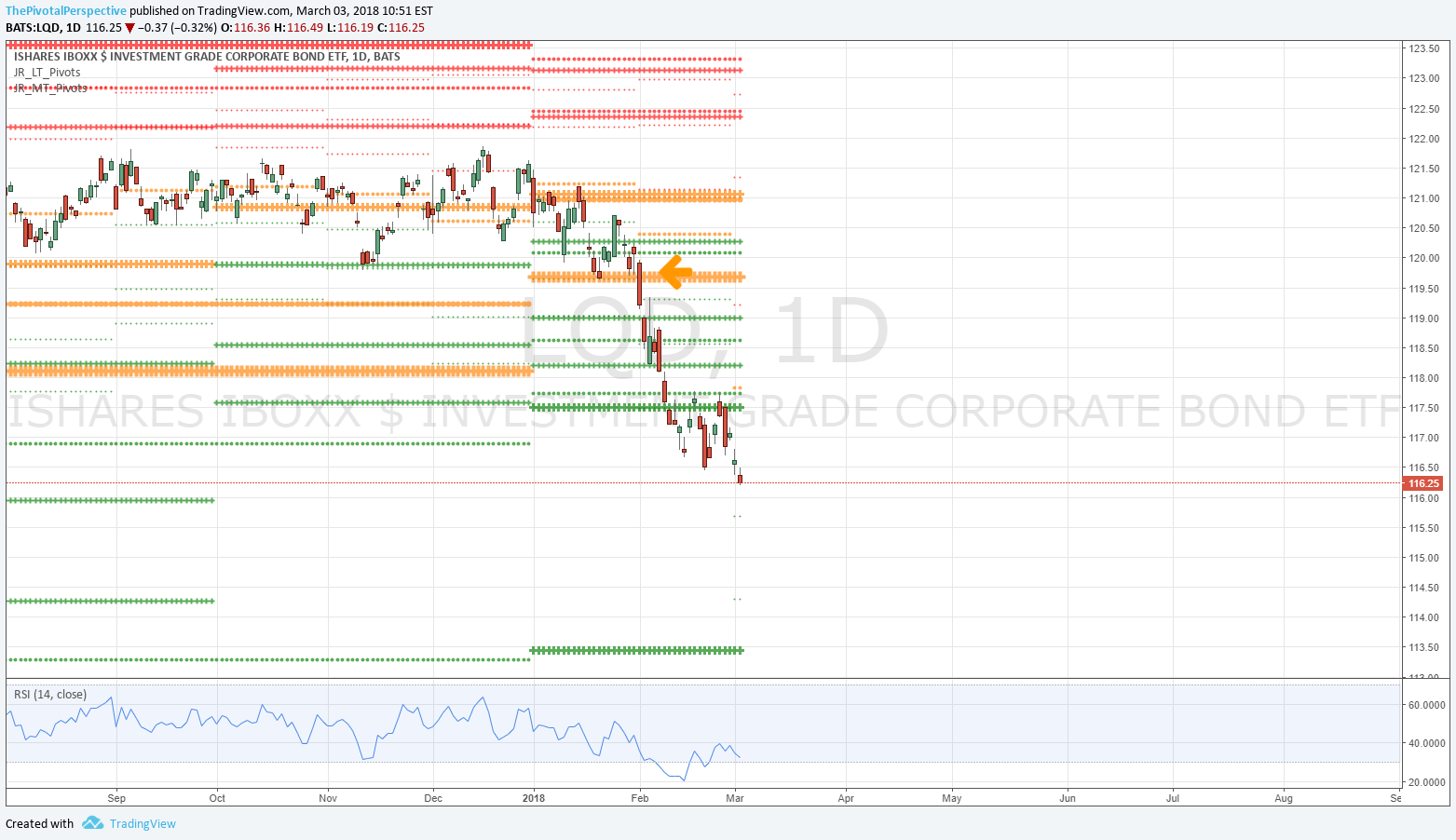

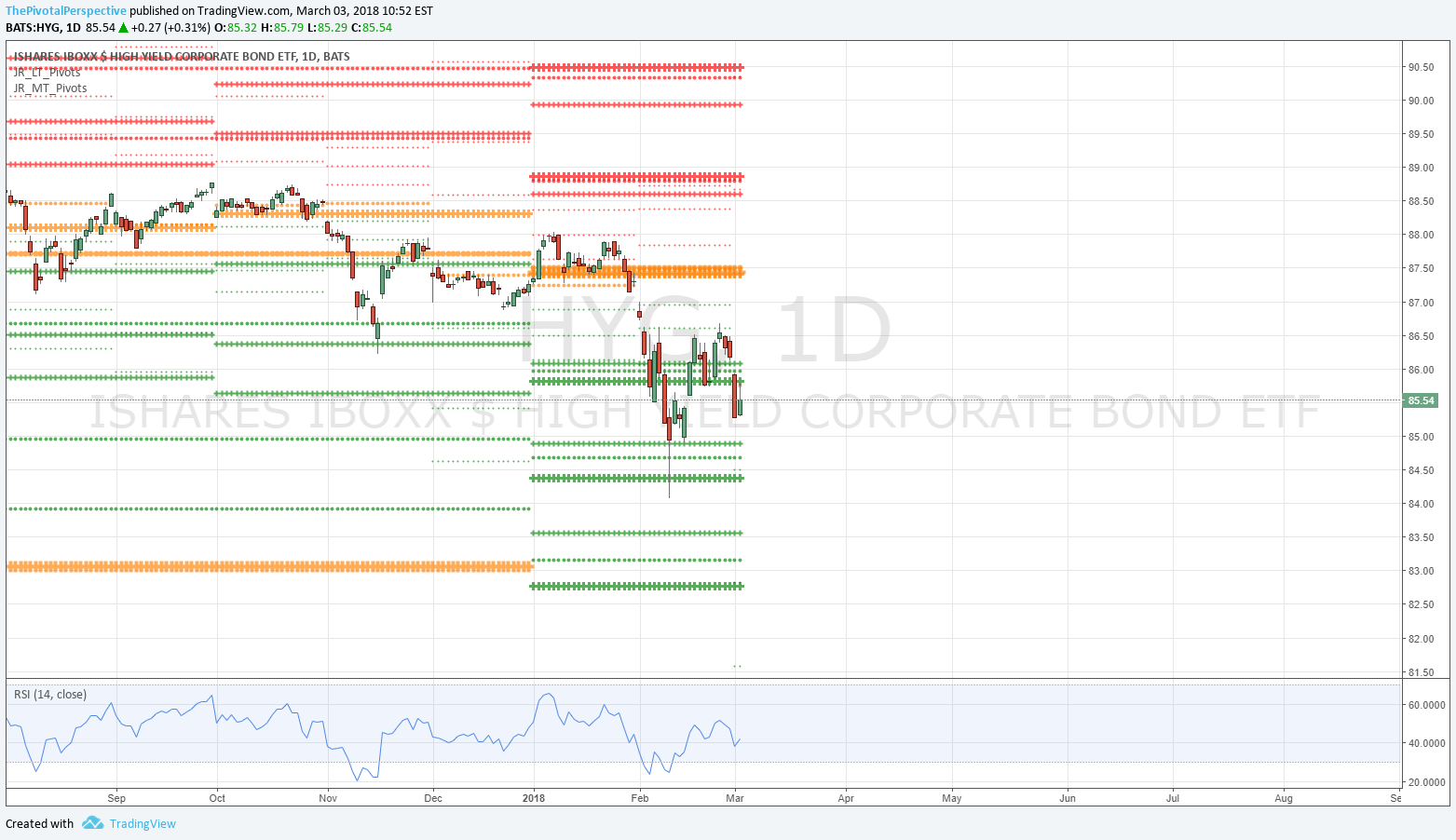

Bonds, while off the lows, have not been much help as all major categories: TLT AGG LQD HYG are negative YTD.

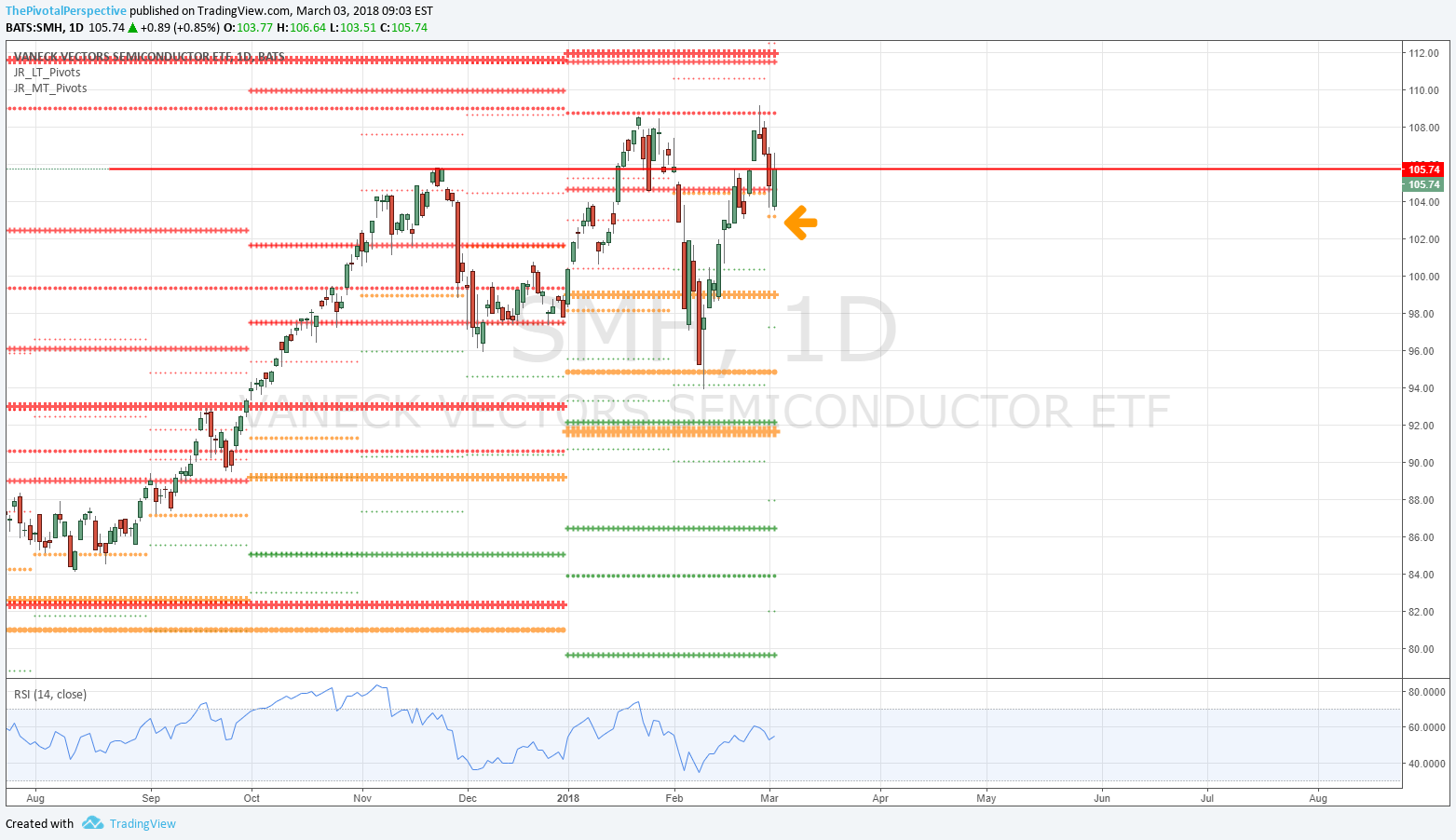

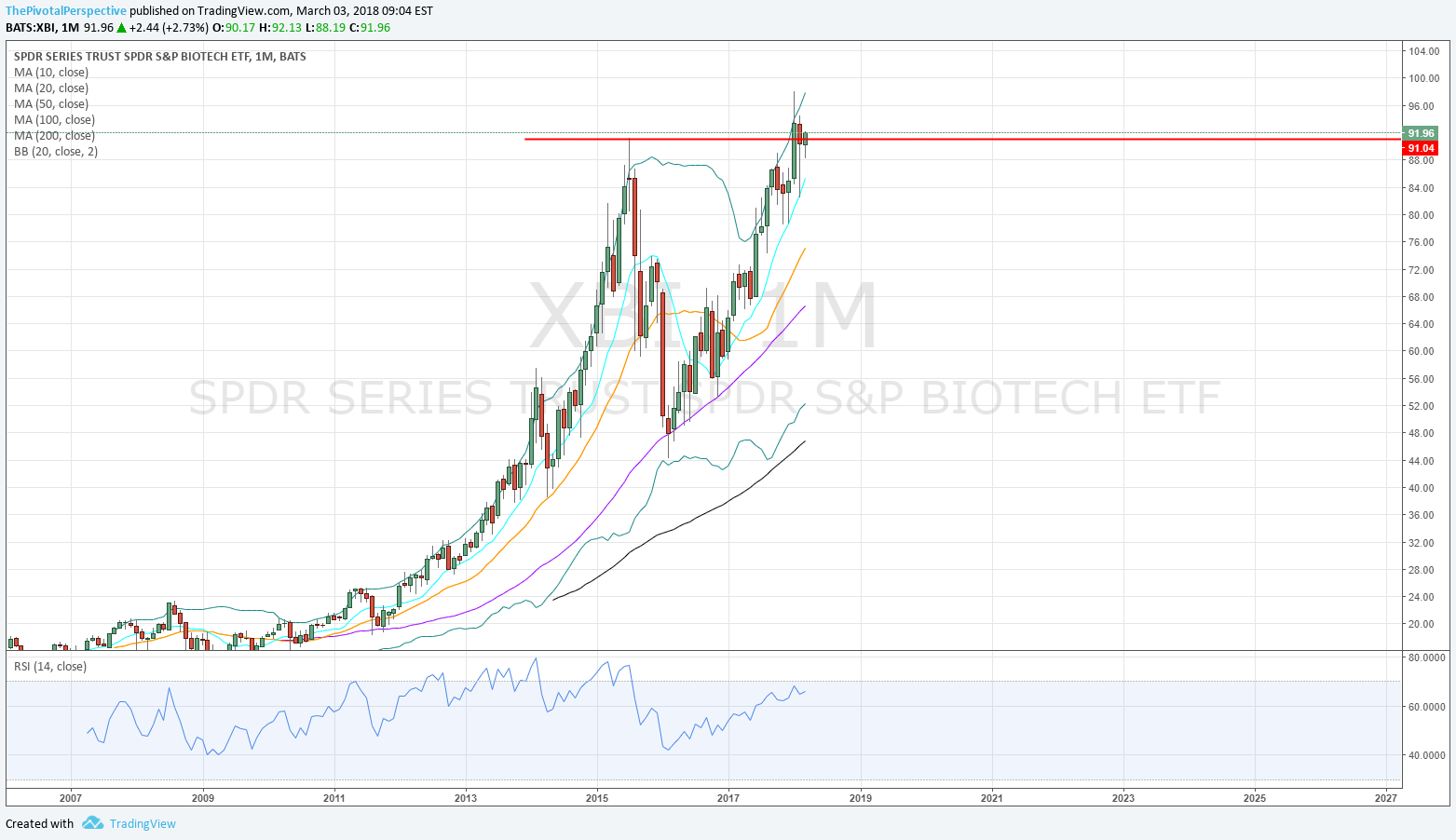

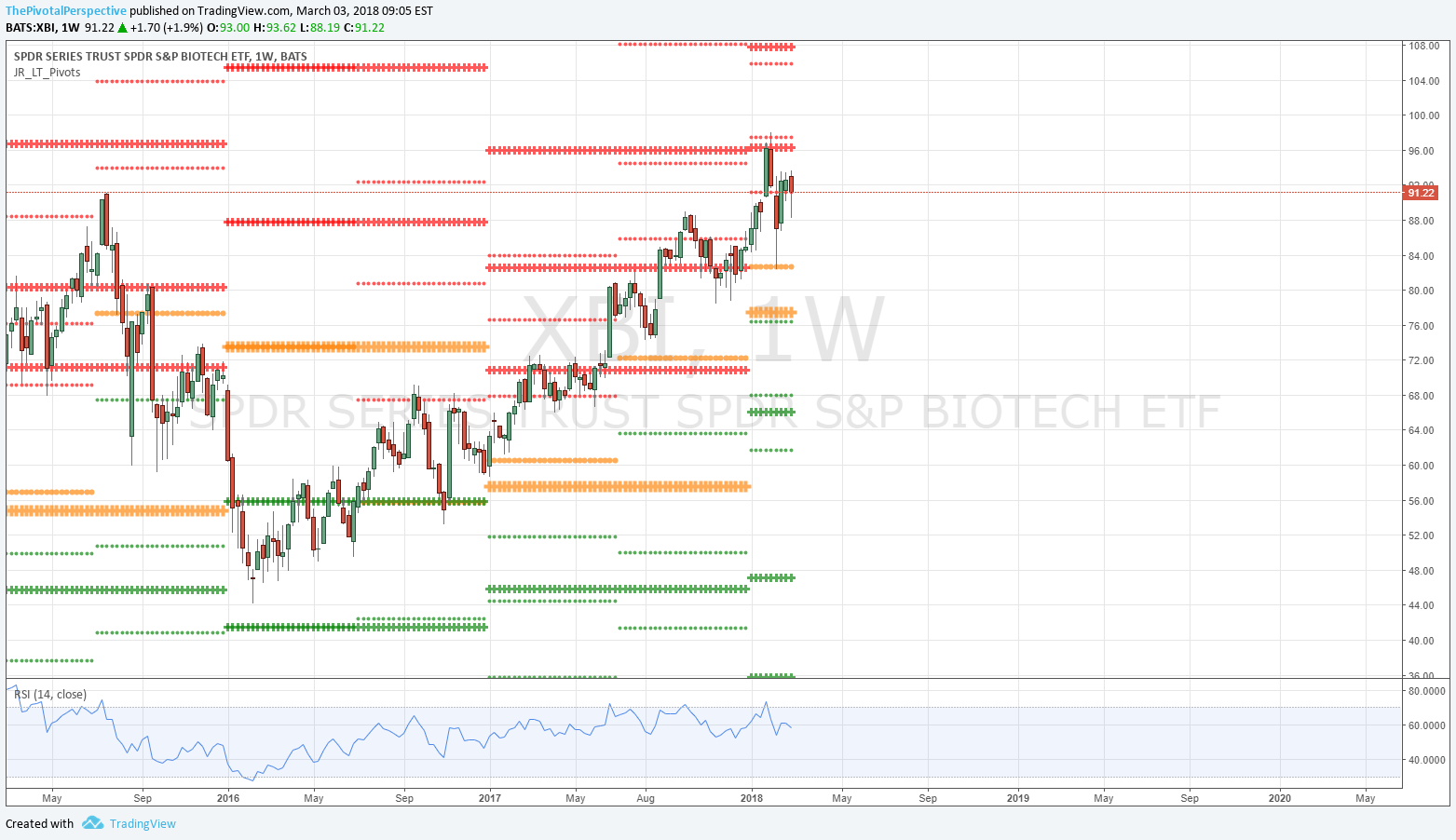

2017 hot trades SMH and XBI have tried to clear major highs of 2000 and 2015 respectively - and despite poking above for a few days the larger move on these has been down.

Many overseas markets are mixed in a similar fashion as USA main indexes - still above long term Y and 1H pivots, but under new Q2 and monthly pivots.

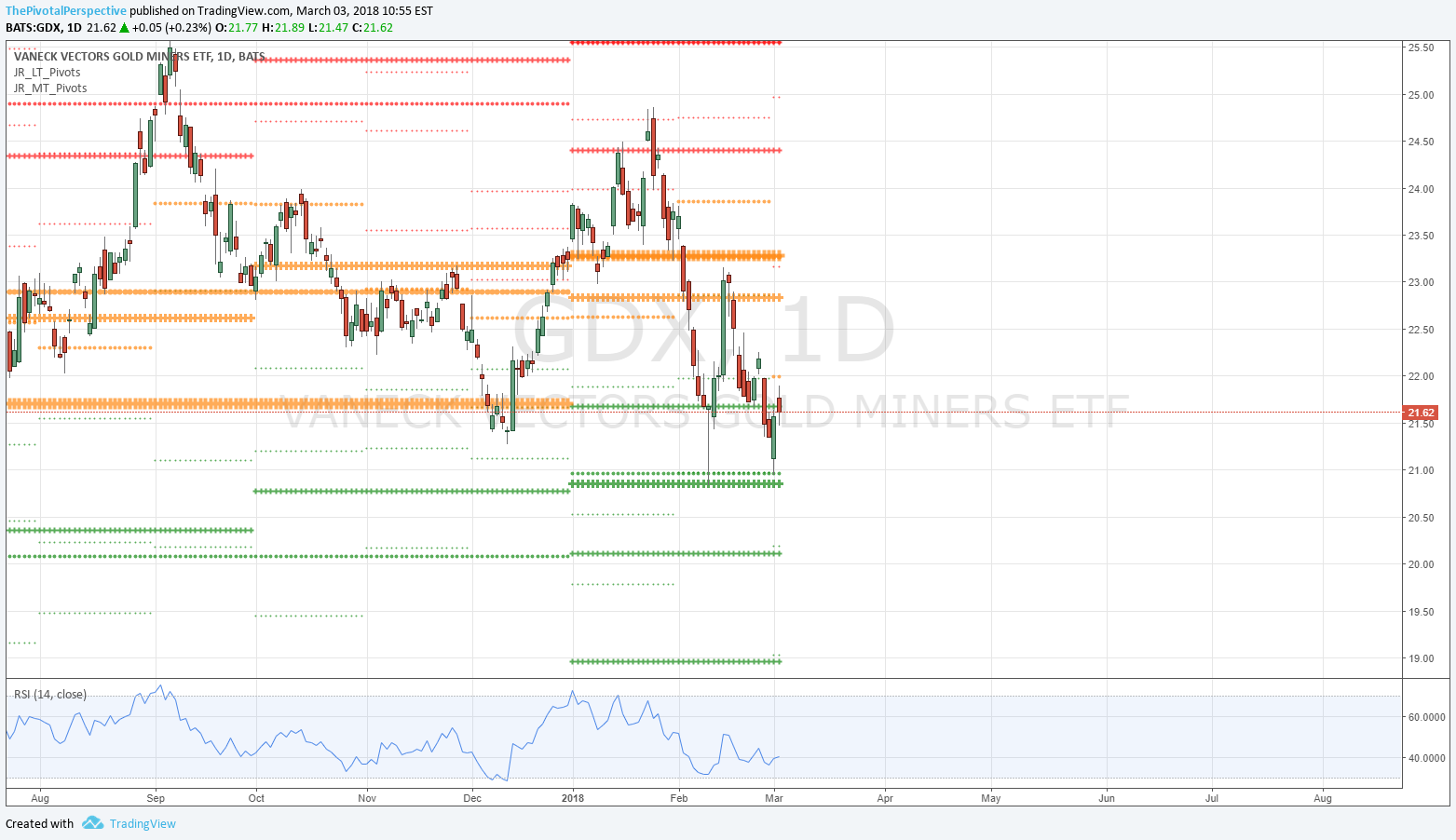

Anything above all pivots? Of the items I track currently only GLD, but without the broader participation of GDX and SLV.

Cryptos continue bloodbath as warned by benchmark BTHUSD below its YP from January and pivotal leader ETHUSD breaking down below all pivots in March.

What next? Last total market view suggested that it may be helpful to have larger amounts of cash ready to commit to the next good setup which frequently happens near the end of quarters and beginning of new ones. While some indexes appeared to be more hopeful on the bull side on 4/4 (SPY test and hold 1HP and rising D200MA), the inability to clear QP and MP (Q2P and AprP), along with falling D20 and D50MAs, invited selling. In other words, many indexes are in mixed fashion (above some levels, below others). As long as this continues better to stay on sidelines or continue to short resistance as this seems to be the easiest play in 2018 thus far. One could also go with current pivotal leader GLD although even this seems to have been hopeful a few times this year only to fade near top of range.

The big question is whether the big levels on USA mains - YP, HP and D200MA will continue to hold. Maybe not - but unless you shorted say DIA on 3/14-21 and/or USA mains 4/5, entries are tougher and could be subject to big short squeezes with put-call quite high and indexes near major support of daily 200MAs and weekly 50MAs.

PIVOTS

USA main indexes: SPY, QQQ, DIA and IWM above YP & HP, below QP and MP. NYA also below HP - watching its YP as a break below that would be a troublesome sign.

Sectors of note: SMH and XBI failing below 2000 and 2015 highs respectively. XLF stopped at its quarterly price high. Does not help the bull side with these charts starting to look like scramble to get out.

Global developed: EFA and EWJ in similar pivot situation as the USA mains. EWG slightly under HP as well.

Global emerging: SHComp below all pivots. FXI, EEM, KWEB, EWZ and RSX all above YP and HP yet below QP and MP. INDA slight variation on this theme.

Safe havens: VXX working somewhat as replacement to XIV. VXX up near its YP the last several days, but notably still above MP, QP and HP. If VXX clears its YP then I will think more chance of breakdown of key support in USA main indexes.

Commodities: GLD above all pivots 4 of 5 trading days in April so far. USO also tried and failed to clear its MP and as of Friday like several other indexes - above YP and HP, below QP and MP.

OTHER TECHNICALS

New high new low indicator went back into caution mode on 3/23. This doesn't really work as a sell signal, but when the 10 day MA of new highs exceeds new lows it usually pays to re-commit to the bull side. This has happened twice in 2018 so far, first 2/26 to have a brief failure then again on 3/7. There is quite some work for the "all clear" signal to happen from here.

VALUATION

Some smarter commentators noting that earnings + price drop has resulted in significantly lower valuations that the January blow-off top. As long as recession signals appear unlikely then drop from highs likely to remain in -10 to -20% range. However, with Trump increasingly off the rails in haphazard fashion I think "sell in May" likely for the summer and perhaps Feb lows are undercut to see more of a -15% to -20% moment on the key indexes.

SENTIMENT

Daily put-call highest since election on 4/4, and weekly levels starting to reach near frequent turn zones as well.

TIMING

April dates

4/2 (so far USA main index low, date listed per 3/18 Total market view)

4/13 (mild)

4/17

4/23