Quiet day to end the week. As for much of the year, USA main indexes are in mixed condition. As usual, more on the blog this weekend.

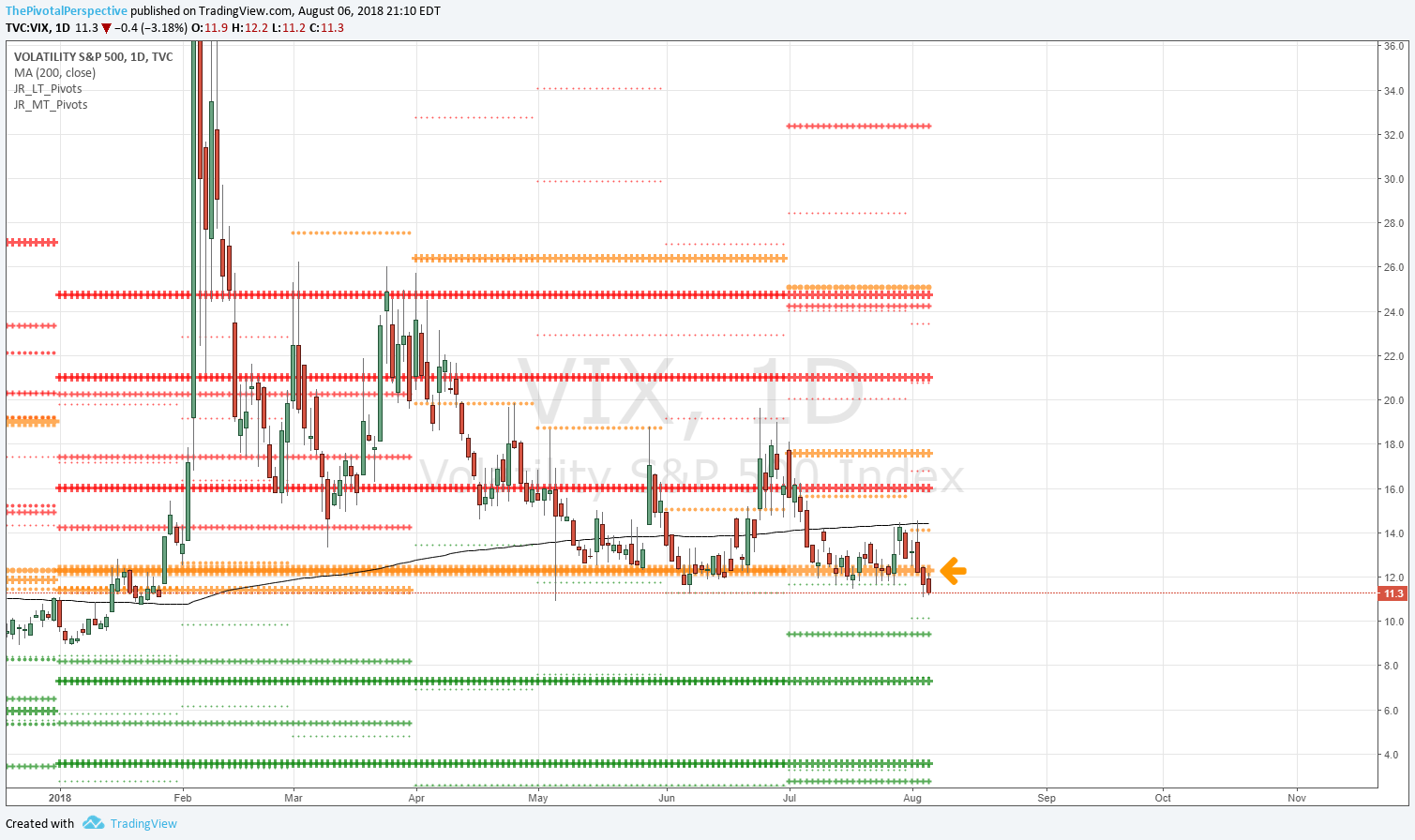

Point for the bulls - VIX rejected the test of AugP.

SPX and VIX below.

Your Custom Text Here

Quiet day to end the week. As for much of the year, USA main indexes are in mixed condition. As usual, more on the blog this weekend.

Point for the bulls - VIX rejected the test of AugP.

SPX and VIX below.

Yesterday I was understandably impressed with NDX launch above YR2, but I neglected to mention DJI pause at HR1. Though DJI tends to take 3rd place after SPX and NDX in institutional trading, nevertheless, in The Pivotal Perspective it carries equal weight and many times is the most important.

On 8/15, DJI held its MP and that was the last key pullback low. Yesterday, DJI tagged HR1 but did not exceed and that may have been enough for a trading top.

VIX jumped today with a big lift above YP. At this point it will be close to SepP, and that will be a key tell early next week.

Lastly, the 3 China indexes, FXI KWEB and EEM all fell back under YPs today. Despite strength for part of this week, so far setting up for a weekly rejection of YP - bearish.

SPX and DJI below.

Wow! As of a few days ago when writing the Total market view, I thought NDX approaching YR2 along with seasonal dullness might be enough for some reaction lower. I did not think it would power through without some delay.

Just the opposite happened - a massive liftoff from YR2! Thankfully I paid attention to the details and momentum strength and did not exit, hedge or short per other daily comments and tweets this week.

As major turns typically happen on the big levels, the liftoff from NDX YR2 is significant. The next major resistance for NDX is above 7800 at the QR1 and then HR1 above that.

Although I mention VIX often, I rarely mention VXN. This also was a good tell by hanging around the YP with no jump from the level. Contrast this week's action with mid January, March, and later June.

SPX, NDX and VXN below.

Copied from blog ... I posted in wrong section.

In the latest Total market view on the blog, I thought SPX would rally above HR1 2883 but didn't think NDX would crack YR2 7572 on the first try.

Due to strength, yesterday I said less sure that YR2 stops the rally. That is still the case.

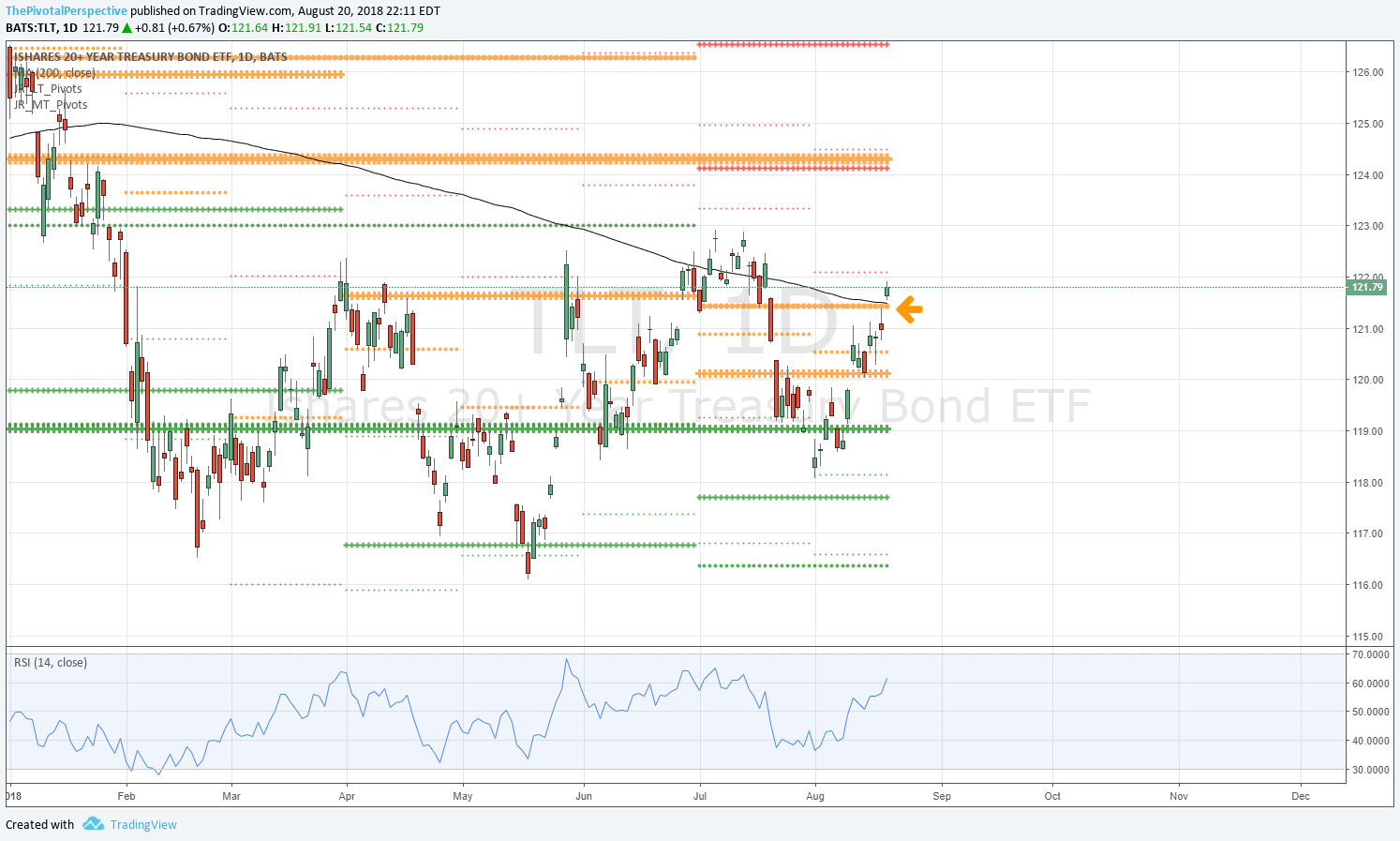

VIX points to limited upside or pullback. But TLT crumbled today, so I think this offsets the VIX move somewhat.

Also, USA technical leader RUT IWM had 2 days of weak selling and seems poised to resume up.

In sum no sign of rejection from NDX YR2 level yet. Long and strong. Bit concerned about VIX but so far no stock index exit / hedge / short signal.

SPX, NDX and VIX below.

Oops, the Daily comments of the last two days wound up on the blog instead of here. So today I'm copying verbatim and then will delete from the blog.

In the most recent Total market view I thought that SPX would clear HR1 resistance but watching for reaction at NDX YR2. This has been a strong move for late August, and in the last few days tech has gotten into gear after looking somewhat weaker. SMH, XBI and KWEB all are supporting the move of NDX to higher highs. Anything can happen but at this point, especially with VIX under YP, that NDX will clear YR2 without too much trouble. VXN is an interesting one to watch, because a big lift on that with a small advance would tell a different story.

Speaking of KWEB, it along with EEM and FXI recovered YPs today as well, which is additionally bullish for risk.

SPX and NDX below.

SPX at 2018 highs and bang on AugR1 with HR1 just above. As usual more on the blog soon.

SPX has paused under its high test for the last few days. So far this move looks like pause not rejection. I find it hard to believe that the longest bull market of all time* will go out with a whimper of a high test.

NDX tested its QR1 and fell back, showing that pro sellers are trimming their tech exposure on the rallies.

RUT continues to hold above YR2. the only main index to do so.

Yesterday, VIX was fractionally below its YP so I thought the bulls had the benefit of the doubt. Today it returned fractionally above, but without the look of support. TLT has been stronger, but looks ready to drop.

In sum it is a late August lull. Sentiment per put-call and other measures is nowhere near euphoric. It would not take much for SPX to push through to convincing new highs. I think this will happen soon, but maybe not tomorrow.

*Not sure this is right - definitions of timing vary. Discussion for another day.

SPX, NDX and RUT below.

Main indexes mixed today with NDX perking up, RUT adding to gains, SPX sideways, yet both DJI and NYA fading a bit.

Safe havens were also mixed with VIX collapsing fractionally below its YP as TLT held above HP.

Given larger trends, bulls get the benefit of the doubt. Tech perking up will energize the market - XBI biotechs on the move the last few days, and SMH trying to reclaim above all pivots as well.

Another score from the latest Total market view: "Commodities - USO broke under HP support along with DXY thrust. CL1 contract has given many good signals in the past and low bang on D200MA so far, so USO could recover soon."

SPX, NDX and VIX below.

Yesterday I thought it would take longer for SPX to test its 2018 high and HR1 area - the market proved me wrong on that. But what I have been definitely right about was that IWM and other small caps would more likely power through to a new high before tech / NDX QQQ / FAANG / XBI / SMH.

8/11 USA main indexes: "At this point I think RUT has a greater chance of clearing its YR2 than NDX."

8/11 Total market view: "Also, as noted above, both biotechs and semi-conductors (XBI and SMH) are a bit weaker, which makes it less likely that NDX QQQ will power up above its YR2. Therefore, along with DXY strength, I'm thinking that RUT IWM will have the best chance at the next leadership move."

8/18 USA main indexes: "2018 gainers QQQ and IWM having trouble to push through resistance areas, but so far just going sideways. If other indexes are moving up then a rally on at least one of these is more likely. If picking one to get through I'm still think IWM has the better chance."

8/19 Total market view: "Of all the sectors that look ready to propel higher I think IWM and other various small cap growth will make the move. I'm referring to ETFs like VIOG, VIOO, VBK, VTWG here (though time may prevent detailed tracking). These are on the 2018 YTD leaderboard and I think greater potential to continue higher than the more crowded tech."

DING DING DING!

RUT IWM powered up above its YR2 today and made a decent new high. All the growth small cap ETFs (Vanguard versions quoted above) had great gains today as well. Compare this to NDX QQQ rather stuck, XBI and SMH still under MPs, and KWEB still under its YP.

All that said there were some bearish moves today:

VIX held its YP with a reversal bar

SPX rejected HR1 near tag

NDX rejected QR1 near tag

RUT faded from from futures (RTY) AugR1

But with sentiment far from euphoric, I'm allowing for the possibility of a shuffle here while thinking the market will go higher yet before a major top.

Indexes higher today, but some signs that a power through to new highs will not happen tomorrow:

TLT reclaimed its HP and D200MA; often, strength in safe havens is a prelude to stock weakness.

VIX held its YP - similar point in that if risk on were stronger, given the index move, this should have broken.

RUT small advance; NDX still below its WP.

I do expect SPX to test its 2018 high and reach HR1 area - matter of time. But that might not be tomorrow.

SPX, VIX and TLT below.

Wednesday's hold of DJI and RUT MP, along with VXX MP rejection, looking even more important.

SPX 2nd day in a row of holding the YR1 as support, after breaking 2 of the 3 days before that. Above the YR1 points to HR1 at minimum and possibly YR2 near 3000 in term of long term targets.

As usual more to come on the blog this weekend.

SPX below.

Win for the bulls with the three tells of yesterday playing out. DJI huge hold of MP, IWM also rebound from MP, and VXX rejection of its MP.

Today SPX moved back above YR1 nixing the rejection. But a wick on the candle, along with NDX QQQ weakness, continues to suggest congestion which has been my view for the last few days.

SPX, NDX, DJI and RUT below.

Yesterday's daily comment noted that although SPX looked bullish, 3 other USA main indexes were bang on resistance so the next move could be either way. It was a nasty day but there were a few bullish tells on the close:

DJI held MP exact with a huge rebound

RUT also held MP, though with less of a rebound

VXX stopped cold at MP and dropped

On shorter timeframes, several WS2s held at the lows.

As I type indexes are green overnight.

However, let's not dismiss SPX partial YR1 rejection, RUT again having trouble at YR2, NDX cluster rejection and NYA again back to long term support.

In sum another bounce in the works but this may not yet be the end of a congestion period - which would be totally normal for August.

SPX, DJI and VXX below.

SPX made a decent recovery today, along with VIX rejection its MP. Typically this would be bullish.

But 3 other indexes stopped right at resistance so I'm a bit less sure - NDX QQQ, DJI DIA, and NYA all tagged their QR1s and stopped cold.

And if we really want to fine tune, SPX did not recover its WP.

The latest Total market view thought that RUT IWM had the best chance of leadership to new highs / above pivots resistance, in part due to my expectation that the DXY move was for real. I keep to this view - if higher, then RUT IWM and probably also NDX QQQ will lead; if lower, DJI DIA and NYA will get hit.

SPX, DJI and VIX below.

Per the recent Total market view, I was tending to think of last week as a one day bear wonder but so far this is off. SPX broke its YR1, and VIX closed above its MP. This means less risk-on is appropriate.

Short term charts are in areas that would typically bounce, so I'm not talking about anything drastic. However, SPX below its YR1 with VIX above a monthly pivot means that SPX may test its MP as well.

The Total market view mentioned DJI DIA as a hedging vehicle given strength of DXY and DIA move from QR1. INDA was a nice pick just off its YP but has given back a lot of gains due to currency; it is currently testing MP HP combo which needs to hold to stay in the position. Similarly, XLF had break of D200MA and fractional break of HP - so this would not be happening in a one day bear wonder scenario.

In other news, CL rallied massively to hold its HP so I think this is worth keeping an eye on.

SPX and VIX below.

There is something deeply gratifying about taking some gains off the table, hedging out on volatility, and waking up to a decently red day.

Market unfolded according to plan and VXX worked nicely (not nice enough considering VXX but that is another story).

As usual more on the blog coming up.

SPY and VXX below.

From yesterday's daily comment: "I am expecting some give back on this rally we have had from 8/2 open. But with current configurations, I still think this is a minor shuffle before another move higher. ... Also, VXX is near key support so if I am right about a near term shuffle this is now a good candidate for a hedging trade."

Ding! VXX bottomed today on the AugS1. Stock indexes had a minor reversal bar. As long as VIX remains under its YP I will keep to the view that SPX will test its high. That said a pullback to moving averages, and potentially a down week indexes, would be very normal at this stage.

Indexes did not reach resistance levels so there aren't rejections to report (except XBI). However, VIX and VXX lifted from AugS1s, TLT got in gear, and GLD while not doing much is holding YS1.

Minor pullback in stocks should be the next move.

SPX, VXX and VIX below.

SPX SPY really does look like some kind of top today, but again - if it were serious then VIX should have had an up day not down. Also, the recent laggard, RUT IWM, would have had more damage - instead it held its near test of MP and rebounded.

It is August so the market may not move too much. I am expecting some give back on this rally we have had from 8/2 open. But with current configurations, I still think this is a minor shuffle before another move higher.

USO had a big move down today and the tell was 2 days trying to clear its MP and failing, along with lower highs in general. This is a bit interesting to me because the 2018 first half leaders are, for now, leading lower - USO, IWM, XBI - except QQQ. I do feel like QQQ will be the last domino but when it does fall it will be big. This is just a broader timeframe thought - not talking about tomorrow.

Also, VXX is near key support so if I am right about a near term shuffle this is now a good candidate for a hedging trade. The other thing to watch is very oversold gold which via GLD on HS1 and GC Z on YS1 is holding key support.

SPX, VXX and GC Z below.

Sure daily bars look a bit toppy today. Short term charts (2H ETF session only) reached overbought again on all but IWM. Pushing outside daily Bollinger bands is fairly rare, and in August, that is just not likely to maintain.

In addition, we are in a timing window for a turn 8/6-8 as posted from July in recent Total market views (the last few timing dates have been spot on).

But as long as VIX stays under its YP I don't think this is a major top. SPX wants to test the high at least.

SPX and VIX below.

All 5 USA main indexes continue above all pivots, and none of them are at any major resistance levels.

RUT IWM has been the weak link of late, and that held AugP today. To be clear, both of these are bullish points.

VIX collapsing below YP is especially positive, because if the smart $ were thinking drop they would be buying VIX as SPX crept higher. Instead we are seeing the opposite, a mild up day in SPX and -3% in VIX. According to the smart money, indexes are going higher.

The only thing that concerns me is very low volume, which could mean the market doesn't have enough juice to reach the intended target. But with everything lining up bullish I'm giving the trend the benefit of the doubt.

SPX, RUT and VIX below.