REVIEW

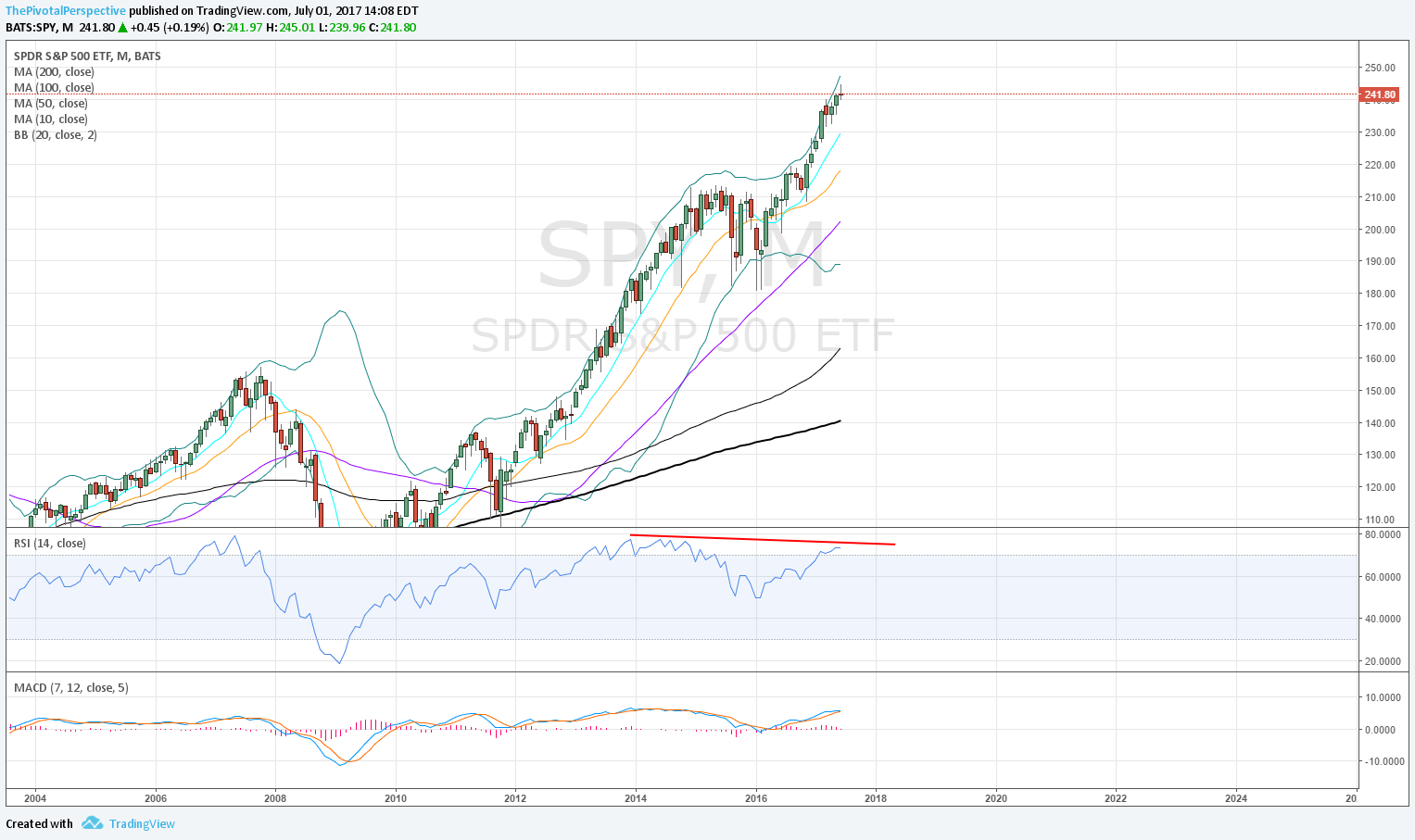

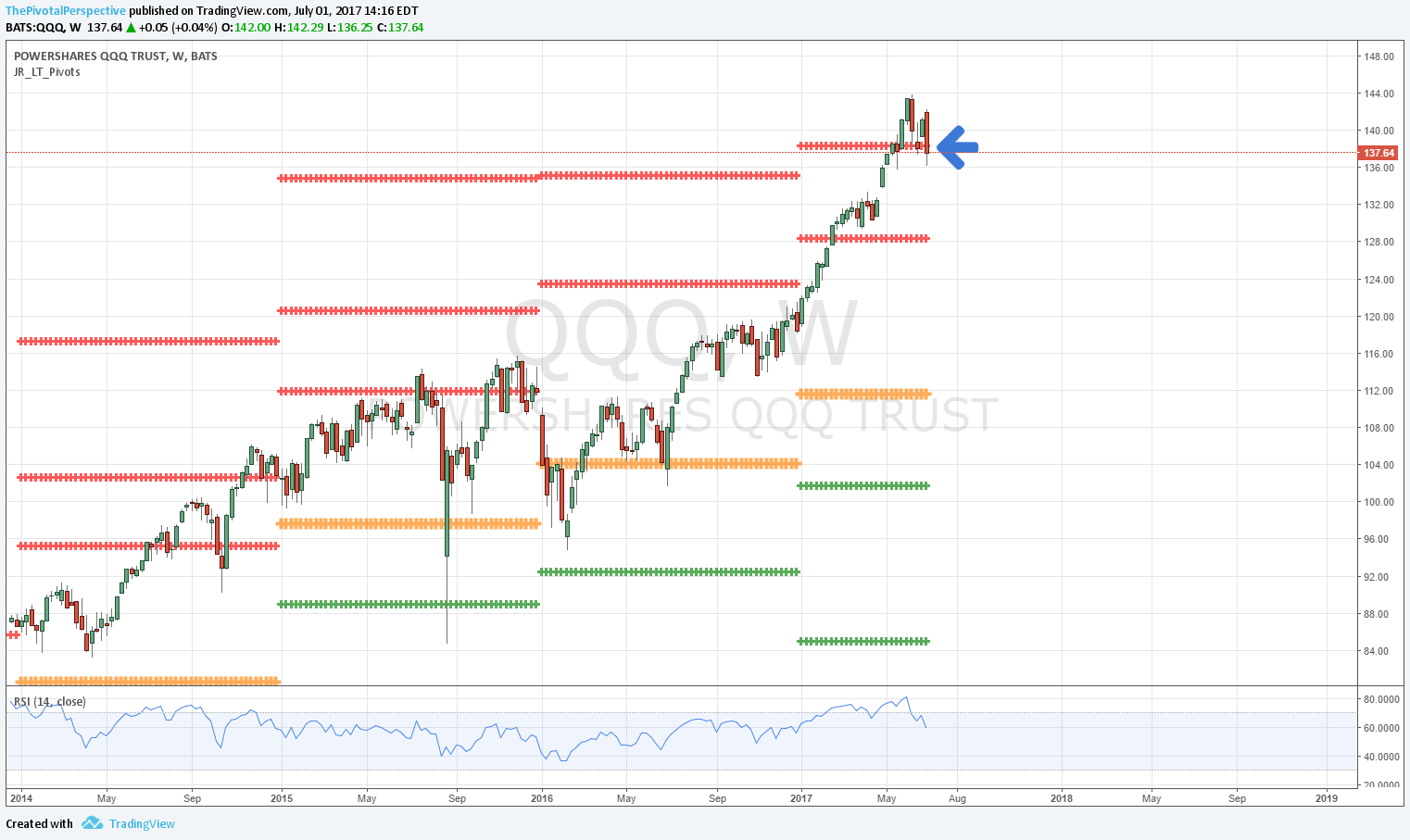

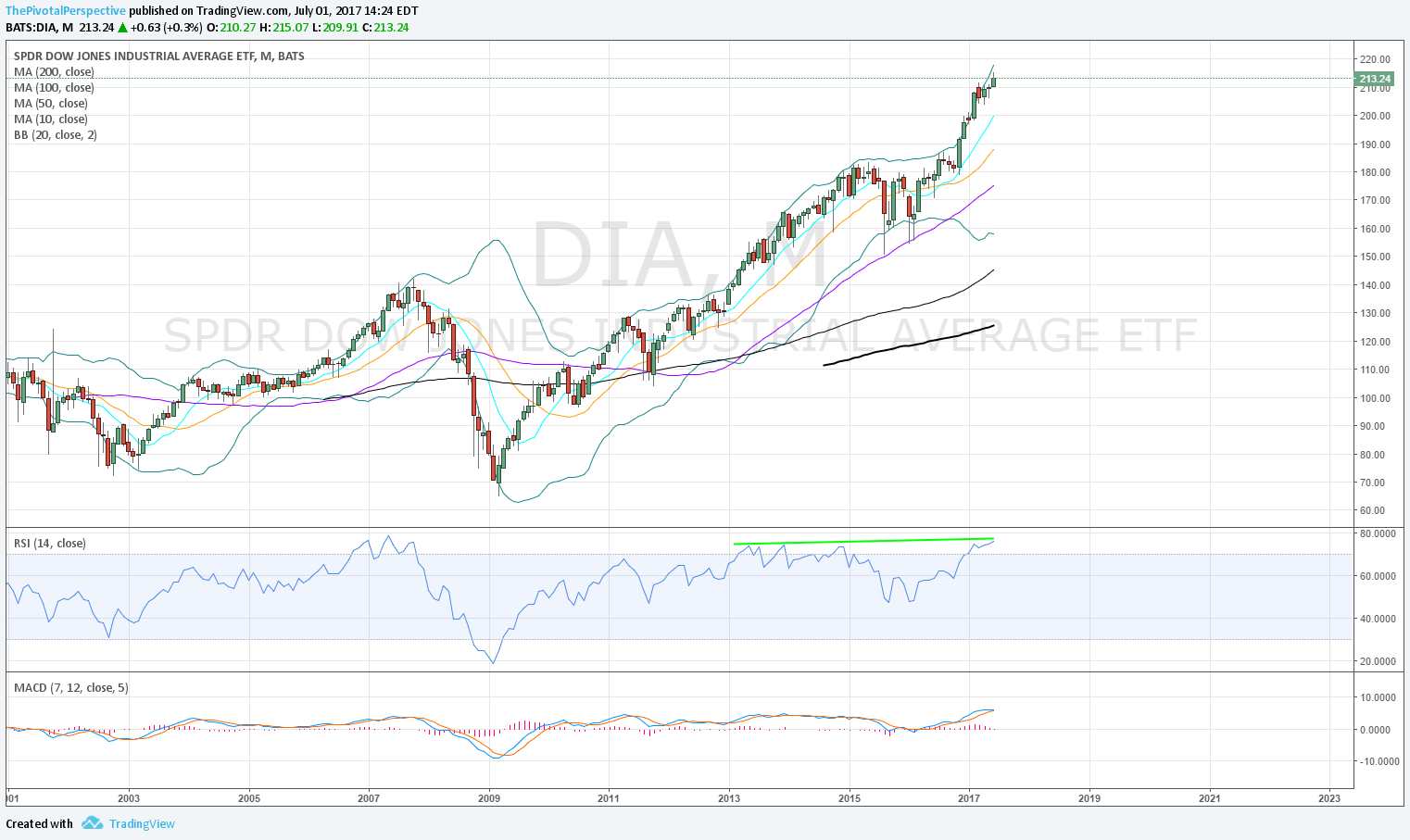

From 6/3/2017 Total market view: "All 5 USA main indexes are above all pivots, with VIX below all pivots (and not showing any caution signs) and XIV above all pivots. This basic configuration is very bullish for risk assets. In addition, 3 of 5 USA mains just cleared significant levels - QQQ jumped above Q2R2, and even more important, SPY cleared YR1 and VTI traded above YR1 for one day. Tops begin with rejections - not clearing - of levels. As long as these maintain, markets are doing fine. Next to watch will be DIA set YR1 area. ... Another thought - at some point in June we may see professional re-balancing move. This would imply tech slowdown and and possible bid in energy, the weakest S&P sector this year. Not sure where IWM & XLF fall in this picture however."

Most indexes continued up, with DIA nearly reaching YR1 last week. Tech cracked and energy (XLE) jumped on Friday.

SUM

Basic configurations remain supportive for stocks - all 5 USA main indexes above all pivots, VIX below all pivots, XIV above all pivots. However, with momentum stocks getting slammed and Dow testing YR1 area it is a week to be watching carefully.

Given the disparity between tech gains and energy losses, I think there could be more to recent moves given likely institutional re-balancing near the end of the second quarter.

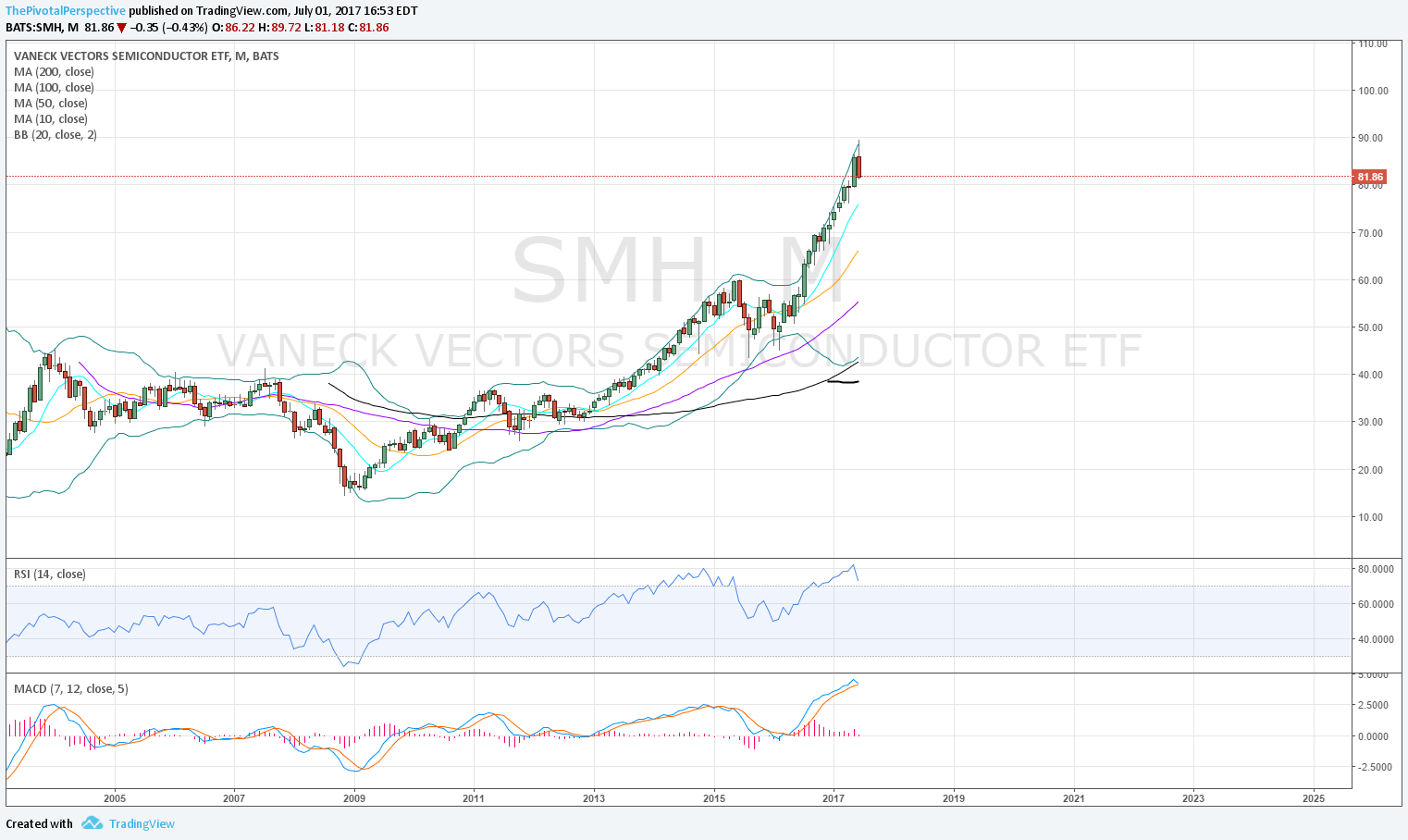

Several indexes are mixed in the sense of above/below all pivots, but also moving from support/resistance levels indicating key turn more likely and change in trend enough to matter in the near future. For example, VIX below all pivots yet moving up from Q2S1; XIV above all pivots, but moving down from 1HR3. This is also true of QQQ, SMH, COMPQ, KWEB, ACWI, GLD, DXY (almost), EURUSD (also almost), and others all on various support/resistance levels. In this list I am referring to quarterly, half-year and yearly levels only (not just monthly).

Bottom line

In 2017 stock bulls have been in charge with QQQ powering up through YR1 and then above YR2, SPY clearing YR1, VTI just clearing YR1, and now DIA testing its YR1 too. Will it join the others by clearing the level or will market turn here? I don't know, but can show the history since 2005 of many market turns on Dow yearly levels. It is time to pay attention. The market would remain in a stronger state if QQQ & and SMH hold above all pivots; but we also might see rotation with tech slowing and financials continuing to jump on rising rates.

If the market makes a true risk off move, it will be more than just tech dropping. We will see changes of pivot status in VIX, XIV and likely GLD will remain stronger. Bonds typically do well in risk-off environments, but may given the FOMC a stock correction on rising rates is possible.

I don't mean to sound unclear but sometimes markets have mixed signals and that is what is going on here. We don't have to jump the gun. Often definitive moves begin near near the end of quarters or beginnings of new ones, so if there is not a good setup or definitive move on Monday then it is likely one will become clear soon enough.

Positioning

Back to 100% long with small counter-trend loss, but I may try again via short on Dow YR1.

PIVOTS

USA main indexes - Dow YR1 test. QQQ slammed but still above all pivots.

Safe havens - VIX and XIV still supportive of risk. Interesting move on VXN.

Sectors of note - XLF above Q2P for the first time all quarter on Friday.

Global indexes - ACWI, EEM, FXI INDA, KWEB all above all pivots. SHComp just reclaimed YP for the 3rd time since breaking in May. EWZ and RSX weaker. Of the indexes above all pivots, ACWI high on Q2R2 but others not on levels or monthly levels only.

Currency and commodity - DXY almost made first target of 1HS1, missing by .22. Still below all pivots though. DXY strength would likely pressure global indexes. CL continuous contract back to key YP support. Any lower bearish for oil despite my idea of energy supported soon due to re-balancing.

OTHER TECHNICALS

Last week I pointed out RSI overbought on SPY across timeframes. Weekly RSI dropped down to 69.7, and daily to 63.67. Ultimately I think we will see RSIs lower, but near term room for daily chart to revisit highs.

VALUATION AND FUNDAMENTALS

Earnings estimates doing great and jumping in the last few weeks for SPX. But economic data continuing to come in under expectations has to take some toll at some point.

SENTIMENT

2 of 4 meters I track at extremes a couple of weeks ago, but so far stocks still doing fine.

TIMING

Proprietary work in progress model that I quietly persist in pursuing due to calls like this from a week ago:

"In addition, a larger timing cycle points to momentum slowing in risk assets from 6/5 into July."

QQQ, the main index momentum leader, fractionally higher on 6/8 then slammed.

This timing work used to be more of a focus when I worked for a small hedge fund, but I just don't have the time to properly devote to it now. Still, given timing, I would rather see some topping process this week then more of a risk off move.

June dates (published in 5/29 Total market view)

6/9

6/15-16

6/21-26