Yesterday even though my usual signals were all bearish I didn’t fully trust it because of the FOMC day pattern. That was the right idea, as indexes tried to rally today.

However, other than NDX, bearish action on levels:

SPX QR resistance

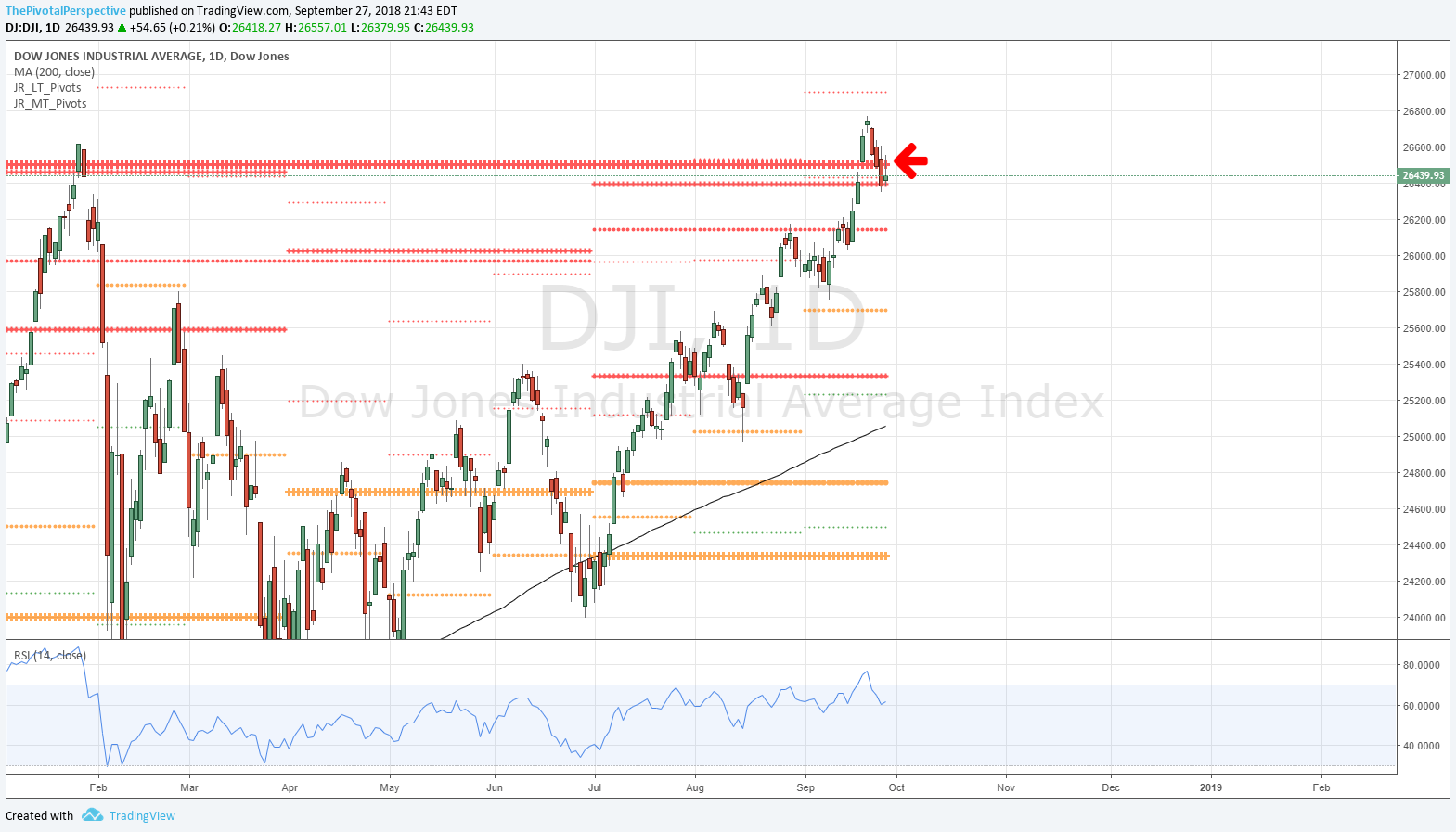

DJI YR1 resistance

RUT YR2 resistance

NYA continuing lower from QR and R highs

VIX YP support

But - NDX jumped above YR2 which is huge.

The door is open for selling tomorrow on the weaker indexes, meaning NYA, DJI and RUT. However, I don’t think Friday will do too much damage. The real message of the market’s response to these levels is likely 10/1.

NDX and DJI below.