Abbreviated posting this week.

Sum

VIX healthy and confirming risk on. I will be more concerned with reversal bar and/or divergence, meaning higher highs in indexes without lower lows in VIX. XIV slight divergence per recent lower highs, but above all pivots as of 5/19.

But TLT above D200, AGG above all pivots and GLD above all pivots! That is rather odd to have 2 key safe havens above all pivots at the same time as USA main indexes also above all pivots. But until VIX & XIV confrims trouble, better to stay fully invested.

VIX

At lows, no divergence compared to indexes; typically bullish for risk.

XIV

Minor divergence only, slightly lower high compared to 5/16.

TLT

Jump above D200MA and near test of YP & 1HP!

AGG

Already above YP & 1HP, so above all pivots, above D200, testing D400 (ie near monthly 20 MA).

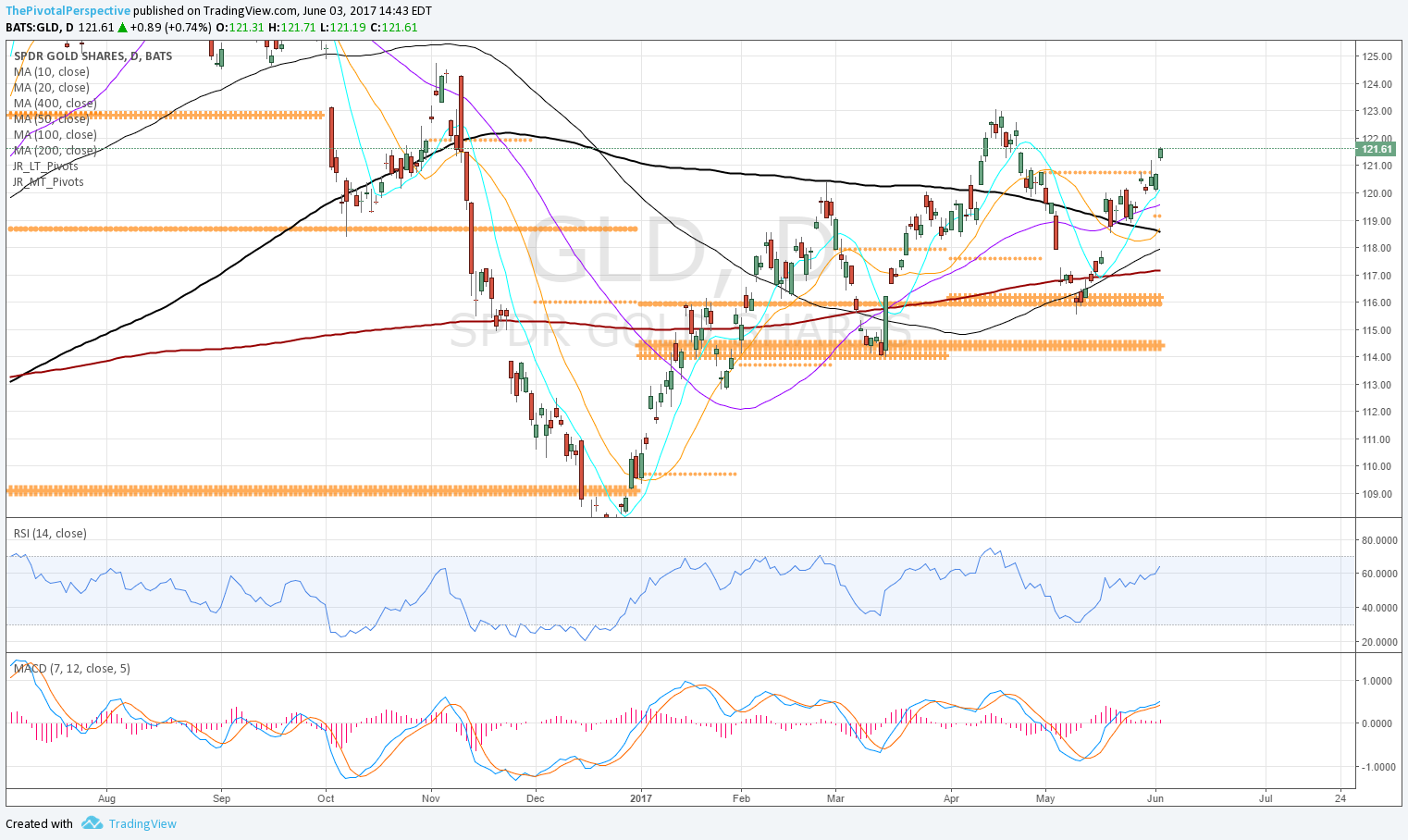

GLD

Well above all pivots and MAs, looking good.

GDX

Not attractive as a long option.