REVIEW

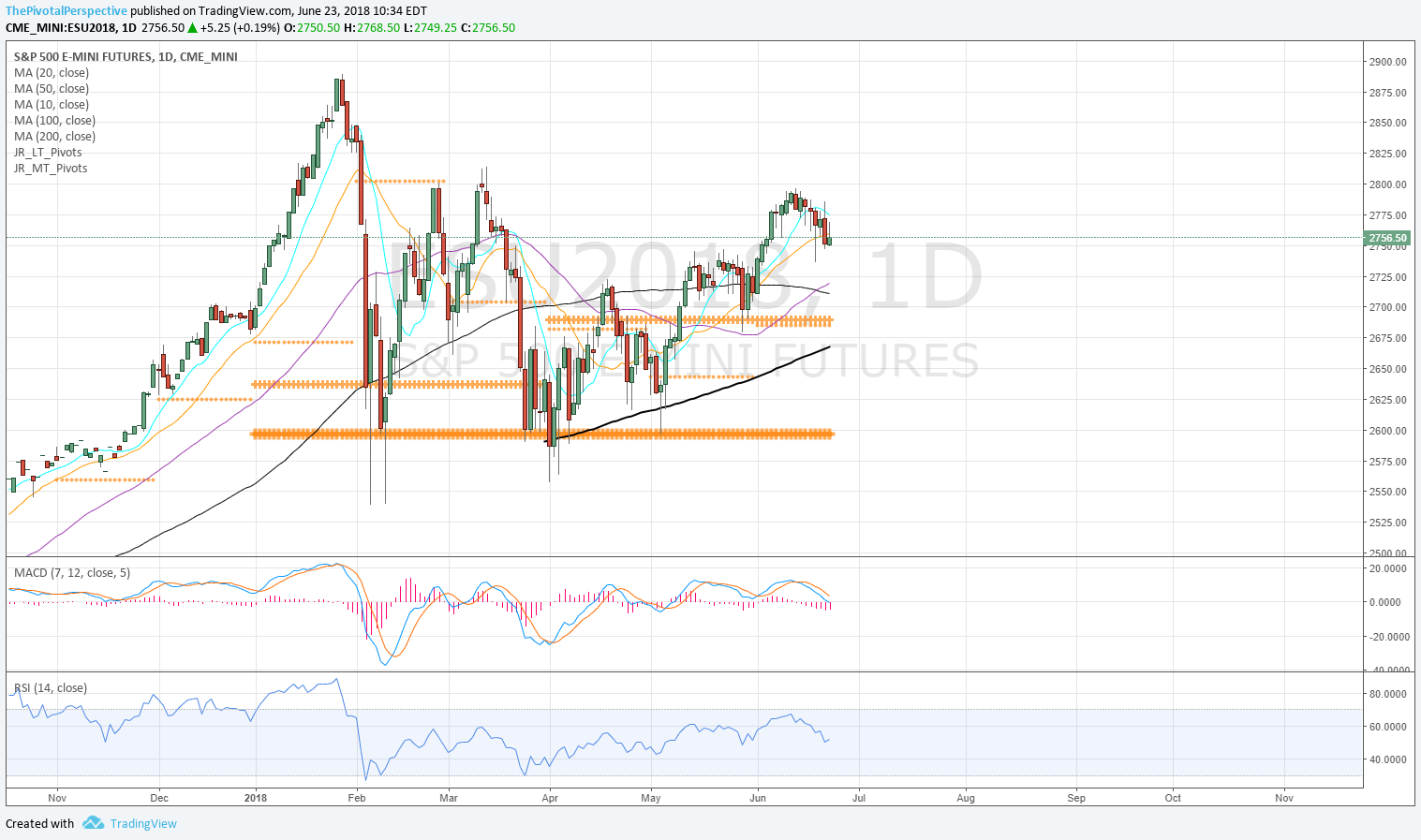

6/17/2018 Total market view: "Bottom line - If markets go higher it is likely the leaders will have another push up to reach IWM HR2 / YR2 area and QQQ JunR2. If lower then likely international names leading down, and one could have already have a partial short position on anything below Q2Ps. Until VIX & VXX confirm trouble the bull trend of risk on gets benefit of the doubt. At the same time the combination of crazy momentum on IWM, quarter end r-ebalancing soon in play, frothy sentiment and the HR2 / YR2 combo make this an ideal area for a decent reversal." [bold added]

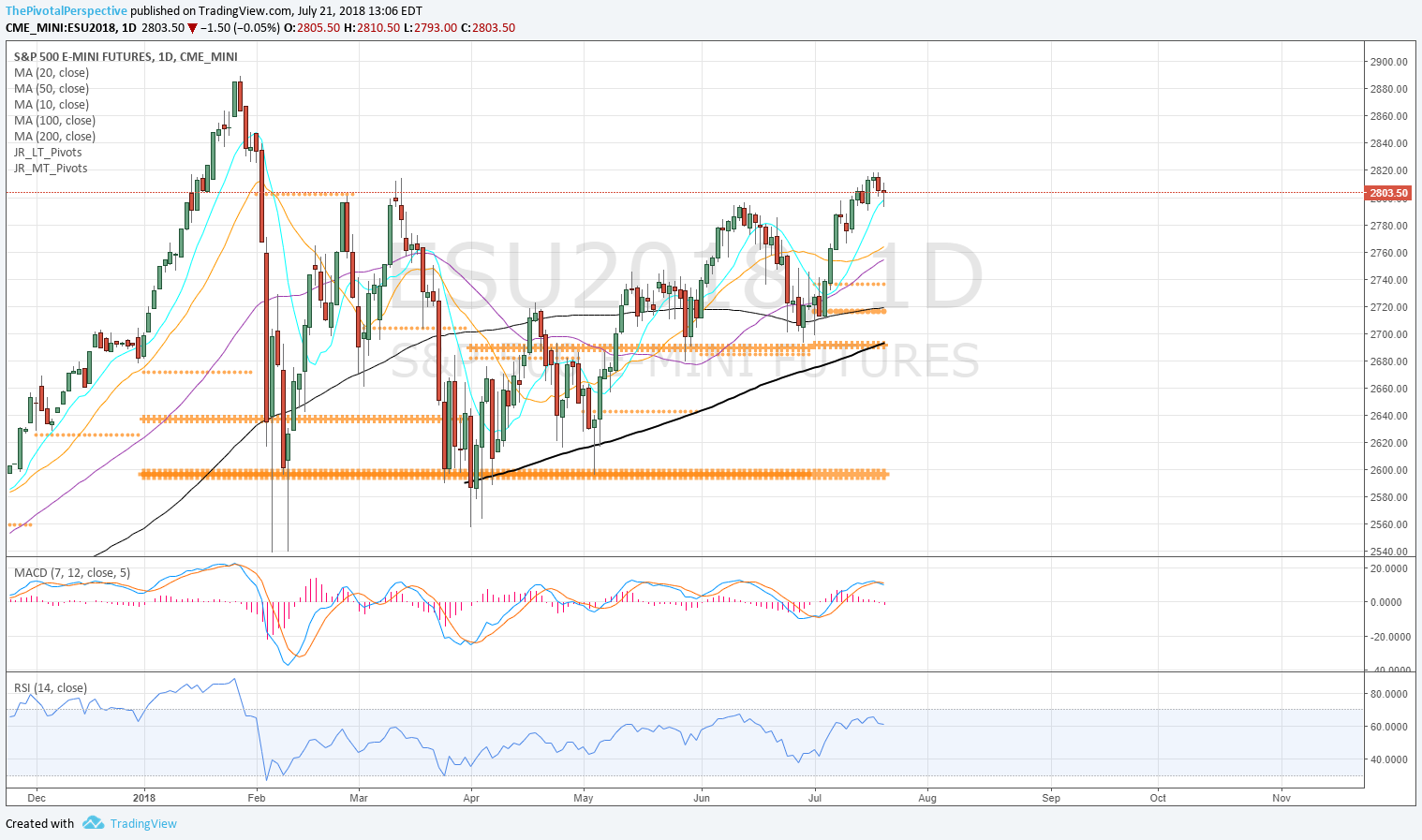

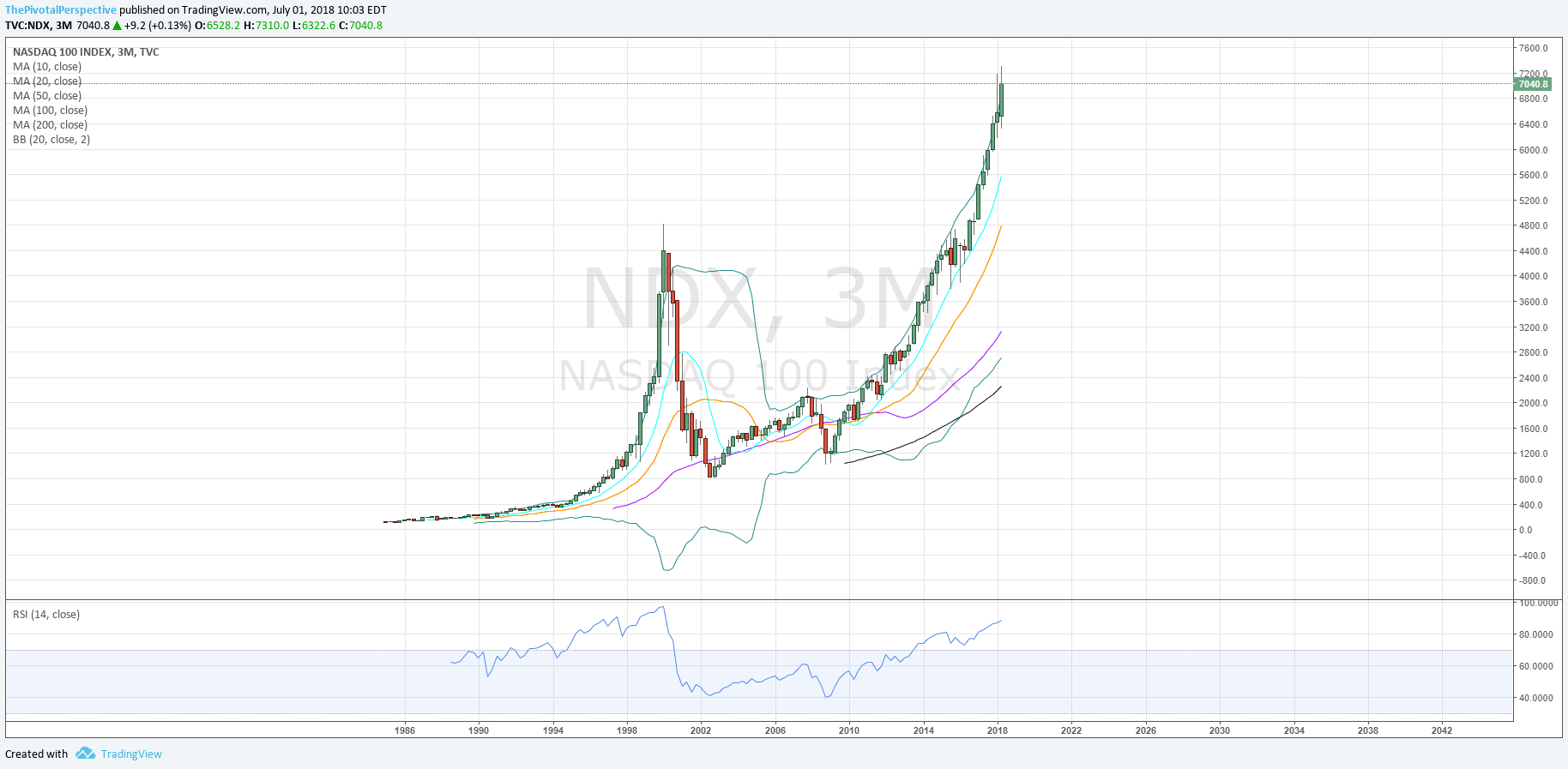

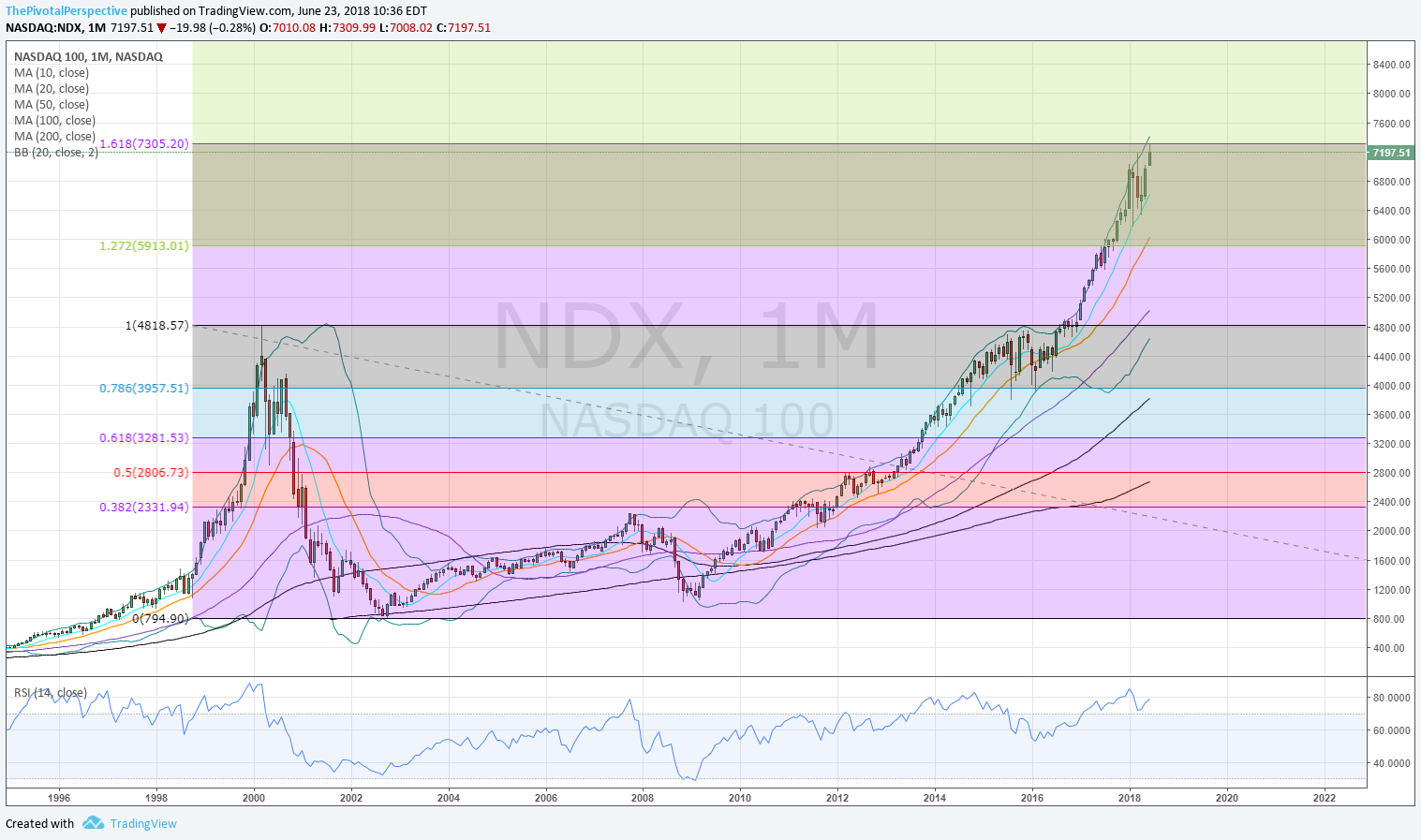

Rather nailed that with 6/20 top just a bit above YR2, and then a quick slam the next 2 days. NDX topped on JunR2 near exact (QQQ version a bit shy, NQ futs exact tag).

SUM

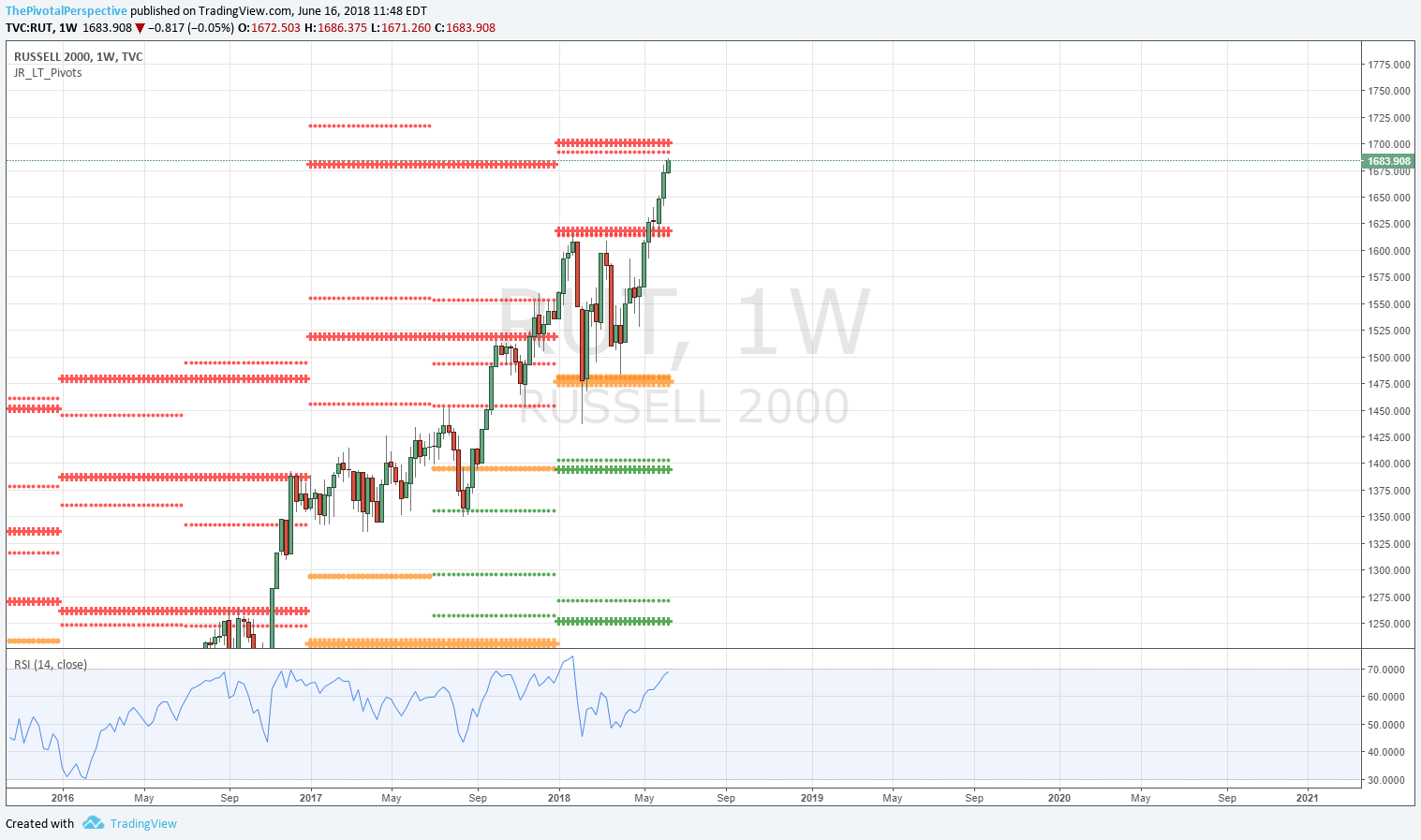

While I pay attention to all levels, when indexes are near yearly pivots, support or resistance then these typically become my focus. Last week IWM topped on YR2 in a similar manner to CL1 (oil continuous contract) earlier this year. We might not see the same percentage drop but so far it has been the right move to take gains near that level and reassess or even take a speculative short.

Yearly levels don't always generate major turns but here is a partial list this year:

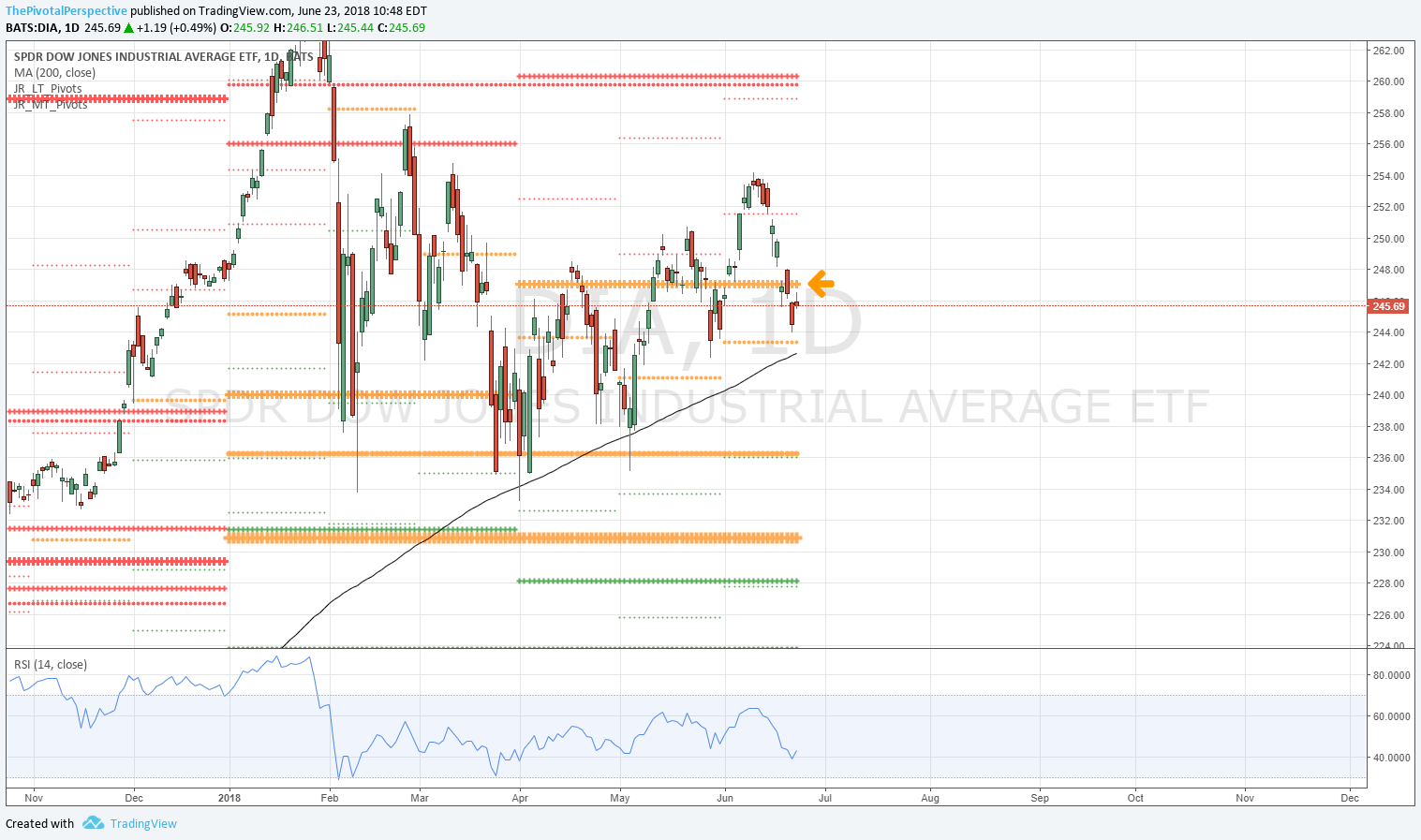

DIA high of year (1/26) on YR1, along with many other risk asset highs on YR1s that week

SPY low of year (2/9) on YP exact

BTCUSD key lower highs 2/20 and 3/5 testing YP from underneath (since then down ~50%)

ZB1 (continuous contract) low of year 5/18 on YS2

XLE high of year (5/21-22) on YR1 exact, along with CL1 (continuous contract) YR2

SMH 2nd high of year 6/6-7) on YR1 exact

IWM high of year (6/20) on YR2

DXY high of year YP (6/21) near tag

EEM low (?) on YP 6/21 exact

I think you are getting the point now. This means we may have just seen a major IWM high along with a DXY high. Interestingly GLD dropped just a bit under its YP but could easily recover with any more higher.

This week ends 1H and Q2 and June so soon all the pivots except yearlies will be changing over. It is often good to have cash ready for the next best looking setup. It is also time where we can see institutional re-balancing which typically trims winners and adds back to losers - this would put pressure on IWM and QQQ, and potentially support international names and bonds. As it turns out IWM and QQQ weekly charts look quite toppy, and if DXY drops further from its YP then emerging names (EEM, FXI, RSX, INDA) could get more a bounce. Note - all 4 of these had tag or near tag of YP last week and close above.

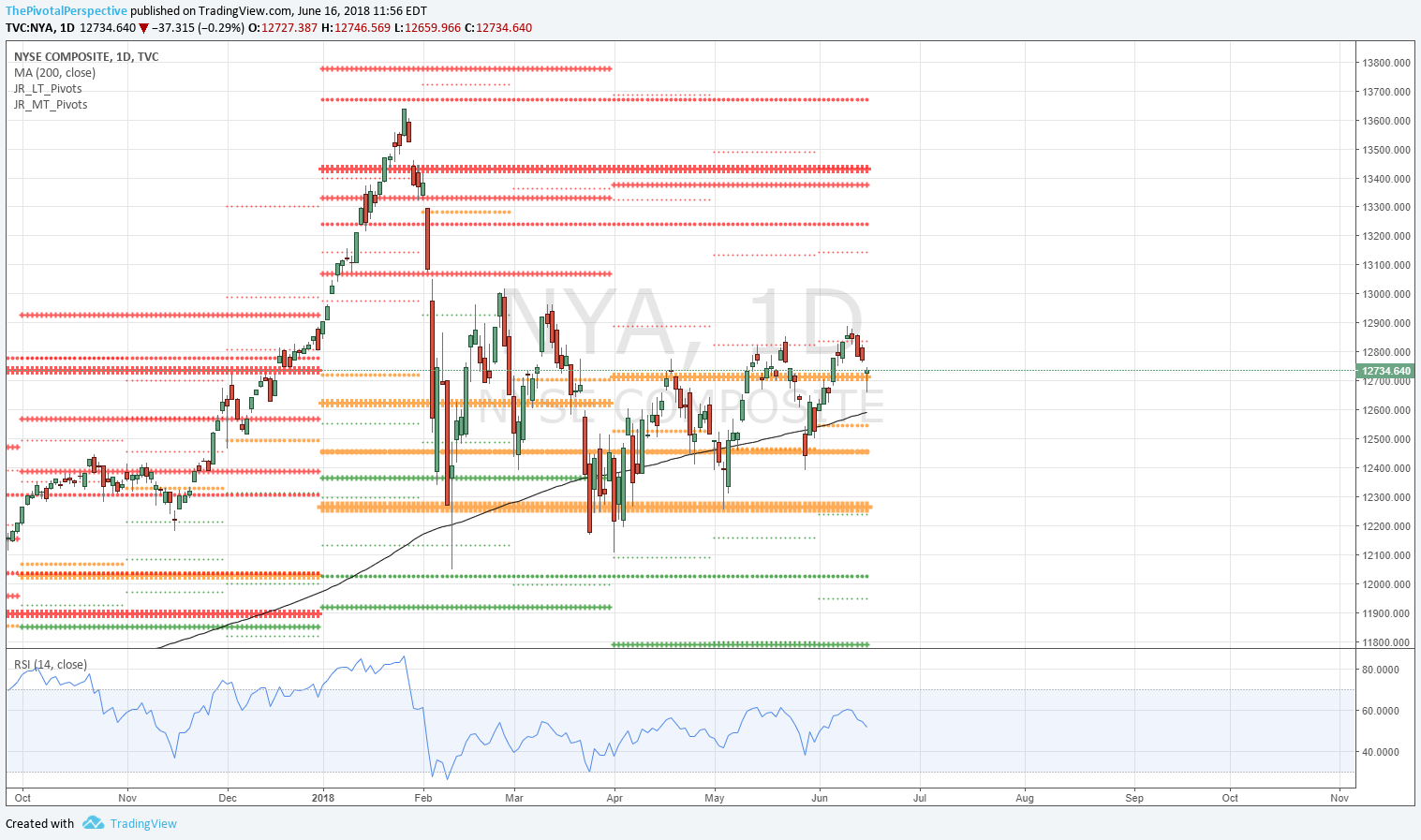

It is hard for me to imagine a pure bullish scenario for risk with VIX perking up above its YP, TLT above its MP and toppy looking bars on the leaders. A pure bearish scenario would be risk off with VIX and TLT leading, international names breaking down, and IWM & QQQ fading off highs. But perhaps what I think is most likely is a reversal sort of week - a bounce on DIA and international names, IWM and QQQ moving lower.

In this system trend trades are my focus, especially what is moving up. In Q2 this meant huge overweight on IWM (read the USA main index post for more detail on this), and then tech names and regional banks. If you were looking to short in Q2 then anything below QPs as other indexes were above all pivots were the candidates and there were several of those. Although the absolute best shorts this year were below all pivots and not just a QP - first bonds in Q1, the BTCUSD and EWZ in Q2.

Occasionally a "surprise" trend change is worth playing like XLE moving above all pivots on 4/11 after being below all pivots just a few days before. These can be tricky because sometimes surprises fade and a quick poke above all pivots remains just that with a fast drop back below (DBA good example this year).

Lastly, once in a great while, I will mention a purely speculative move (short above all pivots at major resistance, long below all pivots at major support) - recently, TLT buy mentioned 5/20, SMH short 6/7, and IWM short last week.

In terms of new trends, we have the pending 2HP, Q3P and July pivots to consider. There is something interesting going on with TLT and XLF. TLT has been quietly stabilizing since the fast rally off the HS2 low on 5/17. In June YS1 was bought, and it has essentially held its MP since reclaiming on 6/14. At the same time, XLF is glaringly weak. It failed at the Q2P several times, and finished last week under its MP and D200MA! A weekly close at the same price would put XLF below 2HP, Q3P and JulyP.

Bottom line - If pure bullish scenario next week, then I may miss out on QQQ and IWM bounce gains but I don't think these will be very much. And one can always hop on SPY to add long exposure though it hasn't done much this year. If international names rally then it will be time to scram from any remaining shorts (and if taken against QQQ and IWM longs, one could be out of those already if long side reduced). If the mixed scenario above I'll be watching for deep pocket buying in names like EEM, FXI, KWEB, INDA. If risk off, then GLD could start looking good with a move above its YP.

PIVOTS

USA main indexes - Another key high near a yearly level on IWM last week. As called!

Sectors of note - XLF trending weak. XBI took lead on SMH with SMH having YR1 rejection as XBI not much damange then clear.

Developed - Still weak despite DXY fade. EWG below all pivots!

Emerging - Several YPs in play: EEM YP low exact, FXI YP near tag, SHComp YS2 low, INDA held YP higher low 6/19. RSX also benefited from USO bounce and recovered YP as well.

Safe havens - VIX above YP some warning for stocks. But could not move above MP last week. TLT quietly strengthening. If GLD joins VIX above its YP then this would point to further risk off move for stocks.

Commodities - USO still fairly strong, with simple pullback to JunS1 and then an explosion higher on Friday to move back above all pivots.

Currency - DXY YP exact on the high.

Cryptos - Seems like BTCUSD heading to 3-4K as I have mentioned on this site several times. This is even more likely now with ETHUSD having a 2nd rejection from its YP just last week.

OTHER TECHNICALS

Noticing screaming RSIs across timeframes was part of take gains on IWM last week. That said now lows remain rather dormant and until we see uptick then we have to give bull scenario in stocks some weight.