3/18/2018 Total market view: "Any weakness in smaller timeframe charts may be a prelude to a further drop. This will be especially the case if Dow shows rejection of its MP."

3/21/2018 Daily comment: "Indexes were about even but I view today as clearly bearish. DIA and NYA MPs acted as resistance .... Next move for risk should be down."

And down it went. Going back to my last Total market view, note that there were two scenarios for the main indexes - sideways or down. No up scenario. This is because "resistance matters" is my theme of 2018 and I'll keep repeating it until it stops working.

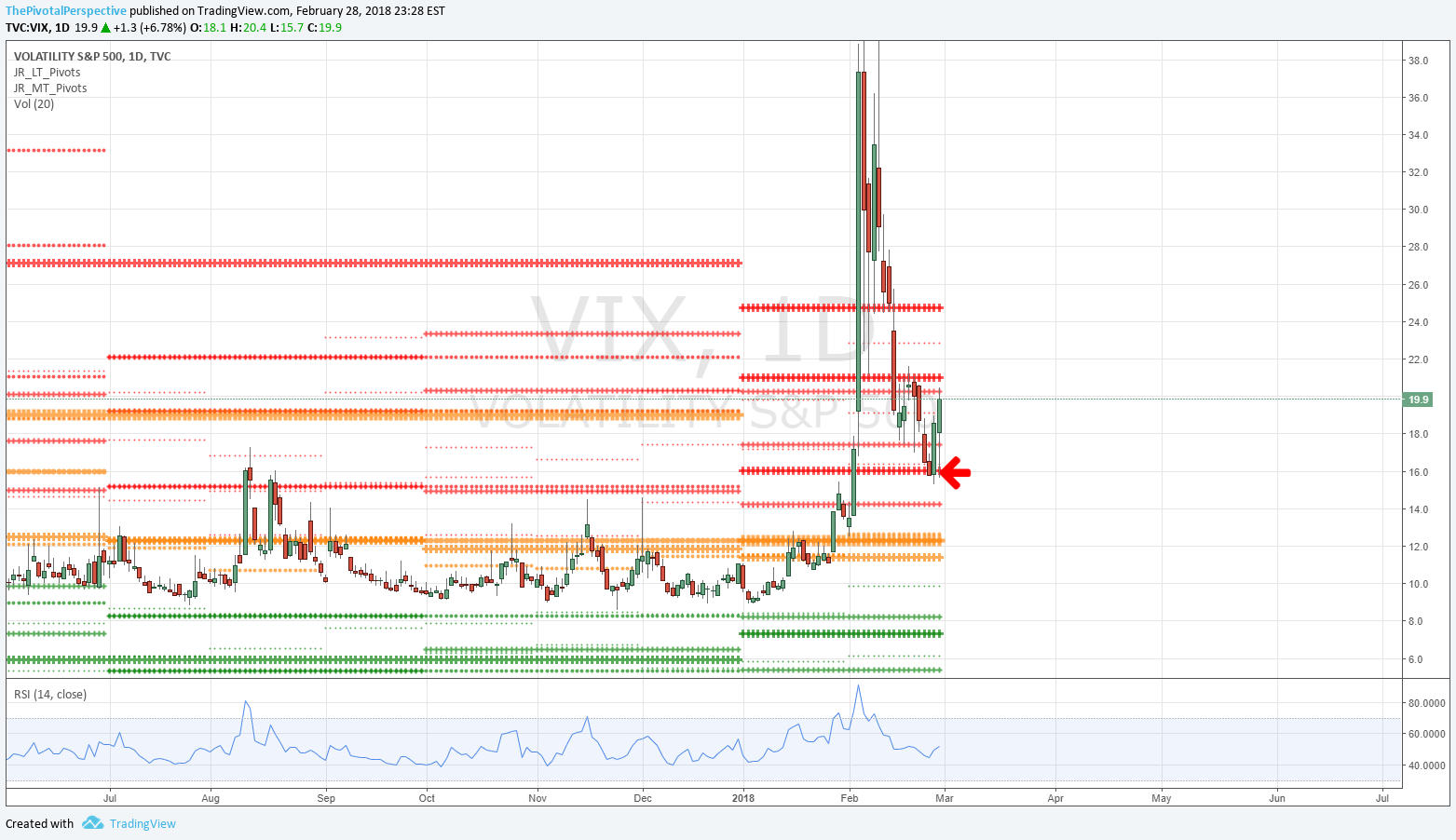

VIX has done an admirable job of saying that the selling is for real. On 1/29 VIX exploded above all pivots and I was very clear that it was time to take defensive action. On 2/27 VIX launched from YR1 and that began a multi-day sell-off in stocks, nicely coinciding with some key index MPs. Then 3/19 also jumped back above YR1, and though YR2 was tested and there was some shuffle in front of FOMC, all signals were clear on yesterday's close - scram. Also note, despite the NDX rally back to new highs, VIX remained above YP HP and QP the entire time.

Now what? Any hope for a bounce due to general 2018 leader QQQ holding its MP on close are being dashed in overnight action in NQ futures, and ES and YM are following along. ES is down about 100 points in not much more than 24 hours. With big moves the market reaches levels quickly, already at QP at 2629. This needs to hold to stop the bleeding.

Going back to regular session action now, an assessment:

SPY - MP break and rejection, nearing QP

QQQ - MP hold (larger move rejection from YR1 failure that began at the start of the week continues)

DIA - MP rejection from yesterday cascaded today, already with slight break of QP

IWM - QR rejection but still above all pivots

NYA - NYA signals rarely disappoint. MP rejection from yesterday, QP break from open, HP break. This is bad.

VIX back to near YR3 so that is also a key level along with MarP in terms of real panic.

SPY, DIA, NYA and VIX below.