Sum

In last week's Total market view, "To my eyes, some sort of safe haven breakdown looks to be the more likely move." That played out with TLT breaking 2HP, GLD Q4P, GDX 2HP and SLV YP.

VIX is below all pivots after moving above its OctP for a few days last week, and getting hit by 2HP and Q4P. XIV also above all pivots as it has been since 9/11, though had a sharp 3 day from from near 2HR2 all the way down to 2HR1 and back up again. That 2HR2 still in play and worth watching.

Other safe havens I don't really have a bias; weekly charts of TLT and AGG suggest bounce. Metals either way.

VIX

W: Off the lows but another sharp drop from very temporary spike.

D: And there are the pivots on play - above OctP for 4 days but 2HP and Q4P held on close and then smackdown.

XIV

W: RSI in toppy area; sharp drop from 2HR2 that found support at 2HR1.

D: Last week mentioned that a drop under 2HR2 would trigger a UVXY hedge which still had some gains before cutting on Friday with move above Q4R1.

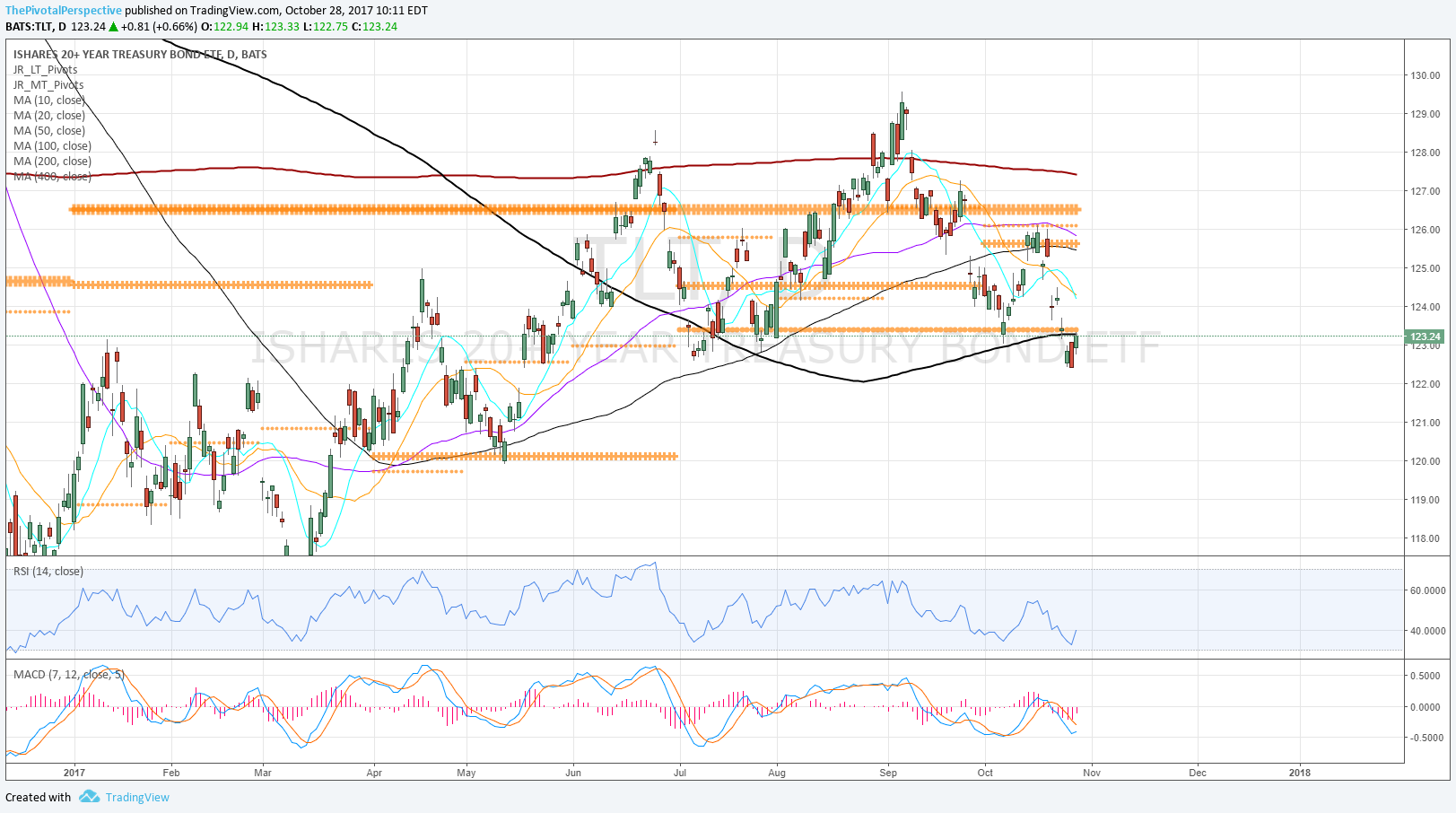

TLT

Broke under 2HP and D200MA but back to testing level and may try to come back.

AGG

Held 2HP and reclaimed D200MA.

HYG

Dip below Q4P which came back.

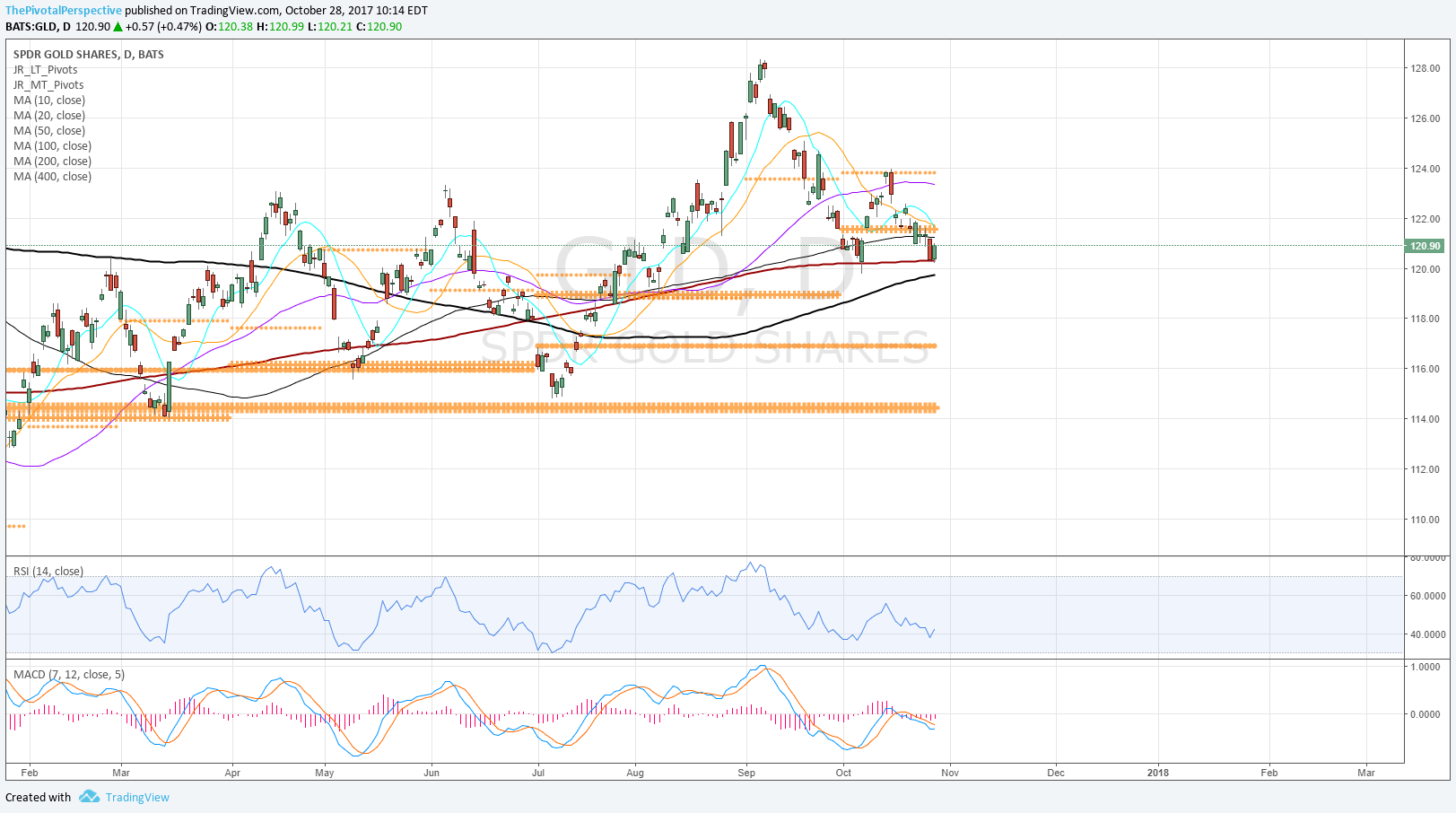

GLD

Fell under Q4P.

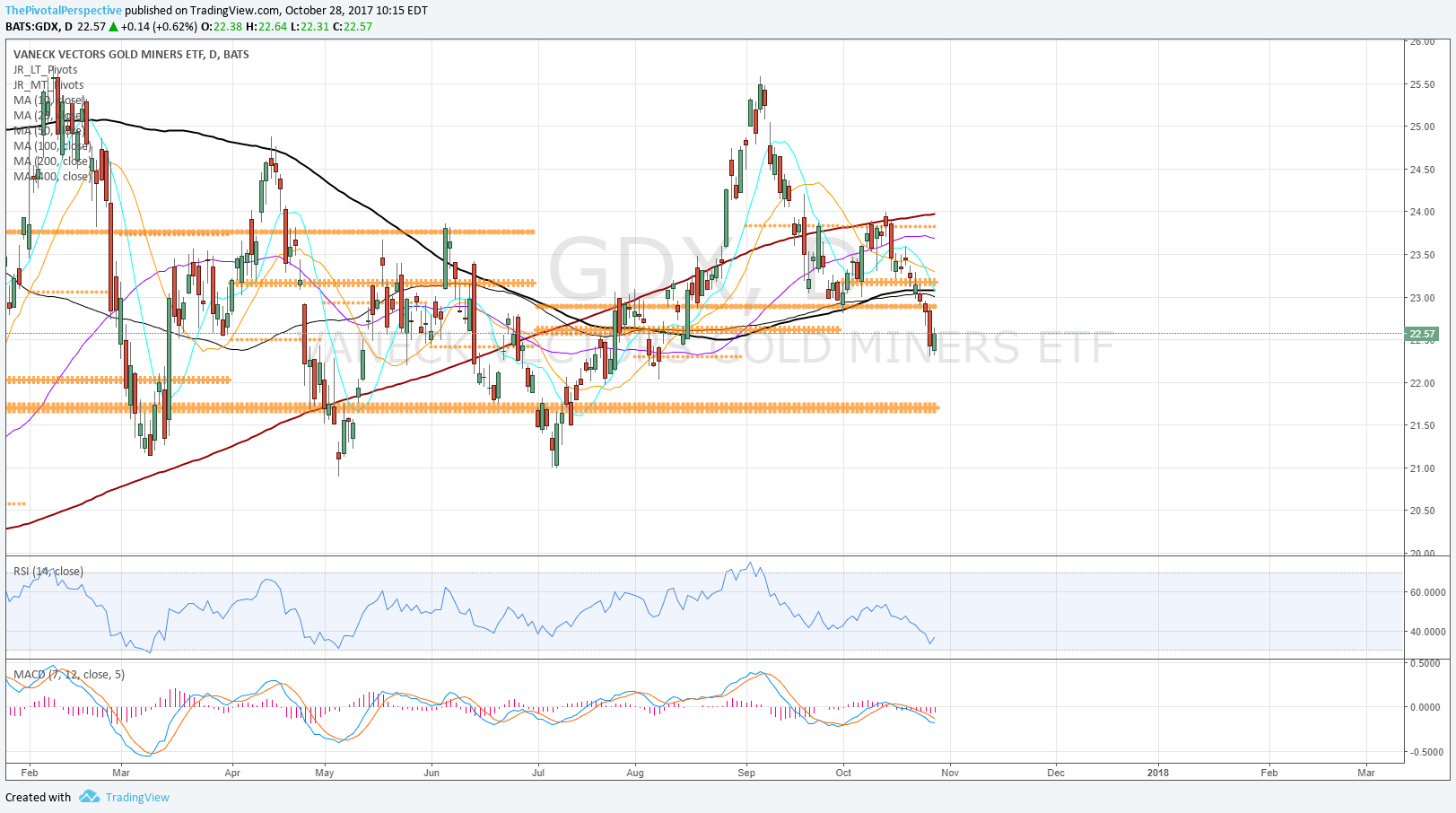

GDX

Broke 2HP big.

SLV

Drop under YP, but held Q4P.