Tug of war continues. Market cannot go up, but cannot go down seriously either.

+s

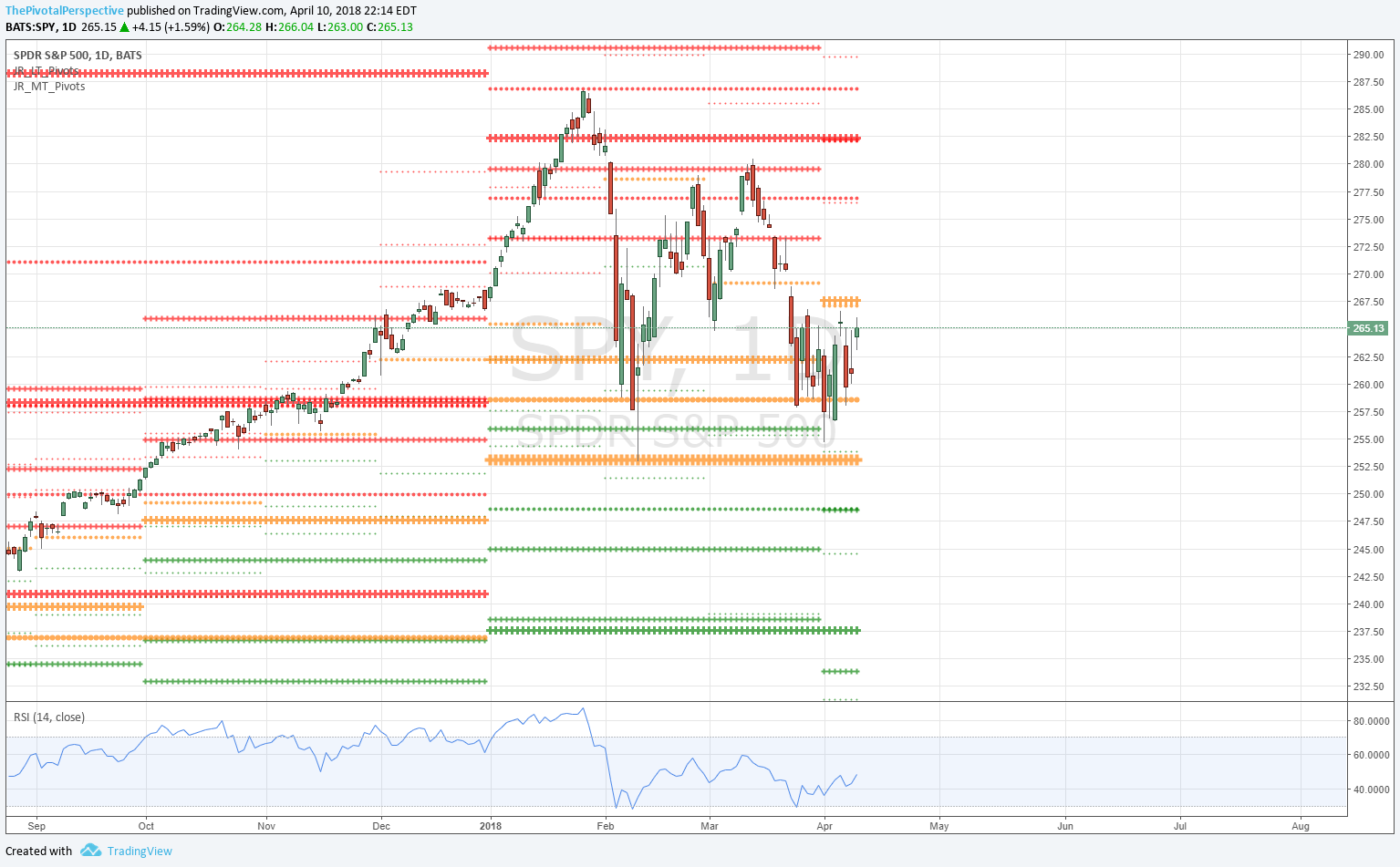

SPY massive hold of HP & D200MA combo - important long term levels

QQQ held MayP

DIA also held HP and D200MA

IWM remained above QP and MP (MayP), above all long term and medium term pivots

NYA held YP

-s

SPY below MP

QQQ under QP

NYA under HP and D200MA

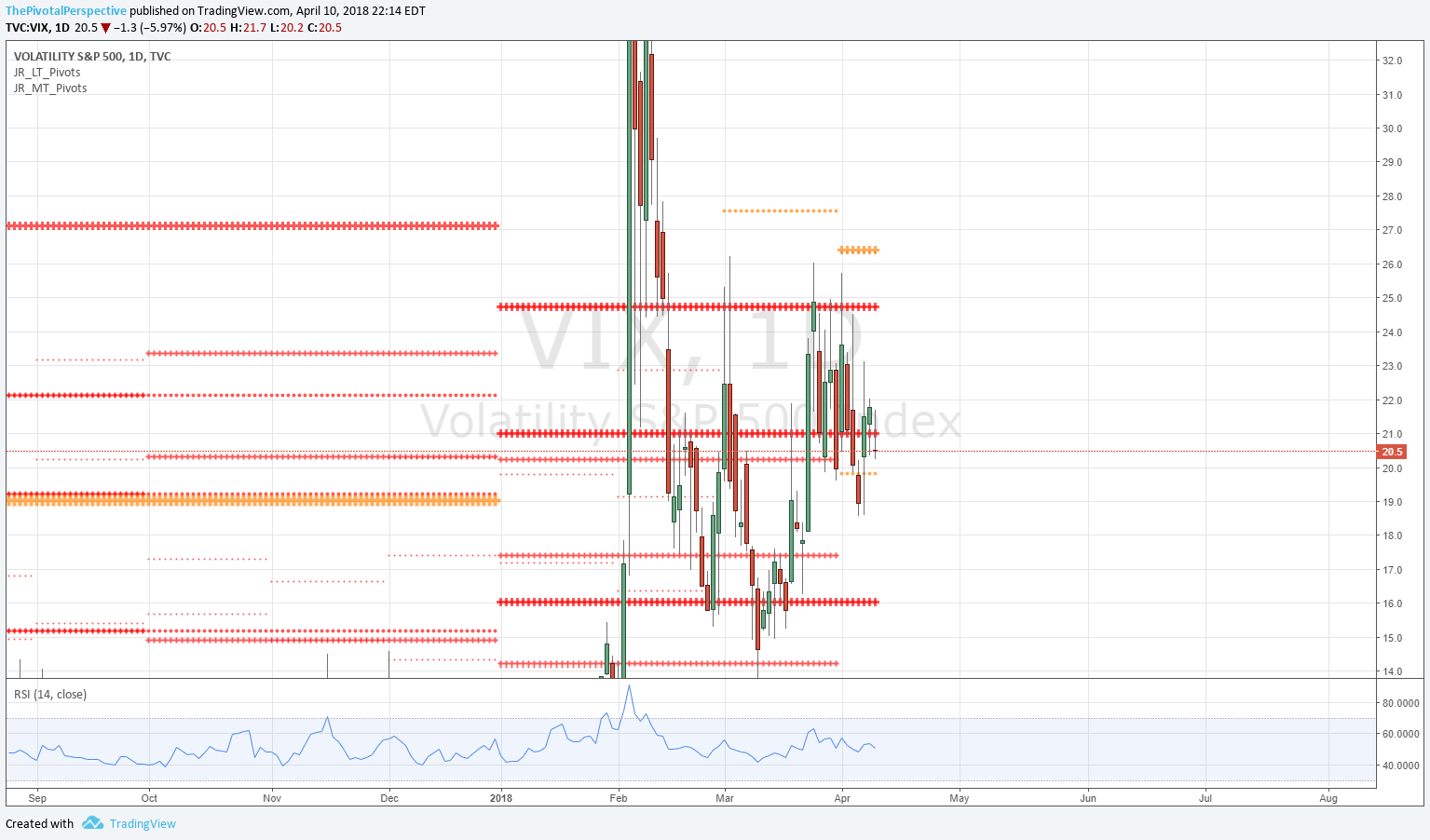

VIX spiked all the way to MP exact, and fell back under YR1 - point for the stock bulls

VXX tested QP and fell back, also a point for the bulls

As you can see there are now more +s than -s after this move got started on Monday with 5 clear negatives on the USA mains. The door is open for the bulls to rally back - we'll see what happens.

SPY, IWM and NYA below.