The move I have been pointing to the last two days happened today.

12/12: "SPX/SPY, RUT/IWM, NYA and VTI look pretty toppy today. Add in TLT hold of Q4P, VIX reversal bar, and first timing date since 12/1 (which was a key low) and there is a good shot at decent trading turn here. Portfolio has already reduced exposure with hedges on SMH and FXI on 11/27 that i have made no mention of covering. I also recently recommended TLT as an option above the YP. Yesterday was too close to call and today held a Q4P and key MA (moving average) so I'm going to give it one more day. In addition, adding to hedges on SPY based on SPX and both ESZ17 and ESH18 contracts." (bold added)

12/13: "Toppy looking bars on SPX, NYA and VTI, and somewhat on DIA. ... In addition to safe haven buys and possible short hedges against the SPX Q4R3 level, we could also look for glaring weakness. EWZ is trading below its Q4P, but there has been some chop around this level without a definitive move."

Also confirmed via recent Tweets on both SPY / SPX / ES and TLT, this one from 12/12: "Pivot resistance across USA main indexes; $SPY divergence high on Bollinger bands; put-call near multi-year lows; ISEE spike high today; timing date (first since 12/1) - all set up for trading top. Great r/r short hedge here below $ES_F H8 2670." (ps - levels based on daily close as always, so not stopped out.)

Moving on to today.

SPX Q4R3 rejection

DIA Dec R1 rejection

IWM YR1 and DecP break

NYA YR2 rejection, VTI Q4R3 rejection

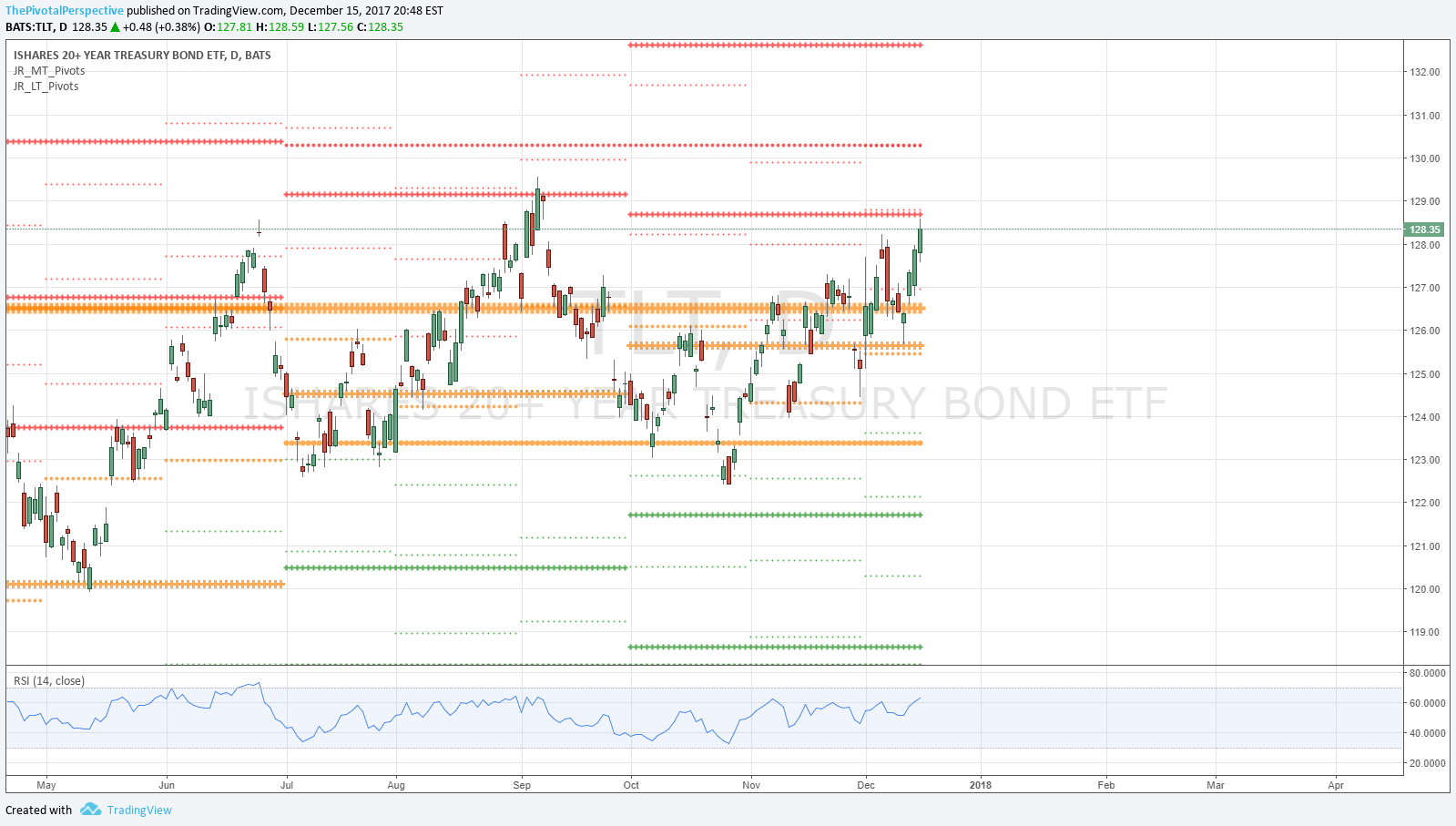

TLT lifting above YP, strength in metals

However - VIX, while on the move, is still below all pivots; no notable move in XIV at all!

Given the yearly levels involved on IWM, NYA, VTI and TLT, this could be an important turn. But I'd feel a lot more confident in further downside with a real VIX/XIV move.

Portfolio is already nicely positioned from this week, already hedged on FXI and SMH from late November, recently long TLT (and adding), then added short hedges on SPY on Tuesday and EWZ short from yesterday. Today added a GDX partial long based on YP, IWM short and sold the FXI to have the units short instead of just hedge.

In sum i am making a gamble on further downside without VIX/XIV confirm which is a bit tough to do. That said, NYA signals rarely disappoint. And with put-call just off 3.5 year lows, compared to mid November when it was at relative high, means better to go a little bigger on the bear side.

SPX, IWM, NYA, FXI, TLT below.