Sum

Healthy uptrends, with some mixed messages and rotation. NYA & INDU both above 2HR1; RUT has raced back to highs after deeper August pullback low, and and confidently approaching resistance so far. SPX and VTI are also testing 2HR1; SPX with a weaker advance last week that invites some selling. Lastly, NDX still above all pivots but testing its SepP and has been taking a breather as other indexes and sectors perk up.

SPY 2HR1 is a key level to watch next week, along with reaction from IWM Q3R1 and QQQ SepP.

SPX / SPY / ESZ

SPX W: Doji bar at top of BB with RSI divergence invites selling.

SPX W: At 2HR1 - poke above, close below.

SPY D: High of month remains SepR1, after low of last month on AugS1.

ES Z: Above all pivots and MAs; buy signal 8/30-31 (back above all pivots, lifting above rising MAs, MACD flipping + 8/31) delivering another gain.

SPX sum: At long term resistance with weekly BB inviting sellers. That said, daily chart still above all pivots and MAs.

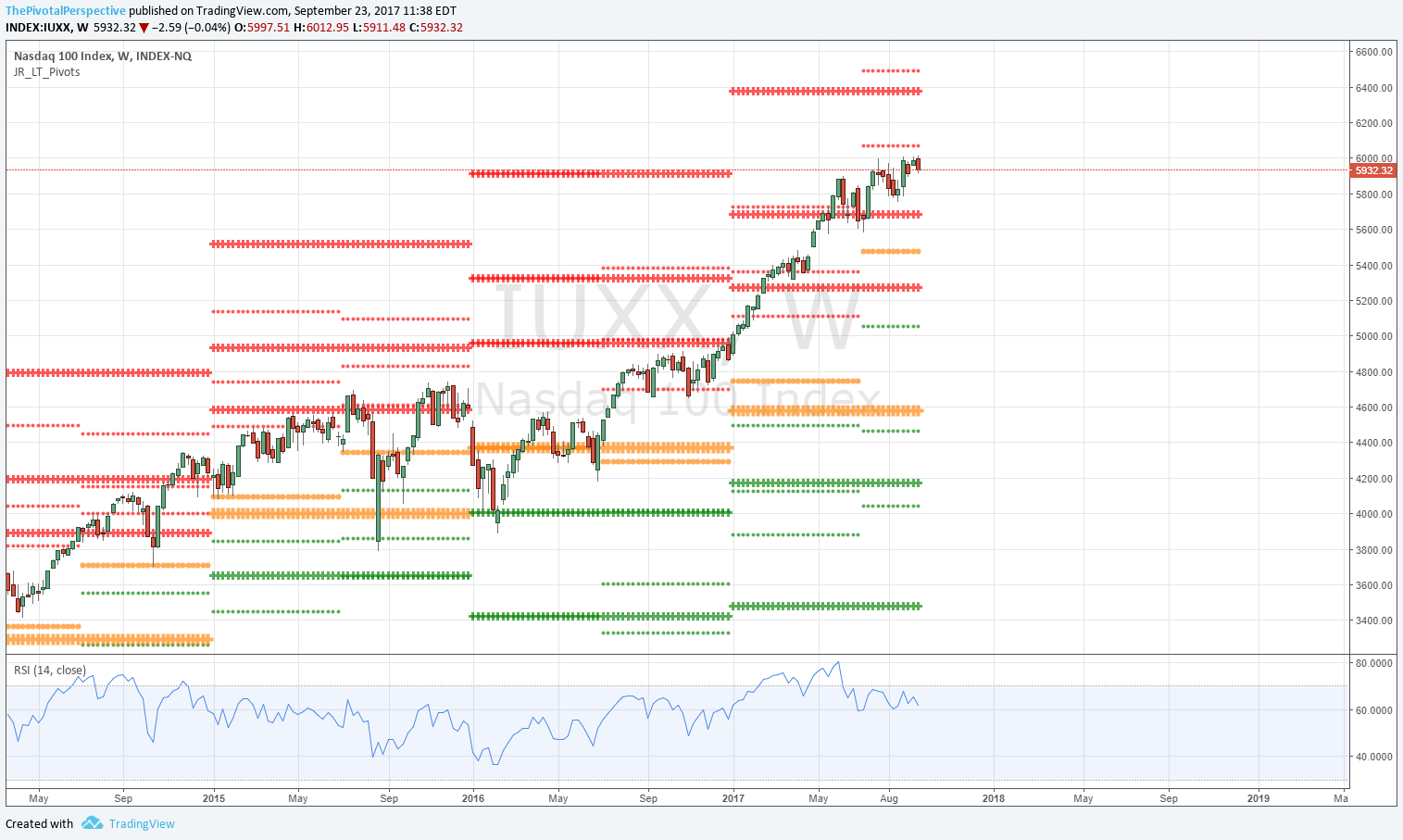

NDX / QQQ / NQZ

NDX W: Testing 10MA again.

NDX W: Did not quite reach 2HR1.

QQQ D: Still closing above Q3R1 and SepP.

NQ Z D: Holding SepP and D50; below D10 and D20.

NDX sum: NDX relinquishing leadership this month after selling at the highs early September. Testing SepP and D50MA.

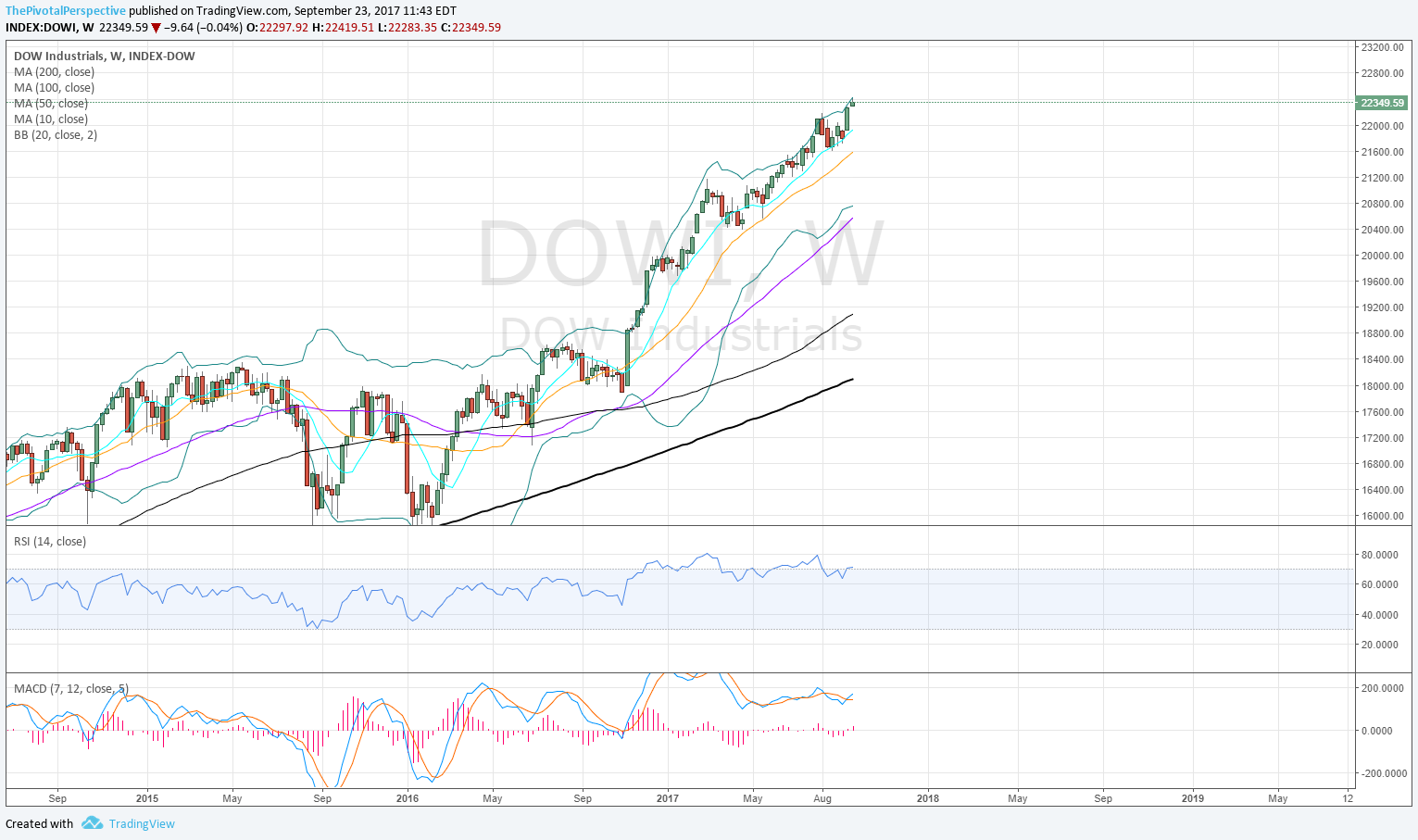

INDU / DIA

INDU W: Invites sellers.

INDU W: Between long term levels.

DIA D: Also between levels, with some pause at RSI overbought.

INDU: Again USA main index leader, recent higher highs; not on any pivot resistance but weekly Bollinger band resistance inviting some pullback.

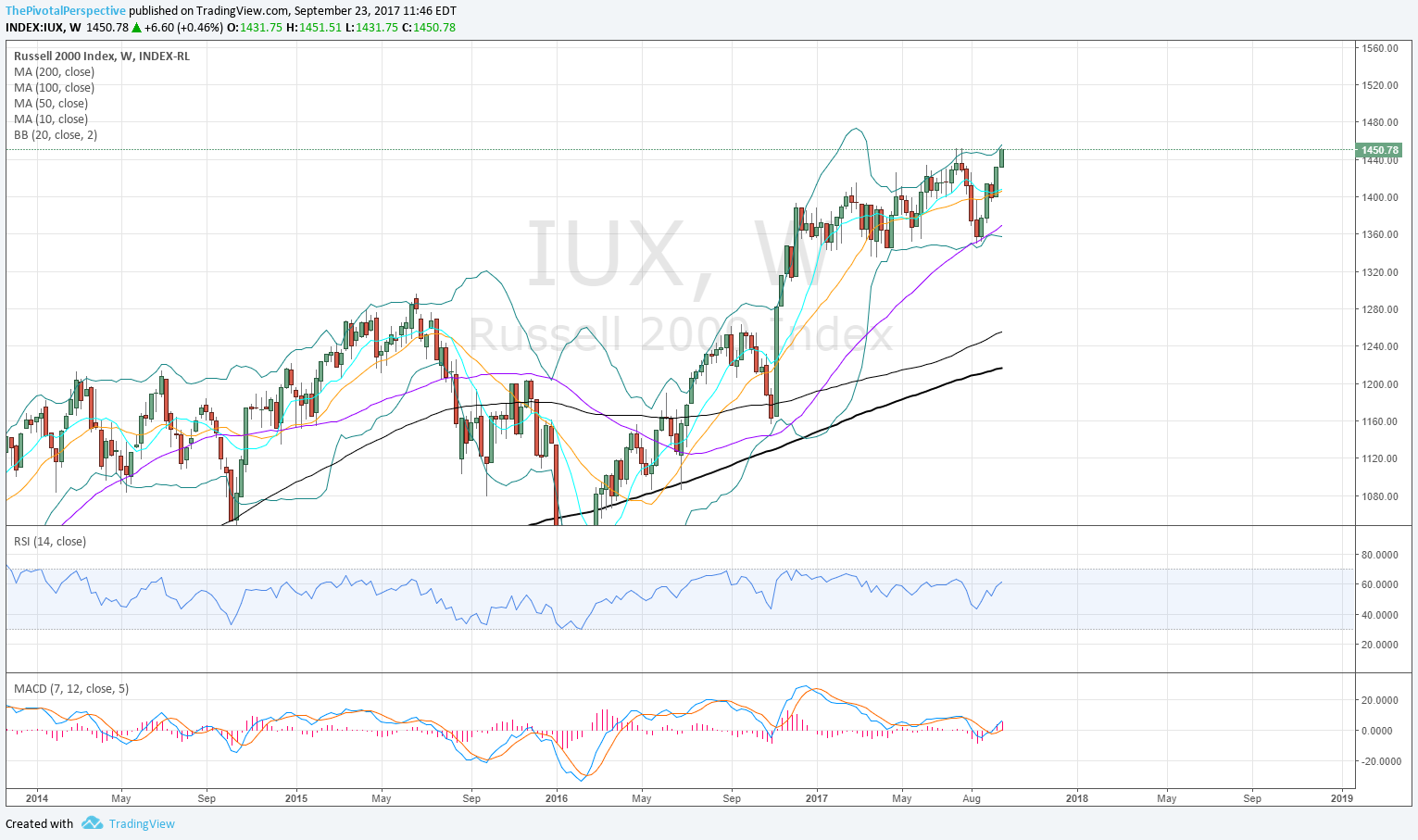

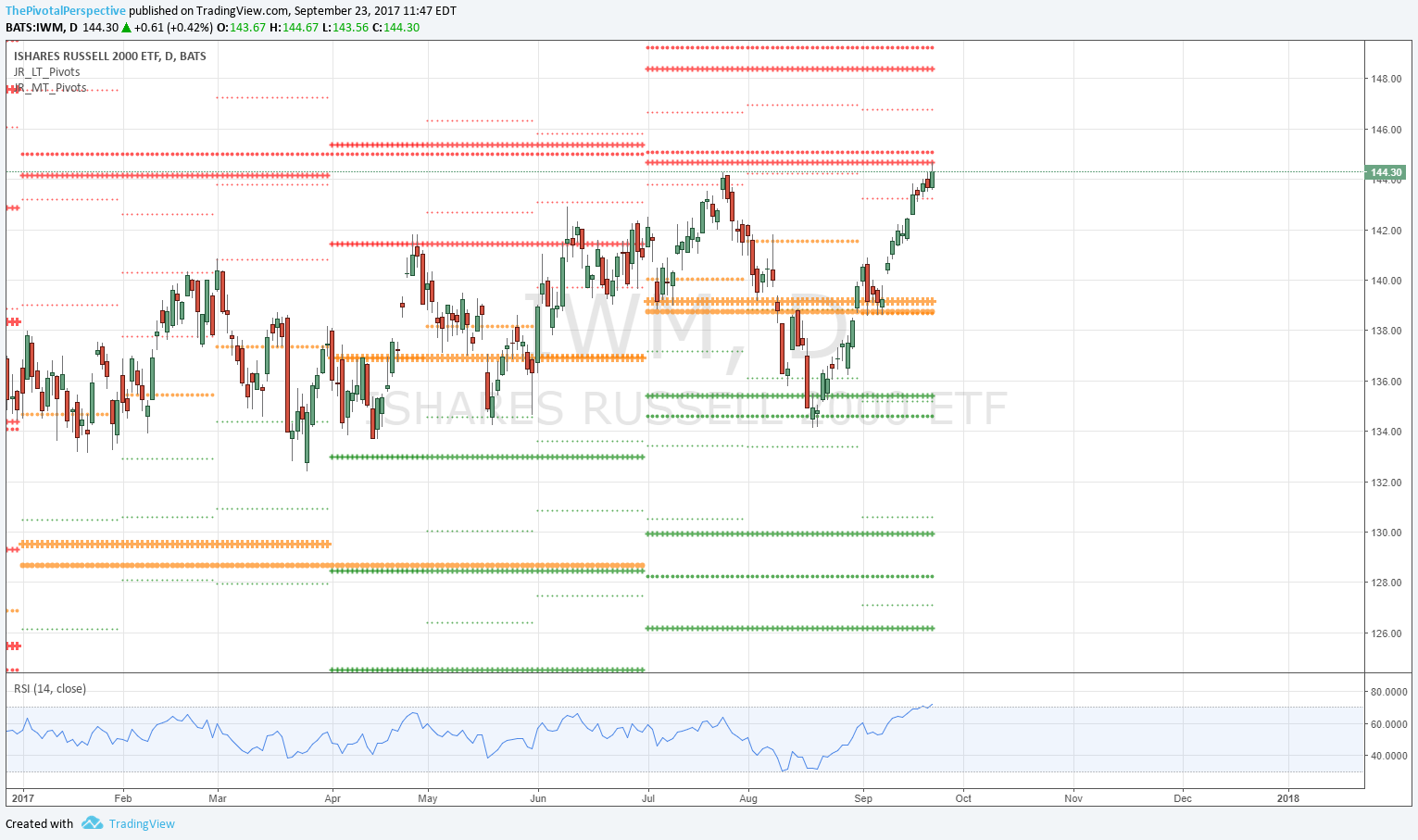

RUT / IWM

RUT W: Looks great.

RUT W: At resistance but confidently approaching, unlike SPX.

IWM D: That was a fast move back up from 2HS1 & Q3S1, back above pivots, then to Q3R1 and near 2HR1.

RUT sum: Also at resistance, but approaching confidently and weekly chart looks strong.

NYA & VTI

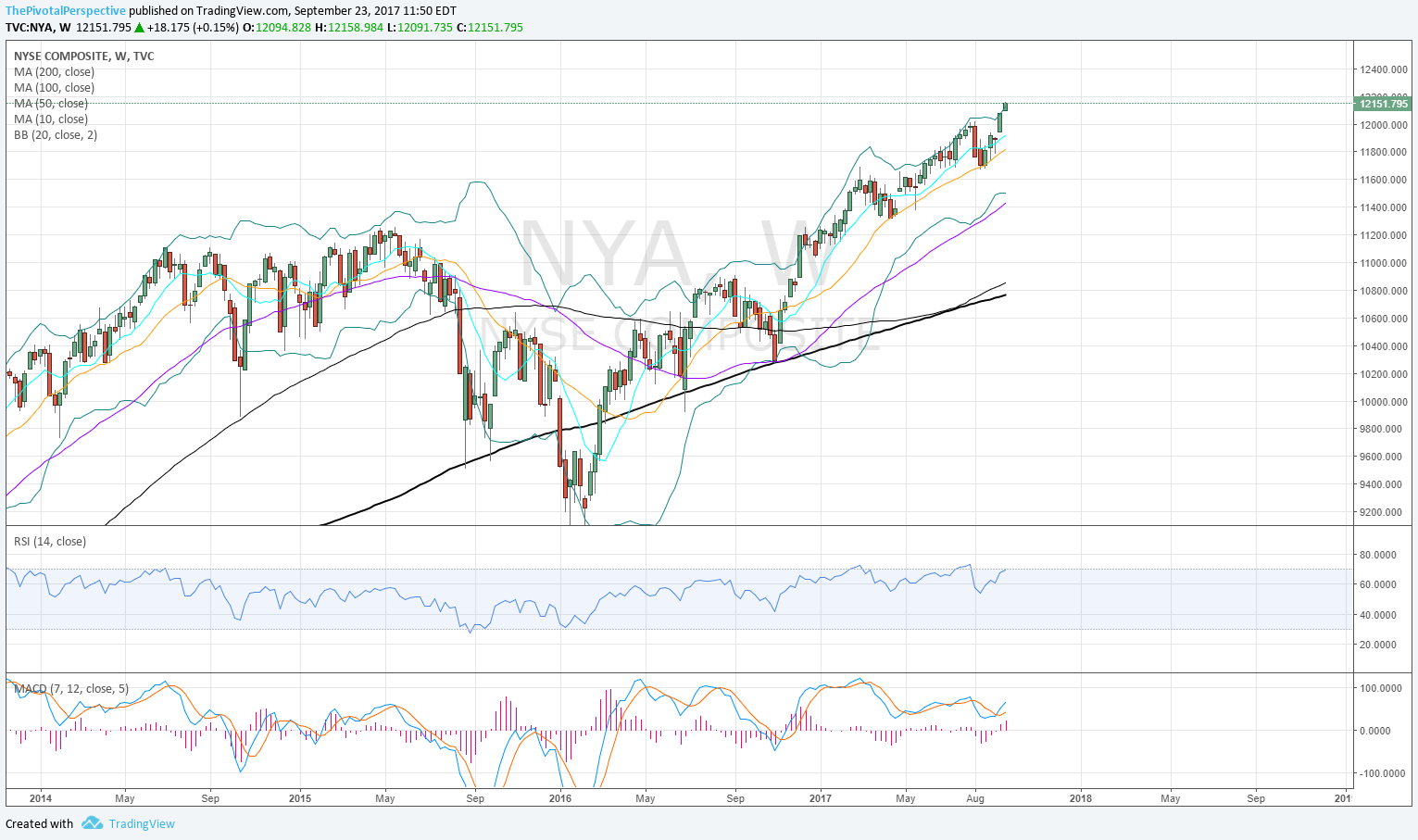

NYA W: Wow - that is pretty rare stuff, 2 weeks overshoot of BB.

NYA W: Liftoff above YR1 and also through 2HR1 - looking good.

NYA D: Testing Q3R2.

NYA sum - looking great, above 2HR1 and testing Q3R1 (which is only in play 1 more week).

VTI W: Pause at upper BB.

VTI W: Also at 2HR1.

VTI D: Traded above 2HR1 for 4 days but fell back for the weekly close. Note RSI reaction.