REVIEW

7/29/2018 Total market view: "Bottom line - Buying into the rally from early Q3 has done moderately well. It turned out the better gains came on the setups after the first IWM & XBI longs - SPY, QQQ, then XLF and INDA. With former leaders now leading down, and former laggards turning into leaders, there is no simple index hedge (though you can always hedge a QQQ long with the same short). That means taking profits, or at least not letting gains turn into losses, was the right move. If DIA and NYA were leading down and VIX moved more to upside last week, I'd be thinking about a major turn. But with markets making more of a rotation move, I will think at some point soon there will be another attempt to move broadly higher."

Result - Pullback continued Monday and early Thursday, and then most indexes went back up.

SUM

All 5 USA main indexes are above all pivots. AugPs had test or near test on SPX, NDX, DJI, RUT and NYA and this was bought very aggressively. 3 indexes, SPX, DJI and NYA cleared resistance levels (YR1 and two QR1s). All this is very bullish.

Similarly, VIX tested its AugP and rejected it. Friday closed decently under its YP - actually rare this year for VIX to move below all pivots. VIX pivot rejections tend to be risk-on for stocks not just one day but several days ahead. VXX also below all pivots and not near any major support.

Simply stated path of least resistance is higher for indexes, and for now we can watch SPX YR1 to hold as support and VIX YP to hold as resistance. Should these continue it will be likely to see SPX test its 2018 high.

Interestingly, though RUT IWM was the clear leader early in Q2, first to reclaim status of above all pivots, which was a great tell for a 2 month rally, it is not the same in Q3. So far YR2 has stopped the rally three times and if there is any weakness next week it will likely be the first USA main to move again below its AugP.

Similarly, 2018 performance leader XBI started Q3 strong, actually the first leading above all pivots, but has faded quite a bit. Friday closed under its AugP and below YR1 with look of rejection.

This is happening as two of the FAANG stocks, FB and NFLX are also having trouble. But instead of the momentum leaders dragging everything down it seems rotation is the more likely move. NYA is perking up, meaning renewed buying for some international names, and value ETFs also were popping at the end of last week. I like the idea of a rotation into value as growth has far outperformed for so long.

Bonds are a crowded short but TLT below all pivots and I'm not keen to allocate here with indexes looking so strong.

Metals are also extended on downside and may have reached exhaustion on GLD HS1, GDX YS1 and SLV YS1. Above a WP could trigger a speculative long.

Bottom line the earliest longs on RUT IWM and XBI were out on a profit taking move. Thankfully the next index longs on SPY QQQ then XLF and INDA are doing well. There is really no reason to not be fully long with all 5 USA mains above all pivots; SPY above YR1 is a good risk/reward level for later longs. I also like the value theme as above, and may try a GLD position and play for a quick pop or more. Lastly I will be watching USO as potential long candidate if above all pivots. If I want to increase reduce long exposure then first choices likely IWM & XBI shorts, and potentially a TLT long if it stays above its YS1.

PIVOTS

USA main indexes - Better if RUT IWM can hold its AugP. If not that is a good r/r (risk reward) on short side.

Sectors of note - XBI turning around in 2H, from performance leader up nearly 20% YTD to be the first to technically break down, below AugP and YR1 rejection last week. XLF seems like it has the most potential though XLE could also get in gear if USO moves back above all pivots.

Developed - Lagging, thought N225 is above all pivots. Currency impact makes these less optimal choices.

Emerging - China looking terrible both on Shanghai Comp, Hang Seng, FXI and KWEB. Sensex / INDA has picked up and have to say thinking that institutions would overweight India to escape China drama was a great call, with INDA turning into the best % gainer in 2H so far.

Safe havens - VIX under all pivots is bullish for stocks. TLT YS1 worth watching, but I suspect bonds will move lower so not inclined to make any counter-trend plays here. GLD fully oversold on W chart with RSI divergence, and on long term support across the metals - GLD HS1, GDX YS1 and GDX YS1. This is a place were a bounce becomes more likely. If not here, then I'll be watching GLD YS1.

Currencies - DXY high 95 area and YP has been resistance for a long time, but it is back there again.

Cryptos - ETH and LTC look pretty bad, and BTC is fading back under all pivots as I type. Perhaps that 3-4K target is on track after all. 4800 is the first major support for Q3.

OTHER TECHNICALS

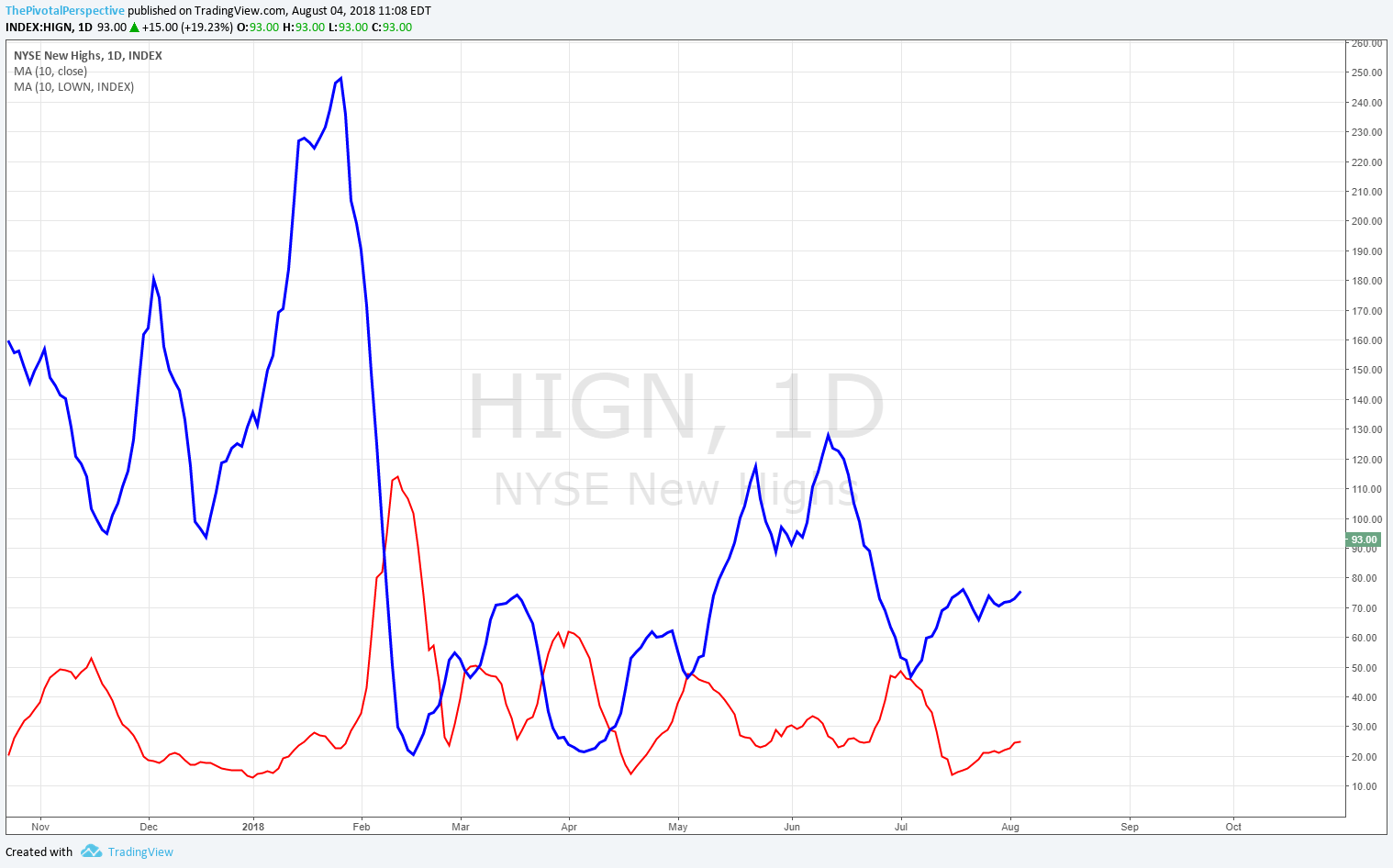

New highs & new lows indicator did a great job of remaining committed to the bull side both in early May and early July. That said there was some chop earlier this year. Current posture new lows rising from 7/17, but new highs still strong.

VALUATION

If SPX reaches 18X forward earnings again, that will be over 3000. For this to happen it needs to get into the 17Xs, which has been near resistance since March of this year.

SENTIMENT

Not too bullish here despite the proximity to highs. Put call and Equity only put call currencly not near January and June extremes.

TIMING

7/3 - Stock index pullback low

7/10-11 - Actually looks like pullback low on 7/11

7/25 - "Pulling for a stock high" DING

7/27 (adding) - "Looks like volatility spike" DING

August dates (posted 7/22 Total market view)

8/2 - Stock pullback low

8/6-8 strong - Seems like setting up for high

8/17-20