Based on my analysis in the Total market view, I came into this week prepared to make a defensive adjustment should enough signals trigger on Monday. They did, and locking in some gains in small caps and tech so far the right move.

But the market came back faster than I thought, and with VIX moving back under the MP yesterday and already testing YP instead of launching, and with SPX, DJI and NYA above WPs - thought crucially not NDX and RUT - there was room to add some longs back.

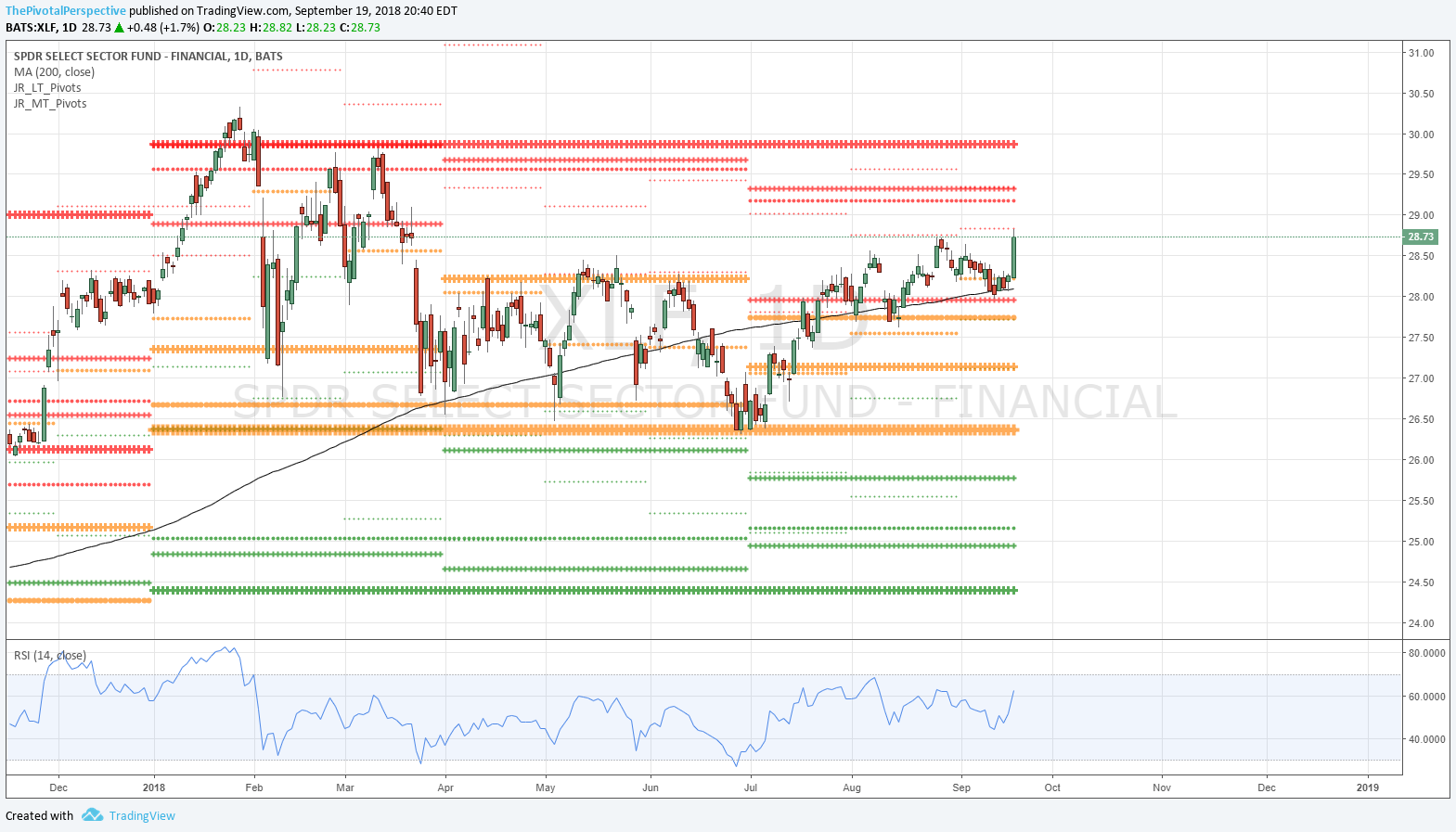

I had mentioned XLF as a maybe two weeks ago as something to watch given the move in rates, and thankfully I spotted that early enough to catch some.

But the larger issue is that the market is an interesting place. There are ingredients for a decent trading top in this area - DJI YR1, NDX YR2, VIX YP, along with other technicals, and breadth and new high / new low deterioration. But so far VIX pointing to bullish resolution; DJI approaching YR1 confidently which increases the chance of clear; and NDX also could have dropped more today but didn’t, and it seems a recapture of MP could happen tomorrow.

If the market makes a small shakeout and then resumes higher we have to be open to that possibility as much as a trading top. For now I like the financials into quarter end as re-balancing is hitting the winners and helping the laggards. But I’m not playing the emerging indexes yet because virtually everything is still under long term pivots.

DJI XLF VIX below.