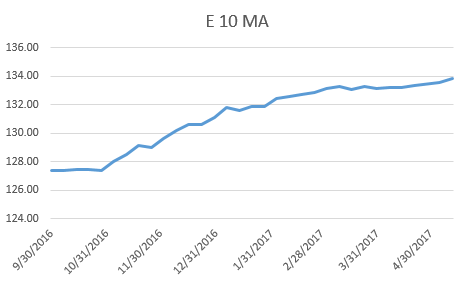

Thomson Reuters data showing 12 month forward P/E of 17.57. This makes the 10 period moving average of implied earnings 133.83, up decently from last week.

Multiply this by 18 and you have valuation level resistance for SPX, which has now climbed above 2400.

But this is still looking like resistance for SPX.

Increasing earnings is a positive, but still there appears to be professional selling at this multiple. I will score this a 1 based on rising slope.

*

Citigroup Economic Surprise Index is just not helping things here.

Score this -2.

Combined total = -1 on a scale of -10 to +10. According to my rough estimates of valuation and fundamentals, markets should be topping out with very slim chance of SPX blasting through YR1.