REVIEW

8/19/2018 Total market view: "The current configurations point to higher before a top of significance. Sentiment per put call is fairly bearish, valuation hanging around mid 16s per SPX forward P/E, and even a return to 17X implies a test of SPX 2018 highs at minimum. ... of all the sectors that look ready to propel higher I think IWM and other various small cap growth will make the move."

Result - IWM blasted through to new highs on Tuesday and helped pull other indexes higher into Friday.

SUM

Of the 5 USA main indexes, RUT IWM has jumped above YR2. SPX and NDX area currently testing major resistance. DJI and NYA haven't made it yet. Playing for the small cap breakout worked nicely as positions are now an easy hold above that level.

In terms of what is next, watching for reactions to SPX HR1 and then NDX HR1 / YR2. Due the following factors I think we will see SPX above HR1:

* 2018 2nd half trending nicely, not like start and stop of most of 1st half.

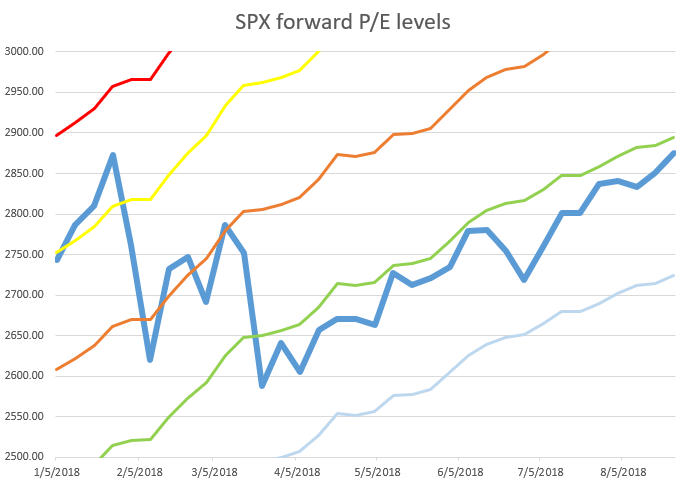

* SPX forward P/E in the high 16s; in January at the same price it was above 19 (this is how much the tax cut and positive environment has benefited corporate earnings).

* Sentiment not that euphoric, with put-call and equity only put-call near median levels for the year so far; in January put-call was at a multi-year low.

* New highs / new low ratio looks fine.

* Growth / value ratios actually perking up again in favor of growth; out-performance of value along with bond strength would be a concern.

* VIX trading below its YP helps the bull case.

All that said NDX YR2 will be an interesting area to watch and some reaction possible from that level.

At this point, only recent bond strength with TLT above HP and D200MA is questioning my bullish idea.

Global indexes got a boost from a dollar index DXY back under its YP, a move I did not expect after the convincing clear earlier in August. INDA (first rec early July) looking great and the clear winner of the global indexes I track. EEM, FXI, KWEB all on the verge of recovering YPs which would add to the bull case.

Another weak link SMH just jumped from a big support area - HP QP D200MA and then cleared MP, back above all pivots. XBI also held HP QP combo but did not finish above its MP. Still, tech perking up typically helps the market, and at least increases the chance of seeing NDX YR2 7572.

Bottom line - The Pivotal Perspective has been bullish since early July, and anticipated a minor shuffle from the 7/25 high. Adding back into small caps worked very well last week, so mostly in monitoring phase. While I would like to see SPX clear its HR1, I'm not sure that NDX will blast through its YR2 on the first try. Note that RUT was stuck under its YR2 after first test on 6/20 and had several selling attempts before it finally cleared - something to keep in mind for tech longs.

For now though SMH XBI both lifting off key support, and USO about to clear all pivots if there is room to put capital to work. Also watching EEM FXI and KWEB as a coordinated recovery of their YPs could be a decent setup.

SUM

USA main indexes - RUT IWM leading, first to clear above YR2. Note how many weeks it took to do that. Will NDX blast through on first try? I'm bullish on the market in general but think odds favor tradeable reaction down from that level.

Sectors of note - XLE oddly tepid compared to USO but this has happened before and it could get in gear. SMH and XBI recovering / holding HPs helps the market.

Developed - DAX is below all pivots, but didn't have much of a drop before returning to test QP from underneath. Nikkei similar to SMH, a recent move below HP QP and D200MA and now back above all.

Emerging - INDA the big winner in the second half. Perhaps instead of looking for others I should just be adding here. That said watching EEM FXI KWEB YPs this week.

Safe havens - VIX under YP helps the stock bull case, and VXX not on a level yet. Bonds showing some concern with TLT strength; actually returning to long term buy.

Commodities - Last week I wrote that CL1 (continuous contract) has given many good signals, and although CL below pivots it may recover due to CL1 D200MA. Exactly how it played out with big rally in CL USO last week, with USO finishing on its MP; any higher and above all pivots.

Currency - DXY under YP, a move I did not anticipate after working so hard to clear.

Crypto - If ETHUSD recaptures QP 7430 for the 2nd time then may have second thoughts about my 3-4K preferred low.

OTHER TECHNICALS

New lows turning down as new highs perk up - bullish. Although you could say new high level far off June, so continuing motion higher would be helpful.

VALUATION

Price the same with valuation in 16s compared to the 19s in January. I think smart money is eyeing 18X, which currently targets above 3000. Continued bond strength and yield curve inversion, should that happen, along with other defensive rotations would threaten that view.

TIMING

See this recent review.

August dates (posted 7/22 Total market view)

8/2 - Stock pullback low

8/6-8 strong - "Seems like setting up for high"

8/17-20 - 8/21 minor high and mild pullback

8/27 (adding)

September dates

9/6

9/13

9/20-21