YR1s strike! Yesterday I noted how many indexes were simultaneously reaching YR1s and that the last time I remembered this many on the same day was Jan-Feb 2016 (the last big low in the market). We have seen many one day wonders but I think downside risks have significantly increased. But this would be much more so if VIX stayed convincingly above levels and XIV did not bounce so much off lows. It is a time to be watching carefully especially if one has been seduced to buying recently at these lofty levels.

What to do, especially if VIX is above its Q1P and JanP tomorrow? And then even more so when it lifts above its YP and doesn't look back - something we haven't seen since 8/2015.

- Take gains on longs that are having clear rejections from resistance levels.

- Bonds are not working as safe havens this year, so avoid.

- GLD & GLD are popping on these days especially with $DXY down - watch for these setups or add (site recommended GDX 12/13 then cut mid Jan; GLD from 12/26, still holding personally).

- UVXY - I've already had one great trade this year and started talking about this yesterday on the site and twitter. I think this will be a favorite setup this year as VIX low is the 2nd trading day of the year and XIV high is not far after on 1/11.

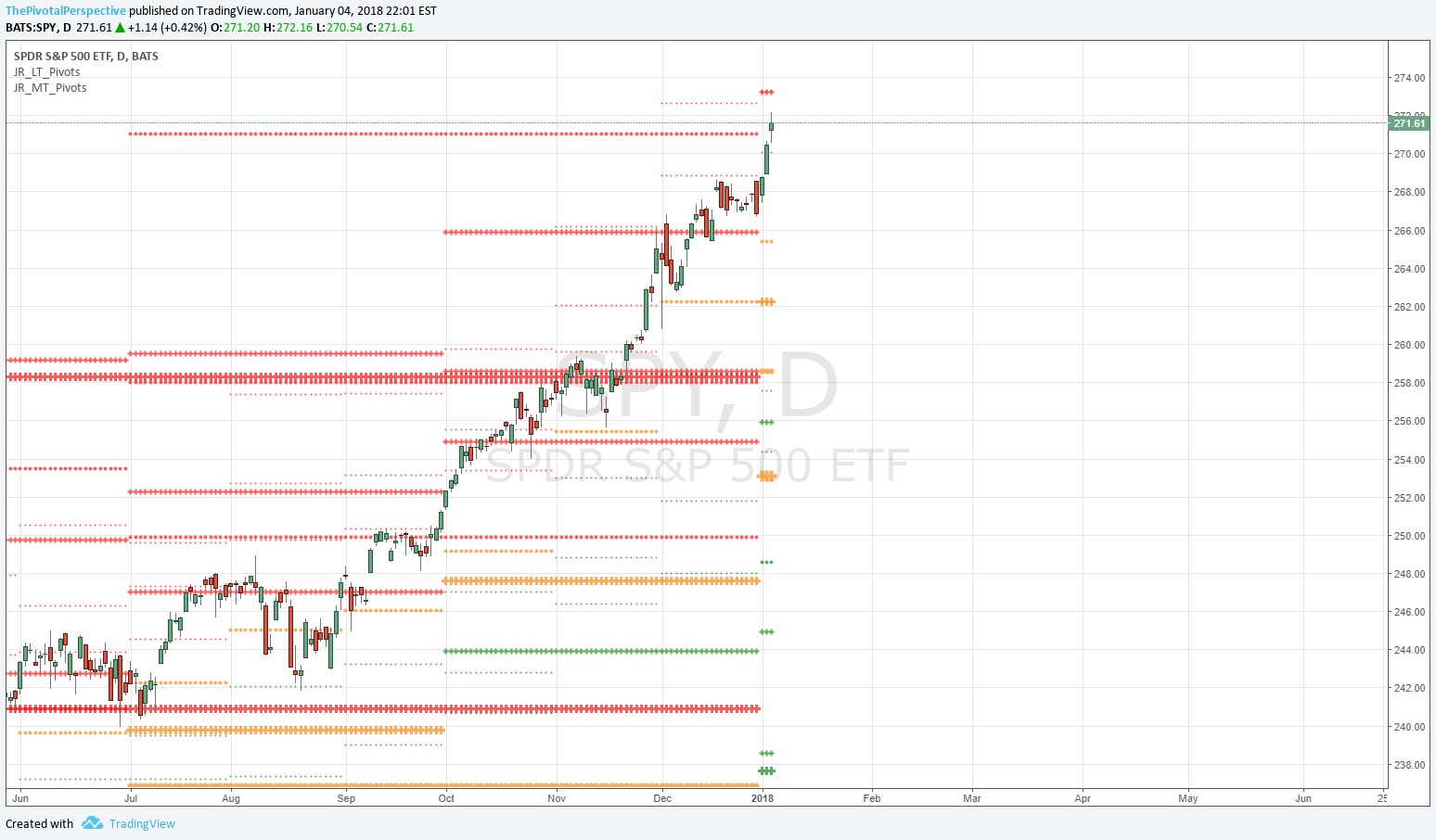

SPX YR1 hold so far

QQQ YR1 semi-rejection

IWM 1HR1 (& near tag YR1) rejection

SPX and VIX below.